Silver Set to Skyrocket in 2024: Hidden Trends and the Impending Bull Run

In the realm of precious metals, the silver market is currently under scrutiny, particularly in comparison to its illustrious counterpart, gold. While the visual representation on the charts might not exhibit the same overtly positive trends as seen in gold, a closer examination unveils a more nuanced perspective.

Historical Behavior and Bull Markets:

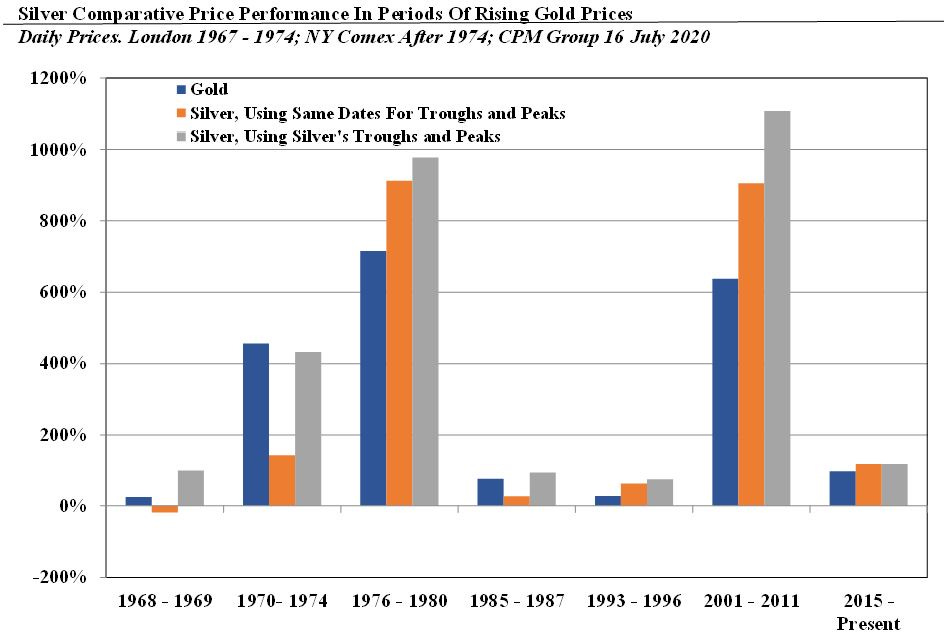

Looking back at the past 50 years, a recurring pattern emerges. During bull markets, silver tends to tag along with gold, albeit with a certain degree of unpredictability. Described metaphorically as a "wet noodle," silver's rise appears gradual when compared to the more tonally firm ascent of gold. However, historical data indicates that it is precisely in the late stages of these bull trends that silver goes ballistic.

Silver as the "Poor Man's Gold":

Often referred to as the "poor man's gold," silver has demonstrated a capacity to outperform gold significantly in the latter phases of bull markets. This characteristic, though not explicitly attributed to its status as the "poor man's gold," adds a layer of intrigue to its potential trajectory.

Historical Peaks and Outperformance:

Examining specific instances, such as the bull market that peaked in 1980, reveals a fascinating dynamic. While gold made a substantial move from 1976 to 1980, a significant portion of this surge occurred in the last year, 1979. In parallel, silver, which had been relatively subdued, exhibited a sudden and powerful surge, outpacing gold.

A similar pattern unfolded during the 2000 to 2011 bull market in gold. In 2010, silver started to outperform gold significantly, setting the stage for a remarkable upswing.

Current Trends and Spread Relationships:

In the contemporary context, the analysis extends to current trends and spread relationships. Although silver's momentum dynamics may appear to lag behind gold, closer scrutiny suggests a more intricate picture. Despite a period of apparent sideways movement, there is an anticipation that the relationship between silver and gold could shift.

Spread Dynamics and Future Predictions:

One key metric under scrutiny is the spread relationship between silver and gold. The current spread hovers around 1.8%, with an expectation that a modest change, reaching approximately 1.2%, could signify a shift. Should this occur, it is projected to herald the end of a corrective or sideways mode, transitioning into an uptrend. This shift is seen as concurrent with the anticipated resurgence of silver, going "ballistic" in the latter phase of the ongoing bull market.

Long-Term Outlook:

Considering a broader perspective, the analysis explores a scenario where gold undergoes a significant uptrend, potentially reaching $8,000. Historically, this could trigger a substantial increase in the value of silver, ranging between 2 and 2.5% of the gold price, translating to a potentially significant valuation.

Timing and Market Dynamics:

Acknowledging the cyclical nature of bull markets, it is emphasized that the most impactful price movements often occur in the last year or so. Given that the current bull market has been ongoing for eight years, there is a sense that the market may be approaching a phase where silver could experience remarkable upswings.

In conclusion, the analysis amalgamates historical patterns, current trends, and potential future scenarios to present a comprehensive overview of the silver market. The focus remains on the intricate dance between silver and gold, hinting at the potential for silver to emerge as a dynamic force in the latter stages of the current bull market.

Support Our Work with a Bitcoin Donation

We also offer the opportunity to support our work and help us continue building the Financial Anarchy community. If you would like to contribute, we gratefully accept donations in Bitcoin. Your support will enable us to create more educational content, engage in meaningful activism, and further our mission of challenging the status quo. To donate, please use the following Bitcoin address:

Thank you for joining us on this journey of understanding and change. Together, we can shape a brighter financial future for all.