Money Illusion: The Hidden Crisis

How Central Banks' Secrets are Shaping Your Financial Future by Rafi Farber

In this article, we delve into some of the most pertinent quotes and data to shed light on key aspects of the current economic environment. From discussions on monetary policy and inflation to insights on systemic risks in the banking sector, we aim to provide a comprehensive analysis that equips readers with valuable insights into the prevailing economic conditions. One such illuminating conversation unfolds between Jesse, the host of the Commodity Culture podcast, and Rafi Farber, known for his critical insights into monetary policy, the implications of debt, and the complex workings of fiat currency systems. This exchange provides a fertile ground for exploring the nuanced impacts of central bank policies on the economy, offering listeners a deeper understanding of the interconnectedness of debt, money supply, and financial stability.

The Impact of Monetary Policy

One fundamental aspect of the economy revolves around monetary policy, particularly the actions of central banks. As renowned economist Rafi Farber points out, "It's not up to Congress; they're not the ones doing it. When you're in a Fiat system... if you decrease the debt, you're going to decrease the money supply." This quote underscores the intricate relationship between debt, money supply, and central bank policies. The reliance on fiat currencies and fractional reserve systems means that attempts to reduce debt can inadvertently lead to a contraction in the money supply, potentially triggering banking failures and economic instability.

The impact of monetary policy on economic stability and growth is profound and multifaceted, especially within the context of fiat money systems and fractional-reserve banking. Rafi Farber’s observations provide a critical lens through which to view the interdependence of debt, money supply, and the overarching role of central banks. This section delves deeper into these dynamics, highlighting the mechanisms at play and their implications for the economy.

Central banks, such as the Federal Reserve in the United States, the European Central Bank in the Eurozone, or the Bank of Japan, wield significant influence over the economy through their control of monetary policy. They manage the money supply, set interest rates, and regulate the banking system, with the primary goals of maintaining price stability, fostering full employment, and ensuring the stability of the financial system. Farber’s point that "It's not up to Congress" underscores the autonomy and the crucial role these institutions play, distinct from fiscal policy decisions made by governments.

The Fiat System and Fractional Reserve Banking

In a fiat system, money is not backed by a physical commodity but by the government's decree. This system allows central banks to exercise considerable flexibility in managing the money supply. However, it also introduces complexities, particularly concerning debt and money creation.

Banks operate under a fractional reserve system, where only a fraction of bank deposits are kept as reserves, and the rest is used for lending. This system multiplies the money creation process but also ties the creation of money closely to the creation of debt. When a bank extends a loan, it essentially creates money. Consequently, as Farber notes, reducing debt directly affects the money supply because paying off or reducing debt means less money is circulating within the economy.

The Paradox of Debt Reduction

Attempting to reduce debt in a fiat currency system can lead to unintended economic consequences. While reducing debt may seem to be a prudent fiscal approach, it can inadvertently cause a contraction in the money supply. This contraction could lead to lower spending, investment, and overall economic activity, potentially triggering a recession or deflationary pressures.

Moreover, in a world where economic growth often depends on the expansion of credit, a reduction in debt levels can signal tightening financial conditions. Businesses may find it harder to borrow for expansion, and consumers may reduce spending, further exacerbating economic slowdowns.

Banking Failures and Economic Instability

A significant contraction in the money supply can put stress on the banking system. Banks rely on deposits and lending to generate profits. A reduction in lending activity can squeeze banks' profit margins, increasing the risk of bank failures. Additionally, if businesses and consumers face difficulties in repaying loans due to a contracting economy, banks could see a rise in non-performing loans, further destabilizing the financial system.

The global financial crisis of 2007-2008 offers a stark example of how vulnerabilities in the banking sector can lead to widespread economic turmoil. It highlighted the critical importance of central bank interventions to stabilize the money supply and ensure the flow of credit in times of crisis.

Inflationary Pressures and Asset Prices

The ongoing debate surrounding inflationary pressures and asset prices is another area of significant interest. Farber's commentary on hyperinflationary economies offers valuable insights into the potential consequences of monetary expansion. He highlights the role of inflation in distorting investment patterns, noting that "inflation pours demand into areas that they shouldn't be in." This observation underscores the importance of understanding how monetary policies impact asset valuations and market dynamics, particularly in an environment of heightened inflationary expectations.

Systemic Risks in the Banking Sector

The recent challenges faced by financial institutions, such as the New York Community Bank Corp, serve as a stark reminder of the systemic risks inherent in the banking sector. As highlighted in the article, the collapse of a single bank can have far-reaching implications, given the interconnected nature of the financial system. Rafi Farber's assessment of the situation underscores the fragility of centralized banking systems, where a single failure can trigger a domino effect, leading to widespread financial turmoil.

The Role of Community and Preparedness

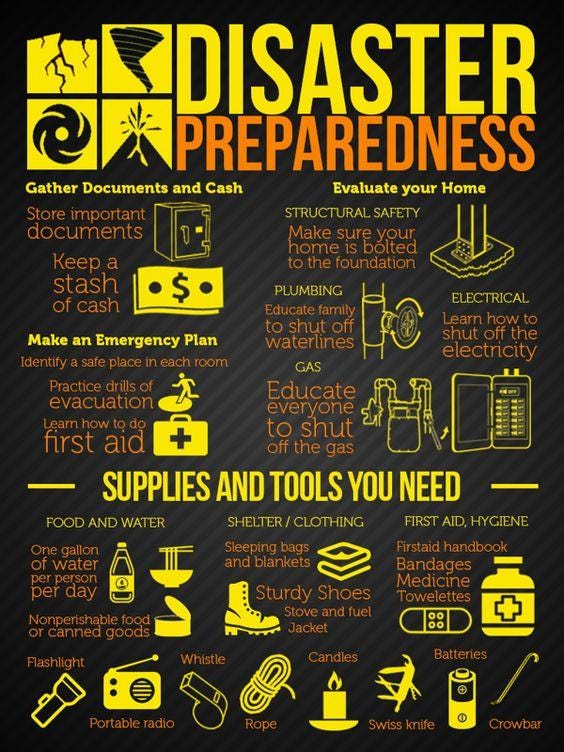

Amidst the uncertainties and challenges posed by the current economic environment, the importance of community and preparedness cannot be overstated. Farber emphasizes the significance of surrounding oneself with morally upright individuals, stating, "Community is the most important thing... be around people who are not insane." This sentiment resonates with the notion that collective resilience and support networks play a crucial role in navigating economic upheavals and societal disruptions.

Conclusion

The interplay between monetary policy, the money supply, and debt within a fiat currency system is complex and filled with nuances. As Farber illuminates, efforts to manage economic outcomes through monetary policy must balance fostering economic growth and preventing financial instability. Central banks' role in this balancing act is critical, as they must respond to economic signals while mitigating the risks associated with debt reduction and money supply contraction. Understanding these dynamics is essential for appreciating the challenges and strategies involved in steering the economy toward sustained growth and stability.

Support Our Work with a Bitcoin Donation

We also offer the opportunity to support our work and help us continue building the Financial Anarchy community. If you would like to contribute, we gratefully accept donations in Bitcoin. Your support will enable us to create more educational content, engage in meaningful activism, and further our mission of challenging the status quo. To donate, please use the following Bitcoin address:

bc1qmzzj5lfhe5ghv2yh3tfgt3qcuycl3r6n4llrsk

Thank you for joining us on this journey of understanding and change. Together, we can shape a brighter financial future for all.