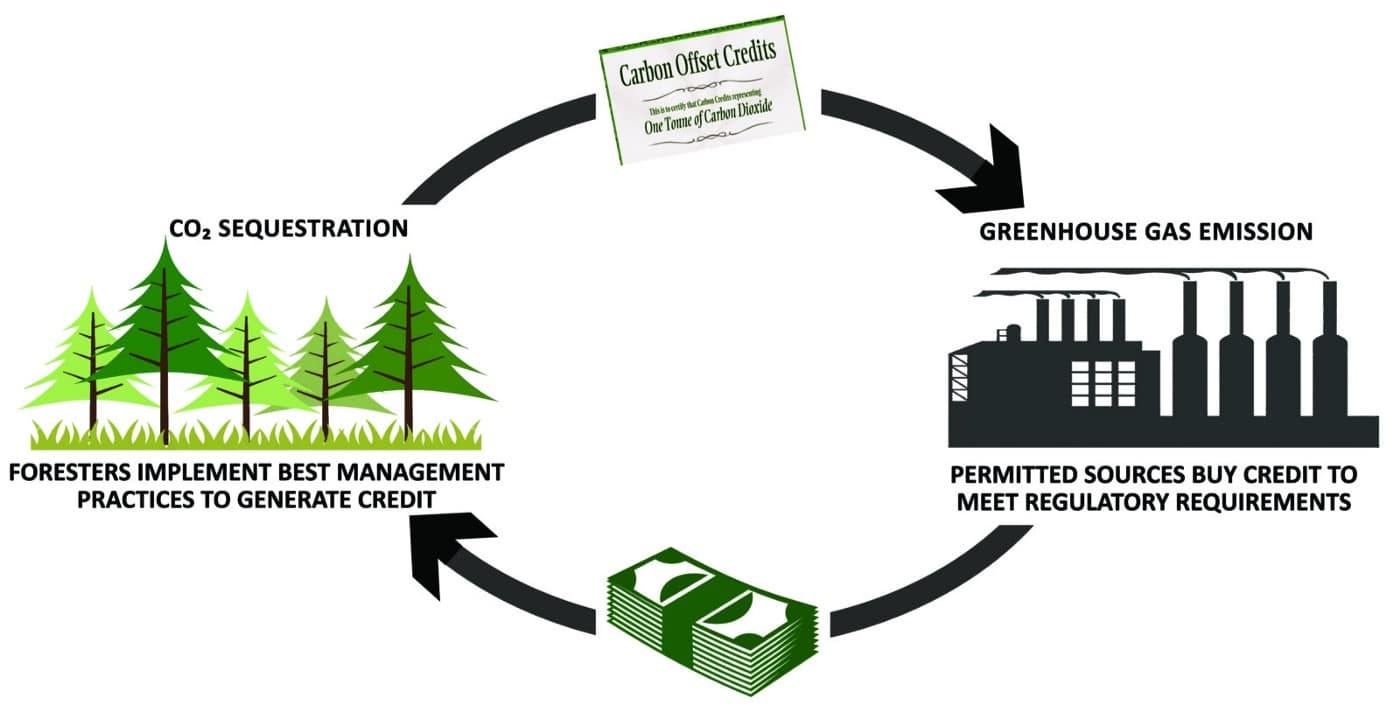

Carbon credits are a straightforward financial mechanism designed for carbon emitters facing challenges in reducing their carbon footprint. These emitters can offset their emissions by participating in carbon projects. In such projects, carbon is either sequestered or mitigated elsewhere. For example, a power plant unable to achieve zero emissions might purchase a carbon credit from an entity engaged in projects like tree planting or distributing clean cooking devices. Trees, being Carboniferous, absorb carbon from the atmosphere, while clean cooking devices help reduce biomass burning, lowering carbon emissions. In essence, carbon credits serve as a trade-off mechanism, allowing those who can reduce carbon to transfer their credits to industries facing difficulties in carbon footprint reduction. The overall impact is a reduction in the environmental carbon load, which is beneficial for the planet.

