Energy Summit and Changing Oil Market Dynamics

A significant event, known as the Break Summit, took place recently. Countries such as Saudi Arabia, UAE, Iran, Russia, and China participated, among others. Unlike the G7 countries, which include mainly the US and Canada, these nations are major players in oil production. This shift in alliances carries the potential to reshape the oil market over various timeframes—short, medium, and long-term.

By having powerful oil-producing nations like Saudi Arabia, UAE, Iran, Russia, and China come together, a significant shift occurs in the global oil landscape. These countries wield substantial influence due to their large oil production capacities. This development contrasts with the G7, where oil production isn't a defining factor for most member countries.

The participation of these oil-producing nations in the Break Summit holds implications for the oil market. In the short term, changes in oil prices, supply, and demand could occur due to altered trading dynamics. Medium-term effects might involve shifts in global energy partnerships and supply routes. Looking ahead to the long term, the collaborations formed during the summit could reshape the energy industry's power dynamics and market structure.

One key consideration is how these new alliances will impact trade balances and market stability. The involvement of these oil-rich nations could lead to changes in the way oil is bought and sold on the international stage. The outcome could influence the global economy, energy security, and even political relationships.

Another important aspect is the potential influence on global currencies and the US dollar. If these countries establish new mechanisms for trading oil that doesn't rely on the dollar, it could lead to shifts in the international monetary landscape. This transition could carry long-term implications for global financial systems and economic strategies.

As the Break Summit outcomes unfold, it will be intriguing to observe how these influential oil producers work together and how their collaborations impact global energy markets. The balance of power in the oil sector might undergo substantial changes, leading to both challenges and opportunities for various nations, industries, and investors.

Overall, the Break Summit's involvement of major oil-producing nations signifies a significant turning point in the energy sector's trajectory, with ripple effects expected across short, medium, and long-term timeframes.

