Introduction:

In a rapidly changing world, where economic uncertainties, currency fluctuations, and geopolitical realignments are becoming the norm, the search for stability and financial security has never been more crucial. This quest has ignited a renewed interest in the timeless and ageless allure of precious metals, particularly gold and silver. These metals, with their enduring intrinsic value and time-tested resilience, have taken on new significance as individuals and nations seek refuge from the uncertainties of fiat currencies and the ever-evolving global financial landscape.

This exploration delves into the enduring role of gold and silver as storehouses of wealth and the complex dynamics surrounding their acquisition and utilization on both an individual and global scale. From the discreet actions of central banks to the motivations behind the shift in the distribution of these precious metals, we journey through a financial world in transition. Join us as we navigate through the intricate pathways that lead to the heart of gold and silver's enduring appeal and their place in the evolving global economy.

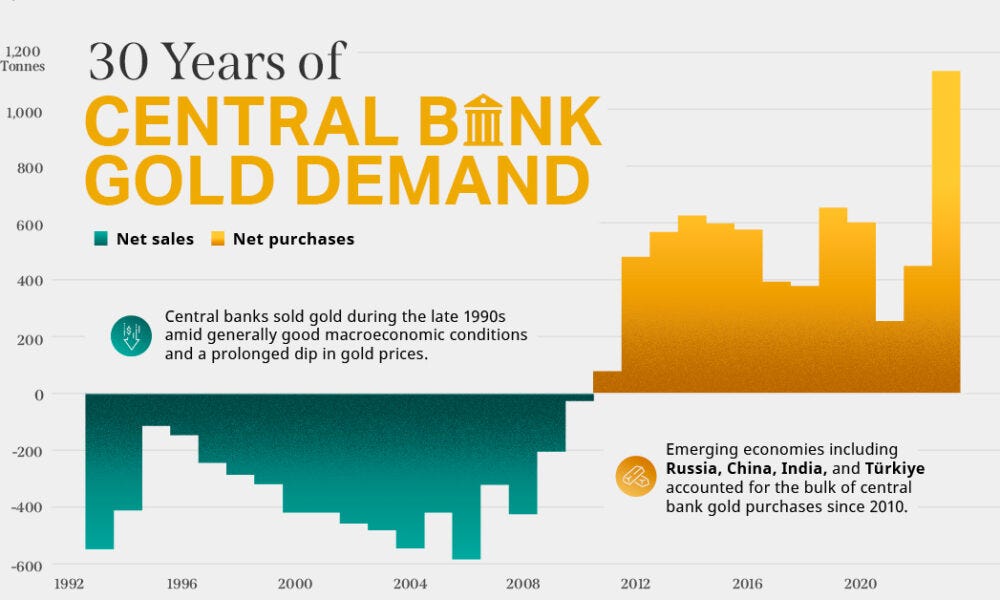

It seems that Western central banks are providing gold to the East and other regions, notably China and Singapore. This practice is not well-publicized, and I believe it is part of a larger global shift. There is a growing desire to reduce reliance on the US dollar for reserve holdings. This realignment is happening on both sides, the East and the West, as orchestrated by the financial elite. This process could contribute to keeping the gold price in check, as it allows the gradual transition from treasuries to gold. The treasuries are held by various countries, especially in the East, as they seek an alternative to the dollar. This gives rise to the need for a stable store of wealth, which gold represents. While questions linger about the authenticity of the US Treasury's gold reserves, it is important to understand that much of it has been encumbered through leasing, possibly as a means to prevent a rapid surge in gold prices. These gold dynamics are essential in the larger context of rebalancing wealth distribution on a global scale.

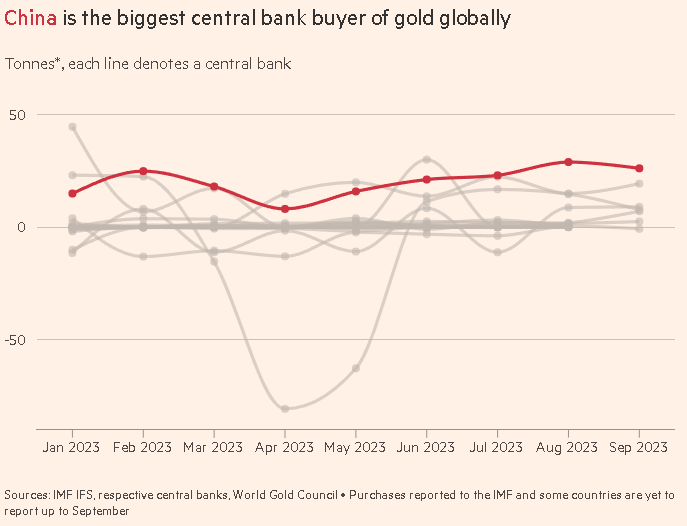

China remains a leading buyer of gold, with central banks acquiring record amounts of the precious metal in recent years. Despite fluctuations in gold prices, the trend suggests that the demand for gold remains robust. While some attribute gold's resilience to real interest rates, it's essential to acknowledge that the real rates are influenced by inflation, and they may not accurately reflect its impact on the debasement of fiat currencies. Paper gold and silver investments, like ETFs, are not always trustworthy, while mining stocks are often speculative. My recommendation is to opt for physical gold and silver as a store of wealth, keeping you away from the fiat currency train that's heading toward a cliff. Instead, consider riding the gold and silver train, which is likely headed in a more favorable direction.

