IMF's Concerns about the Banking System and the Financial Crisis

Exploring the IMF's 2023 Statement on Article 4 and its Implications

The International Monetary Fund (IMF) has recently expressed grave concerns about the state of the global banking system. In their concluding statement for Article 4, the IMF's worries appear to be much more negative compared to the prelude of the 2008 financial crisis. When an institution like the IMF is concerned, it is an indicator that something potentially catastrophic is looming on the horizon. It is crucial for individuals to pay attention to these warnings, depending on whether they possess substantial assets or not. The concerns of the elite class of bankers suggest that a significant and sinister event might be on its way, at least for them. However, individuals who make rational decisions and take appropriate precautions may be able to protect themselves.

Let's delve into the details of the IMF's 2023 statement on Article 4. The United States of America staff's concluding statement reveals that this particular article holds immense significance among all the articles released by the IMF. Article 4, though not fully comprehended by the general public, carries considerable weight. In this paper, we will explore the 2023 statement's contents and implications.

The statement begins by acknowledging the resilience demonstrated by the US economy in the face of significant fiscal and monetary policy tightening in 2022. To comprehend the magnitude of monetary tightening, we examine the 10-year chart of the money supply in the United States. The trend line, representing the general monetary policy from 2013 to 2020, reveals that the monetary overhang amounts to approximately 3 trillion dollars. Therefore, it is not surprising that the economy has not collapsed entirely. However, it is essential to note that the IMF warns that a collapse is imminent.

The IMF's statement also highlights certain positive aspects, such as rising wages for lower-income workers, rapid employment growth, and government transfers related to the pandemic. These factors have played a significant role in reducing poverty. Notably, the poverty rate for Black and Hispanic households fell at a rate twice as much as the national average, primarily due to economic impact payments and the fully refundable child tax credit. However, the IMF indicates that the progress made in poverty reduction in 2021 was largely undone in 2022 when pandemic benefits expired.

A critical sentence in the statement raises concerns about the potential need for the Federal Reserve to raise the policy rate significantly higher than expected to curb inflation. This implies that the IMF recognizes the possibility of brewing problems in the treasury market. While failures of non-internationally active banks have had a modest effect on credit conditions thus far, they could be a prelude to more severe and systemic financial stability issues.

By comparing the IMF's statements from 2007 and 2008, it becomes apparent that the IMF's outlook was much more positive before the financial crisis unfolded. In their concluding statements in June 2007, the IMF projected a soft landing for the US economy, expecting growth to recover and inflation to fall. However, their predictions fell short as the crisis deepened. The IMF's 2009 statement reflects the severity of the global repercussions of the financial and economic crisis, acknowledging the underestimation of risks and major weaknesses in regulatory frameworks.