Criticism of Carbon Credits:

The concept of carbon credits faces substantial criticism on various fronts. One major concern revolves around the effectiveness of carbon offset projects in truly mitigating environmental damage. Skepticism exists regarding the actual impact of initiatives like tree planting or clean cookstove distribution, with doubts raised about the quantifiable and verifiable reduction in carbon emissions. Critics argue that these projects may be mere greenwashing efforts, providing a false sense of environmental responsibility without addressing the root causes of carbon emissions.

Market Dynamics:

The carbon credit market's susceptibility to manipulation and lack of standardized measurement methods also contribute to skepticism. Instances of double-counting and inaccuracies in assessing emissions reductions have been reported, casting doubt on the integrity of the entire carbon credit system. The lack of a universally accepted standard for assessing and verifying emission reductions raises questions about the reliability of the reported environmental benefits.

Carbon Credit as a Commodity:

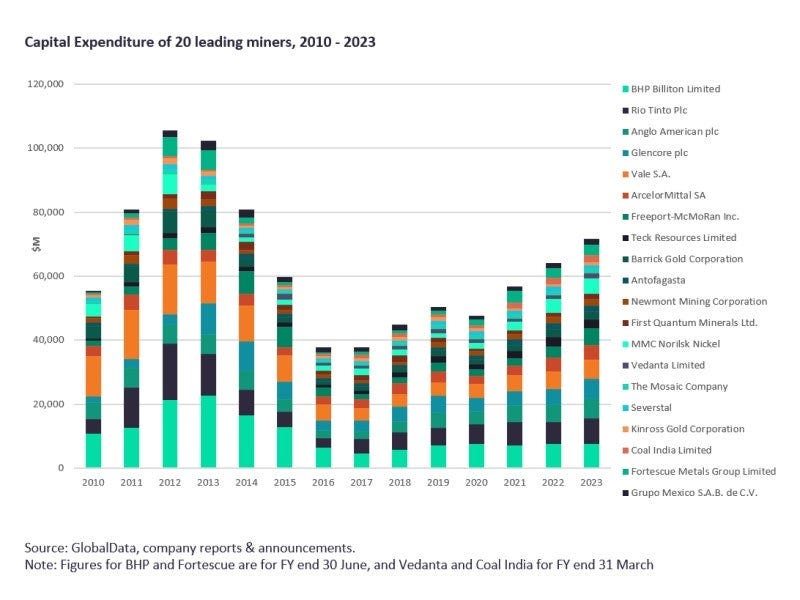

In examining the carbon credit industry, a notable aspect lies in its classification as a commodity, yet it distinguishes itself by being tethered to legal contracts rather than geological factors. This sets it apart from traditional commodities, such as those in mining. In the mining sector, the path to success typically involves the discovery of valuable mineral deposits, leading to additional drilling activities. The reward for such success manifests in the opportunity for more refined drilling techniques, downhole geostatistics, and other advancements. The culmination of these efforts is often an expensive feasibility study, serving as a precursor to development.

Investment and Expenditure:

While acknowledging the inherent risk-reward dynamic in mining, it's essential to note that the comparison made with the carbon industry suggests a different paradigm. In the carbon credit sector, the perceived "knowability" is notably higher. This characteristic is attributed to the industry's reliance on legal frameworks, providing a structured and predictable environment. Consequently, the ability to underwrite expected returns and make informed decisions appears more robust in the carbon credit industry compared to traditional commodities like mining. This distinction emphasizes a potential advantage in managing and mitigating risks within the carbon credit sector.

Project Securing Process:

The process of securing a project in the carbon credit industry diverges significantly from that of the mining sector. In the described carbon business model, the initial investment involves activities like tree planting and distributing cook stoves to communities lacking safe cooking facilities. This approach yields a reduction in carbon emissions, and subsequent years generate returns with minimal operational expenditures, although not entirely without any costs.

