Introduction: A New Bull Market in Precious Metals – Insights from Rick Rule

In times of economic uncertainty, seasoned investors often turn to precious metals as a hedge against inflation, currency devaluation, and broader market volatility. As global debt levels rise and concerns over the stability of fiat currencies intensify, the spotlight is once again on gold and silver. Rick Rule, a renowned expert in natural resource investing and CEO of RuleInvestmentMedia.com, believes that the precious metals market is firmly in a confirmed bull cycle, with gold leading the charge. However, it's silver—often a laggard in the early stages—that could ultimately deliver more explosive gains as the market matures.

During an in-depth interview with host Kaiser Johnson on Liberty and Finance, Rule discussed his outlook on the precious metals market and shared invaluable insights on the current macroeconomic landscape. In this article, we explore Rule’s comprehensive analysis of the precious metals market, the driving forces behind the current bull market, and his insights on volatility, short positions, and the long-term strategies that investors should consider. With silver poised for potential outperformance and gold setting the stage for further gains, Rule offers both practical advice and a long-term outlook for those looking to navigate these turbulent waters. Through a careful examination of debt dynamics, monetary policies, and global market shifts, Rule argues that the precious metals sector is not only a safe haven but also a high-potential investment in the years to come.

Gold’s Bull Market: A Confirmed Breakout

Rick Rule opens the interview with a bold declaration: “We are in a confirmed gold bull market.” He points to recent price action that has taken gold into new all-time high territory—something he considers technically and psychologically significant. According to Rule, what makes this bull market especially compelling is that it is fundamentally driven rather than sentiment-driven.

“The most important thing to me is not that gold is up, it’s why gold is up.”

He attributes the rally to a toxic mix of macroeconomic factors: increasing fiscal deficits, rising interest payments on the federal debt, massive entitlement liabilities, and politically motivated spending. These forces, he argues, are deeply structural and unsustainable.

This opening sets the tone for the entire conversation. Rule is not celebrating short-term price gains—he’s diagnosing a systemic issue. In this context, gold becomes not just a hedge, but a referendum on monetary policy and fiscal irresponsibility. It’s a direct response to debasement of fiat currencies, particularly the U.S. dollar.

For newer investors, it helps to understand that governments often finance deficits through borrowing. When that debt grows faster than GDP, and central banks respond by keeping interest rates low or implementing quantitative easing (central bank bond buying), it can lead to inflation and currency devaluation—classic conditions for gold appreciation.

Silver’s Lag—and Explosive Potential

Rule acknowledges that silver has lagged gold in this bull market so far. However, he emphasizes that this is a historical norm. Silver typically plays catch-up later in the cycle, often with far greater velocity and upside.

“Silver is always late to the party. But when it arrives, it arrives with tequila and a boom box.”

He explains that silver's dual identity—as both a monetary and industrial metal—creates more complex supply/demand dynamics. Silver is less driven by central banks and more influenced by retail sentiment, speculative flows, and industrial demand.

Silver’s volatility, often viewed as a risk, is reframed here as an opportunity. Rule implies that patient investors willing to endure its erratic behavior could be handsomely rewarded once momentum shifts. This historical pattern suggests a strategic window for accumulation before the crowd catches on.

Silver’s past behavior in bull markets (e.g., the 1970s and early 2000s) shows that it tends to outperform gold late in the cycle. This is often triggered by retail investors who see gold rising and want a “cheaper” alternative, creating a FOMO-driven buying spree.

Volatility: A Feature, Not a Flaw

Rule offers a critical mindset shift: volatility is not something to fear—it is the price of admission for extraordinary returns in the precious metals space.

“You have to be willing to withstand volatility. It’s not a bug; it’s a feature.”

He warns investors to expect sharp corrections—even in the middle of a bull market. He references past instances where precious metals corrected 30–50% during a longer-term uptrend.

This is an important psychological anchor for investors. Rule is essentially giving permission to hold through the pain. The ability to zoom out, maintain conviction, and focus on fundamentals is what separates successful metals investors from shaken speculators.

For readers less familiar with trading terms: a 50% correction doesn’t mean the end of the bull market—it means the market is digesting gains before continuing higher. This is common in sectors driven by emotion and macro uncertainty.

