"Exploring the Potential of Uranium, Gold, and Silver: A Comprehensive Analysis"

"Maximizing Your Potential: Insights on Success and Mindset" Includes An Inspirational Commentary for Andrew Tate

To start, I would like to express my gratitude to everyone who takes the time to read my posts. In order to foster a strong relationship between my audience and my content, I believe it's essential to share more about myself. As we continue on this journey, I will gradually reveal more details about my personal life. Honesty and openness are important values to me, and I aim to provide you with insight into my activities through this newsletter.

I enjoy writing and sharing my interests with the world. Although I am not a professional investor yet, I have put in a great deal of effort and time to learn about investing. Through listening to the best contrarian professional investor podcasts, watching countless YouTube interviews, analyzing charts, reprogramming my subconscious mind, and persevering through failures, I am confident that I am on the right path. While I have not achieved my ultimate goal yet, I am determined to get there. It's not about being the smartest person in the room, but rather about the effort and dedication I put into my work.

The focus here is on personal growth. It seems that nowadays, there are more and more people who are content with being lazy. While this is not a concern for me, as it means they won't be obstacles to my own success, I find inspiration in those who put in the effort to achieve their goals and make significant strides in their careers. Those who wake up early, exercise diligently, and prioritize self-improvement and constant growth are particularly motivating for me.

I come from humble beginnings and did not have the advantage of being born into a wealthy family. While I did not experience extreme hunger, I faced challenges in making ends meet. I witnessed my father's struggles to provide for me and my mother's efforts to educate me and instill the values that guide me today. I feel a strong sense of responsibility to take care of them and my family in the face of an impending economic collapse, and I am prepared to do whatever it takes to ensure their well-being.

The future may not be promising for many individuals due to a lack of focus on truly important matters. People seem to be easily distracted by the meaningless ramblings of lazy influencers, corrupt politicians, fake news outlets, and propaganda ministers. However, if we simply turn down the noise, turn off our televisions, and delete our social media (unless we are content creators), we can start listening to individuals who possess the ability to think critically and independently. By doing so, we can become more aware of the issues that truly matter and work towards a better future.

I'm curious, how many of you are truly committed to growing and achieving abundance through hard work, consistency, and discipline? These are the qualities that I value in my readers. I strive to surround myself with the best of the best - those who possess insightful opinions and not just regurgitated ideas. I'm not interested in engaging with individuals who parrot "woke" nonsense, but rather with those who are truly dedicated to achieving success.

I want to make a list of the people I follow and admire, so you guys can understand a little more about the people I trust and believe in:

Rick Rule: Rule Investment Media

Justin Hugh: Uranium Insider

Steve Penny: Silver Chartist

Iman Gadzhi: Entrepreneur and YouTuber

Maneco 64: YouTube educator

Gregory Mannarino: Substack, YouTuber, Trader

Luke Belmar: CapitalClubCommunity

Sprott Money: Financial news, YouTube

Mike Maloney: GoldSilver YouTube educator

Robert Kiyosaki: The rich dad poor dad

Peter Schiff: Schiff Gold, investor, banker

Rafi Farber: End game investor

Andrew McGuire: Kinesis Money

Andrew Tate: No need for an introduction

And many others…

Andrew Tate has been a tremendous source of inspiration in my life. His words of wisdom have pushed me to strive for excellence, to work hard towards my goals, and to be disciplined in many things I do.

One of the things that I admire most about Tate is his unwavering dedication to hard work. He has taught me that success is not something that is handed to you on a silver platter - it is something that must be earned through relentless effort and a strong work ethic. His advice has helped me to stay focused and driven, even when faced with difficult challenges.

Another thing that I appreciate about Tate is his commitment to speaking his mind and having relevant opinions. In today's world, it's all too easy to fall into the trap of political correctness and self-censorship. But Tate encourages us to be bold and unapologetic in our thoughts and beliefs. He reminds us that the only way to achieve true success is to be authentic and honest in everything we do.

Finally, I want to express my gratitude to all those who support the idea of working with all our hearts toward our goals. Whether it's through following Tate's advice or simply by being a positive influence in others’ people lives, it's important to surround ourselves with people who encourage us to be the best versions of ourselves. So let's all commit to being disciplined, hardworking, and focused on our goals - because as Andrew Tate reminds us, "The world belongs to those who get things done fast."

Now that you guys have more insights behind whoever is writing these words, a Few updates on the markets this weekend, preparing ourselves for whatever is coming.

Uranium, Gold, and Silver.

Let’s start with Uranium.

While it may seem counterintuitive, I'm actually thrilled about the recent sharp drop in uranium equities. Of course, seeing your portfolio's value go down can be difficult to handle, especially if you have a negative mindset. But I like to think of this as a temporary setback, something that's simply part of the process. In fact, I often refer to it as being "upside down". So, while it might not be pleasant in the short term, I'm confident that this downturn will eventually lead to greater gains in the long run.

Think about it this way: why would I want to pay more for the same product at the supermarket? It's frustrating to see prices increasing while the value remains the same. But when prices go down, suddenly that same product becomes more enticing and you might find yourself wanting to buy more of it - especially if you believe that prices will eventually go back up. In today's world of unpredictable inflationary pressures, it's important to be mindful of how much we're spending and where our money is going. At least that’s how I like to buy items these days, we can never be certain how high prices will go with the current inflationary pressure.

