"Get Ready for the Biggest Economic Shift in History"

"Gold's True Intrinsic Value and Global Reshaping"

This year, the People's Bank of China (PBOC) has been actively promoting gold purchases among citizens. The benchmark for Western diluted gold prices fluctuated around 1950 to 2000, reflecting the volatility of the market. Leading up to the Chinese Golden Week holiday, liquidity on the Shanghai Gold Exchange thinned out. The exchange witnessed premiums that closely mirrored the US dollar-denominated entry price of approximately 19950 to 2000.

Differences in premiums between the Shanghai Gold Exchange and Western-denominated gold are significant, with the former sometimes commanding premiums exceeding $120 per ounce. However, it's essential to examine these variations in the context of the isolated nature of the CME and Chinese markets. These premiums fluctuate within their respective exchanges.

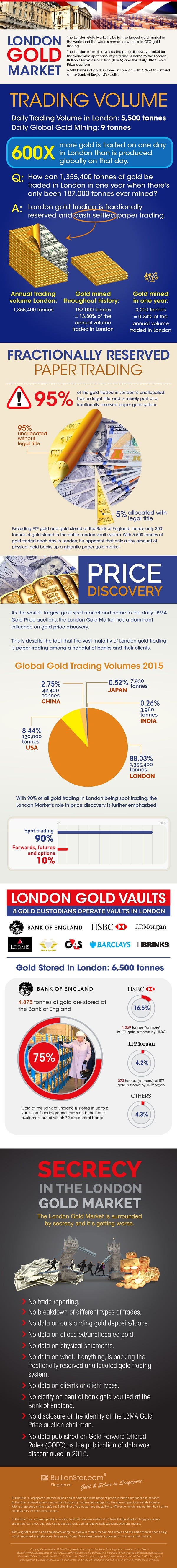

Notably, the PBOC's intervention coincided with the opening of import quotas, allowing more gold to enter China. This move aimed to reduce premiums, although they remained elevated. The PBOC strategically increased quotas just before the Golden Week holiday, aligning with the heightened demand. The imported bullion is sourced from fractionally held paper markets in the West, which are already experiencing tight global physical supply.

Two key aspects draw attention from a wholesale market perspective. Firstly, the timing of the PBOC's increased import quotas aligns with the end-of-quarter paper-driven selloff. Secondly, the bullion flowing into China comes from Western markets with fractionally held paper, contributing to the tight global physical supply.

The People's Bank of China can support Chinese gold pricing due to the siloed nature of the Chinese gold market, operating inversely to the siloed COMEX Market designed to support the dollar. Despite their siloed nature, both markets ultimately rely on a single supply of immediately deliverable global bullion. This dynamic is often overlooked in the arbitrage process.

The COMEX paper gold pricing mechanism restricts U.S. commodity trading advisors and traders from directly accessing physically backed first-T1 delivery markets compliant with Basel 3. Instead, participants are encouraged to engage in the carefully controlled fractionally backed COMEX paper market, where highly leveraged non-delivery paper gold positions can be borrowed.

The recent push to incentivize citizens to buy gold aligns with President Xi Jinping's broader strategy, including the largest military buildup since World War II. China is mobilizing its civilian population for potential conflict, necessitating a sanction-proof regime against a weaponized dollar. This effort may grant access to additional gold held by citizens, providing a strong bid under physical gold.

In the broader context, China's moves are impacting Western liquidity providers, affecting efforts to balance both markets. The current geopolitical landscape and the potential shift in gold dynamics underscore the intricate interplay between global economic forces and regional strategic considerations.

The next bull market in gold is poised to be a game-changer that could leave investors astonished as the precious metal's price aligns with its real intrinsic value. The current dynamics in the gold market, especially with the People's Bank of China (PBOC) actively encouraging gold purchases and strategically influencing the market, suggest a shift toward value-based fairness.

The shockwaves will reverberate as gold, historically undervalued due to paper-driven markets and speculative pressures, begins to trade at its true intrinsic worth. This recalibration holds significant implications for both producing and consuming countries. Producing nations stand to benefit substantially as their gold reserves, often undervalued in the current market, will see a surge in value. Countries that have traditionally been major gold producers, such as China and Russia, could experience a substantial boost to their economic strength.

Conversely, consuming nations, particularly those heavily reliant on the dollar as a global reserve currency, may face challenges. The rise in the price of gold, especially if tied to initiatives like Russia accepting gold in exchange for oil, disrupts the established economic order. The move away from fiat currencies to gold-backed transactions introduces a level of financial sovereignty that challenges the dominance of traditional reserve currencies.

Russia's acceptance of gold for oil is a pivotal development. It not only signifies a strategic shift in economic transactions but also underscores the geopolitical importance of gold in a world where economic power is increasingly tied to tangible assets. This move could potentially inspire other producing nations to reconsider their trade policies, leading to a broader shift away from fiat currencies.

