Breaking Down the Nuclear Renaissance: An Interview with Justin Huhn

In this insightful interview with Justin Huhn of Uranium Insider, Steve Barton of In it to Win it explores the uranium market's intricate dynamics, the burgeoning nuclear renaissance, and investment strategies for those looking to capitalize on this growing industry. Justin provides a detailed analysis of market trends, the role of tech companies in nuclear energy, and actionable insights for investors, while highlighting his team's dedicated work in demystifying this complex sector.

Energy Markets: The Shift Toward Real Assets

Justin begins by stressing the importance of investing in tangible assets, particularly in an era of increasing economic and geopolitical uncertainty. “Own real stuff,” he advises, suggesting that commodities like uranium, gold, and copper are critical additions to any portfolio. He mentions the new physical copper fund launched by Sprott as an example of an accessible investment vehicle for those interested in hard assets.

When asked about his investment approach, Justin explains that his portfolio is heavily weighted toward energy, with a focus on sectors that will remain indispensable in the coming decades. “Stay long energy,” he reiterates, adding that energy demand is a theme unlikely to fade. While he has a small allocation to secondary AI plays, Justin emphasizes that his primary focus is on energy, a sector he views as foundational to the global economy.

Supply and Demand Dynamics in the Uranium Market

A major topic of the discussion is the tight supply-demand balance in the uranium market. Justin highlights the limited availability of enrichment capacity and excess enriched uranium product (EUP), which has driven utilities to accumulate significant conversion and enrichment inventories. "Time to come to the table for uranium, especially in the US," he observes, predicting a resumption of utility purchasing in the near future.

Despite a temporary slowdown in the term market for 2024, Justin remains optimistic about the long-term demand for uranium. He describes the physical market as constrained by structural supply issues, noting that utilities have few remaining options to secure the material they need. "They really can't pull very many more levers," he says, underscoring the urgency for buyers to lock in supplies as uncertainties in the US market begin to clear.

Tech Giants and the Nuclear Renaissance

One of the most intriguing trends Justin discusses is the increasing involvement of tech companies in the nuclear sector. He cites Amazon’s $500 million investment in X-energy and Google’s $200 million funding for Kairos as significant milestones. While these investments may initially appear to be ESG-driven, Justin believes they signal the start of a broader collaboration between the tech and nuclear industries. “We don’t think this is going to stop,” he predicts, envisioning a future where headlines about new nuclear projects become commonplace.

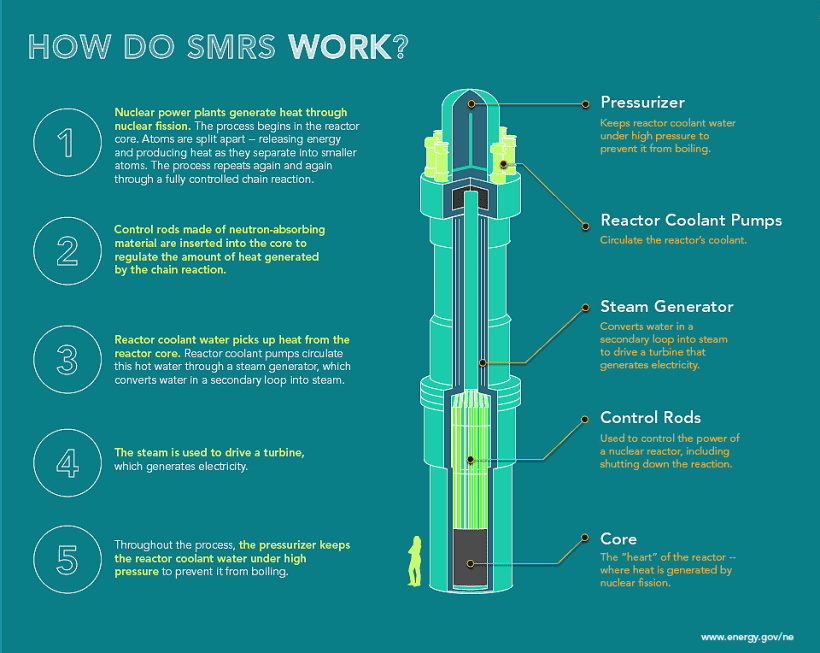

Justin emphasizes the transformative potential of small modular reactors (SMRs) in this context. He describes the industry as being in its infancy, likening the current stage to “the top of the first inning.” Once the first wave of SMR projects proves successful, he foresees a snowball effect, with demand surging as governments and corporations alike recognize the benefits of these innovative technologies.

