Insights from Luke Gromen on The Tucker Carlson Show

The CIA, Conspiracy Theories, and Narrative Control

Economic Manipulation and U.S. Debt Strategy

The U.S. Government's Role in Economic Control

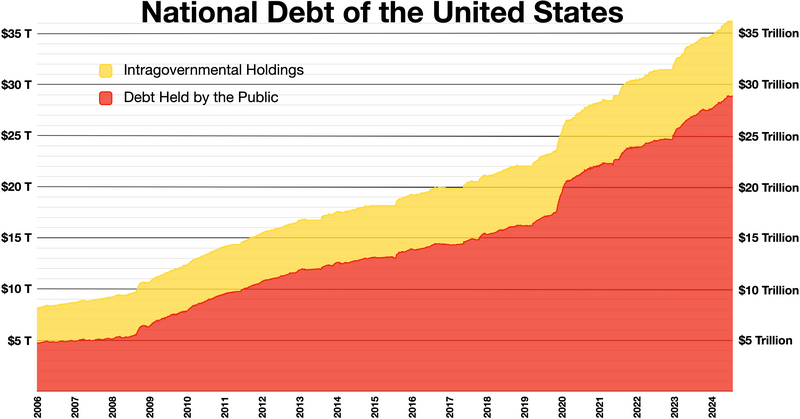

Luke Gromen dives into the intricate mechanisms behind the U.S. government’s economic strategies, focusing on the management of inflation, foreign debt, and financial instruments like Treasury bonds. He explains that the government has adopted an inflationary approach as a tool for managing the nation's debt. This, according to Gromen, is an essential aspect of the government's strategy, particularly when discussing the growing national debt and foreign-held debt.

Gromen explains:

“If you're getting 3.3 trillion in receipts for receipts, super nice. But how do you get them to pay more for their own care? Well simple. You get them into treasury bonds and then you tell them inflation's for you give them a 4.4% on the Treasury bond and you actually let inflation run six.”

This strategy is controversial because it involves increasing inflation rates while simultaneously offering seemingly attractive returns on Treasury bonds. The implication is that, although investors appear to benefit from the bonds, the purchasing power of the money is being eroded due to inflation.

Gromen highlights how the government’s strategy indirectly forces the population, including investors, to bear the brunt of inflation through financial instruments that ultimately don't protect real purchasing power. By inflating the economy and maintaining these financial strategies, the government effectively minimizes its own fiscal burden while making it increasingly difficult for citizens to maintain wealth. This raises important questions about economic fairness and the long-term sustainability of such strategies.

Baby Boomers and Economic Entitlements

Generational Financial Burdens and Self-Interest

Gromen critiques the economic policies that have benefited the Baby Boomer generation, particularly the significant entitlements they receive. He highlights how nearly 70% of U.S. government receipts are allocated to boomers, while the economic burden continues to grow. Gromen's comments convey his frustration with the Baby Boomer generation, which he views as overly self-interested and self-congratulatory for their historical role in shaping America.

Gromen states:

“So about 70, almost 70% of receipts are going to boomers. Has there ever been a generation that deserves it less?”

He further expands on his critique, suggesting that the Baby Boomers have created a cultural and economic environment that is both narcissistic and destructive. He points to the generational focus on individual narratives, such as the Vietnam War and the Civil Rights Movement, as emblematic of their self-involvement.

This perspective presents a critical view of the Baby Boomer generation, particularly regarding their economic influence and entitlement programs. Gromen's frustration stems from a belief that Baby Boomers have reaped the rewards of prosperity and peace but have left younger generations to deal with the consequences, such as rising debt and inflation. This critique invites a broader conversation about intergenerational economic responsibility and whether the policies benefiting older generations have long-term negative consequences for younger ones.

The Legacy of the Vietnam War and Civil Rights Movement

Cultural and Political Narratives of the 1960s

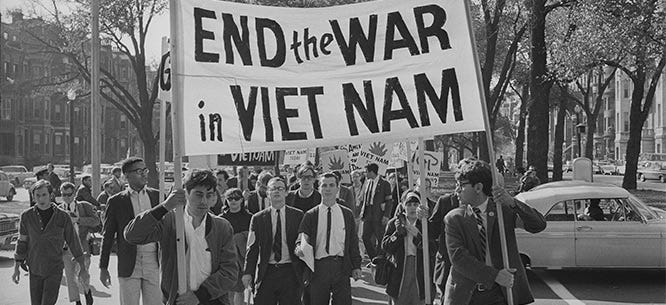

Gromen is critical of the cultural legacy of the 1960s, particularly the Vietnam War protests and the Civil Rights Movement. While acknowledging the importance of these events, he suggests that the way they have been mythologized in American culture is problematic. He views these movements as examples of how the Baby Boomer generation has excessively framed their own actions as heroic and transformative, even when the actual outcomes were less impactful.