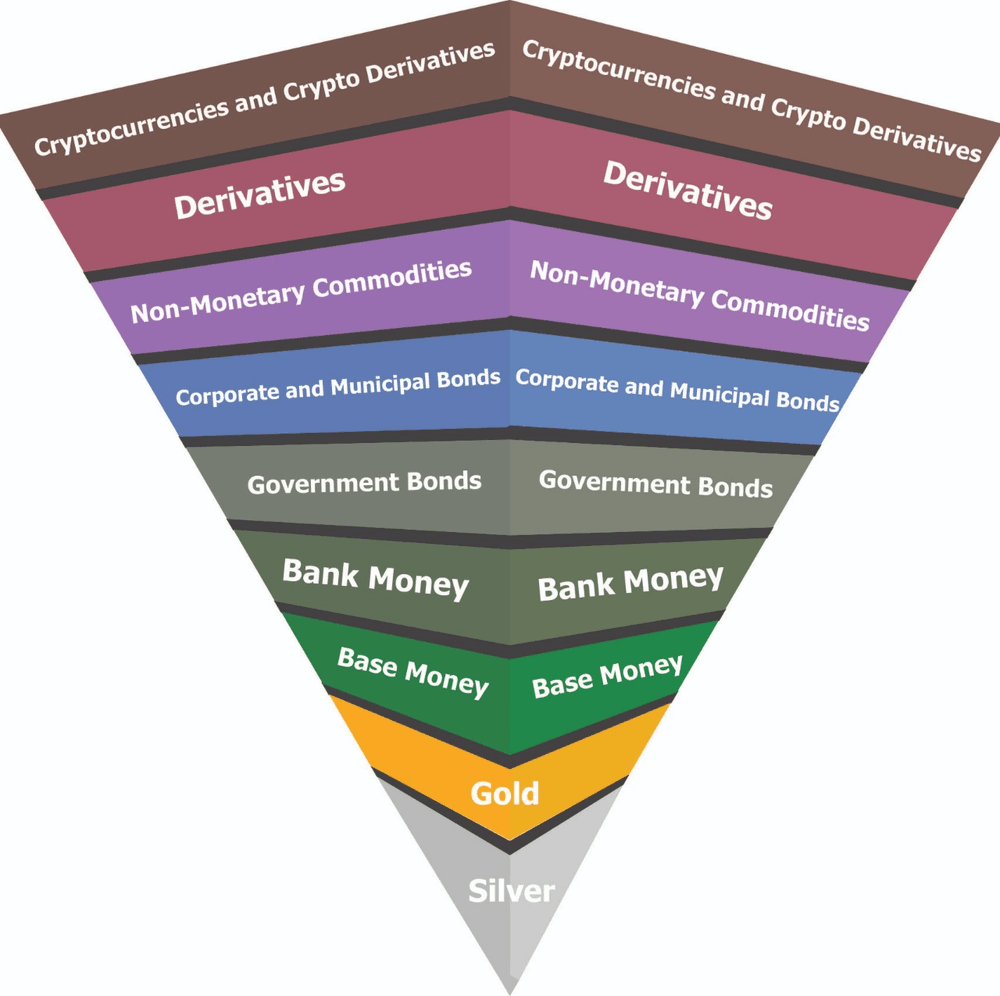

For regular individuals, owning gold and silver becomes not just a means of preserving wealth but a proactive strategy in navigating the impending shift in the financial order. The advantages of holding precious metals lie in their historical role as a hedge against inflation and currency devaluation. As the market reevaluates the value of gold, individuals who have positioned themselves with physical assets may see a significant increase in their net worth.

Gold and silver, with their intrinsic value and limited supply, offer a stable foundation in times of economic uncertainty. In the face of potential currency devaluation and geopolitical tensions, these precious metals act as a form of insurance for personal wealth. Moreover, with the looming transformation in the financial landscape, the ownership of gold and silver positions individuals to benefit from the forthcoming changes in the global economic order.

This shift toward gold's intrinsic value marks one of the most significant developments in modern financial history. Investors, governments, and individuals alike need to recognize the potential repercussions and strategically position themselves to not only weather the storm but thrive in the emerging financial paradigm.

In conclusion, we stand on the precipice of an unprecedented economic transformation, heralding what could be the most significant shift in financial history. The current surge in gold's value, driven by strategic interventions and changing dynamics in global trade, foreshadows a new era where the true intrinsic worth of precious metals takes center stage.

As we witness nations like China and Russia strategically accumulating gold and redefining trade norms, it becomes evident that the upcoming bull market in gold will be a game-changer. The shockwaves of this shift will resonate across producing and consuming countries alike, fundamentally altering the economic landscape.

For investors, governments, and regular individuals, this presents both challenges and opportunities. The advantage lies in understanding the evolving dynamics and proactively positioning oneself. Gold and silver, with their historical role as wealth preservers, emerge as crucial assets in navigating the uncertainties of this impending financial transformation.

"Get Ready for the Biggest Economic Shift in History" encapsulates the urgency and significance of preparing for what lies ahead. Whether it's recognizing the true value of gold, understanding the geopolitical implications of new trade norms, or securing personal wealth through tangible assets, individuals are presented with a unique opportunity to not only weather the storm but thrive in the emerging economic paradigm.

In the face of these transformative times, staying informed, embracing strategic investments, and recognizing the role of precious metals are key to navigating the uncharted waters of this monumental shift. The journey ahead promises challenges, but it also opens doors to a new era of financial resilience and opportunity for those ready to adapt.

Like, Subscribe, and Share to Spread the Word!

If you found this analysis informative and eye-opening, we invite you to like, subscribe, and share this video to help us spread the word. Together, we can build a community of Financial Anarchy advocates who are dedicated to promoting financial literacy and advocating for sound monetary policies. By amplifying our message, we can empower individuals to take control of their financial well-being and contribute to a more equitable and sustainable future.

Support Our Work with a Bitcoin Donation

We also offer the opportunity to support our work and help us continue building the Financial Anarchy community. If you would like to make a contribution, we gratefully accept donations in Bitcoin. Your support will enable us to create more educational content, engage in meaningful activism, and further our mission of challenging the status quo. To donate, please use the following Bitcoin address:

1EkmtWDYzuhkiv3iYozKVnZFxsQxDetnfH

Thank you for joining us on this journey of understanding and change. Together, we can shape a brighter financial future for all.