Market Analysis: Economic Turmoil and Future Projections

Examination of Gregory Manarino's Insights

In a recent segment titled "Markets: A Look Ahead," Gregory Manarino comprehensively analyzes the current global economic landscape. His insights, grounded in years of market observation, outline a series of interconnected dynamics that paint a rather bleak picture of the world economy. This article will break down Manarino’s key points, providing a structured and detailed examination of his arguments.

Global Economic Scenario

According to Manarino, the global economy is undergoing significant turmoil characterized by social unrest, expanding wars, and economic contraction. He describes this as a deliberate deconstruction of the economic system, stating, "The world economy today has become a weapon of mass deconstruction. It’s being systematically taken apart." This perspective suggests that the current state of affairs is not accidental but rather a result of intentional policies and actions.

The Economic Illusion

Manarino highlights the disparity between the official narrative of economic prosperity and the reality of a contracting global economy. He argues that propaganda efforts are masking the true state of economic decline. "People are being scammed and tricked," Manarino asserts, emphasizing the discrepancy between reported economic growth and the actual shrinking of the middle class and rising global debt.

Inflation and Monetary Policy

A significant portion of Manarino's analysis focuses on inflation and its root causes. He points out that inflation is primarily a monetary policy issue, driven by central banks rather than political leaders. "Central banks around the world are responsible for monetary policy," he explains, criticizing the common misconception that presidents or political parties are to blame for inflation. This distinction is crucial for understanding the real drivers behind the rising cost of living.

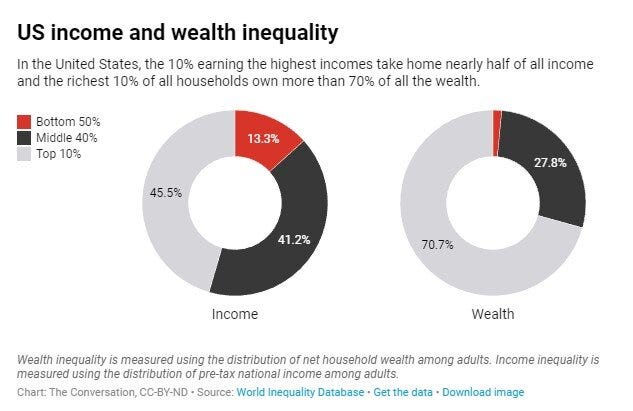

The Wealth Divide

Manarino observes that the wealth gap is widening at an unprecedented rate. The wealthiest individuals are accumulating wealth faster than ever, while the middle class is shrinking. According to Manarino, this is not a coincidence but a deliberate strategy to create economic dependency. "Today, the wealthiest are getting richer faster than at any time in history, while the middle class dwindles," he notes, highlighting the systemic nature of this trend.

Politicians and Monetary Policy

Manarino draws attention to the rhetoric of politicians who advocate for lower interest rates and a weaker dollar. He argues that these policies are interconnected and ultimately detrimental to the average consumer. "When you hear a politician talking about lower rates, they’re also talking about a weaker dollar," he explains. A weaker dollar increases the cost of goods and services, creating an illusion of a booming stock market while eroding purchasing power.

Central Banks and Market Manipulation

According to Manarino, central banks play a pivotal role in propping up financial markets through asset purchases and rate manipulations. He notes that recent actions by the Federal Reserve, such as buying debt and influencing mortgage rates, are clear examples of this strategy. "The Fed’s buying it all," he says, referring to the central bank's intervention in the debt market to stabilize stock prices and maintain economic illusions.

The Illusion of Market Stability

Manarino asserts that the apparent stability of the stock market is an illusion fostered by central bank interventions. He points out that traditional market fundamentals, such as price-to-earnings ratios and forward guidance, no longer hold significance. "The stock markets of the world are nothing more than derivatives of the action that's happening in the debt market," he states, emphasizing the lack of genuine price discovery in today’s financial landscape.

Conclusion

In his analysis, Gregory Manarino presents a sobering view of the current economic situation, marked by deliberate deconstruction, widening wealth gaps, and manipulated market stability. He urges individuals to recognize these dynamics and consider strategies to navigate this challenging environment. By understanding the true drivers behind economic policies and market actions, people can better prepare for the future.

Manarino's insights provide a valuable perspective on the complexities of the global economy, highlighting the need for vigilance and informed decision-making in the face of systemic challenges.

Support Our Work with a Bitcoin Donation

We also offer the opportunity to support our work and help us continue building the Financial Anarchy community. If you would like to contribute, we gratefully accept donations in Bitcoin. Your support will enable us to create more educational content, engage in meaningful activism, and further our mission of challenging the status quo. To donate, please use the following Bitcoin address:

bc1qmzzj5lfhe5ghv2yh3tfgt3qcuycl3r6n4llrsk

Thank you for joining us on this journey of understanding and change. Together, we can shape a brighter financial future for all.

Pricing Implication of Centrality in an OTC Derivative Market: An Empirical Analysis Using Transaction-Level CDS Data – Inseikai Tohoku TUMES](2024/02/08) Pricing Implication of Centrality in an OTC Derivative Market: An Empirical Analysis Using Transaction-Level CDS Data – Inseikai Tohoku](https://substackcdn.com/image/fetch/w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F9cb4094a-d2e7-4424-890d-e478848b9978_1880x1030.jpeg)