Warren Buffett’s Market Strategy

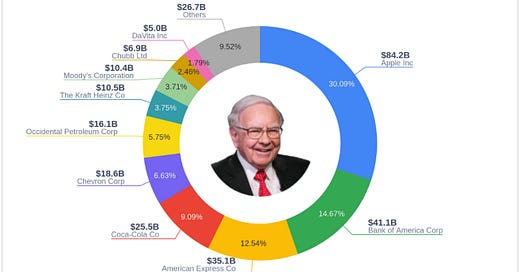

Jay Martin: "We’re seeing Buffett take a very, very cautious approach here. He's sitting on piles of cash right now. When you look at the cash balance and you think about his opportunities, does that give you any concern about the outlook?"

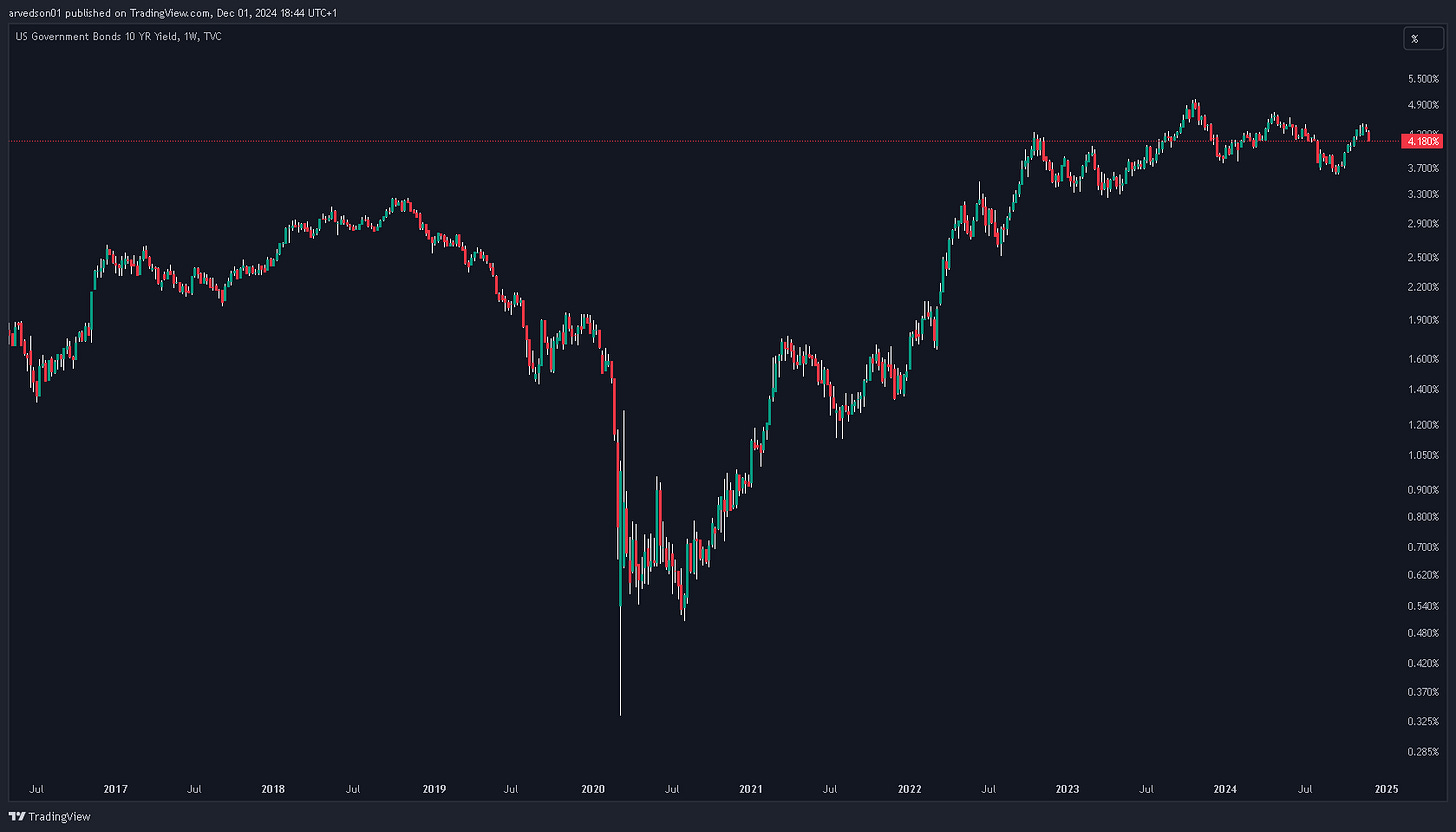

Jeff Snider: "So I think the first thing, you know, it's interesting because when Buffett talks about investing, he always talks about risk versus return. So if you take something as simple as US Treasuries, if you can earn 5% in US Treasuries, that’s probably the best return you're going to get, and why take risks when you're getting 5% guaranteed? So I think Buffett, in his case, is looking at the world right now and saying, 'I don't see anything better than 5% in Treasuries,' and he's looking at his business model and saying, 'I can find something better than that, but it has to be really good for me to go out there and take those risks.' So right now, it’s all about risk mitigation. The world is just too uncertain.”