Cameco and the Long-Term Investment Case

During the interview, Justin identifies Cameco as a standout investment in the uranium sector, describing it as a stock to “hold forever.” He highlights the company’s strategic position in the nuclear supply chain, particularly in conversion and enrichment processes, and its potential to benefit from the restarting of facilities like Springfields in the UK. "You probably just want to hold it, kind of forever," he suggests, likening it to a generational asset.

Justin also points to the financial implications of building new AP1000 reactors, which could significantly boost Cameco’s bottom line. If a wave of these reactors is constructed, it would create substantial growth opportunities for companies like Westinghouse and their supply chain partners. “It’s going to be very, very good for the company,” Justin asserts, emphasizing the far-reaching impact of the nuclear renaissance on key industry players.

SMRs: A Game-Changer for the Industry

Small modular reactors (SMRs) are a recurring theme in the discussion, with Justin describing them as a key driver of future growth in the nuclear sector. He views the current stage of SMR development as “growing pains” for a nascent industry, with many first-of-a-kind projects still in their early stages. However, he remains confident in their potential to revolutionize the energy landscape. “This is the top of the first inning for SMRs,” he says, highlighting the massive opportunities that lie ahead.

Justin notes that once the initial hurdles are overcome, SMRs could drive unprecedented demand for uranium. He anticipates a wave of new orders as governments and private companies recognize the benefits of these compact, efficient reactors. The collaboration between tech giants and nuclear startups could further accelerate this trend, creating a fertile environment for innovation and growth.

Rotation and the Mid-Cap Opportunity

Another critical point Justin addresses is the potential for market rotation within the uranium sector. He explains that mid-cap development companies, which have yet to reach full-scale production, offer significant upside potential. "We're generally long the mid-cap developing companies," he says, highlighting their ability to transition into cash-flowing businesses. This rotation, he argues, could represent a major opportunity for investors looking to capture alpha in the uranium market.

Justin also notes that these companies have historically underperformed relative to larger players but believes their time is approaching. As the market evolves and demand continues to rise, mid-cap firms are well-positioned to capitalize on the next phase of growth. "We think there's a rotation that's coming," he predicts, pointing to the sector's strong fundamentals as a driving force.

Risks and Market Uncertainties

Despite his bullish outlook, Justin acknowledges the risks that could impact the uranium market. He cites potential demand shocks or sudden increases in supply as factors that could alter market dynamics. "A big negative shock to demand or a large influx of supply will obviously change the dynamics in the physical market," he cautions, emphasizing the importance of monitoring these variables.

However, Justin remains optimistic about the sector’s long-term prospects. He notes that the current market environment is highly supportive of uranium, with strong demand fundamentals and limited downside risk. "As far as we can tell right now, there's nothing slowing this thing down," he says, reflecting his confidence in the industry's trajectory.

Uranium Insider: A Trusted Resource for Investors

For those looking to navigate the complexities of the uranium market, Justin highlights the resources offered by Uranium Insider. The newsletter provides subscribers with detailed reports on the physical uranium market, including weekly updates on pricing, transactions, and trends. "We try to take an extremely complex sector and distill it down into information that's actionable for investors," he explains.

https://www.uraniuminsider.com/

Justin also emphasizes the newsletter’s track record of success, noting that their focus list of recommended securities has consistently outperformed the broader market. "Our focus list has outperformed the ETF by almost a factor of two," he says, attributing this success to their rigorous research and deep understanding of the sector.

Thank You for Reading!

We sincerely appreciate you taking the time to read our article. Your support means the world to us, and we hope the information we shared has been helpful. To continue delivering valuable content and providing informative articles like this, we kindly ask for your support. By subscribing and liking this article, you help us reach more readers and keep our work going. Your engagement makes a real difference in allowing us to continue our mission of bringing you high-quality, insightful content. Thank you again for your time, and we look forward to sharing more with you soon!