Silver Squeeze 2.0: Will It Destroy the System? Are You Ready to Join the Revolution?

Insights from Rafi Farber: The Endgame Investor on What’s Coming for Silver and the Global Economy

In an exclusive interview with Rafi Farber, a well-known commentator on precious metals and financial markets, we gain a deep dive into one of the most pressing questions in the world of silver: Is Silver Squeeze 2.0 on the horizon? What does this mean for the price of silver, and is the collapse of central banks imminent? In this article, we break down the key takeaways from the interview, shedding light on the future of silver, the risks surrounding central banking, and why now might be the time for silver lovers to brace themselves for something big.

The Silver Squeeze 2.0: A Real Possibility?

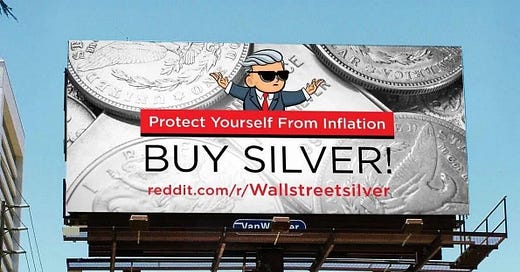

Rafi Farber has been a vocal supporter of the idea that a second silver squeeze is not just a possibility, but a likely event on the horizon. He references the previous silver squeeze that took place in early 2021, driven by grassroots movements like WallStreetBets, where retail investors rallied together to drive silver prices upward in an attempt to expose the manipulation within the precious metals markets.

In the interview, Farber argues that while the silver squeeze in 2021 was partially driven by a coordinated effort, the next one will be far more organic and will come when the stars align—when the fundamental drivers of silver’s value cannot be ignored any longer. He emphasizes that such a squeeze may not be orchestrated by a group of retail investors, but rather will happen organically when people begin to realize the true value of silver as an asset and safe haven, especially in the face of potential economic collapse.

"If we do it again, we could do it. It's not going to be planned; it's not going to be us doing it. It’s going to be everything coming together organically. Everyone's going to say, ‘We need to buy silver.’”

Silver enthusiasts should prepare for a market event that is beyond anyone's control. With the amount of silver held by ETFs and in the LBMA (London Bullion Market Association) vaults dwindling to dangerously low levels, the possibility of a true silver shortage grows. If silver prices begin to spike in response to a global economic shift or panic, a sudden rush to acquire physical silver could trigger the Silver Squeeze 2.0.

The significance of this squeeze is massive: a sudden surge in silver prices could further expose the paper-silver market (where contracts and derivatives are traded rather than the physical metal) as a house of cards. Farber suggests that the collapse of the silver paper market could cause prices to decouple from artificially suppressed levels, sending silver into a meteoric rise.

What Does a Silver Shortage Mean for the Price?

The discussion then shifts to the broader context of silver’s value in the current financial environment. Farber stresses that silver, just like gold, is being increasingly viewed not just as an industrial commodity, but as a monetary asset. He points to the global demand for physical gold and silver, especially in light of the monetary system’s fragility.

According to Farber, the current silver shortage is not just a supply-side issue, but a reflection of the systemic pressures on the broader financial system. With central banks around the world flooding the market with fiat currency, the purchasing power of money continues to erode. As this occurs, investors and governments are turning to tangible assets like gold and silver as a store of value, pushing the demand for physical silver to the breaking point.

"In a world where there's no function in Gold derivatives, what happens to silver? Well, it has to go to 15:1, because there's nothing else to use."

Farber’s comment on the gold-to-silver ratio touches on a critical point: historically, the gold-to-silver ratio has hovered around 15:1 during times of monetary upheaval. When the value of paper currencies collapses or is severely devalued, silver typically follows gold in terms of upward price movement. However, silver’s lower price point compared to gold means that it could see more explosive gains when panic sets in.

The crux of the matter is that silver’s current price doesn’t reflect its true value. Industrial demand, limited supply, and increasing recognition of silver’s role as a hedge against inflation all point toward a potential surge in price. For silver stackers, this could be the moment they’ve been waiting for: a market disruption that elevates silver to its rightful place as a store of value.