Stock Market and Economic Divergences

Jay Martin: "Jeff, I want to ask you about the stock market, because we're seeing divergences in the stock market that are starting to indicate something. What do you see in terms of the divergence that you're seeing right now?"

Jeff Snider: "You know, I don't really pay that much attention to the stock market, honestly. For me, stocks don’t really tell you anything about the fundamentals of the economy. People talk about how stocks are a mechanism for discounting the health of the economy, and that’s just not true. So when we see divergences, like the Philadelphia Semiconductor Index, which is a highly cyclical industry – it’s been diverging from the S&P 500, especially since July, which was a shift. The S&P 500 and the Philly Semiconductor Index used to move in lockstep for years, but then around July, the semiconductors started behaving differently. The semiconductor market is more sensitive to global economic conditions, so this suggests that even the market is starting to see a shift. Investors are starting to get cautious about the cyclical risks out there, especially with the semiconductor sector.”

Presidential Policies and Economic Impact

Jay Martin: "Let’s talk about the potential impact of a new U.S. president coming into office. Does a new administration really change anything in terms of the economy?"

Jeff Snider: "Well, there is a sentimental effect. We saw it in 2008-2009 when Obama came into office, and everyone thought things would be different. But in reality, things didn’t change all that much, even though there was a sense of optimism with the new president. The economy follows its own trajectory, regardless of who's in power. Sure, policies can have an effect, but those effects take time to materialize. If the global economy had a downturn in the summer, it’s already baked in. It doesn't matter who is in the White House because the economic trends are already set."

Global Economic Risks and Signals

Jay Martin: "If the global economy is heading towards a downturn, what signals would you be looking for to validate that?"

Jeff Snider: "There are already a lot of signals suggesting that the global economy is slowing down. For instance, the negative interest rate swap spreads are one key signal. This suggests that sophisticated market players expect interest rates to stay lower for longer, which is typically a sign of low growth. The copper-to-gold ratio is another indicator. It’s at its lowest level since 2008 and 2020, suggesting that investors are pessimistic about the global economy. When we see these types of signals, it points to low growth expectations, not just in the U.S. but globally. The markets are already adjusting to these risks, which tells us that the downturn is already underway, regardless of government policies or any short-term positive sentiment."

Market Behavior and Global Economic Trends

Jay Martin: "So, you're suggesting that all of these signals, like the swap spreads and the copper-to-gold ratio, are aligning and suggesting we’re headed into a downturn?"

Jeff Snider: "Yes, exactly. The markets are already moving in that direction. Despite all the talk about central banks’ rate cuts, stimulus measures, and other government interventions, the market isn’t buying it. It’s signaling that even with all these actions, the outlook remains grim. The fact that China and Japan are selling U.S. treasuries further underscores the tightening global liquidity and risk aversion that are setting in. We’re seeing market behavior that’s telling us the global economy is facing significant cyclical risks, and we should pay close attention to these indicators."

Resources for Further Learning

Jay Martin: "For those who want to go deeper into these topics, where can they find more information from you?"

Jeff Snider: "You can find me daily on Eurodollar University. We dive deep into these topics, breaking down the mechanics of the eurodollar system, the implications of interest rate swaps, and other macroeconomic factors. I also have memberships that provide deeper insights into the data behind the markets, with a focus on understanding what's really driving economic conditions. We break down complex concepts, and I go deep into issues like the current crisis in Germany, the U.S. economy, and more. For those who want a more detailed, structured approach to these topics, that’s where you can get it."

Final Thoughts

Jeff Snider emphasizes the growing risks in the global economy, with signals pointing to an economic slowdown that’s already in motion. He highlights Warren Buffett's cautious stance as an indicator of broader market sentiments. Snider also stresses the importance of monitoring key economic indicators like interest rate swaps and commodity ratios to understand the underlying economic trends, rather than relying on government policies or short-term market shifts.

For those looking to deepen their understanding of these complex issues, Snider’s Eurodollar University offers daily analysis and deeper dives into the mechanics of global markets.