In the case of Uranium, we see its price consistently remaining higher even when we are unexpectedly seeing its equities heading south. You don’t need to be a genius to notice that when Uranium was starting to move higher, all equities were way ahead of themselves, now it’s the complete opposite, and I see it as a spectacular moment to begin accumulating the best equities at lower prices.

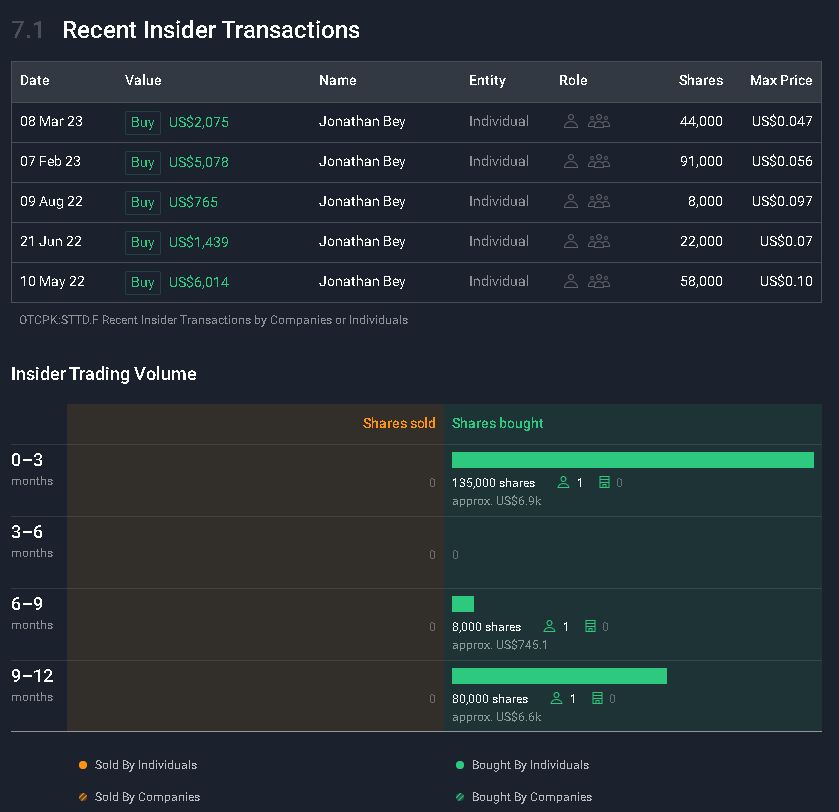

In a prior article, we made a commitment to disclose one Uranium equity, which is presently one of our largest assets and owned by Sprott. Rick Rule has also remarked on its potential and predicted that the stock could perform exceptionally well when the uranium market recovers to its previous peak trajectory.

We see that the stock has been a net buy, even with its dilution and the sector’s downtrend trajectory.

Standard Uranium - STND

Gold

A pullback was necessary for this sector, as it had become extremely overbought across all timeframes, indicating that it was overheating. As we mentioned in a previous post, our target price for gold is $1947, and from that point, it is expected to continue its upward trajectory. For this to happen, gold needs to break through the $2055 and $2070 resistance levels. If it surpasses its all-time high, there is a possibility that gold could reach anywhere from $2500 to $3000 this year.

I really hope you have exposure to physical Gold before you intend to buy any mining equities due to the dangers of a liquidity crunch we may experience in the not-so-far future. You must have the liquidity in hand to be able to take advantage of a situation like that, rather than being taken advantage of by it.

Only after you have a physical allocation, I can recommend you initiate an allocation on the best possible equities in the sector. I believe they will trade at multiples of what they are worth today.

Silver

If I had to choose a sector to invest in and could not allocate capital elsewhere, I would choose Silver. We previously explained why it’s believed that silver will outperform all other asset classes over the next decade. When you consider how undervalued silver is compared to other assets, it becomes clear that it is an excellent investment opportunity. Silver has been dormant for nearly five decades, but this is about to change. There are several reasons for this, which we have explained in our previous posts. When an asset's value has been suppressed for so long, it can be likened to a dormant volcano. And just like a volcano, when it erupts, it can have disastrous consequences, including earthquakes, tsunamis, fires, and melted rocks and ashes spewing out. This is a significant moment in history that will undoubtedly be remembered.

Silver is currently experiencing a slight pullback. If the support level breaks, there is a possibility that it could drop to $23.80 before continuing its upward trajectory. While this may seem concerning, it presents an opportunity to accumulate more before the expected explosion. Once this pullback consolidates, we may see silver prices rise straight to $30, where the second biggest resistance level is located. The strongest resistance level is at $50. If silver breaks through this resistance level, it could experience its biggest rally in modern history.

Thank you for taking the time to read our article. We appreciate your interest and hope that you found it informative. Don't forget to check back soon for our next piece, as we strive to provide you with quality content and valuable insights.

As always, we appreciate your support and welcome your feedback. If you enjoyed this article, please don't forget to like and subscribe to our channel to stay updated on our latest content. Thank you again for reading, and we look forward to seeing you soon!