BRICS: The beginig of the end?

How Countries Abandoned the Centuries-Old Monetary System and Paved the Way for a New Era of Global Finance.

The US dollar has been the dominant reserve currency in the world for much of the post-World War II period. This status has given the United States a significant advantage in global trade and finance, allowing it to borrow more cheaply than other countries and enjoy a privileged position in international diplomacy.

But that’s about to change. Get ready to hold on to your hats as we take a journey through the fascinating world of economics and global finance! Once upon a time, the gold standard was the reigning champion of monetary systems, but it seems that its golden age has come to an end and other competitors are starting to take advantage of it.

As the world changes and evolves, other countries are beginning to challenge the long-held hegemony of the US dollar as the dominant reserve currency. With the rise of new economic powerhouses like China and Russia, the US dollar is facing stiff competition, and the global financial system is shifting in unpredictable ways. But before we dive into the current state of affairs, let's first explore what the gold standard was and why it was abandoned by so many countries.

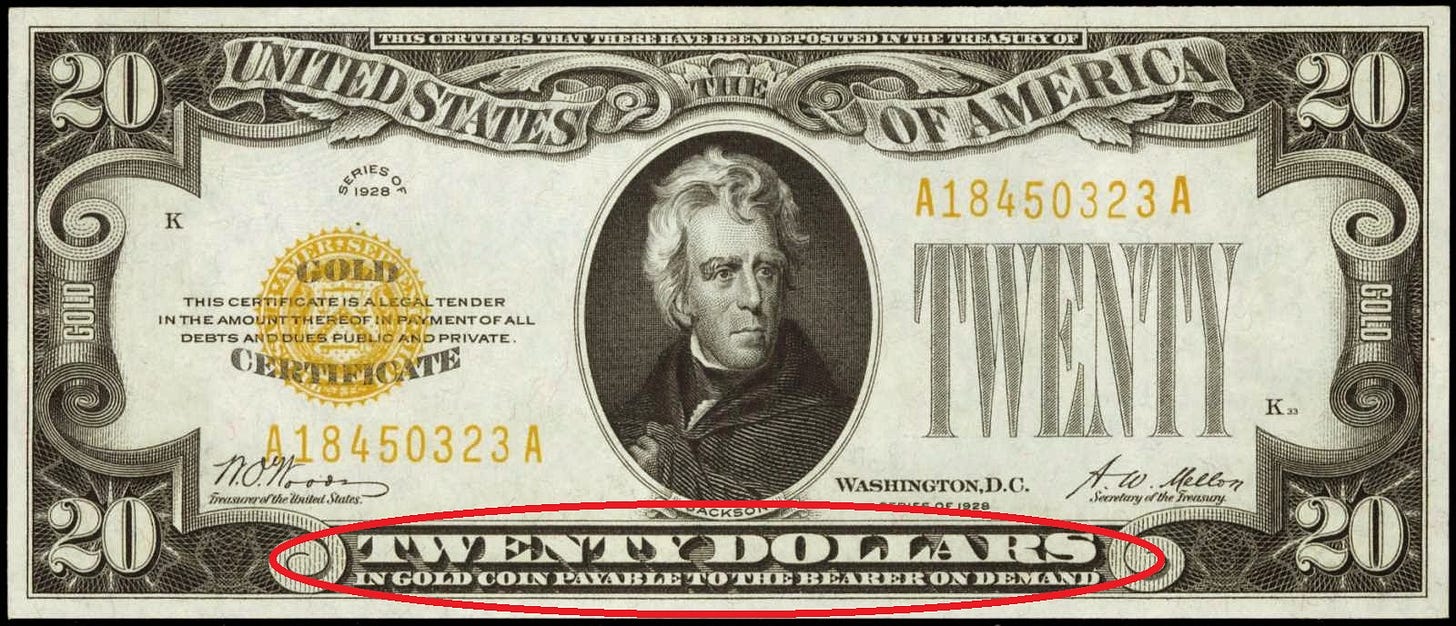

Well, the gold standard was a monetary system in which a country's currency was pegged to a specific amount of gold. This meant that the country's central bank had to hold a certain amount of gold reserves to back up the currency in circulation. Sound simple enough, right?

Initially, the gold standard was seen as a way to promote economic stability and facilitate international trade. But like any system, it had its limitations. One major drawback was that countries couldn't easily expand their money supply to keep pace with economic growth. Additionally, the system was vulnerable to speculative attacks on the currency, which could cause devastating economic crises.

The first crack in the gold standard's armor appeared during World War I. In order to finance the war effort, many countries suspended gold convertibility. And after the war, there was a brief return to the gold standard, only for the system to be suspended once again during the Great Depression of the 1930s.

Now let's take a trip back in time to 1944 when the world was still reeling from the aftermath of World War II. Against this backdrop of global uncertainty and instability, representatives from 44 countries gathered in Bretton Woods, New Hampshire to hammer out a historic agreement that would change the course of world economics forever.

