Thank You for Reading!

Thank you for taking the time to read this article! We truly appreciate your interest in our work and your support for the important discussions we’re bringing to light. If you found this content valuable, please consider liking, subscribing, and sharing it with your friends and family to help us reach more people.

Your support enables us to continue our mission of delivering insightful, thought-provoking content. If you’re able, we encourage you to donate to our efforts, so we can keep improving and expanding the work we do. Every contribution, big or small, helps us create even better material for our dedicated audience. Together, we can keep pushing the conversation forward and provide valuable resources to those seeking to understand the world around them.

Thank you again for being a part of this journey!

Introduction

The documentary End of the Road examines the intricate dynamics of the global financial system, highlighting its reliance on fiat currency, manipulation, and unsustainable policies. Experts delve into historical developments, the flaws in monetary policies, and the implications of central banking practices. The film unpacks how these mechanisms, designed to stabilize economies, have instead fostered volatility, inequality, and systemic risks. With an eye on historical precedent and economic principles, the documentary seeks to inform viewers about the underlying causes of recurring financial crises and the steps individuals can take to protect their wealth.

Bretton Woods (1944)

The Bretton Woods Agreement of 1944 established a new global monetary order, linking world currencies to the U.S. dollar, which was convertible to gold at $35 per ounce. This system aimed to create financial stability and promote international trade by eliminating currency fluctuations. A central element of this agreement was trust in the U.S. dollar as a reserve currency. However, this reliance would eventually expose vulnerabilities.

One of the participants explains, “The idea was to build a system where countries could stabilize their economies post-war, but tying currencies to the dollar made the U.S. the central banker of the world. It was a huge responsibility.” Over time, however, the U.S. faced mounting deficits, leading to questions about the sustainability of this arrangement. The Bretton Woods system ultimately collapsed under the weight of these challenges, setting the stage for the Nixon Shock.

Nixon Shock (1971)

In 1971, President Richard Nixon unilaterally ended the convertibility of the U.S. dollar to gold, effectively dismantling the Bretton Woods system. This decision was driven by an overextension of U.S. monetary policy, particularly the costs of the Vietnam War and domestic spending programs. The "Nixon Shock" marked the official transition to a fiat currency system, wherein the dollar's value was no longer anchored to gold.

“The Nixon administration took a drastic step,” the documentary states, “because the U.S. didn’t have enough gold to back its commitments. It was a turning point, but not a good one.” This decision created a fiat system that relies entirely on trust in government-issued currency, leading to unprecedented financial instability in the decades that followed.

Fiat Currency

The documentary critiques fiat currency as inherently flawed because it enables governments to create money without tangible backing. This power, while initially beneficial for managing economic growth and responding to crises, ultimately leads to inflation and devaluation. Fiat currency, unlike gold, lacks intrinsic value and is vulnerable to political manipulation.

One expert argues, “Fiat currency is a promise backed by nothing. It’s a tool for governments to take on unsustainable debt and fund programs without accountability.” The film emphasizes that while fiat money is convenient, it fails as a store of value over time, eroding purchasing power and exacerbating wealth inequality.

Ponzi Scheme

The financial system is described as a giant Ponzi scheme, dependent on the constant creation of new debt to sustain itself. Governments and central banks perpetuate this cycle by issuing IOUs that future generations must repay. This unsustainable model has no endgame, the documentary suggests, as it relies on ever-increasing borrowing and spending.

“This system only works as long as people believe in it,” one participant explains. “But like any Ponzi scheme, it will collapse when confidence erodes.” The film draws parallels between this structure and well-known financial frauds, arguing that the consequences for society are far more significant.

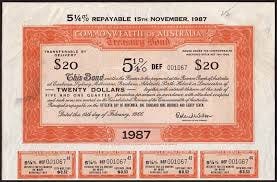

IOU Bonds

Bonds issued by governments are essentially IOUs, promising future repayment with interest. The film highlights how these instruments are used to fund excessive spending and create an illusion of prosperity. However, the reliance on bonds places immense strain on future taxpayers, who must bear the burden of repayment.

