Rise of Gold & Silver: Navigating the Fiat & Debt Debasement Parabola

Market Sniper Insights Analisys on Protecting Wealth with Precious Metals

Unraveling the Financial Landscape: Insights from The Market Sniper

The Market Sniper, Francis Hunt, offers a critical view on the mainstream media's coverage of commodity price increases, such as those in the coffee and cocoa market. He argues that the media often provides superficial or misleading explanations for these price movements, attributing them to transient or simplistic factors while ignoring deeper systemic issues.

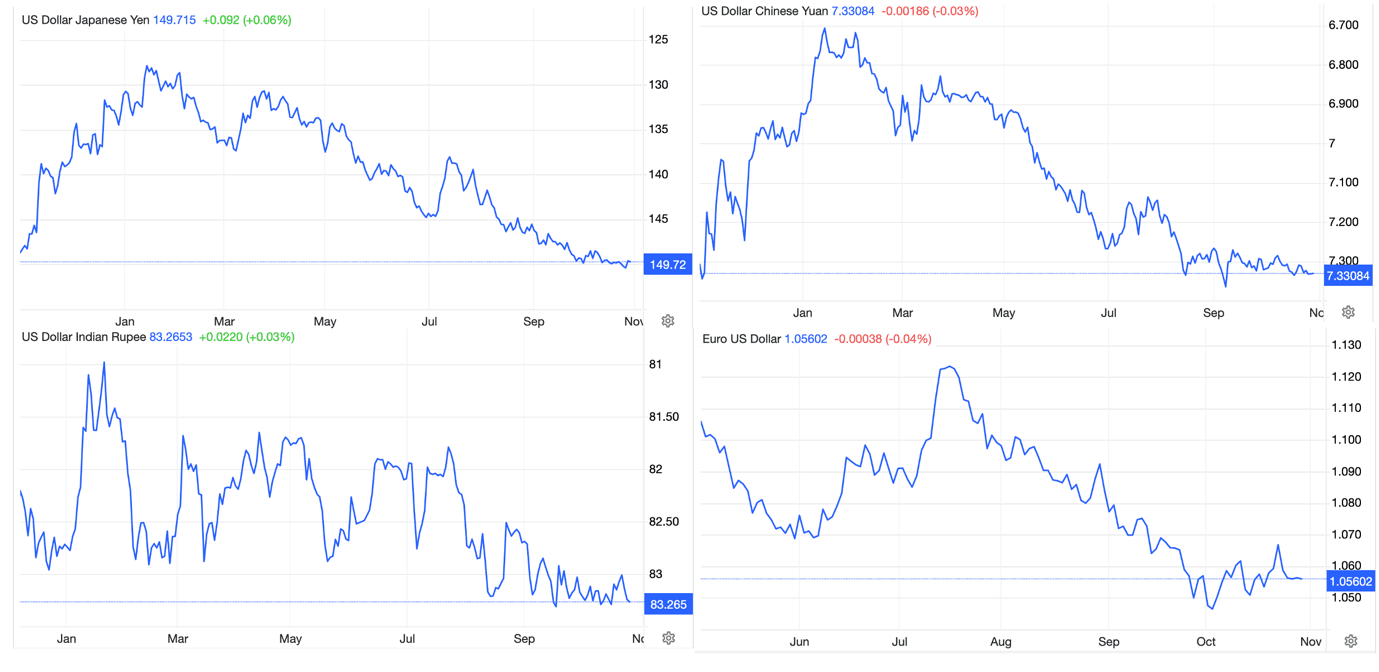

According to Hunt, while the media might cite immediate causes like temporary supply disruptions, seasonal weather patterns, or short-term demand spikes, these explanations often miss the underlying trends driven by long-term macroeconomic changes. He emphasizes that fundamental shifts such as currency debasement, inflationary pressures, and global economic instability are the real drivers behind sustained increases in commodity prices.

Hunt suggests that by focusing on these superficial factors, the media fails to inform the public about the true state of economic affairs, particularly the erosion of purchasing power due to the expansive monetary policies of central banks. This narrative serves to obscure the systemic risks and the need for protective measures such as investing in commodities like coffee or cocoa, which can serve as a hedge against inflation.

Central banks play a significant role in these macroeconomic dynamics. Hunt suggests that the expansive monetary policies pursued by central banks, including quantitative easing and near-zero interest rates, have led to the debasement of fiat currencies.

Furthermore, he points out that this kind of coverage can mislead investors about the timing and nature of entering commodity markets. While short-term factors might cause temporary price spikes or drops, it's the long-term economic trends that will likely dictate market trajectories over more extended periods. Investors who understand these dynamics can make more informed decisions, potentially leading to more robust investment outcomes.

The Market Sniper underscores the importance of looking beyond the often simplistic and misleading explanations offered by the media. By understanding the deeper economic factors at play, investors can better navigate the complexities of the commodities markets and protect their financial health against systemic risks and inflation.

The Bullish Case for Precious Metals

One of the central themes in The Market Sniper's analysis is the bullish outlook for precious metals, particularly gold and silver. According to The Market Sniper, these commodities are poised for significant upside potential in the face of looming inflationary pressures and currency devaluation. Drawing on historical data and technical analysis, The Market Sniper makes a compelling case for investors to allocate a portion of their portfolios to gold and silver as a hedge against economic uncertainty.

The Role of Central Banks

Central banks play a horrible role in impoverishing the world’s population, with their policies and interventions exerting a profound influence on asset prices and market dynamics. The Market Sniper highlights the role of central banks in fueling inflationary pressures through excessive money printing and debt monetization. By artificially suppressing interest rates and flooding the financial system with liquidity, central banks have inflated asset bubbles and eroded the purchasing power of fiat currencies.

The Debt and Fiat Collapse

A recurring theme in The Market Sniper's analysis is the looming specter of a debt and fiat collapse, driven by unsustainable levels of debt accumulation and currency debasement. According to The Market Sniper, the current financial system is built on a fragile foundation of debt and leverage, with governments and central banks resorting to ever-more extreme measures to prop up the system. However, this house of cards is destined to crumble under its own weight, leading to a seismic shift in the global economic order.

The Implications for Investors

The Market Sniper offers valuable insights and actionable advice for investors seeking to navigate these turbulent times. By allocating a portion of their portfolios to tangible assets such as gold and silver, investors can protect themselves against the ravages of inflation and currency devaluation. Moreover, The Market Sniper advocates for a prudent approach to risk management, emphasizing the importance of diversification and capital preservation in uncertain times.

Conclusion

In conclusion, The Market Sniper's analysis offers a sobering assessment of the current state of the global economy and the challenges facing investors in the years ahead. By understanding the underlying dynamics driving market trends, investors can position themselves to capitalize on emerging opportunities while mitigating potential risks. Whether it's the bullish case for precious metals or the looming specter of a debt and fiat collapse, The Market Sniper's insights provide valuable guidance for investors seeking to navigate the complexities of today's financial landscape.

Support Our Work with a Bitcoin Donation

We also offer the opportunity to support our work and help us continue building the Financial Anarchy community. If you would like to contribute, we gratefully accept donations in Bitcoin. Your support will enable us to create more educational content, engage in meaningful activism, and further our mission of challenging the status quo. To donate, please use the following Bitcoin address:

bc1qmzzj5lfhe5ghv2yh3tfgt3qcuycl3r6n4llrsk

Thank you for joining us on this journey of understanding and change. Together, we can shape a brighter financial future for all.