Analysis of the 2023 U.S. Credit Rating Downgrade by Fitch

The Crucial Role of Credit Rating Agencies in Financial Decision-Making

An In-Depth Analysis of the 2023 U.S. Credit Rating Downgrade by Fitch

Introduction:

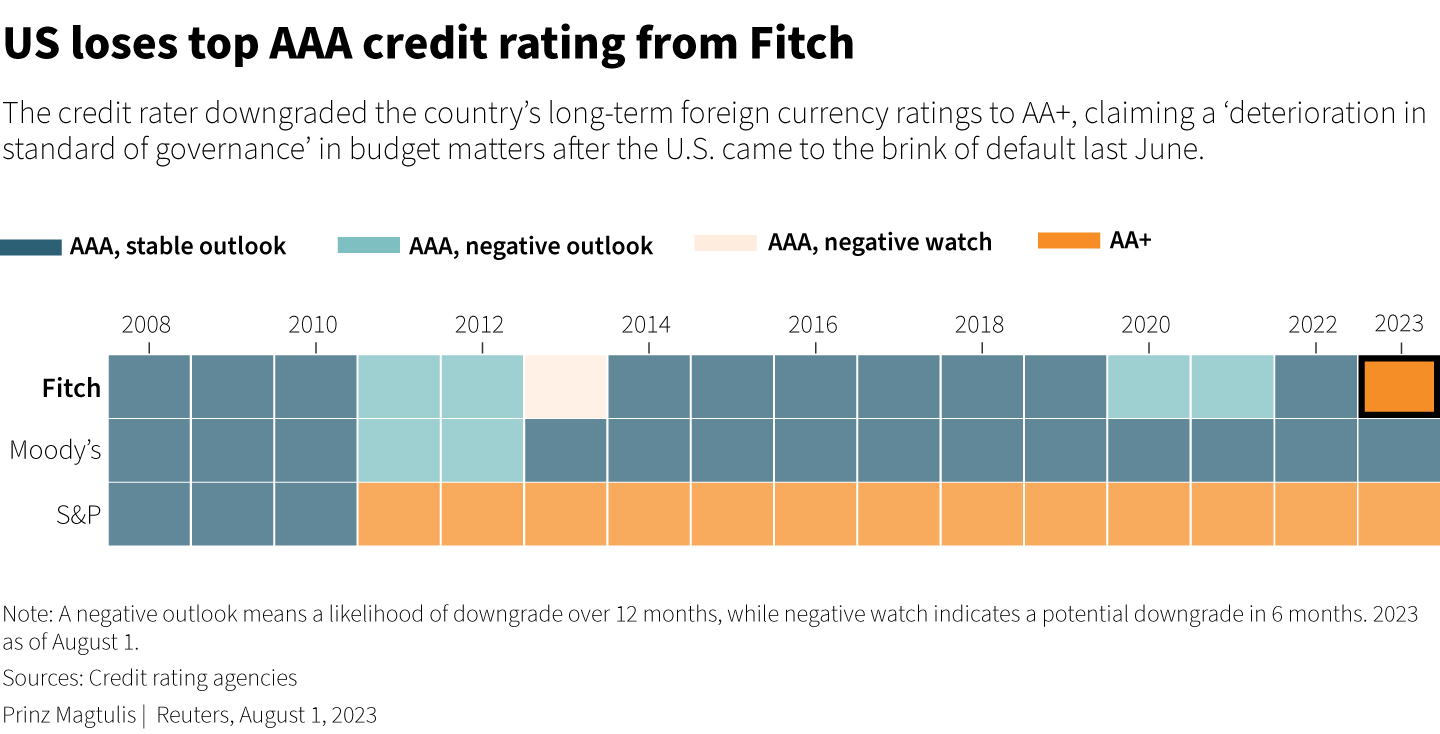

In 2023, Fitch Ratings, one of the major credit rating agencies, made a significant decision to downgrade the United States' credit rating. This move drew considerable attention and raised concerns among policymakers, investors, and the general public. The downgrade signifies Fitch's assessment of the country's fiscal health and its ability to meet its debt obligations.

