Bank Bail-Ins: Your Savings at Risk!

The Shocking Truth about the Financial System's Dark Secret

Bank Bail-Ins: Financial Stability Measures?

In the aftermath of the global financial crisis of 2008, the world was left to grapple with the complexities and consequences of traditional bank bailouts. Policymakers and regulators, in search of more sustainable solutions to ensure financial stability, turned their attention towards a novel concept – bank bail-ins. A bank bail-in represents a paradigm shift in crisis management, where the responsibility for recapitalizing a struggling financial institution shifts from governments to the institution's creditors, which may include bondholders and depositors.

In the tumultuous world of modern finance, the term "bank bail-in" has garnered a great deal of attention and generated ample debate. This financial mechanism, often regarded as a last resort for ailing banks, has sent shockwaves through the global financial landscape. While the concept might seem distant and complex, its implications cut to the very core of the financial system, and more alarmingly, into the heart of depositors' accounts. In this critical exploration, we delve into the disconcerting reality of bank bail-ins and the precarious state of the people's accounts.

The Ominous Bail-In Framework

Bank bail-ins represent a disturbing departure from the traditional understanding of deposit accounts. Instead of safeguarding the wealth of their customers, banks now stand as potential predators, waiting to feed on the savings of those they are meant to protect. The machinery of a bail-in empowers financial institutions to reach into the pockets of depositors, effectively turning them into involuntary creditors of the very banks they trusted.

The Unsettling Demise of the Creditor

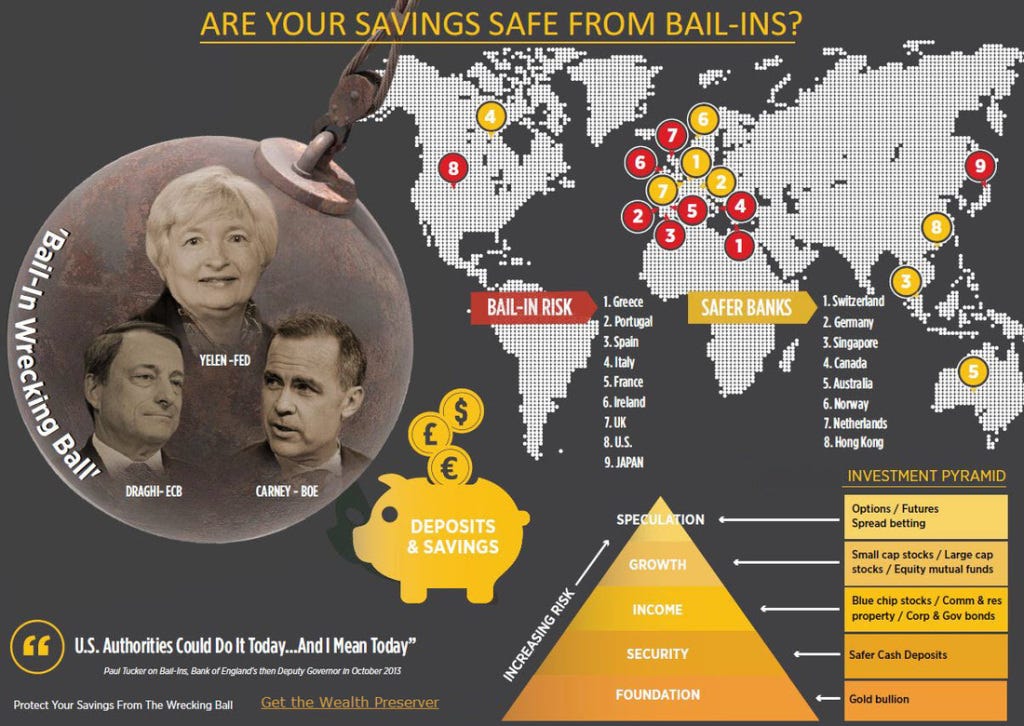

A bail-in target is not solely limited to depositors but also extends to bondholders, stockholders, and other investors. Nevertheless, it's the everyday account holders, the common people, who stand at the forefront of this financial battleground. While banks boast of deposit insurance schemes, these are often grossly inadequate to handle the fallout from a systemic crisis. In such dire circumstances, the average account holder could see their funds erode, even if they held their end of the bargain and stayed well within the prescribed insurance limits.

The Vulnerability of the Uninitiated

One of the most insidious aspects of bank bail-ins is their ability to ensnare unsuspecting individuals who have diligently saved their hard-earned money. Many people remain blissfully ignorant of the lurking risks associated with the modern banking system, which has evolved into a casino where depositor funds are used to speculate on complex financial instruments. The traditional notion of a savings account as a safe haven for one's money has been replaced by a risky gambit where depositors unwittingly become enablers of a perilous game played by the financial elites.

The Precedent-Setting Dilemma

Recent examples around the world underscore the pressing concerns. During the 2008-2009 financial crisis, governments rushed to the aid of failing banks, using taxpayer money to bail them out. However, in a chilling twist of fate, post-crisis regulations were enacted to ensure that future financial burdens would be shouldered not by governments, but by the very depositors who had bailed out the banks initially. In the end, taxpayers were the true creditors, bearing the brunt of this financial alchemy.

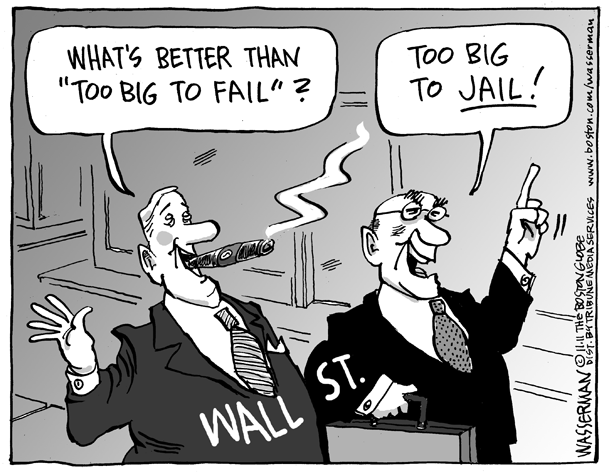

The Fallacy of "Too Big to Fail"

The notion of "too big to fail" has long been the rationale for rescuing failing banks, but it is precisely this idea that bank bail-ins challenge. Instead of dismantling or regulating these behemoth financial institutions, governments are now sending a clear message to depositors: "Your savings are expendable." This creates a moral hazard, whereby banks feel little pressure to reform or moderate their behavior, as the expectation of a bailout, whether through a government rescue or a bail-in, remains ever-present.

Conclusion: A Reckoning for Depositors

Bank bail-ins represent a stark and unsettling reality. In times of economic turmoil, the primary losers are not the reckless bankers or speculative investors, but rather the average account holders who find their hard-earned savings in jeopardy. This ominous trend underscores the urgent need for financial education, regulatory reform, and a reimagining of a system where the people's accounts are no longer perceived as a convenient piggy bank for failing institutions. It is high time to restore the sanctity of personal savings and to ensure that depositors are not unwittingly transformed into creditors of last resort. The fate of the people's accounts hangs in the balance, and it is up to society and regulators to ensure that their trust is not betrayed.