In this in-depth interview with Liberty and Finance, Rafi Farber, the founder of Endgame Investor, shares his insights on the current state of the global financial system and the potential risks that lie ahead. Discussing everything from the looming financial crisis, the role of the repo market, and the basis trade, to the contrasting potential of gold and Bitcoin as safe-haven assets, Farber offers a detailed perspective on where the world economy may be headed. With a focus on the importance of community and long-term wealth preservation, Farber explains why gold remains a reliable asset, while expressing caution about Bitcoin's ability to serve as money in times of financial turmoil. Throughout the interview, Farber underscores the need for preparedness, both financially and socially, as we approach what he describes as the "endgame" of the current economic system. This article summarizes his key points and provides a comprehensive look at his analysis of today's economic challenges.

Financial Crisis and Economic Risks

Rafi Farber began by emphasizing the uncertain state of the financial system, noting that, while some people are focused on accumulating assets like gold, the most important factor for survival during times of crisis is the strength of one’s community. He stated:

"It doesn’t matter how much gold to silver you have or how much ammo you have or how much you prepare for the next crash; it’s how much your community is, and if this election is going to be successful, then bringing the American people back together will give it the best chance of surviving the endgame intact as a political unit."

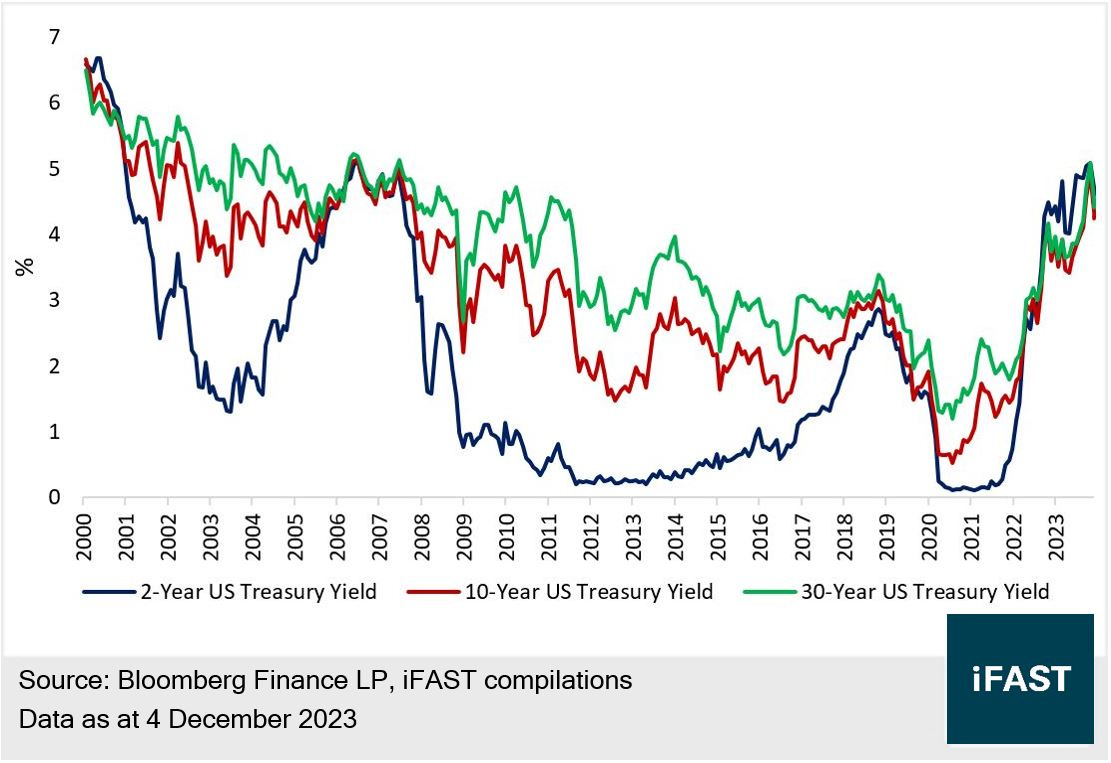

Farber then shifted to discuss the ongoing situation in the bond market, particularly the basis trade and the record highs in short positions in certain bond yields. He predicted that the extreme short positions in treasuries would act as a trigger for the next financial crisis. Farber explained that short positions are increasing week by week, with firms taking on greater leverage to execute these trades:

"For open short positions, you need dollars, right? And for dollars, in order to make any money on these trades, you need to multiply them over and over again, so you need to borrow a lot of money... Firms get leverage through the repo market... and the repo market is running out of dollars."