Background and Context:

1.1 The Role of Credit Rating Agencies:

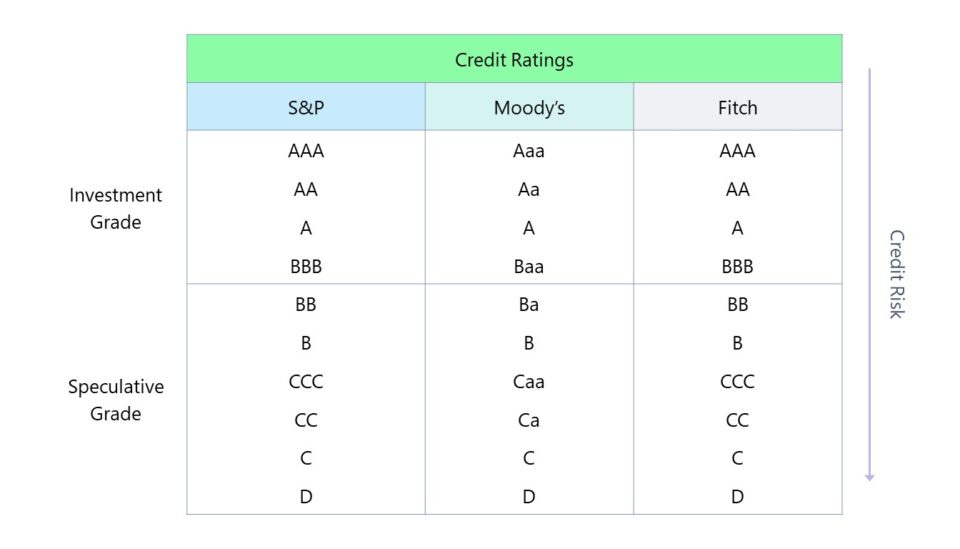

Credit rating agencies hold a crucial role in the financial markets by evaluating the creditworthiness of various entities, including governments, corporations, and financial instruments. Through in-depth analyses, they assess factors such as financial health, economic conditions, and management practices to determine the credit risk associated with these entities. Based on their evaluations, credit rating agencies assign credit ratings, expressed as letter codes like "AAA" or "BBB," which indicate the likelihood of defaulting on debt obligations. These ratings provide essential information to investors and lenders, helping them make informed decisions about lending money or investing in debt instruments. Higher credit ratings imply lower credit risk and may result in more favorable terms for borrowers, while lower ratings signal higher risk, potentially leading to higher borrowing costs and reduced investor confidence. Credit ratings also influence financial markets, as rating downgrades can trigger negative reactions and impact asset prices. Furthermore, these ratings have regulatory importance, as certain regulations and investment guidelines may dictate specific asset holdings based on their credit ratings. Despite occasional criticism, credit rating agencies' assessments remain vital tools for managing credit risk and guiding investment decisions in the global financial landscape.

1.2 U.S. Government Debt and Debt Ceiling:

The United States government often borrows funds to finance its operations and obligations, resulting in national debt. The debt ceiling is a legal limit on the amount of debt the U.S. government can issue. Political debates surrounding raising the debt ceiling can lead to uncertainties about the government's ability to meet its obligations.

Fitch's Downgrade Decision:

2.1 Fitch's Statement:

Fitch cited a "steady deterioration in standards of governance" over the past two decades, including fiscal and debt matters, as the reason for the downgrade. This deterioration raised concerns about the government's ability to manage its finances effectively.

2.2 Debt Ceiling Crisis Impact

The 2023 U.S. credit rating downgrade by Fitch was significantly influenced by the repeated political standoffs over the debt ceiling and last-minute resolutions. The debt ceiling is a statutory limit on the total amount of debt that the U.S. government can incur, and when reached, it requires Congress to raise or suspend the limit to avoid defaulting on its obligations.

The political battles over the debt ceiling have become a recurring issue in American politics, with both parties often using it as a bargaining chip in negotiations. The brinkmanship and uncertainties surrounding the debt ceiling raise concerns about the government's ability to manage its finances effectively.

Fitch's downgrade reflects its assessment that the prolonged and contentious debt ceiling debates have contributed to a "steady deterioration in standards of governance" over the past two decades. This erosion of confidence in fiscal management raises doubts about the government's ability to address long-term fiscal challenges responsibly.

The debt ceiling crisis in May, which brought the nation to the brink of default, likely played a significant role in Fitch's decision to downgrade the U.S. credit rating. The potential risk of defaulting on obligations is a serious concern for credit rating agencies, and the crisis heightened uncertainties about the country's fiscal health and stability.