He explains:

“The stupid Vietnam War, every cliche, but Woodstock and the dumb civil rights movement, which actually didn’t really help anybody and everything about it was just like... they were drowning in Lake Me.”

Gromen’s critique of the Vietnam War and Civil Rights Movement suggests that while these movements were significant in history, the way they are perceived today is often disconnected from their actual impact. By labeling them as "cliché" and ineffective, Gromen challenges the narrative that these events were the heroic, transformative moments many consider them to be. His viewpoint serves as a reminder that historical narratives are often shaped by those who have the power to tell them, and these dominant narratives may not always reflect the full scope of their social and economic impact.

The Role of Gold in Economic Stability

Gold as a Hedge Against Economic Instability

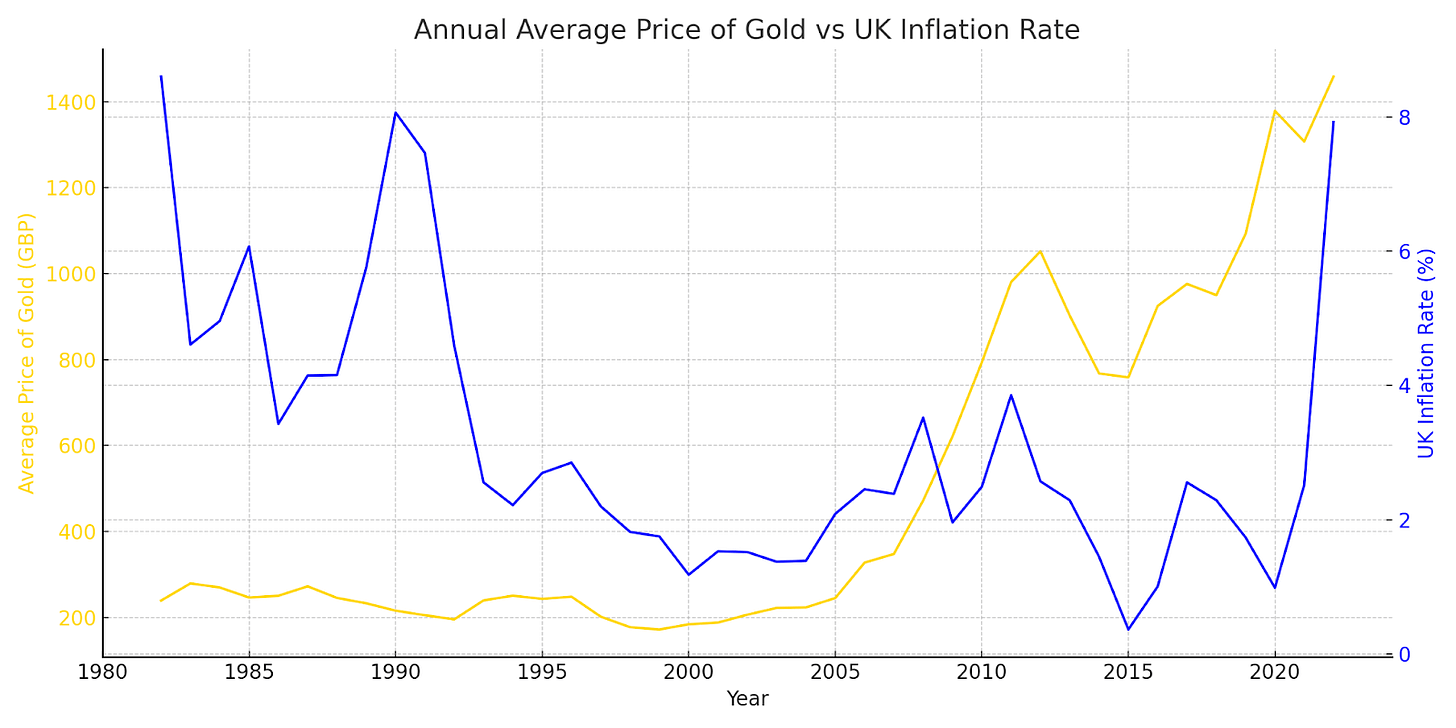

Gromen advocates for gold as a crucial asset for individuals seeking to protect themselves from inflation and economic instability. He believes that gold remains one of the few reliable stores of value in a world where traditional financial instruments like bonds may fail to maintain purchasing power. He argues that as inflation erodes the value of paper money, gold offers a way to preserve wealth in uncertain economic times.