Why Patience Will Be Rewarded: Eric Sprott's GOLD & SILVER Forecast for 2025

The Beginning: How Eric Sprott Got into Precious Metals

Sprott’s journey into the precious metals sector was shaped by a keen awareness of market vulnerabilities. In the late 1990s, while managing small-cap investments, he recognized the risks associated with an overheated NASDAQ. As the tech bubble neared its peak, he sought ways to protect his portfolio and came to the conclusion that gold and silver were the best hedges against economic downturns.

“I came to the conclusion that gold and silver would be the answer—both the physical metals and the shares.”

What Happens if Central Banks Collapse?

One of the more provocative discussions in the interview revolves around the looming collapse of central banks. Farber argues that the dollar's collapse, alongside the failure of the global financial system, is not only possible but likely. He compares the value of the dollar to that of gold, noting that the true value of gold and silver should be many times higher than their current prices.

He paints a picture of a financial world where the trust in fiat currency is shattered, and the only thing that remains valuable is precious metals. Whether it’s Fort Knox holding gold or the presence of derivatives and ETFs suppressing metal prices, the central issue remains: the dollar is losing credibility, and an alternative system may be emerging—one where gold and silver are once again at the center of global trade.

"The faith in the dollar as a gold derivative is going to be lost... the exchange rate for gold versus dollars in a world where the dollar no longer is trusted is something like $40,000-$50,000 per ounce.”

The collapse of central banks, as implied by Farber, would signify the end of the dollar’s dominance in global finance. This would lead to massive shifts in asset allocation, as people flee from the dollar and seek tangible assets like gold and silver. The question then becomes not if but when this collapse occurs. If Farber’s predictions hold, it could mark a fundamental shift in the financial world, and silver could rise to fill the void as a key store of value.

Tariffs and Economic Shifts: A Global Play

The interview also touches on the issue of tariffs and the role they play in the global economic system. Farber acknowledges that while he is against tariffs on principle, they can serve as effective negotiation tactics. He compares them to self-inflicted wounds, where governments shoot themselves in the foot, but with the hope that the other party will suffer just as badly.

Farber also touches on the ongoing tariff threats from the US to countries like China, noting that such tactics can create economic instability, but in a world of fragile economies, they might be seen as necessary. However, the reality is that tariffs, like other forms of economic pressure, only exacerbate the underlying problems in the global financial system.

"I’m against tariffs on principle, but I can understand why somebody like Trump would use them for leverage."

Tariffs, while they may provide short-term negotiation advantages, often lead to longer-term economic damage. The trade war between the US and other nations, particularly China, is a reminder of the fragility of global economic systems. For silver stackers and those concerned with a potential collapse, these tariff tensions are yet another signal that the global economic system is under significant stress, furthering the case for physical assets like silver.

Embracing the Future with Silver in Hand

As we look ahead, it’s impossible to ignore the rising tension in the financial world. Rafi Farber’s insights into the potential for a Silver Squeeze 2.0 and the fragility of central banks paint a vivid picture of an uncertain future. But even in uncertainty, there’s always opportunity.

Silver, for all its volatility, represents something deeper: a timeless asset that has been trusted for centuries. In a world that’s constantly shifting, it may just be the safeguard we need—a tangible way to protect our wealth when the storm hits. Yet, as Rafi wisely pointed out, it’s not simply about waiting for silver’s price to skyrocket; it’s about recognizing the shift before it happens.

So, the real question is: will you be ready?

When the moment arrives, will you wish you’d acted sooner? Or will you be the one who saw what others couldn’t and positioned yourself before it was too late?

Silver isn’t just about making money—it’s about securing your future and standing strong when the world feels shaky. The choice is yours. You can sit back and wait, or you can make moves today that could make all the difference tomorrow.

And when it all unfolds, you’ll know you were part of something bigger than just a trend.

Support My Work – Help Secure a Stronger Future

If you enjoy reading Financial Anarchy and find value in the content I produce, I would greatly appreciate your support through a paid subscription or donation. While all my work is available for free, your support helps me maintain and grow this platform while providing for my family.

Your contributions allow me to continue creating high-quality, insightful material on finance, economics, and global events—without relying on outside funding. This means I can remain independent and focused on delivering the content that matters to you.

Becoming a paid supporter, even at a small level, helps improve my financial stability, allowing me to dedicate more time and resources to producing content you love. Every donation makes a difference, and your support truly means the world to me and my family.

Thank you for being part of Financial Anarchy. Together, we can continue to grow this community and keep the content coming!