This agreement, known as the Bretton Woods Agreement, aimed to establish a new international monetary system that would promote stability and growth in the global economy. One of the key provisions of the agreement was the establishment of the US dollar as the world's primary reserve currency, backed by gold at a fixed exchange rate of $35 per ounce.

Under this system, other countries' currencies were pegged to the dollar at fixed exchange rates, creating a sense of stability and predictability in the global economy. Countries could buy and sell dollars from the US government to maintain those exchange rates, and the dollar became the bedrock of the global financial system.

The Bretton Woods Agreement was a pivotal moment in the evolution of the global financial system, setting the stage for a new era of international economic cooperation and stability. This groundbreaking agreement established the US dollar as the world's dominant currency, giving rise to two new international organizations to manage the global financial system: the International Monetary Fund (IMF) and the International Bank for Reconstruction and Development (IBRD), which would later become the World Bank.

The IMF was tasked with promoting international monetary cooperation, facilitating trade, and providing loans to countries experiencing balance of payments problems. Meanwhile, the World Bank was created to support post-war reconstruction and development projects. Together, these institutions helped to stabilize the global financial system, ensuring that currencies remained relatively stable in value against each other.

But, as they say, all good things must come to an end. In the 1960s, the US government's pursuit of domestic economic policies that led to inflation and a growing trade deficit began to unravel the Bretton Woods system. Other countries demanded gold in exchange for their dollars, as per the system's rules, resulting in a significant outflow of gold from the US. Despite this, the Bretton Woods Agreement remains a landmark achievement in international economic cooperation, having promoted stability and growth in the post-World War II period and establishing key international institutions that continue to play significant roles in the global financial system today.

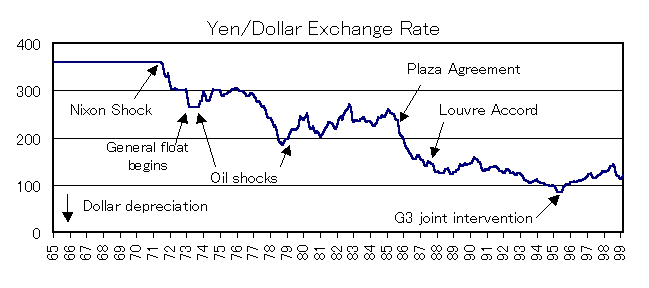

In 1971, President Richard Nixon announced that the US would no longer exchange dollars for gold, effectively ending the Bretton Woods system and the gold standard. This move led to a system of floating exchange rates, in which currencies were allowed to fluctuate freely against each other based on market demand and supply.

Since the demise of the Bretton Woods system, the US dollar has remained the dominant reserve currency in the world. This is due, in part, to the strength and stability of the US economy, as well as the dominance of US companies in global trade and finance. Other countries continue to hold dollars as a safe haven asset, reinforcing the dollar's position as the world's leading currency.

However, the dollar's status as the dominant reserve currency has not been without challenges. In the 1970s and 1980s, the rise of Japan as an economic powerhouse led to some speculation that the yen might challenge the dollar's dominance, but this did not materialize. More recently, the growing economic power of China has led some experts to speculate that the yuan might eventually challenge the dollar's dominance, but this remains to be seen.

One of the factors contributing to the potential decline in our modern times for the dollar as a reserve currency is the rise of the BRICS nations, which are a group of five major emerging economies: Brazil, Russia, India, China, and South Africa. These countries are seen as potential challengers to the dominance of the US dollar, as they account for a growing share of global economic output and trade.

China, in particular, is seen as a key player in the potential shift away from the dollar. The country has been steadily increasing its holdings of US debt and has been actively promoting the use of its own currency, the yuan, in international trade. In recent years, the Chinese government has taken steps to internationalize the yuan, including setting up offshore trading centers and establishing currency swap agreements with other countries.

The BRICS nations have also been working together to create their own institutions and mechanisms for international trade and finance. For example, in 2014, they established the New Development Bank, which is aimed at financing infrastructure and sustainable development projects in emerging economies. They have also set up the Contingent Reserve Arrangement, which is a fund aimed at providing financial assistance to member countries in the event of balance of payments crises.

Despite these developments, however, it is important to note that the US dollar remains the dominant reserve currency by a wide margin. According to the International Monetary Fund (IMF), as of 2020, the US dollar accounted for around 60% of global foreign exchange reserves, while the euro accounted for around 20%.

In the short to medium term, it is unlikely that the US dollar will lose its status as the dominant reserve currency. However, there are concerns that the long-term trends may be less favorable for the dollar, as other currencies gain in importance and the global economy becomes more multipolar. The extent to which the BRICS nations will play a role in this shift remains to be seen, but their growing economic and political influence is likely to have important implications for the global financial system in the coming years.