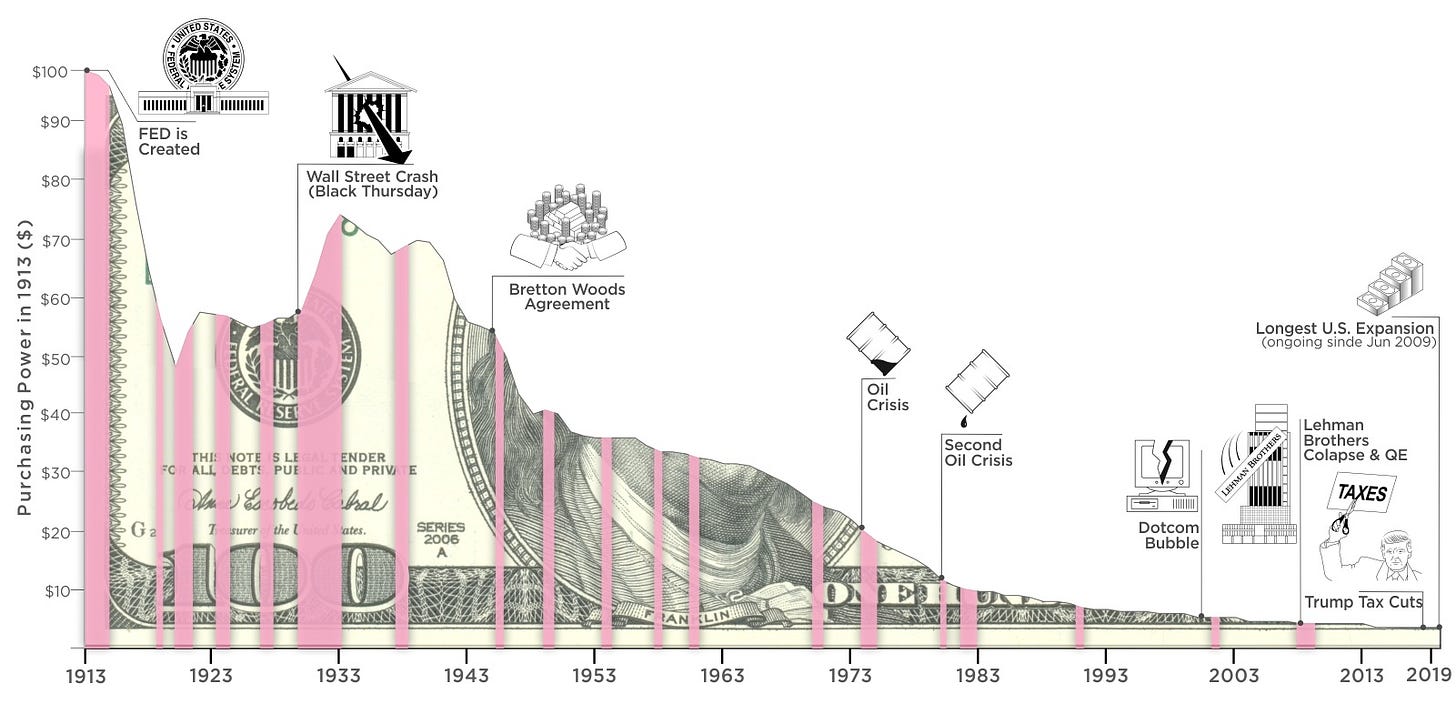

The IMF's concerns in the 2023 statement suggest that they anticipate significant challenges ahead, particularly in the banking sector and treasury market functionality. Moreover, with a tentative debt ceiling deal on the horizon, a massive influx of treasury bills is expected, which could impact deposits in the banking system. Consequently, the Federal Reserve might be compelled to reduce interest rates back to zero or potentially negative levels, depending on the severity of the crisis. This chain of events could lead to the ultimate demise of the dollar and other fiat currencies linked to it.

It is important to note that the collapse of the dollar and other fiat currencies linked to it is not just a financial phenomenon but also has far-reaching implications in various aspects of society, including academia and healthcare. The ongoing inflationary nightmare, which encompasses not only monetary but also academic and medical spheres, is poised to reach a dramatic and hyperinflationary climax. The IMF's concerns serve as a confirmation that significant changes are on the horizon.

If the IMF, an influential global institution, is genuinely worried about the unfolding situation, it provides a glimmer of hope. The fact that they are acknowledging the severity of the potential crisis indicates that there is a chance for a wake-up call and an opportunity to shift towards a more sustainable and stable financial system.

In conclusion, the IMF's concerns about the banking system and the current state of affairs are not to be taken lightly. Their concluding statement for Article 4 in 2023 highlights the potential risks and challenges ahead. Individuals and institutions should pay heed to these warnings and take necessary steps to protect their interests. The trajectory of the global financial system is uncertain, and being informed and prepared can make a significant difference in navigating the potential storm that lies ahead.

Like, Subscribe, and Share to Spread the Word!

Subscribed

If you found this analysis informative and eye-opening, we invite you to like, subscribe, and share this video to help us spread the word. Together, we can build a community of Financial Anarchy advocates who are dedicated to promoting financial literacy and advocating for sound monetary policies. By amplifying our message, we can empower individuals to take control of their financial well-being and contribute to a more equitable and sustainable future.

Support Our Work with a Bitcoin Donation

We also offer the opportunity to support our work and help us continue building the Financial Anarchy community. If you would like to make a contribution, we gratefully accept donations in Bitcoin. Your support will enable us to create more educational content, engage in meaningful activism, and further our mission of challenging the status quo. To donate, please use the following Bitcoin address:

1EkmtWDYzuhkiv3iYozKVnZFxsQxDetnfH

Thank you for joining us on this journey of understanding and change. Together, we can shape a brighter financial future for all.