Implications of the Downgrade:

3.1 Economic Impact:

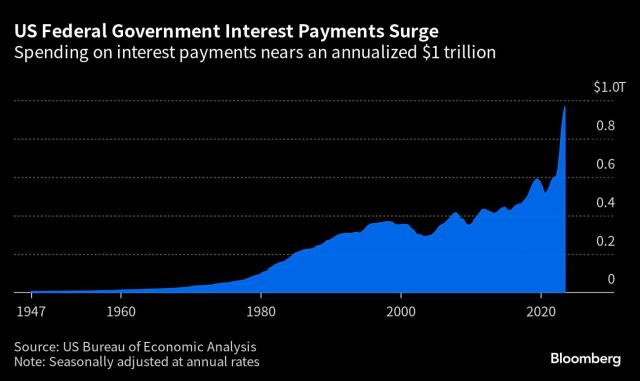

Investors may demand higher interest rates on U.S. bonds due to increased perceived risks associated with the downgrade. This could add financial strain to the government's budget and impact fiscal policies, underscoring the significance of maintaining a strong credit rating to manage debt efficiently and minimize borrowing costs.

3.2 Investor Confidence:

It also could have significant implications for investor confidence in the U.S. economy and financial markets. The downgrade may lead to a reassessment of the country's creditworthiness, prompting international investors to reevaluate their holdings of U.S. assets.

Impact on Investment Decisions: The downgrade may cause investors to question the perceived level of risk associated with holding U.S. assets. Some international investors might opt to reduce their exposure to U.S. securities, bonds, and equities, seeking safer or more attractive investment alternatives in other regions or asset classes.

Capital Flows: As investors adjust their portfolios in response to the downgrade, capital flows could be affected. A decrease in foreign investments in U.S. assets might lead to reduced funding for businesses and projects, potentially impacting economic growth.

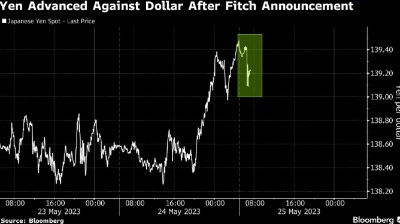

Currency Movements: The downgrade could influence currency exchange rates, as international investors adjust their currency exposures based on changing perceptions of the U.S. economy's strength. This could have implications for international trade and economic competitiveness.

Market Volatility: Investor uncertainty and changes in asset allocations may contribute to increased market volatility. Fluctuations in financial markets could affect investor sentiment and confidence, influencing future investment decisions.

Long-Term Impact: The downgrade's impact on investor confidence may not be limited to the short term. If it raises concerns about the U.S.'s ability to manage its fiscal responsibilities effectively, it could have lasting effects on international investors' perceptions of the country's financial stability.

Policy Implications: The potential shift in investor sentiment could influence policy decisions by policymakers, prompting them to address concerns raised by investors and rating agencies. Policymakers may focus on implementing measures to bolster economic resilience and stability.

The overall impact on investor confidence highlights the importance of maintaining strong fiscal policies, financial stability, and effective economic management to retain the trust of domestic and international investors. Rebuilding investor confidence may require demonstrating a commitment to addressing long-term fiscal challenges and implementing policies that promote sustainable economic growth.

3.3 Global Economic Impact:

Market Volatility: The downgrade may lead to increased market volatility, as investors and institutions adjust their investment strategies in response to the new credit rating. This could affect stock markets, bond markets, and other financial instruments, leading to fluctuations in asset prices.

Investor Sentiment: The downgrade could influence investor sentiment and confidence not only in the U.S. economy but also in other economies closely tied to the U.S. Investors may become more cautious and reassess their exposure to U.S. assets and investments in other countries.

Interest Rates and Borrowing Costs: The downgrade may lead to changes in interest rates for U.S. debt instruments, potentially impacting borrowing costs for the U.S. government. Additionally, it could affect interest rates in other countries as global markets react to the downgrade.

Capital Flows: Investors may shift their capital flows away from the U.S. and towards other regions or countries perceived as having better credit ratings and economic prospects. This could impact investment flows and currency exchange rates.

Trade and Economic Relations: The downgrade may influence international trade relations and economic policies. Other countries' governments and businesses may reassess their trade and financial ties with the U.S., potentially leading to changes in trade agreements and economic partnerships.

Contagion Effects: The global interconnectedness of financial markets means that a downgrade of a major player like the U.S. could trigger contagion effects, affecting other countries and regions that have strong economic ties to the U.S.

The global economic impact of the U.S. credit rating downgrade highlights the interconnected nature of the world economy and the importance of stable and sustainable economic policies. It underscores the significance of credit rating agencies' evaluations in shaping international perceptions of a country's creditworthiness and economic stability. Policymakers around the world may closely monitor the implications of the downgrade and take appropriate measures to mitigate potential risks and uncertainties arising from the evolving economic landscape.

