Lynette Zang & Francis Hunt: Building Resilience with Sound Money

"How Zang and Hunt Advocate for Financial and Community Preparedness"

This article encapsulates the rich dialogue between two individuals deeply concerned about the future of our economic systems and the importance of preparing for the challenges ahead. By focusing on sound money, community building, and global strategies, they offer a roadmap for navigating the complexities of an uncertain world.

Introduction

In a world teetering on economic instability, the importance of sound money and community preparedness cannot be overstated. This discussion delves into the practical steps individuals can take to safeguard their financial and physical well-being. The conversation between Lynette Zang and a like-minded interlocutor highlights the urgent need for a shift from fiat currency to sound money, while also emphasizing the significance of local community building and the benefits of having global fallback options.

The Need for Sound Money

The current global economic system, heavily reliant on fiat currency, is increasingly seen as unsustainable. Lynette Zang, an advocate for sound money, underscores the pressing need to transition from debt-based money to savings-based money. "If we don't do something, we are not going to have a seat at the table," she warns. The concept of a "peaceful revolution" through the conversion of fiat money into sound money is presented as a viable strategy to counter economic instability.

The shift to sound money is not merely a financial move but a revolutionary step towards reclaiming economic autonomy. "This is going into this battle with a bazooka," Zang states, emphasizing the strength that comes from sound money, compared to the vulnerability of relying on fiat currency.

Moving Beyond Rage: Building New Systems

While it is easy to vent frustrations about the current economic system, real change requires proactive efforts. The interlocutor acknowledges, "Sometimes I'm probably as guilty of this as anyone else," referring to the tendency to complain about systemic issues without taking action. Instead, the conversation pivots towards constructive measures individuals can take.

"You build your own system, and you have to do it ground up; that is local," the interlocutor asserts, highlighting the importance of community-based initiatives. This sentiment is echoed by Zang, who has been actively involved in creating sustainable local communities. "We are doing something similar," she affirms, referring to efforts to establish self-reliant communities that can withstand economic turmoil.

The Global Perspective: Optionality and Resilience

The discussion also touches on the broader global context and the strategic value of having multiple jurisdictions. The interlocutor points out the disparity in population and economic activity between the East and the West, noting that "most of the world is like this with that huge bulge of population," while the West, with its lower population, has historically enjoyed higher relative income. This imbalance is shifting, with the West facing the harshest economic downdraft due to over-reliance on financial services.

