"Recession Looms Amidst Shifting Financial Landscapes"

"From CEO Warnings to Diminishing Purchasing Power, Threads of an Impending Economic Downturn"

In the ever-evolving world of finance, ominous clouds are gathering on the economic horizon. Over the past 24 hours, a flurry of reports has surfaced, each echoing the same foreboding message - an impending recession looms, casting its shadow on the global financial stage.

CEO Alarms and Debt's Dominance:

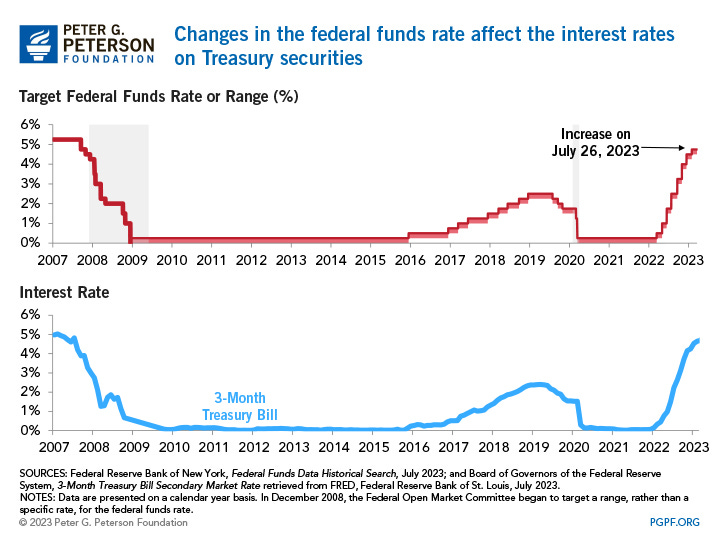

At the forefront of these warnings is Jeffrey Gelac, the CEO of DoubleLine, who recently sounded the alarm, predicting a recession by early 2024. Gelac points the finger squarely at the surging interest on debt, painting a vivid picture of a financial trajectory going "literally vertical." The Federal Reserve's decision to raise interest rates has accelerated this ascent, with interest expenses on debt skyrocketing by hundreds of billions annually, nearing a staggering half a trillion dollars.

Consumer Confidence Crumbles:

The economic storm is not confined to boardrooms and balance sheets. Reports highlight a freefall in consumer confidence, accompanied by dwindling spending and ominous signs of a Freight recession. The specter of bankruptcy looms large, reminiscent of the prelude to the 2008 Great Recession and the turbulence of the COVID-19 pandemic. Personal debt, credit card balances, and late payments on vehicles are reaching or surpassing record levels, signaling that consumers may be nearing the limits of their spending capacities.

AI, Job Cuts, and Commercial Real Estate:

Adding complexity to the economic landscape are advancements in artificial intelligence. As companies seek efficiency in the face of economic pressures, job cuts become inevitable. The ripple effect extends to various sectors, including those traditionally manned by human workers. Commercial real estate faces a paradigm shift, requiring a fundamental reevaluation of investment strategies in response to the changing tides.

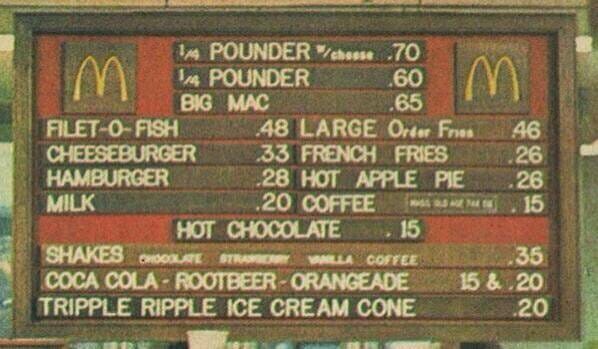

Purchasing Power Plummets:

Simultaneously, the purchasing power of the US dollar is undergoing a profound transformation. A stark example is the shift in the cost of a McDonald's value meal, once priced at $2.50 in the 1980s, now demanding $9 or $10. The impact of this decline reverberates, underscoring the currency's weakened traction in the face of inflation.

Global Conflicts and Financial Realities:

Late October saw Jamie Dimon of JP Morgan drawing attention to the wider implications of global conflicts in Ukraine and the Middle East. The diversion of funds to these conflicts, at the expense of domestic needs, is expected to lead to prolonged periods of elevated food prices and higher interest rates.

Dimon's sobering analysis underscores a critical aspect of the global economic landscape - the diversion of substantial financial resources toward funding these conflicts. The financial toll exacted by sustained military operations in these regions directly competes with the allocation of resources for crucial domestic needs within the United States. This diversion of funds, as highlighted by Dimon, is not merely a matter of strategic or geopolitical concern; it has palpable and immediate consequences for the American economy.

One of the ripple effects predicted by Dimon is the likelihood of prolonged periods of elevated food prices. The reasoning behind this forecast lies in the allocation of significant financial resources to military engagements abroad. As funds are siphoned away from investments in agriculture, food production, and distribution, the result is an increase in the cost of food at home. The implications for consumers, already grappling with economic uncertainties, are clear - a potential spike in the prices of essential commodities, impacting household budgets and further straining economic resilience.

Conclusion: Navigating Uncertainty with Strategic Agility

As the financial landscape undergoes a seismic shift, investors are advised to swiftly adapt to a new era marked by the end of declining interest rates. With a looming recession on the horizon, prudent planning for increased expenditures on essentials like food and energy becomes imperative. Aligning investment strategies with an environment of 5% to 7% mortgages stands as the foundation for future financial success.

Acknowledging the uncertainty ahead, investors are encouraged to diversify portfolios, leveraging the stability of precious metals like gold and silver as safeguards against market volatility. The timeless wisdom of a diversified approach and the importance of protecting capital take center stage, providing a shield against economic storms.

In this dynamic landscape, strategic foresight and resilience are paramount. Those who recalibrate, diversify, and recognize the significance of preserving capital will not only weather the economic turbulence but potentially emerge strengthened amidst the evolving currents of financial uncertainty.

Like, Subscribe, and Share to Spread the Word!

If you found this analysis informative and eye-opening, we invite you to like, subscribe, and share this video to help us spread the word. Together, we can build a community of Financial Anarchy advocates who are dedicated to promoting financial literacy and advocating for sound monetary policies. By amplifying our message, we can empower individuals to take control of their financial well-being and contribute to a more equitable and sustainable future.

Support Our Work with a Bitcoin Donation

We also offer the opportunity to support our work and help us continue building the Financial Anarchy community. If you would like to make a contribution, we gratefully accept donations in Bitcoin. Your support will enable us to create more educational content, engage in meaningful activism, and further our mission of challenging the status quo. To donate, please use the following Bitcoin address:

Thank you for joining us on this journey of understanding and change. Together, we can shape a brighter financial future for all.