3.4 Political Reactions:

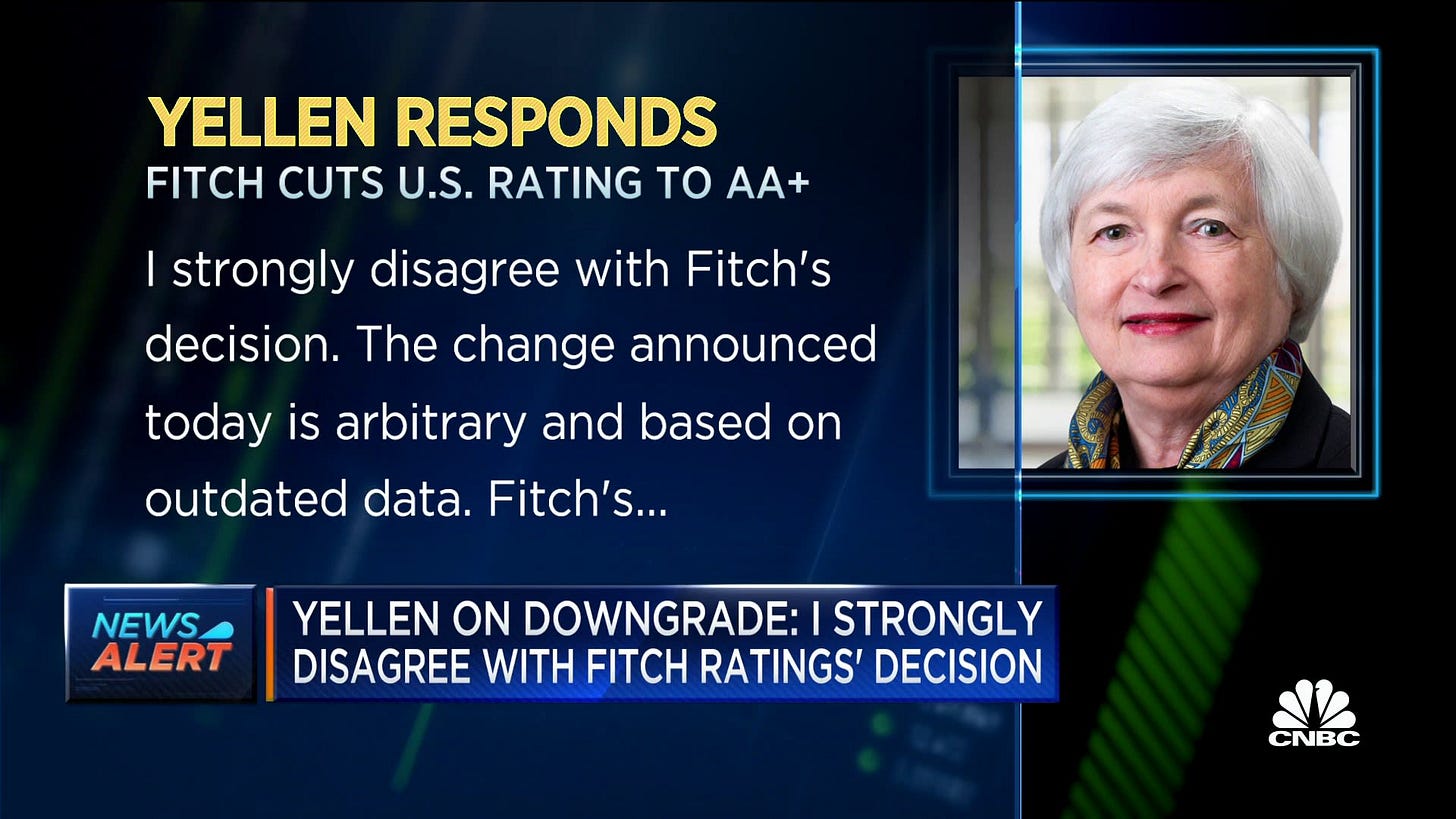

The 2023 U.S. credit rating downgrade by Fitch elicited strong responses from the White House and the Treasury Secretary. Both officials expressed disagreement with Fitch's decision and defended the country's economic recovery under President Biden's leadership. The administration likely sought to reassure the public and investors that they remain committed to sound economic policies and addressing the concerns raised by the downgrade. Such political reactions highlight the importance of credit ratings in shaping public perception and the government's stance on economic matters. It also emphasizes the significance of effectively managing fiscal policies to maintain favorable credit ratings and foster investor confidence in the U.S. economy.