He described how this dynamic was similar to a Ponzi scheme, where initial trades that seem profitable require ever more funds to sustain. According to Farber, when the supply of new dollars runs out, these firms will be unable to exit their positions, triggering a cascade of closures, potentially leading to a severe financial collapse.

Farber also expressed concern about the Federal Reserve’s ability to handle the situation. He noted that the repo market is already under significant pressure, with bank reserves being heavily used for repos:

"We’re at about a 74% ratio of total bank reserves of repos to total bank reserves... Last time we had a repo apocalypse in 2019, the ratio was about 83–85%... We're almost there. We might not get there by January, but it’s going in one direction."

He warned that if the Federal Reserve prints more money, as it did during the 2020 crisis, it could cause the dollar to fall.

Gold as a Safe Investment

Transitioning to a more specific investment strategy, Farber was asked about gold as a long-term investment, especially following recent price fluctuations. He acknowledged that gold has experienced significant rises to all-time highs, but noted a sharp pullback below $2600. Farber reassured viewers that a correction of this magnitude (around 9.3%) is typical and not cause for concern:

"I think it’s a pretty good buying opportunity. I looked at the low versus the high. I think it came at 9.3%. 99.3% is a perfectly normal correction... These things happened during the 2009 to 2011 major bull run."

He explained that, during periods of gold market volatility, what truly matters is buying on a regular basis (dollar-cost averaging). For instance, he stated that it does not matter if someone bought gold at $2800 and later at $2550 because over time, regular buying helps mitigate the effects of short-term price swings.

"We've got to stop looking at the dollar price. The dollar price doesn’t really matter with gold."

Farber highlighted that gold’s value is far more stable than cryptocurrencies, specifically Bitcoin, which he described as having a much shorter history. He expressed caution about Bitcoin’s viability as a long-term store of value compared to gold, which has sustained its value for 5,000 to 6,000 years.

Bitcoin’s Role and Concerns

While acknowledging Bitcoin's recent rise in popularity, Farber was clear that he was not convinced of its long-term value as a store of wealth or a form of money. He emphasized that Bitcoin had not yet proven itself in times of monetary crises. Referring to a video he did recently, he reiterated his stance that Bitcoin’s performance in a crisis will be the deciding factor:

"When that happens again [financial crisis], if Bitcoin can maintain its price in Gold terms—not in dollar terms—I’d say, okay, fine, Bitcoin is Bitcoin."

Farber specifically discussed Tether, a major stablecoin used to trade Bitcoin, which he believes indirectly supports the U.S. Treasury. He explained that when people exchange Bitcoin for Tether, Tether needs to buy treasuries to maintain its peg to the dollar. He was wary of the potential consequences of this situation:

"Tether is basically financing the US government to a certain degree... Every time somebody buys Tether, they have to buy treasuries to cover that, because they’re supposed to maintain a peg."

Furthermore, Farber raised concerns about the growing involvement of banksters in Bitcoin, citing Howard Lutnick, the head of Cantor Fitzgerald, who had spoken about Bitcoin's connection to the U.S. Treasury. Farber also pointed out that while Bitcoin had a strong performance up to 2024, its value had not been stable during past crises:

"It went from 37 [thousand dollars] to 10 [thousand dollars] in 2022. This time, I think it’s going to be even worse."

Farber concluded that he would consider Bitcoin only if it were to prove itself as a stable asset during financial crises:

"If Bitcoin can maintain its value in Gold terms, during the next monetary crunch, then I would say, okay, I’ll buy some Bitcoin."

Farber concluded by stressing the importance of understanding both the financial system and its historical context, especially as it relates to biblical discussions about money and economics. He provided these resources for those who wish to explore these topics further.

"Gold has been around for 5,000 to 6,000 years... monetary topics and economics have been discussed for 5,000 to 6,000 years in the Bible, and I open up those instances to people who might not have seen them before."