The Crucial Role of Oil Exporters in Global Dynamics

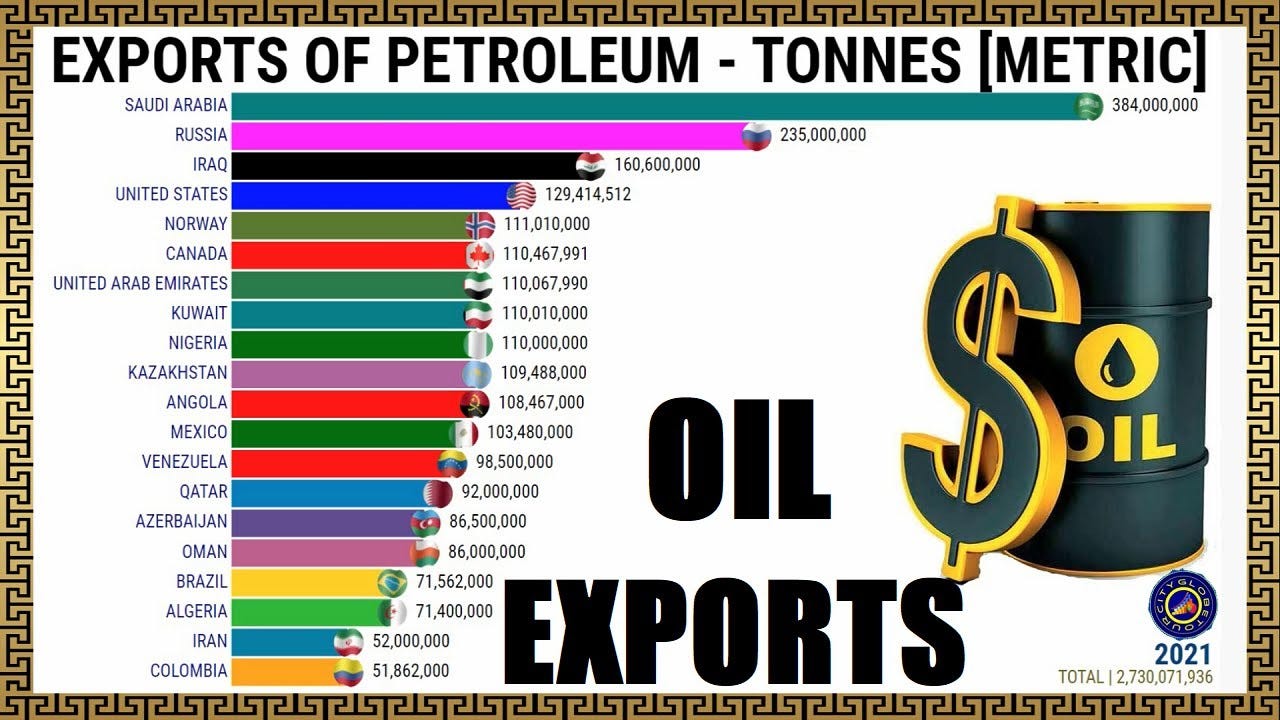

The influence of countries like Saudi Arabia, Russia, UAE, and Iran in the oil export domain cannot be underestimated. These nations command a significant chunk of the world's oil export capacity, a pivotal factor in shaping global economic dynamics. This influence extends even further with the presence of the OPEC+ coalition, which wields substantial control over oil supply and pricing.

When we talk about export capacity, we're essentially referring to a nation's ability to send oil to other countries. Saudi Arabia, for instance, is known for its massive oil production capabilities, and its influence is amplified due to its substantial export potential. Russia, UAE, and Iran similarly possess considerable export capacities. The combination of these nations forms a formidable force in shaping the direction of oil markets.

The OPEC+ Dynamic

OPEC+ is an alliance that includes the Organization of the Petroleum Exporting Countries (OPEC) and other major oil producers like Russia. This alliance holds significant sway over global oil supply levels. Through coordinated production adjustments, OPEC+ can influence oil prices, impacting not only the economies of member countries but also the global energy landscape.

The real intrigue lies in the potential impact of these new alliances on international trade balances and monetary systems. The alignment of powerful oil producers can alter the dynamics of energy trade, with potential consequences for economies heavily reliant on oil imports. Additionally, these alliances could reshape how countries settle trade transactions—particularly concerning the US dollar, which has traditionally dominated global trade.

Dollar Dependency and Energy Markets

Historically, oil transactions have been closely linked to the US dollar. This arrangement has given the US significant influence over global financial systems. However, the emergence of new alliances could introduce alternative trading mechanisms, potentially diminishing the dollar's dominance in international trade. This shift could redefine the balance of power and influence in the energy sector.

As these new alliances form and evolve, a range of economic and geopolitical implications emerges. The strategic decisions made by these oil-exporting nations can influence energy prices, economic stability, and even diplomatic relationships. The choices they make regarding trade, partnerships, and currency preferences could set the stage for how the global energy landscape unfolds.

Observing how these alliances develop and the subsequent impact on international trade and monetary systems is a fascinating journey. The potential for restructured trade balances, altered energy pricing dynamics, and changes in currency preferences can lead to a new chapter in the history of global economics and geopolitics. The interactions among these influential nations will continue to shape the narrative, affecting everything from energy markets to diplomatic ties.

Balancing Renewable Energy and Fossil Fuels in a Changing Landscape

The ongoing transition towards renewable energy sources is a defining global trend. However, it's essential to recognize that while renewable energy is gaining ground, fossil fuels remain pivotal to our energy mix. The reasons for this intricate relationship are multifaceted and deserve a closer look.

Fossil fuels, such as coal, oil, and natural gas, continue to fulfill a significant share of the world's energy demand. They power industries, transportation, and homes across the globe. While the transition to renewables is underway, the infrastructure, expertise, and energy systems built around fossil fuels are deeply entrenched and not easily replaced.

Rising Energy Consumption

The global demand for energy is on a steady rise. As billions of people strive to improve their living standards, the need for reliable and abundant energy sources becomes more pressing. While renewables are growing, they have not yet reached the point of fully replacing the vast energy capacity provided by fossil fuels.

The shift from fossil fuels to renewables involves complex economic, technological, and infrastructural considerations. For instance, while renewables generate electricity, they may not be as suitable for sectors like aviation or heavy industry. Battery technology, required for storing renewable energy, is still evolving and faces limitations in terms of scale and efficiency.

Transitioning from fossil fuels to renewables is not a swift process. It requires massive investments, policy changes, and adaptations across various sectors. Rapid shifts can lead to energy shortages, disruptions, and economic challenges. Moreover, developing countries might find it challenging to leapfrog to renewables due to infrastructure limitations.

The journey toward a cleaner energy future involves a delicate balancing act. While renewables are a beacon of hope for reducing greenhouse gas emissions and environmental damage, they coexist with fossil fuels for the foreseeable future. An intelligent approach involves optimizing energy systems, maximizing the potential of both renewables and fossil fuels and working toward gradual but sustainable transformations.

