Peter Schiff's Latest Insights: Why Now Is the Time to BUY Silver at $30

Peter Schiff's Latest Insights: Why Now Is the Time to Invest in Silver and Gold

In his latest video, renowned economist and precious metals expert Peter Schiff discusses the recent breakout in silver prices and the broader implications for investors. Schiff, known for his sharp analysis of economic trends, offers a compelling case for why now is an opportune time to invest in silver and gold. Here's a summary of his key points and recommendations.

Silver's Breakout: A Sign of Things to Come

After months of anticipation, silver prices finally broke through the $30 per ounce barrier, closing the week at around $31.50. This marks the highest close since February 2013 and represents a significant increase of over 30% so far in 2024. Schiff highlights that while it's always best to buy before a breakout, purchasing silver shortly after a breakout can still be highly advantageous. He emphasizes that waiting for pullbacks can be risky, as any such dips are likely to be brief and shallow.

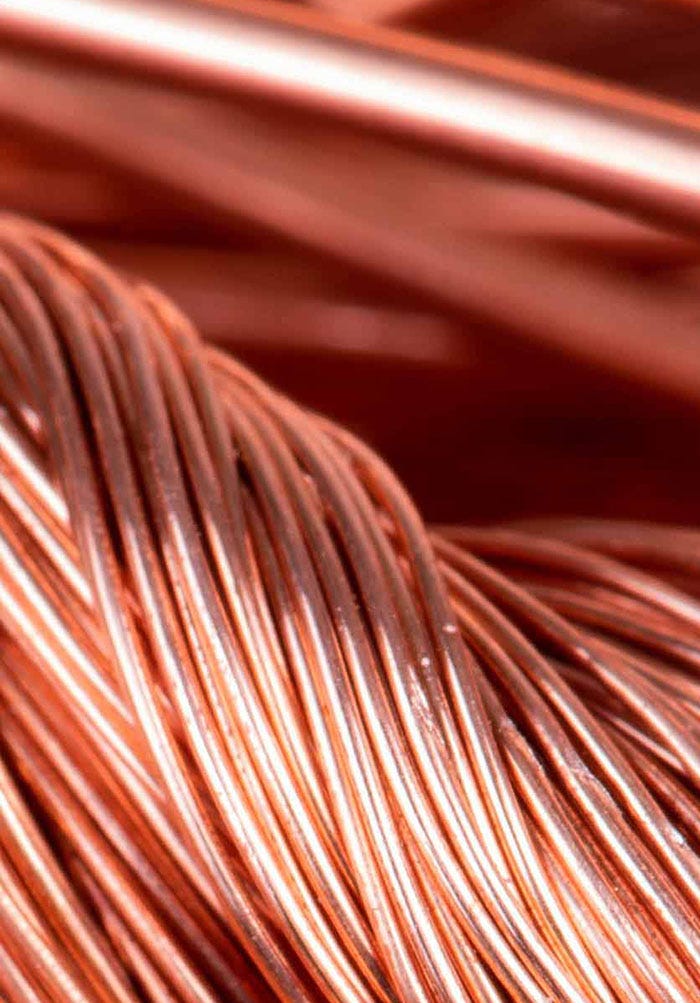

The Rise of Copper and Its Implications

Interestingly, copper has also seen substantial gains, up 33% year-to-date, suggesting broader inflationary pressures in the economy. Schiff compares the current decade to the 1970s, noting that while copper prices increased by about 90% over that decade, they've already risen 80% since 2020. This rapid increase, according to Schiff, signals a far more severe inflationary environment than in the 1970s.

The Case for Junk Silver

Schiff advises investors to consider purchasing junk silver—U.S. coins minted before 1965 that contain 90% silver. He explains that these coins are not only valuable for their silver content but also practical for potential use in barter during economic crises. SchiffGold is currently running a special on junk silver at $1.79 over spot price, which Schiff views as an excellent opportunity given the rising demand and limited supply.

The Gold Market: Central Banks and Future Prices

Gold also closed at a record high of approximately $2,415 per ounce, the highest weekly close ever. Schiff points out that while gold has traditionally been a conservative store of value, the current buying by central banks indicates significant inflationary expectations. He predicts that the current price of gold will soon seem cheap as prices are likely to rise much higher in the future.

Mining Stocks: An Alternative Investment

For those looking beyond physical metals, Schiff suggests investing in mining stocks, particularly through the Euro Pacific Gold Fund. These stocks represent companies that own gold and silver in the ground, potentially offering higher returns as metal prices rise.

Final Thoughts

Peter Schiff concludes his video with a call to action for investors to take advantage of the current market conditions. He stresses the importance of preparing for future economic uncertainties by securing precious metals now. Whether it's through buying physical silver and gold or investing in mining stocks, Schiff's message is clear: the time to act is now, before prices climb even higher.

For those interested in following Schiff's advice, SchiffGold representatives are available to assist with purchases throughout the weekend. With the potential for explosive rallies in the near future, securing these assets now could be a wise move for preserving and growing wealth in an increasingly volatile economic landscape.

--- https://schiffgold.com/buy/silver/

--- https://milesfranklin.com/

This article encapsulates Peter Schiff's latest insights on the silver and gold markets, offering practical advice for investors looking to navigate the current economic climate. By acting on Schiff's recommendations, investors can better position themselves to benefit from the ongoing and anticipated increases in precious metal prices.

Support Our Work with a Bitcoin Donation

We also offer the opportunity to support our work and help us continue building the Financial Anarchy community. If you would like to contribute, we gratefully accept donations in Bitcoin. Your support will enable us to create more educational content, engage in meaningful activism, and further our mission of challenging the status quo. To donate, please use the following Bitcoin address:

bc1qmzzj5lfhe5ghv2yh3tfgt3qcuycl3r6n4llrsk

Thank you for joining us on this journey of understanding and change. Together, we can shape a brighter financial future for all.