CBDC and Hidden Agendas: Central Bankers and Wyoming's Crypto Event Reveal

ITM Trading’s Video Analysis of the Future of Money and Digital Currency Trends.

In a recent video, Taylor Kenny of ITM Trading dives into a compelling and often overlooked topic—the simultaneous gathering of the world’s most powerful central bankers and the debut of the Wyoming Blockchain Symposium in the same small town of Jackson Hole, Wyoming. This unusual coincidence raises critical questions: Are we witnessing the groundwork being laid for a Central Bank Digital Currency (CBDC) in the United States? Is Wyoming’s push for a state-backed digital dollar a sign of what's to come?

In this article, we analyze Kenny’s video to provide a deeper understanding of these events and their potential implications for the future of money. By breaking down her insights and the context surrounding this confluence, we aim to inform our audience about what could be the next major shift in global finance and personal freedom. As the world grapples with the rise of digital currencies, understanding the stakes has never been more important.

Every year, a group of the world’s most influential central bankers and policymakers convene at Jackson Hole, Wyoming, to discuss the future of monetary policy. This event, the Federal Reserve’s Annual Conference, is known for its exclusive and closed-door nature. However, this year, an unexpected parallel event raised eyebrows and sparked debate. At the exact same time and place, the Wyoming Blockchain Symposium made its debut, signaling potential shifts in the future of currency.

Is it a mere coincidence that these two events took place simultaneously in a small town with a population of just 10,000? Or does this convergence hint at something bigger—a foundational move towards the launch of a Central Bank Digital Currency (CBDC)? Let's explore the implications of this event, the concept of CBDCs, and what it could mean for the future of money.

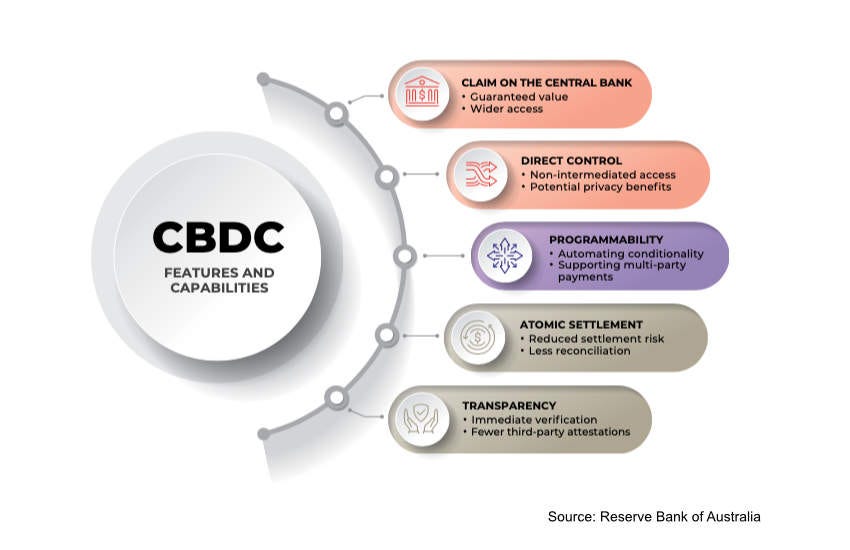

Understanding CBDCs: The Programmable Digital Currency

Central Bank Digital Currencies, or CBDCs, are not a conspiracy theory—they are a reality actively being pursued by most countries worldwide. A CBDC represents a digital form of a nation's currency, issued and regulated by the central bank. Unlike traditional cryptocurrencies like Bitcoin, which are decentralized and built on publicly viewable ledgers, CBDCs are centralized and programmable. This means they can control how, when, and where you spend or save your money.

"The concept of a CBDC isn't new, but the implications of its widespread adoption are profound," said Taylor Kenny of ITM Trading. "In the United States, public pushback has stalled its launch, but the possibility remains."