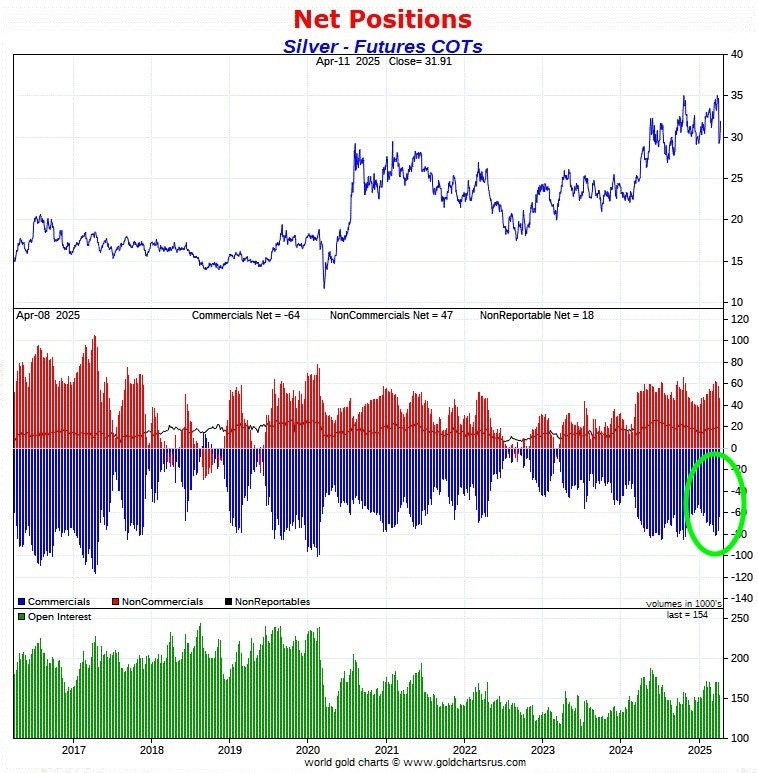

The Naked Short Risk in Silver

One of the more technical but explosive topics covered is the existence of large "naked short" positions in the silver market. Rule doesn’t dwell on conspiracy theories, but he notes that some market participants have taken on massive unhedged short exposure.

“If silver begins to move, it could put real pressure on people who are short… and they may have to cover in a hurry.”

This sets the stage for potential short squeezes—rapid price spikes driven by forced buying.

If silver's price rises fast enough, heavily shorted positions could face margin calls and be forced to buy back silver at higher prices, pushing it even higher. This self-reinforcing dynamic could be explosive. For those holding physical silver, it could mean sudden windfalls.

Naked shorting is the practice of selling a security one does not own, without first borrowing it. In thin or manipulated markets, this can lead to artificial supply pressure—until the shorts are forced to cover, often at a loss.

Beyond the Fed: What the Treasury's QE-Like Move Means for Markets and the Dollar

“We're seeing the government announcing a new round of QE, but what's interesting here is that it’s the government, not the Fed.” This observation immediately underscores a significant departure from traditional monetary policy frameworks where central banks, like the Federal Reserve, typically conduct QE to inject liquidity by purchasing government debt. The fact that the Treasury is now directly engaging in what resembles QE suggests a potential recalibration of the roles and responsibilities within U.S. economic management.

Strategic Portfolio Allocation and Patience

Rule urges investors to take a strategic and long-term view. He recommends measured exposure to gold and silver, advising against excessive concentration. He emphasizes knowing what you own, why you own it, and having a plan.

“Don’t go all-in. Go enough in that it matters—but not enough that it keeps you up at night.”

He encourages portfolio reviews, self-education, and long-term conviction. His website, RuleInvestmentMedia.com, offers free evaluations of natural resource portfolios—provided they are not speculative tech, pot, or crypto plays.

This reflects Rule’s experience as a capital allocator. He knows that portfolio drawdowns can cause panic selling, so he advises a position size that balances conviction with composure. This is especially crucial in a volatile sector like precious metals.

Rule’s offer to rank stocks for free is less of a sales tactic and more a reflection of his educational mission. It’s also a rare opportunity for retail investors to get insight from someone with decades in the resource markets.

Battle Bank: Applying Theory to Practice

Rule closes the conversation by introducing Battle Bank, a new venture designed to address many of the wealth protection issues discussed in the interview.

“If you're unhappy with your bank—and who isn't—you might consider Battle Bank.”

Battle Bank offers:

Interest-bearing checking accounts

Multi-currency savings in up to 20 currencies

Precious metals purchases and lending using metals as collateral

“We believe you're a good credit. We believe precious metals are good collateral.”

Analytical Insight: Battle Bank is more than a financial product—it’s the embodiment of Rule’s worldview. It reflects a growing trend among alternative investors: seeking sovereignty over their capital, protection against fiat erosion, and diversification outside traditional banks.

Contextual Note: Battle Bank’s model may appeal particularly to investors in high-inflation or unstable banking jurisdictions, as well as Americans wary of domestic fiscal mismanagement. Lending against metals is also a tax-efficient liquidity strategy for long-term holders.

Countercurrents and Risks: A Brief Word of Caution

While Rule presents a compelling case, no investment thesis is bulletproof. Some potential headwinds for precious metals include:

Rising real interest rates: These reduce gold’s appeal versus yield-bearing assets.

Equity market strength: Strong stock markets can draw capital away from defensive assets like gold.

Storage and liquidity concerns: Particularly for physical metal investors who lack easy sell options.

Analytical Insight: Being aware of these countercurrents doesn’t invalidate Rule’s thesis—it strengthens it. A well-informed investor should understand not just why an asset should go up, but also what might prevent or delay that outcome.

Final Thoughts: An Invitation to Discernment

Rule’s interview is ultimately a call to think critically about wealth preservation in an era of monetary distortion. His message isn’t about fear—it’s about realism and preparation.

“There are few free lunches in life—but education is close.”

For investors disillusioned with fiat systems, concerned about global debt trajectories, or seeking greater financial sovereignty, Rule offers both insight and tools. The conversation is rich with strategic takeaways, but the key message is timeless: be early, be educated, and be patient.

Call to Action

To access Rick Rule’s portfolio review offer, visit RuleInvestmentMedia.com. For information on alternative banking and wealth protection, explore BattleBank.com. To stay informed on precious metals trends and interviews, subscribe at LibertyAndFinance.com.