John McAfee: Why Bitcoin Is Going to $0

In the summer of 2020, John McAfee sat down for an explosive interview with Tom Shaughnessy to discuss his controversial views on Bitcoin, Monero, and the future of cryptocurrency. With his trademark candor, McAfee criticized Bitcoin's viability as a functional currency, made bold predictions about the financial world, and painted a stark picture of the future of governance and money. His insights, though radical, offered an unfiltered perspective on the evolution of digital currencies, and in many ways, his predictions have sparked ongoing debates.

McAfee’s Critique of Bitcoin: A Currency Without a Purpose

One of the central themes of McAfee’s argument was his firm belief that Bitcoin would ultimately be worth "zero." His main contention was that Bitcoin lacked intrinsic value, as it was not widely accepted by vendors and, in his view, had lost its practical utility. "Show me a single goddamn vendor that will accept Bitcoin," he challenged during the interview, reflecting his frustration with Bitcoin's failure to integrate into everyday transactions. At the time, Bitcoin had become a speculative asset, with its use primarily limited to investors and those in the tech-savvy crypto space.

In hindsight, McAfee’s prediction that Bitcoin would be "worthless" has not materialized. While Bitcoin has certainly encountered setbacks, its acceptance has grown exponentially since 2020. In 2024, major companies like Tesla, Microsoft, and even PayPal allow users to purchase goods or services with Bitcoin, signaling its ongoing integration into traditional commerce. Moreover, institutional investors like MicroStrategy and El Salvador’s government have significantly embraced Bitcoin, adding further legitimacy to its long-term potential. However, concerns about scalability, energy consumption, and volatility still persist, and Bitcoin’s ability to serve as a true "currency" for everyday purchases is still debated.

Monero’s Appeal: Privacy over Popularity

McAfee’s preference for privacy-focused coins like Monero was another focal point of the interview. He argued that Monero, with its superior privacy features, was a much more useful cryptocurrency than Bitcoin for individuals who valued anonymity. Despite Monero’s strengths, McAfee acknowledged its drawbacks, especially its limited liquidity and the challenge of exchanging it into fiat currencies. "When you do want to get out of Monero into dollars or Bitcoin or Ethereum, you have to exchange it on a centralized exchange," he explained, criticizing this dependency on centralized platforms for compromising privacy.

Since McAfee’s comments, Monero has maintained its position as the leading privacy coin, but it still faces the issue of being traded on centralized exchanges, which undermines its original purpose of complete anonymity. Privacy coins, including Monero, have also faced increasing regulatory scrutiny, with authorities in several countries cracking down on anonymous transactions due to concerns about their use in illicit activities. As of 2024, Monero continues to be favored by those seeking privacy, but its future may hinge on its ability to maintain its privacy features while navigating growing legal obstacles.