Wyoming’s Bold Move Towards a Digital Dollar

While the U.S. federal government has been hesitant to introduce a CBDC due to significant public opposition, the state of Wyoming is taking a different approach. Known as America’s “crypto capital,” Wyoming has been at the forefront of creating legislation to support cryptocurrencies and digital payments. Now, the state is moving forward with an initiative to create a stablecoin tied to the U.S. dollar, seemingly in an attempt to nudge the Federal Reserve toward a digital dollar.

"Wyoming's latest initiative to create a digital dollar alternative is framed as a way to foster transactions free from government regulation," Kenny explained. "But the irony is that it would still be government-controlled, issued, and operated."

CBDC vs. Stablecoin: What’s the Difference?

To understand Wyoming’s approach, it's essential to differentiate between a CBDC and a stablecoin. A CBDC is a digital currency issued by a central bank, such as the Federal Reserve. In contrast, a stablecoin is a type of cryptocurrency where its value is pegged to a traditional asset, like the U.S. dollar.

"Stablecoins are designed to offer stability compared to volatile cryptocurrencies because they are backed by tangible assets," said Kenny. "However, they are still concerning because their stability is tied to an asset that is itself unstable—the U.S. dollar."

While stablecoins may seem like a safer alternative to more volatile cryptocurrencies, their reliance on another currency makes them vulnerable to the same risks that affect that currency.

The Lessons from the Bretton Woods Agreement

Kenny draws an analogy between today’s digital currency landscape and the historical Bretton Woods Agreement, where the U.S. dollar was pegged to a fixed value of gold, and other currencies were pegged to the dollar. "Gold was a true store of value, unlike the U.S. dollar, which is subject to government spending and geopolitical risks," Kenny noted. "That’s why we’ve lost over 25% of our purchasing power in the last five years."

The Bretton Woods Agreement ended when the U.S. suspended the dollar’s convertibility into gold, leaving other countries with a currency that lost value. "The United States was able to keep its gold reserves, while the rest of the world was left with devalued dollars," Kenny explained. "If those countries had held gold instead of U.S. dollars, they would have preserved their wealth."

The Risks of a Government-Controlled Digital Currency

The push for CBDCs or government-issued stablecoins raises significant concerns about control and freedom. "Imagine living in a world where your money is fully programmable," Kenny warned. "The government could dictate every transaction you make, monitor your spending, and even restrict purchases if they disagree with them."

Kenny further elaborates on the risks: "Say you want to buy gold to protect your wealth, but the government decides it doesn’t want you to. Suddenly, your CBDC can’t be used for that purchase. This is not your standard cryptocurrency; it is government-controlled and operated, and to many, this is raising alarm bells."

Protecting Wealth in an Uncertain Future

As digital currency initiatives like those in Wyoming move forward, Kenny emphasizes the importance of protecting one's wealth with physical assets like gold. "Gold cannot be devalued or confiscated quietly through taxes and inflation," Kenny said. "This is why everyone needs a gold insurance policy in place if they are concerned about what’s happening."

Kenny encourages people to act now before it’s too late: "This new digital dollar might sound exciting, but it could be a gateway into CBDCs, where we lose financial freedom and privacy. The window of opportunity to protect yourself is now."

Conclusion: A Call to Awareness and Action

As the world moves closer to adopting digital currencies, it is crucial to stay informed and prepared. The recent events at Jackson Hole and the Wyoming Blockchain Symposium may signal the beginning of significant changes in how we perceive and use money. The key takeaway is to remain vigilant and consider diversifying investments to safeguard against potential future risks.

"As more people become aware of what's happening, there is strength in numbers," Kenny concluded. "Let’s not be left with a digital currency that controls our every move. Now is the time to protect yourself and your wealth."

The debate over digital currency is far from over. The decisions made today will shape the financial landscape of tomorrow. What are your thoughts on this? Are you concerned about the future of money, and how are you planning to protect yourself?

Taylor Kenny, from ITM Trading, signs off by reminding readers to stay alert and informed. "Your financial freedom depends on it."

![The most important types [Privacy coin vs Stablecoin vs CBDC] The most important types [Privacy coin vs Stablecoin vs CBDC]](https://substackcdn.com/image/fetch/w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Ffd6bdf9d-459f-4027-941f-983fbd382a5b_1280x720.png)