Comparison with Mining Expenditure:

Comparing this to the mining sector, the expenditure breakdown in a typical mining project's lifecycle includes initial capital expenditure (capex), sustaining capex, and operating expenses. The distribution across these categories varies based on factors like mining type (e.g., underground or open pit). However, in the carbon credits scenario, the bulk of the capital is incurred upfront. This front-loaded structure enhances predictability regarding cost overruns, facilitating accurate project pricing.

Operational Costs and Predictability:

Furthermore, the operational costs in carbon credit projects are noted as considerably low, primarily consisting of regulatory or bureaucratic expenses related to registries and jurisdiction. This stands in contrast to the mining industry, where operational costs can be influenced by fluctuating prices of materials such as steel and consumables, impacting overall profit margins. The noteworthy aspect here is the emphasis on the predictability and stability of costs in the carbon industry, distinguishing it from the inherent uncertainties associated with natural resource sectors like mining.

Commercial Dynamics and Resemblance to Royalty Business Model:

In examining the commercial dynamics, the discussed approach bears a resemblance to the royalty business model. This similarity lies in the initial payment, often a lump sum, for certain rights or benefits, followed by returns generated based on the utilization or performance of those rights. However, a notable challenge shared in both scenarios is the susceptibility to fluctuating costs and prices, introducing an element of unpredictability.

Consumer Awareness and Trends:

Consumers are increasingly seeking information about the carbon footprint impact of the products they use or purchase, reflecting a broader societal shift toward environmental awareness. This trend is acknowledged as a megatrend, suggesting a sustained and pervasive influence on consumer behavior.

Paris Agreement and Regulatory Landscape:

The Paris Agreement is an international accord signed by a majority of countries that outlines commitments for countries to manage and reduce their carbon footprints. The downstream impact on industries within each country highlights a dual motivation for companies involved in carbon emissions. Beyond responding to consumer demands and aligning with stakeholder expectations, there's a recognition of the regulatory environment. The jurisdictions in which companies operate impose, or will likely impose, regulations related to carbon emissions, adding a significant layer of obligation.

Distinction and Dual Perspective:

The distinction is underscored between consumer-driven initiatives and regulatory compliance. While consumer awareness is recognized as valuable, it is characterized as the "icing on the cake" compared to the imperative of navigating and adhering to the regulatory landscape. This dual perspective positions the voluntary markets, where companies currently participate, as a preparatory phase for the anticipated growth of compliance markets globally. In essence, companies are seen as getting themselves ready for a future where regulatory adherence will be a central and perhaps predominant driver of their actions in the carbon sector.

Deepening Criticism:

