"Gold's Comeback: A Visual Guide"

Exploring Key Factors Driving the Resurgence of Precious Metals

Unlocking the Precious Metal Puzzle: A Visual Exploration

In the intricate landscape of precious metals, a captivating narrative is unfolding, supported by a tapestry of compelling factors that not only beckon attention but also paint a vivid picture of opportunities. Let's embark on a visual journey through the facets that favor precious metals, each point a brushstroke contributing to a masterpiece in the making.

1. Gold Production Decline:

As we delve into the data, a striking trend emerges — a decline in gold production among major players. History whispers, echoing patterns from the pivotal market shifts of the 1970s and the early 2000s. This decline is not just a statistic; it's a precursor, a signpost pointing towards the genesis of a new secular market.

2. Central Banks Accumulating Gold:

The canvas expands as central banks enter the scene, actively accumulating gold. This visual cue underscores a collective nod from financial authorities, signaling gold's enduring allure as a strategic asset, a gleaming cornerstone in the global economic landscape.

3. Trifecta of Macro Imbalances:

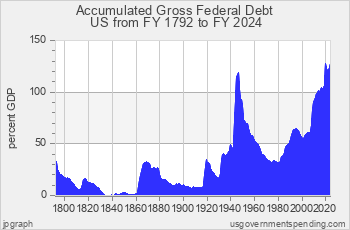

Within this intricate framework, a trifecta of macroeconomic imbalances unfolds — the weight of historical challenges. We see the echoes of the past — the debt predicament of the 1940s, the inflationary dance of the 1970s, and the valuation puzzle akin to the late 1990s. Each element, a thread contributing to the richness of the narrative.

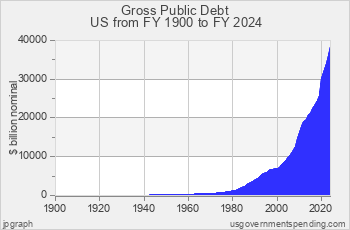

4. Worsening Deficit Issues:

A deeper dive reveals the growing cracks in the economic foundation — worsening deficit issues. Graphs ascend, mirroring the rise in interest rate payments and the urgent demand for increased spending on infrastructure, defense, and other crucial sectors. The economic heartbeat, irregular but resonant.

5. Signs of Deglobalization:

Against this backdrop, signs of deglobalization emerge. An interconnected world grapples with shifting tides, and within this uncertainty, precious metals stand resilient, embodying stability in an ever-evolving global narrative.

6. Anticipated Gold Breakout:

Amidst the complexity, a focal point materializes — the anticipated gold breakout. Not merely a technicality, but a visual spectacle waiting to unfold. Charts poised for ascent, marking the initiation of a new cycle, a crescendo in the symphony of precious metals.

Conclusion:

The visual exploration of these intertwined factors paints a compelling panorama. A narrative rich in historical echoes, macroeconomic imbalances, and shifting global dynamics. As we stand on the precipice of a new era in precious metals, the canvas is vibrant, the story captivating, and the potential, immense. In this visual odyssey, the allure of precious metals shines bright, inviting investors and enthusiasts alike to partake in the unfolding masterpiece of economic evolution.

Like, Subscribe, and Share to Spread the Word!

If you found this analysis informative and eye-opening, we invite you to like, subscribe, and share this video to help us spread the word. Together, we can build a community of Financial Anarchy advocates who are dedicated to promoting financial literacy and advocating for sound monetary policies. By amplifying our message, we can empower individuals to take control of their financial well-being and contribute to a more equitable and sustainable future.

Support Our Work with a Bitcoin Donation

We also offer the opportunity to support our work and help us continue building the Financial Anarchy community. If you would like to make a contribution, we gratefully accept donations in Bitcoin. Your support will enable us to create more educational content, engage in meaningful activism, and further our mission of challenging the status quo. To donate, please use the following Bitcoin address:

Thank you for joining us on this journey of understanding and change. Together, we can shape a brighter financial future for all.