He suggests:

“You need to own some gold because over time you’ll lose on your bonds, but your gold will more than compensate you for that inflation. You maintain your purchasing power.”

Gromen’s emphasis on gold highlights a key theme in his economic philosophy: the protection of wealth through physical, tangible assets. While financial markets and governments may manipulate paper currencies and debt instruments, gold remains a relatively stable store of value. In a broader context, Gromen’s call for gold ownership reflects a growing concern over fiat currency systems and the long-term effects of inflationary monetary policies.

The CIA, Conspiracy Theories, and Narrative Control

The Weaponization of Language: CIA and the "Conspiracy Theorist" Label

One of the most controversial parts of the interview revolves around the CIA’s involvement in shaping public perception, specifically regarding the assassination of President John F. Kennedy. Gromen asserts that the term "conspiracy theorist" was introduced by the intelligence community to discredit those who questioned the official narrative about Kennedy’s death. He connects this historical example to the present-day stigma surrounding individuals who question government narratives or who advocate for alternative economic systems, such as gold investing.

Gromen explains:

“CIA, possibly with the help of foreign government, murders the president of United States. And it’s super obvious that that happened in 1963. And nobody believes the Warren Commission... So they start calling anyone who raises questions about it a conspiracy theorist.”

This perspective challenges the mainstream understanding of how information is controlled and manipulated by powerful institutions, particularly intelligence agencies. By highlighting the creation of the "conspiracy theorist" label, Gromen underscores how those who ask questions or challenge the status quo can be marginalized. His comparison to the gold investing community shows how labeling dissenters is an ongoing tactic used to suppress alternative viewpoints, whether in political or economic matters.

U.S. Dollar and Global Financial Dominance

Maintaining Dollar Hegemony Amid Financial Restructuring

Gromen discusses the U.S. dollar’s global dominance, which has been upheld through financial strategies such as debt accumulation and reliance on foreign creditors. He acknowledges that, while the U.S. has historically used gold as collateral for its debt, the shrinking percentage of foreign-held debt collateralized by U.S. gold is a sign of an impending financial restructuring. As Gromen sees it, the U.S. faces a dilemma: it can either inflate the economy to ease its debt burden or risk a more severe financial reckoning.

He notes:

“So gold in my opinion, minimum over time probably has to rise at least two and probably more like forex just to get back to historical levels, assuming no further growth in the debt.”

Gromen’s commentary underscores the importance of understanding the U.S. dollar's central role in the global financial system. As the U.S. continues to rely on debt to maintain its position, the decreasing backing of foreign-held debt by gold signals a potential shift in global financial power. This shift could have far-reaching consequences for global trade, foreign policy, and economic stability.

Inflation and Its Long-Term Effects

The Inflationary Trend and Its Consequences

Gromen explains how inflation is being used as a tool by the U.S. government to manage its mounting debt. While inflation benefits the government by reducing the real value of debt, it also harms everyday citizens by diminishing their purchasing power. Gromen suggests that inflation, if allowed to continue unchecked, could have serious long-term effects on the U.S. economy and the global financial system.

He comments:

“You have to inflate. And that’s what they’re doing, what they have been doing with... they’re going to continue to keep doing, in my opinion.”

Inflationary tactics may provide short-term relief for the government, but they come at the cost of long-term economic health. Gromen’s analysis suggests that this approach is unsustainable and will likely lead to greater wealth inequality, with ordinary citizens suffering the most. The broader implications of such a strategy include a possible loss of confidence in the U.S. dollar and the financial system, which could lead to a crisis of trust.

A Call for Awareness and Diversification

Throughout the interview, Luke Gromen offers a sobering view of the economic and political landscape, urging individuals to be more aware of the forces shaping their financial futures. His emphasis on gold as a hedge against inflation, the rising economic burden on younger generations, and the manipulation of public perception by government agencies all point to a world where the conventional financial wisdom is increasingly being questioned.

As Gromen concludes:

“Retail investors need to own five, ten percent of their assets in gold bullion.”

Gromen’s conclusion reinforces the importance of diversification and the need for individuals to take control of their financial futures in a world marked by economic volatility and uncertainty. His insights highlight the broader shifts taking place in the global financial system and suggest that, in the face of these challenges, gold and other tangible assets may offer some degree of stability.