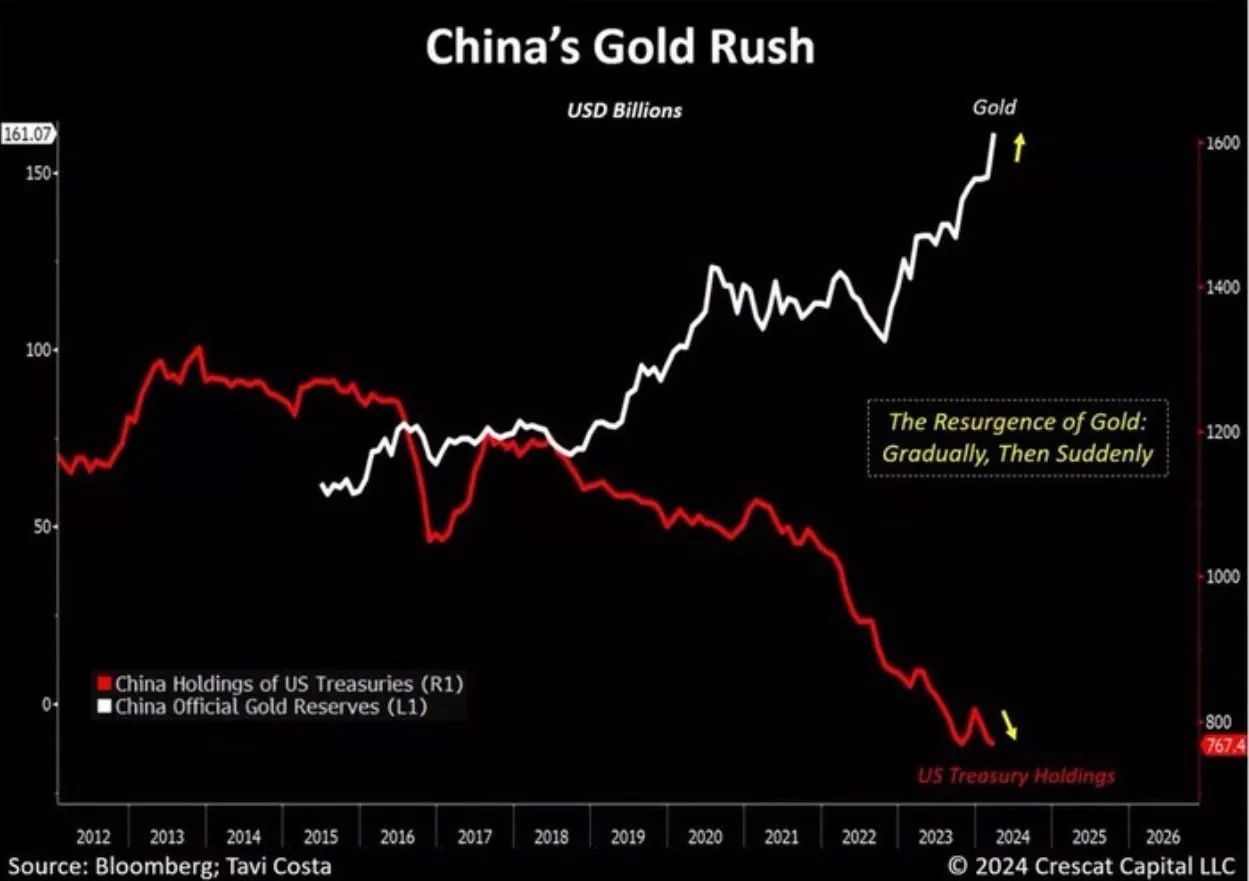

Zang concurs, adding that while middle America might fare slightly better, the overall advantage of the US as the world’s reserve currency holder is diminishing. "The US has had all these years of artificial demand for the dollar, which has been declining very, very substantially," she explains. The decline in the dollar's global trade share is a significant indicator of this shift.

The Role of Central Banks and Digital Currencies

The conversation turns to the role of central banks and the potential impact of central bank digital currencies (CBDCs). Zang highlights the dangers of a fully controlled digital economy, where central authorities could have unprecedented power over individual financial activities. "There are no limitations to how low they can push interest rates," she warns, describing a scenario where individuals could see their bank account balances dwindle due to negative interest rates, even in an inflationary environment.

The interlocutor agrees, noting the draconian nature of such control. "It would be the ultimate, I mean, there will be a descent into godliness virtually one step removed," they assert, stressing the need to resist such developments to maintain economic freedom.

Preparing for the Future: Local and Global Strategies

The conversation then shifts to practical steps for preparing for economic disruptions. Zang emphasizes the importance of local community building and self-reliance. "Get started on your local prepping, which means community self-reliance, food, water, fund balance sheets, gold, and transactional silver," she advises.

Both participants agree on the value of having global fallback options. The interlocutor asks about potential international safe havens, to which Zang responds that while no one country may be better off, places with strong community ties might offer more resilience. "I'm building my own community," she says, detailing her efforts to establish a self-sufficient community capable of supporting itself during crises.

Wealth and Opportunity in Crisis

Zang highlights that crises present opportunities for those who are prepared. "Wealth never disappears; it merely shifts location," she explains. The goal is to position oneself to benefit from these shifts by holding onto assets like gold and silver, which retain their value and can be used to acquire income-producing assets when they become undervalued.

The conversation also touches on the idea of dual citizenship as a form of insurance against economic and political instability. "I think it's a good idea to have dual citizenship and have another location," Zang suggests, while also stressing the importance of preparing well in advance and staying close to family and community.

Skills and Community: The New Wealth

As the conversation concludes, both participants agree on the importance of practical skills and community involvement. The interlocutor laments the loss of traditional skills in modern society but notes that such skills will become increasingly valuable. "People that can grow things, do stuff with their hands, physical toil, fixing, making, mending, growing—they're going to become super useful," they predict.

Zang echoes this sentiment, encouraging people to get involved in local initiatives like farmers' markets and to learn practical skills. "Every farmer could use an extra hand or two," she notes, emphasizing the value of building a community where everyone contributes their unique talents.

Conclusion

The conversation between Lynette Zang and her interlocutor provides a comprehensive look at the strategies for building resilience in an uncertain economic future. From advocating for sound money to emphasizing the importance of local and global community building, the discussion offers practical advice for individuals looking to safeguard their financial and physical well-being. As Zang aptly puts it, "If not me, who? And if not now, when?" The time to act is now, and the path to resilience starts with building strong, self-reliant communities and preparing for whatever the future may hold.

Support Our Work with a Bitcoin Donation

We also offer the opportunity to support our work and help us continue building the Financial Anarchy community. If you would like to contribute, we gratefully accept donations in Bitcoin. Your support will enable us to create more educational content, engage in meaningful activism, and further our mission of challenging the status quo. To donate, please use the following Bitcoin address:

bc1qmzzj5lfhe5ghv2yh3tfgt3qcuycl3r6n4llrsk

Thank you for joining us on this journey of understanding and change. Together, we can shape a brighter financial future for all.