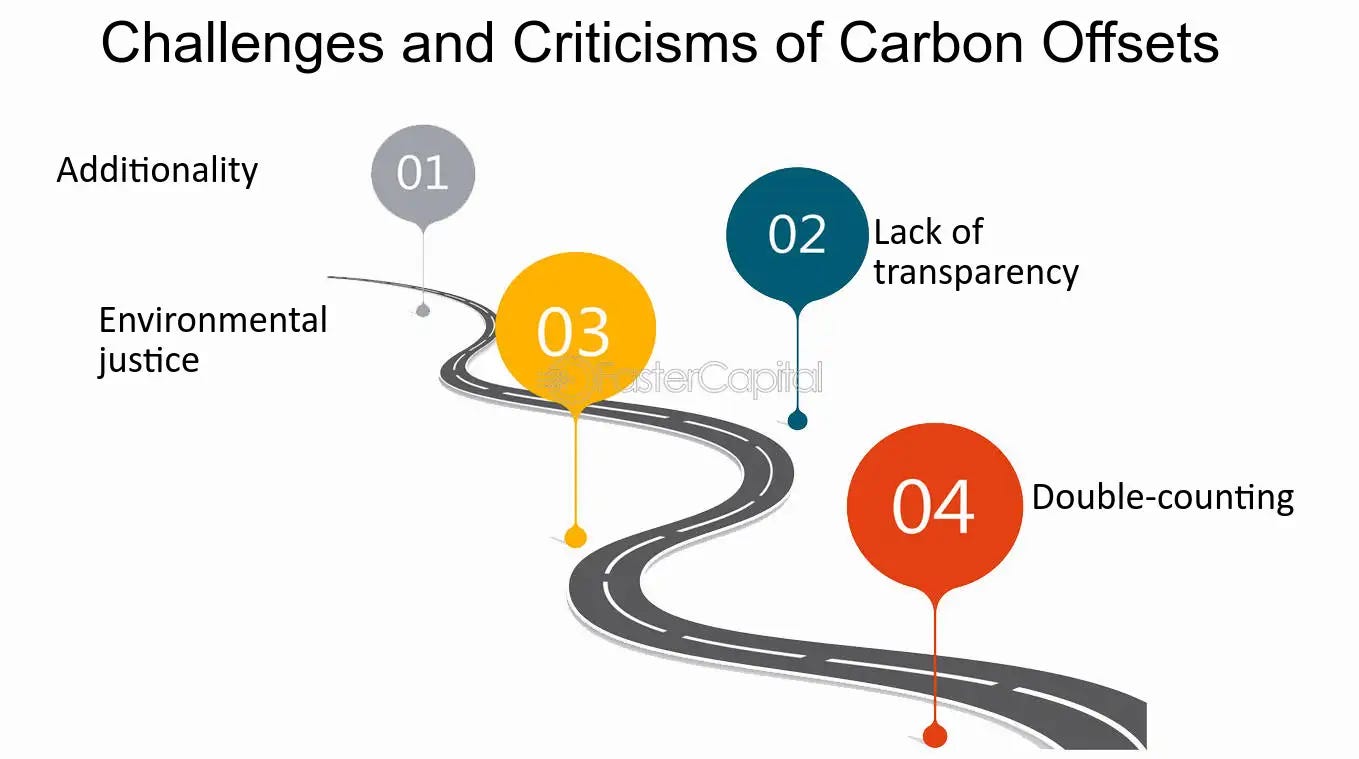

The criticism surrounding carbon credits as a potential scam and unfair taxation deepens when examining the intricate mechanisms of their implementation. One major concern is the concept of additionality, wherein it is questioned whether projects funded by carbon credits genuinely contribute to emission reductions that wouldn't have occurred otherwise. This uncertainty raises doubts about the overall environmental impact of the credits.

Market Manipulation and Unfair Burden:

Furthermore, the lack of a standardized pricing system for carbon credits allows for market manipulation, potentially benefiting large corporations with the financial resources to navigate and influence the market. This dynamic creates an environment where the burden of offsetting emissions falls disproportionately on smaller entities and individuals, stifling their competitiveness.

Loopholes and Unintended Consequences:

The complex nature of carbon credit trading, coupled with the absence of transparent accounting practices, fosters an environment where loopholes can be exploited, diluting the intended purpose of emissions reduction. In essence, the carbon credit system may inadvertently become a tool for perpetuating the status quo rather than driving authentic change in corporate behavior. Consequently, the deeper intricacies of carbon credit implementation fuel skepticism regarding their efficacy and fairness in tackling the global climate crisis.

In conclusion:

While carbon credits present a structured approach to emissions reduction, their complexities and the associated controversies highlight the need for continual evaluation and improvement. Striking a balance between regulatory adherence, consumer awareness, and transparent, standardized practices is crucial to ensure the fair and effective functioning of the carbon credit system in the broader context of environmental sustainability.

Support Our Work with a Bitcoin Donation

We also offer the opportunity to support our work and help us continue building the Financial Anarchy community. If you would like to contribute, we gratefully accept donations in Bitcoin. Your support will enable us to create more educational content, engage in meaningful activism, and further our mission of challenging the status quo. To donate, please use the following Bitcoin address:

Thank you for joining us on this journey of understanding and change. Together, we can shape a brighter financial future for all.