The transition from fossil fuels to renewables is an ongoing process that requires careful navigation. As the world grapples with the challenge of addressing energy demand while minimizing environmental impacts, policy decisions, technological breakthroughs, and international cooperation will play crucial roles in shaping the energy landscape of tomorrow.

In essence, while renewable energy's growth is promising, it is essential to recognize the intricate relationship between renewables and fossil fuels. Achieving a sustainable and clean energy future demands a comprehensive and strategic approach that acknowledges the roles both these energy sources play in powering our world.

The Changing Face of Energy in Europe

Germany, a powerhouse in Europe, plays a significant role in shaping the region's energy policies. Its choices can reverberate across the continent. As Germany grapples with decisions regarding nuclear power phase-outs, coal consumption, and renewable investments, changes in leadership and political climates can lead to policy shifts that affect the entire European energy landscape.

Europe's stance on green energy might shift due to economic challenges and changes in leadership. Germany, for example, might face political changes influenced by its energy decisions. The winter's severity could impact energy decisions, especially if it leads to political upheaval.

The severity of winters can hold profound implications for energy decisions. Harsh winters can strain energy resources and supply chains, leading to potential energy shortages and increased demand. Such scenarios can trigger political upheaval as governments and leaders respond to the challenges of providing adequate energy to their populations.

Navigating Natural Gas Supply in a Complex Landscape

Natural gas supply is a multifaceted puzzle influenced by intricate factors such as storage, demand, and the intricate interconnection of energy grids. European countries grapple with varying storage capacities and the vital role they play, particularly during periods of high demand, like cold snaps. Even as the world moves toward renewable energy, the necessity of backup solutions, like natural gas, remains undeniable.

Natural gas supply hinges on effective storage management. Countries with substantial storage capacities can respond more flexibly to fluctuating demand. During times of low demand, excess gas can be stored, and during peak demand, stored gas can be withdrawn. The efficiency of storage and withdrawal mechanisms is crucial for maintaining energy stability.

Europe's interconnected energy grids allow for resource sharing among neighboring countries. This interconnectedness can serve as a buffer during energy shortages, as countries can share resources to meet demand. However, it also emphasizes the importance of collaboration and coordinated responses to maintain grid stability and energy security.

In conclusion…

The energy landscape is complex and involves a mix of supply, demand, technical innovation, and strategic considerations. Transitioning from fossil fuels to renewables comes with both successes and challenges. The varying nature of renewable sources like wind and solar power introduces new elements to energy grids, leading to situations of excess and scarcity. While negative spot prices during overproduction might seem counterintuitive, they highlight the complexities of grid management and the need for backup solutions.

Integrating intermittent renewables requires careful balancing for grid stability. The dynamics of energy supply, availability, and sustainability create a delicate equilibrium. Renewable sources show promise but still rely on traditional backup solutions like natural gas.

In Europe, changes in energy policy are influenced by economic factors, political decisions, and environmental goals. Germany's role in green energy faces challenges due to practical considerations and potential shifts in political leadership. Harsh winters and their impact on energy decisions emphasize the interplay of weather, politics, and energy security.

Natural gas, with its complex supply patterns and role in energy transition, remains a critical part of the energy puzzle. The interconnectedness of energy grids and varying storage capacities in European countries highlight the need for collaborative solutions during high demand. Renewable energy's growth, though significant, hasn't fully replaced traditional sources, showing the ongoing importance of backup solutions.

In summary, the energy landscape is intricate, involving technology, geopolitics, and environmental objectives. Moving toward a sustainable future requires addressing challenges, embracing innovation, and making strategic decisions to ensure energy supply while minimizing environmental impact. As the world navigates these complexities, the path forward involves a balance of immediate demands and long-term sustainability.

Support Our Work with a Bitcoin Donation

We also offer the opportunity to support our work and help us continue building the Financial Anarchy community. If you would like to make a contribution, we gratefully accept donations in Bitcoin. Your support will enable us to create more educational content, engage in meaningful activism, and further our mission of challenging the status quo. To donate, please use the following Bitcoin address:

1EkmtWDYzuhkiv3iYozKVnZFxsQxDetnfH

Thank you for joining us on this journey of understanding and change. Together, we can shape a brighter financial future for all.