The notion that Western central banks are discreetly providing gold to Eastern and other regions, particularly China and Singapore, suggests a complex and intriguing financial dynamic. This practice is largely hidden from the public eye, and it hints at a more extensive global realignment of financial power. Here's a deeper exploration of these ideas:

Reducing Reliance on the US Dollar: The shift in gold flows from Western central banks to countries in the East and elsewhere is driven by a growing desire to reduce dependency on the US dollar. Many nations, especially in the East, have held significant reserves in US Treasuries, essentially a form of IOUs from the US government. These treasuries are traditionally viewed as safe and stable assets, but concerns about the sustainability of the US dollar and the ever-increasing national debt have led to a reevaluation of this strategy.

A Global Realignment: The movement of gold from West to East is part of a more comprehensive global realignment orchestrated by influential financial and political elites. This realignment seeks to rebalance the distribution of wealth on a worldwide scale. Historically, a small percentage of the world's population in the West held a vast majority of the world's wealth. The current transformation aims to redistribute wealth more equitably.

Keeping Gold Prices in Check: One of the outcomes of this realignment is the deliberate action to prevent a rapid surge in gold prices. A sudden spike in gold values could be destabilizing, so Western central banks are likely playing a role in ensuring that gold prices do not skyrocket. This measured approach allows for a smoother transition from US Treasuries to gold as a store of wealth.

The Role of Gold as a Store of Wealth: Gold has been a historically trusted store of wealth. It doesn't rely on the economic or political stability of a single nation and can act as a hedge against inflation and currency devaluation. As countries look for alternatives to the US dollar, gold represents a stable and universally recognized option for preserving value.

Questioning US Treasury Gold Reserves: The legitimacy of the gold reserves held by the US Treasury is often debated. Much of this gold has been lent or encumbered in various ways over the years. This lending can serve to suppress the gold price, as the actual physical gold may not be readily available to meet claims. This raises concerns about whether the US possesses as much gold as it claims.

China's Prominent Role: China stands out as a leading purchaser of gold, with its central bank acquiring substantial amounts in recent years. The Chinese government and its people have actively promoted the purchase of gold. This is in line with their broader economic and geopolitical strategy to establish an alternative to the US dollar and enhance their financial influence on the global stage.

Resilience of Gold: Gold has shown resilience in the face of fluctuations in its market price. It remains a coveted asset for governments and individuals, especially in times of economic uncertainty and currency devaluation.

Real Interest Rates vs. Inflation: The relationship between gold prices and real interest rates is often debated. While some attribute gold's performance to real interest rates, it's essential to recognize that these rates can be influenced by inflation. Real interest rates may not fully capture the impact of currency debasement on the value of gold.

Physical Gold and Silver: When considering investments in gold and silver, it's advisable to focus on physical holdings rather than paper assets like exchange-traded funds (ETFs). These paper assets may not always reflect true ownership of the precious metals. Mining stocks, on the other hand, are typically more speculative investments.

Riding the Gold and Silver Train: Given the potential challenges and uncertainties associated with fiat currencies and financial markets, owning physical gold and silver can provide a level of security and wealth preservation. Investing in these precious metals aligns with the idea of riding the 'gold and silver train' rather than the 'fiat currency train,' which some argue is heading towards economic instability.

Conclusion:

In an era marked by financial complexities and shifting global dynamics, gold and silver have stood the test of time as reliable bastions of stability. These precious metals, with their intrinsic value and resilience, serve as a bedrock for financial security in a world of uncertainties.

Central banks post another month of strong gold buying in August

The discreet maneuvers of central banks, the desire to reduce reliance on the US dollar, and the rebalancing of global wealth distribution have all played a part in the evolving narrative of gold and silver. Their enduring appeal lies not just in their tangible and timeless nature but in their role as hedges against inflation and currency devaluation. As governments and individuals alike seek shelter from the stormy seas of fiat currencies, these metals shine as beacons of hope and stability.

Amid the ebb and flow of financial markets and the allure of speculative assets, the wisdom of physical gold and silver ownership remains unwavering. These precious metals provide not only a safe harbor but a tangible link to the past and a reliable store of wealth for the future.

As we conclude this exploration, we find that the significance of gold and silver continues to shine brightly. They are the embodiment of enduring value in a world where financial landscapes shift, but their worth remains steadfast. In the quest for financial security and wealth preservation, the gold and silver journey remains one of timeless wisdom and unwavering stability.

Like, Subscribe, and Share to Spread the Word!

If you found this analysis informative and eye-opening, we invite you to like, subscribe, and share this video to help us spread the word. Together, we can build a community of Financial Anarchy advocates who are dedicated to promoting financial literacy and advocating for sound monetary policies. By amplifying our message, we can empower individuals to take control of their financial well-being and contribute to a more equitable and sustainable future.

Support Our Work with a Bitcoin Donation

We also offer the opportunity to support our work and help us continue building the Financial Anarchy community. If you would like to make a contribution, we gratefully accept donations in Bitcoin. Your support will enable us to create more educational content, engage in meaningful activism, and further our mission of challenging the status quo. To donate, please use the following Bitcoin address:

1EkmtWDYzuhkiv3iYozKVnZFxsQxDetnfH

Thank you for joining us on this journey of understanding and change. Together, we can shape a brighter financial future for all.