Ghost: A New Hope for Decentralized Finance

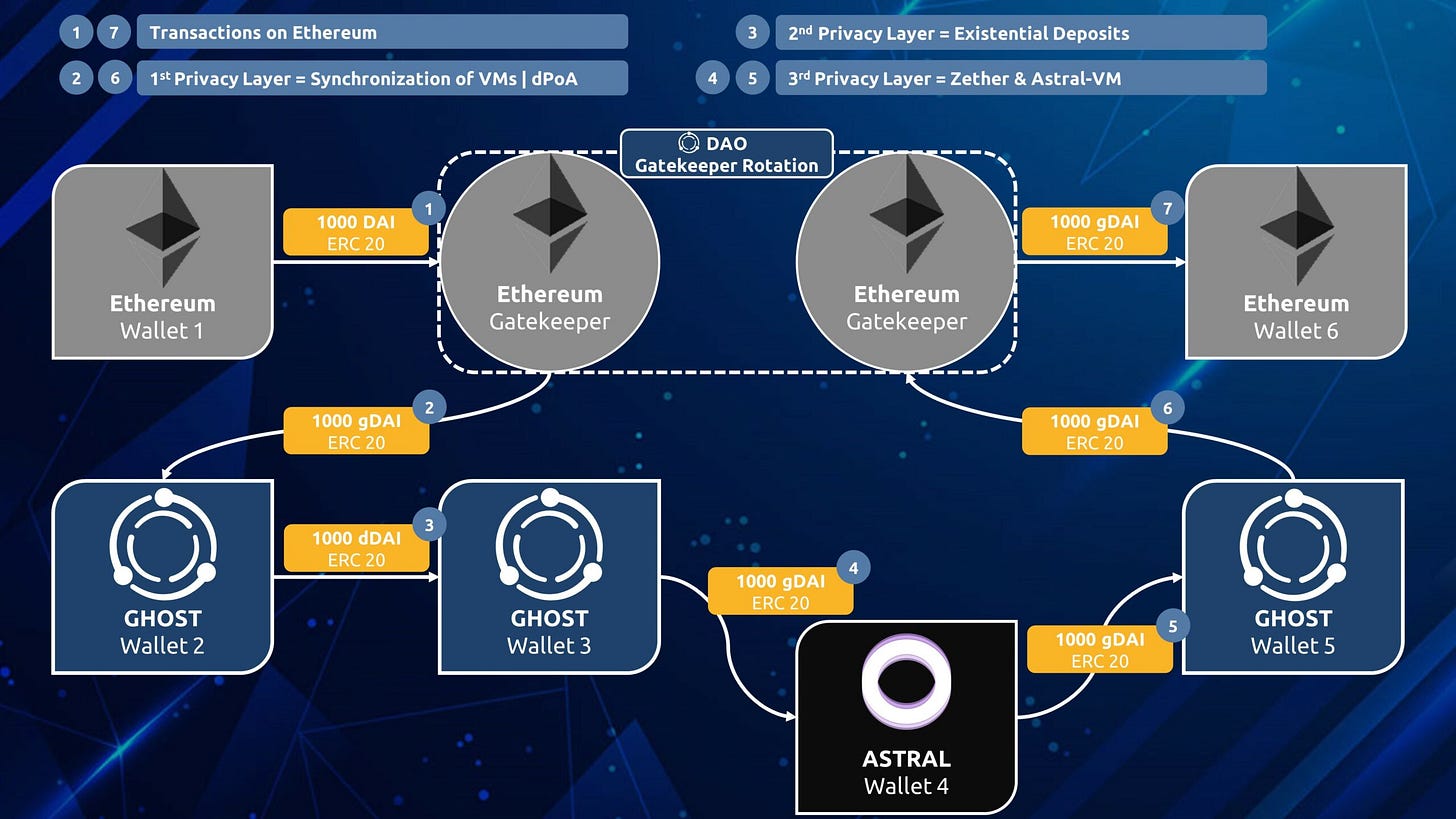

McAfee’s own project, Ghost, represented his vision of a truly private and decentralized digital currency. He spoke about Ghost with great enthusiasm, positioning it as a game-changer in the cryptocurrency space. "On the 22nd, when the Ghost exchange goes live, you can exchange it anonymously with anything you want," McAfee promised, emphasizing the importance of creating a platform that allowed for peer-to-peer transactions without the need for centralized entities.

However, Ghost’s journey since McAfee's prediction has been far from smooth. Despite its ambitious goals, the cryptocurrency has failed to achieve widespread adoption or recognition in the same way that Bitcoin or Monero have. In 2024, Ghost remains a niche player in the cryptocurrency market, and McAfee’s bold predictions for its success have not come to fruition. While the idea of an entirely decentralized, anonymous exchange remains appealing to privacy advocates, the platform's ability to scale and gain traction in the competitive crypto ecosystem has been limited.

McAfee’s Geopolitical Predictions: A World in Decline

Beyond cryptocurrency, McAfee’s outlook on global politics was equally dire. He predicted that the U.S. would lose its status as the world’s dominant superpower, foreseeing a future in which the country would "become Ethiopia’s [expletive] country" within ten years. McAfee was highly critical of American governance, specifically its increasing reliance on centralized systems of control and surveillance. "In ten years, America will be Ethiopia’s [expletive] country," he stated, painting a grim picture of the nation's decline.\

McAfee’s geopolitical concerns seemed prescient as global dynamics shifted in the following years. While the U.S. still retains its position as a global superpower, challenges to its influence have grown. The rise of China, the increasing assertiveness of Russia, and growing calls for the U.S. to abandon its role as the world’s policeman have sparked debates about the future of American leadership. Moreover, the economic impact of the COVID-19 pandemic, rising inequality, and increasing social unrest in the U.S. have contributed to a sense of national decline in some circles.

A Future Without Income Taxes: The Decentralization of Finance

McAfee also entertained the idea of a world where cryptocurrencies and decentralized finance (DeFi) had stripped governments of their ability to levy taxes. He cited historical examples, such as the absence of an income tax in America prior to 1913, to argue that societies had once functioned without the financial structures that currently dominate the world. For McAfee, cryptocurrency represented a potential return to that freedom, a financial system not beholden to governments or banks.

While McAfee’s vision of a tax-free society remains unlikely, the rise of decentralized finance platforms has indeed started to challenge traditional banking and financial structures. DeFi protocols, which allow for peer-to-peer lending, borrowing, and trading of assets, have experienced significant growth in recent years. In 2024, DeFi has become a major sector in the cryptocurrency industry, with billions of dollars in value locked in DeFi applications. The decentralization of finance could pave the way for a more autonomous financial system, though it remains unclear whether it will ever fully replace traditional government-controlled systems.

Conclusion: A Radical Vision, Not Yet Realized

John McAfee’s 2020 interview provided a snapshot of a man unafraid to speak his mind, even if his predictions were radical or unpopular. While some of his forecasts about Bitcoin’s fall into irrelevance have not come to pass, his concerns about privacy, government control, and the rise of decentralized finance continue to resonate. As of 2024, the cryptocurrency space remains in flux, with Bitcoin, Monero, and emerging privacy coins continuing to evolve. McAfee’s legacy, particularly in the realm of cryptocurrency and financial freedom, remains a subject of intense debate, but his predictions—whether accurate or not—have undoubtedly contributed to the ongoing conversation about the future of money, governance, and privacy in a digital world.

![Centralized vs Decentralized Crypto [DEX vs CEX] - A detailed Comparison Centralized vs Decentralized Crypto [DEX vs CEX] - A detailed Comparison](https://substackcdn.com/image/fetch/$s_!_5M2!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Ff2e354dd-c64f-41ff-adb9-18118dcb523e_803x505.png)