Like, Subscribe, and Share to Spread the Word!

If you found this analysis informative and eye-opening, we invite you to like, subscribe, and share this video to help us spread the word. Together, we can build a community of Financial Anarchy advocates who are dedicated to promoting financial literacy and advocating for sound monetary policies. By amplifying our message, we can empower individuals to take control of their financial well-being and contribute to a more equitable and sustainable future.

Support Our Work with a Bitcoin Donation

We also offer the opportunity to support our work and help us continue building the Financial Anarchy community. If you would like to make a contribution, we gratefully accept donations in Bitcoin. Your support will enable us to create more educational content, engage in meaningful activism, and further our mission of challenging the status quo. To donate, please use the following Bitcoin address:

1EkmtWDYzuhkiv3iYozKVnZFxsQxDetnfH

Thank you for joining us on this journey of understanding and change. Together, we can shape a brighter financial future for all.

CPI Report Analysis

The latest CPI (Consumer Price Index) data has just been released, and it's come as a bit of a surprise on the upside. The headline CPI number has shot up to 3.7%.

Now, let's dive into the CPI report. As they say, the devil is in the details, and it's crucial to understand how the markets are reacting to this development. Initially, my expectation was that with such a significant increase in the CPI, the likelihood of the Federal Reserve raising interest rates would skyrocket. I anticipated a downturn in the stock market, especially in the NASDAQ. Other assets like Bitcoin and gold might take a hit, and interest rates would likely rise in response.

CPI and the oil market dynamics

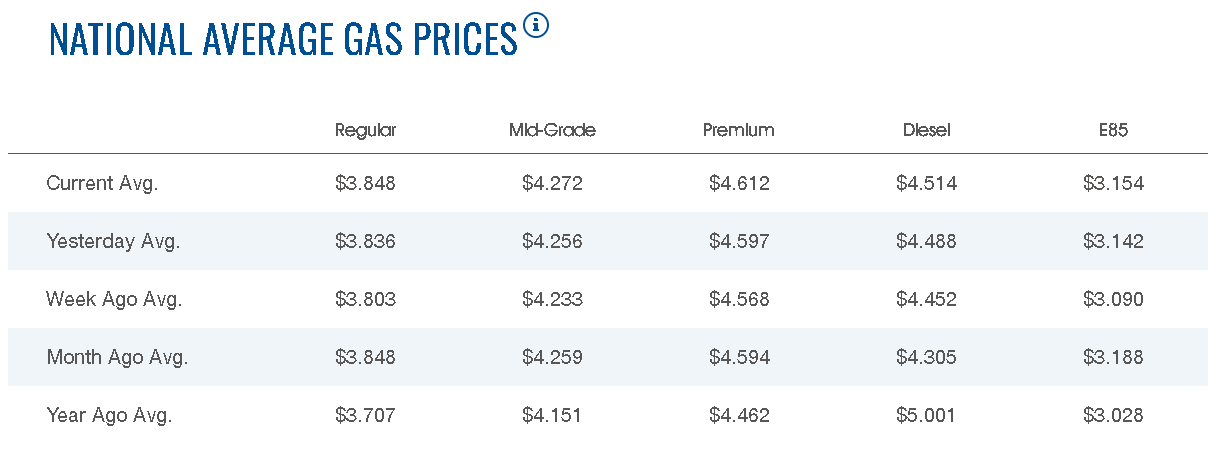

However, the market response has been rather surprising. It appears that the CPI report holds more nuances than what meets the eye. One major contributor to the CPI surge is the rising gas prices, which can be traced back to the oil market dynamics. Yet, some market participants, whom we might refer to as the 'doves,' are pointing out that if we were to slip into a recession, gas prices would likely come back down, offsetting this inflationary pressure. More notably, housing prices, especially the owner's equivalent rent component, which carries significant weight in the CPI calculation, are actually declining.

CPI figures

Let's break down the specific CPI figures. We've witnessed a substantial 0.6% month-over-month increase, a figure we haven't seen in quite some time. Year-over-year, CPI has moved from 3.3% to 3.7%. Core prices, which exclude volatile elements, have climbed by 0.3% on a monthly basis, surpassing initial forecasts, and stand at a 4.3% increase year on year. Interestingly, the core CPI hasn't increased as much as the overall CPI, prompting questions about the forecast for core prices and the underlying reasons behind this discrepancy.

Despite the nuances, it's clear that inflation is still running hotter than what the Federal Reserve would ideally prefer. However, this report hasn't led to any significant shifts in my personal outlook. I had previously transitioned from a pro-inflation stance to a disinflation perspective when I noticed the factors driving inflation starting to weaken. Now, with CPI at 3.7%, I still believe that we're likely to remain within a range of 2.5% to 4%, unless a new catalyst, such as a crisis or government intervention, pushes inflation higher.

Markets reaction

Now, let's examine how the markets have reacted, which I find rather perplexing. Despite the strong CPI figures exceeding expectations, the NASDAQ is only marginally higher, and bond yields haven't surged as anticipated. Bitcoin, oil, and gold are all relatively stable. This suggests that the market is taking into account the intricacies of the situation and not panicking due to the CPI increase.

The spike in gas prices is seen as potentially temporary, assuming it's driven by supply manipulations by Saudi Arabia and OPEC+ to preempt a decline in demand. On the flip side, the decline in the owner's equivalent rent, which has significant weight in the CPI, could be seen as a counterbalancing factor. Core CPI remains at 4.3%, indicating that the Fed may still perceive inflation as a concern. Ultimately, the market seems to be concluding that the CPI increase might not have a substantial impact on the Fed's decision regarding interest rate hikes, resulting in a relatively subdued market reaction.

Conclusion

In conclusion, while the CPI report has revealed unexpected inflationary pressures, the market response suggests that investors are considering the nuances within the data. Factors such as potentially transitory gas price spikes and declining housing costs appear to be tempering the immediate impact of the CPI increase. Although inflation remains a concern, the market doesn't seem to anticipate a significant shift in the Federal Reserve's stance on interest rates at this moment. As always, economic indicators are complex, and their implications may continue to evolve over time.