Comparison with Other Rating Agencies:

4.1 Standard & Poor's (S&P) Credit Rating:

With Fitch's downgrade, the United States' credit rating has been lowered from the highest "AAA" to "AA+," making it the second major rating agency to take this action. S&P had previously downgraded the U.S. credit rating, expressing concerns about fiscal sustainability. This history of multiple rating agencies downgrading the U.S. rating underscores the importance of addressing long-term fiscal challenges and implementing measures to ensure fiscal responsibility. A lower credit rating can impact borrowing costs and investor confidence, making it essential for policymakers to prioritize fiscal sustainability and effective financial management.

4.2 Moody's and Other Rating Agencies:

As of the date of the downgrade, Moody's had not made any changes to its rating of the U.S. government. However, Fitch's downgrade could have an impact on Moody's evaluation. Rating agencies often consider actions taken by other major agencies when reassessing creditworthiness. If Fitch's downgrade raises concerns about the U.S. government's fiscal health and management, Moody's may also scrutinize the situation more closely. The potential for Moody's to revise its rating in the future underscores the importance of maintaining sound fiscal policies and financial stability to retain investor confidence and favorable credit ratings. A Moody's Analytics report from May said a downgrade of Treasury debt would set off a cascade of credit implications and downgrades on the debt of many other institutions.

Market Reactions:

5.1 Stock and Bond Markets:

After the news of the downgrade, U.S. stock futures experienced a decline during European trading, indicating a possible lower market opening. This reaction reflects investor concerns and uncertainties about the impact of the credit rating downgrade on the U.S. economy and financial markets. Additionally, the yield on the benchmark U.S. Treasury note fell by 2 basis points, signaling a flight to safety as investors sought more secure assets in response to the downgrade. The market reactions underscore the significance of credit ratings on investor sentiments and the potential effects on asset prices and market volatility.

5.2 Investor Perceptions:

The downgrade may prompt some investors to reassess their asset allocation and risk management strategies. The downgrade could influence investment decisions across different asset classes. Investors may become more cautious and adjust their portfolios to account for the perceived increase in risks associated with U.S. assets. This reevaluation could lead to shifts in capital flows, affecting both domestic and international investments. It underscores the importance of monitoring market reactions and adjusting investment strategies in response to changes in the country's credit rating and perceived economic stability.

Long-Term Outlook:

6.1 Fiscal Management Reforms:

It could also act as a wake-up call for policymakers to address long-term fiscal issues and implement necessary structural reforms to improve financial management. The downgrade highlights the importance of finding sustainable solutions to manage the nation's finances effectively. Policymakers may be prompted to take proactive measures to improve fiscal responsibility, strengthen budgetary policies, and enhance transparency in financial decision-making. The goal is to instill greater confidence in credit rating agencies and investors, ensuring the country's fiscal health is on a more stable and sustainable path for the future.

6.2 Rating Downgrade and Future Debt Ceiling Debates:

The 2023 U.S. credit rating downgrade by Fitch could complicate future debt ceiling debates and political negotiations. Lawmakers may be more reluctant to raise the debt ceiling, fearing its impact on the country's creditworthiness. Bipartisan agreements on the issue may become harder to reach, and increased partisanship could arise. The downgrade may trigger market volatility and affect borrowing costs, urging policymakers to address long-term fiscal issues more proactively. Overall, it emphasizes the need for cooperation in finding sustainable solutions to fiscal challenges.

Conclusion:

The 2023 U.S. credit rating downgrade by Fitch holds significant implications for the U.S. economy, financial markets, and investor confidence. It highlights the need for sustainable fiscal management and political cooperation in addressing long-term challenges. The effects of the downgrade may unfold over time, shaping policy decisions and investor strategies. Monitoring future developments and policymakers' responses will be essential in understanding the impact of the downgrade on the U.S. economic landscape.

Like, Subscribe, and Share to Spread the Word!

Subscribed

If you found this analysis informative and eye-opening, we invite you to like, subscribe, and share this video to help us spread the word. Together, we can build a community of Financial Anarchy advocates who are dedicated to promoting financial literacy and advocating for sound monetary policies. By amplifying our message, we can empower individuals to take control of their financial well-being and contribute to a more equitable and sustainable future.

Support Our Work with a Bitcoin Donation

We also offer the opportunity to support our work and help us continue building the Financial Anarchy community. If you would like to make a contribution, we gratefully accept donations in Bitcoin. Your support will enable us to create more educational content, engage in meaningful activism, and further our mission of challenging the status quo. To donate, please use the following Bitcoin address:

1EkmtWDYzuhkiv3iYozKVnZFxsQxDetnfH

Thank you for joining us on this journey of understanding and change. Together, we can shape a brighter financial future for all.