An interviewee states, “The bond market is the backbone of this scheme. Governments sell these IOUs to finance deficits, but they are mortgaging our future.” The unsustainable nature of this approach is a recurring theme throughout the documentary, underscoring its role in perpetuating financial instability.

Inflation and Purchasing Power

Inflation, the gradual rise in prices over time, is presented as a hidden tax on citizens. By eroding the purchasing power of money, inflation disproportionately affects savers and those on fixed incomes. The documentary argues that central banks' reliance on inflationary policies to stimulate growth undermines the economy’s long-term stability.

“An ounce of gold buys the same today as it did 2,000 years ago,” one speaker notes, “but fiat currency loses value every day. Inflation is a mechanism to steal wealth without people noticing.” This perspective reinforces the idea that gold remains a reliable store of value amidst economic turmoil.

Occupy Wall Street (2008)

The documentary examines the Occupy Wall Street movement as a response to widespread dissatisfaction with the financial system following the 2008 crisis. Protesters highlighted issues such as income inequality, corporate greed, and the lack of accountability for those responsible for the crisis.

“Occupy Wall Street was a wake-up call,” the film suggests, “but the system didn’t change. The same players remain in power, and the same risks persist.” The movement’s failure to achieve systemic reform is portrayed as a missed opportunity to address the root causes of economic injustice.

Great Recession

The 2008 financial crisis, triggered by the collapse of the housing market, exposed deep flaws in the global financial system. The documentary critiques the role of banks, regulators, and policymakers in creating the conditions for this collapse. The subsequent recession devastated millions, wiping out savings, jobs, and homes.

“2008 was the biggest financial crash in history, but the response was to double down on the same policies that caused it,” one expert asserts. This critique underscores the film’s central argument that the system is inherently broken and in need of fundamental reform.

Money Printing and Bailouts

In response to the 2008 crisis, central banks engaged in massive money printing and bailouts to stabilize the economy. While these measures prevented a total collapse, the documentary argues they exacerbated underlying problems by rewarding bad behavior and creating moral hazard.

“Trillions of dollars were printed to save the banks, but who saved the people?” a participant asks. This section highlights the unequal impact of these policies, with ordinary citizens bearing the brunt of austerity while financial institutions profited.

Return to Gold

The film advocates a return to the gold standard as a solution to fiat currency’s shortcomings. Gold is portrayed as a stable and trustworthy medium of exchange that limits government overreach and ensures financial accountability. The documentary argues that individuals can adopt a personal gold standard by investing in physical gold to protect their wealth.

“Gold is the ultimate form of money,” one speaker states. “It doesn’t rely on trust in politicians or central banks. It’s real, and it’s scarce.” This perspective underscores the film’s endorsement of gold as a safeguard against economic uncertainty.

Manipulation of Gold Prices

The documentary alleges that governments and financial institutions manipulate gold prices to maintain confidence in fiat currency. By suppressing gold’s value, they obscure its role as an alternative to paper money. This manipulation is described as a deliberate strategy to preserve the status quo.

“Gold is a competitor to the dollar,” one expert explains. “When its price rises, it signals trouble for fiat currencies. That’s why they work so hard to keep it down.” This claim is supported by examples of central banks selling or leasing gold to influence the market.

Bullion Banks and Fraudulent Accounting

The film accuses bullion banks and central banks of engaging in fraudulent accounting practices to hide the true state of their gold reserves. These institutions allegedly sell or lease gold that they do not physically possess, creating a system of paper claims on nonexistent assets.

“There’s more than one claim on each ounce of gold,” one participant asserts. “If everyone demanded their gold at once, the system would collapse.” This section emphasizes the importance of owning physical gold as opposed to relying on paper contracts.

Conclusion

End of the Road concludes with a call to action for individuals to take control of their financial futures. The film advocates for education, self-reliance, and a return to sound money principles. While acknowledging the challenges ahead, it also highlights the opportunities for those who are prepared.

“This is the greatest wealth transfer in history,” one speaker notes. “With knowledge and preparation, people can protect themselves and even prosper.” The documentary ends on a hopeful note, emphasizing the resilience of individuals in the face of systemic failure.