Gold and Silver Market Analysis: Insights from Craig Hemke and Chris Vermeulen

In a recent interview on the Sprott Money YouTube channel, host Craig Hemke sat down with market analyst Chris Vermeulen to discuss the latest trends in the gold and silver markets. Their conversation covered technical indicators, Fibonacci levels, market momentum, and the broader implications of precious metals trading. This article breaks down their discussion into key sections, analyzing the insights shared while maintaining the integrity of the original conversation.

Gold’s Technical Picture: Key Resistance and Fibonacci Levels

Chris Vermeulen provided an in-depth analysis of gold’s price action, focusing on technical indicators such as Fibonacci retracement levels and resistance zones. He noted that gold recently encountered a pullback after a strong rally, pausing around the 618 Fibonacci level.

"We have the rally up, we have the pullback, and then we have this 618 level which had a little bit of a hiccup and selloff... it's still actually messing around with this level."

According to Vermeulen, this is a critical area where gold typically consolidates before making another move higher. He identified 3,050 as the next major upside target, expecting gold to potentially reach this level within a week or two.

Analysis and Market Implications

The 618 Fibonacci level is widely regarded as a key retracement zone where assets often stall before continuing their trend. Vermeulen’s observation that gold had a temporary pause at this level aligns with historical price action patterns. If gold successfully breaks through resistance, it could signal further upside potential. However, traders should remain cautious, as false breakouts can occur at these levels.

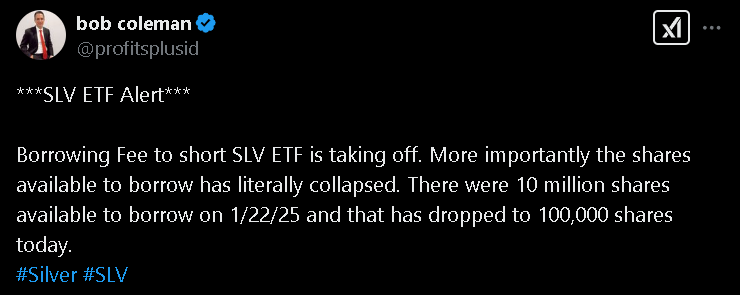

Silver Market Dynamics: Tight Supply and Technical Trends

Silver was another focal point of the discussion, with Hemke pointing out that physical tightness in the market is becoming increasingly evident. He referenced data from Bob Coleman, indicating that the number of shares available for shorting SLV had plummeted from 10 million in January to just 100,000, a staggering 99% reduction.

"There's obviously some tightness… just showing a reluctance of people to lend it out."

On the technical side, Vermeulen explained that silver’s price movements are often more volatile than gold’s, making it a riskier trade. While silver has been consolidating, it appears to be setting up for another move higher.

"It looks like it wants to run and push higher… but silver is always a messier chart."

Analysis and Market Implications

The sharp decline in SLV short availability suggests that fewer investors are willing to lend their shares, potentially indicating concerns about supply constraints. If physical silver tightness continues, it could drive prices higher. However, silver's volatility remains a challenge for traders, making gold a more stable option in uncertain market conditions.

Long-Term Silver Outlook: Resistance at $35 and Historical Highs

Vermeulen identified $35 as a key resistance level for silver, referencing historical price action dating back to 2011–2012. He acknowledged that silver still has about 7–8% upside potential before hitting major resistance but warned that the price could face selling pressure at these levels.

"Silver can pop and drop so quickly… it's definitely struggling and not anywhere near its previous highs."

Despite the current bullish momentum, Vermeulen emphasized that he prefers trading gold over silver in the near term due to its more predictable price movements.

Analysis and Market Implications

Silver’s long-term technical structure suggests potential gains, but its resistance levels indicate possible headwinds. Traders looking for a less volatile trade may find gold more appealing, whereas aggressive investors might see silver as a high-reward play. The upcoming price action at $35 will be crucial in determining silver’s next move.

Inverse Head and Shoulders Pattern in Silver: A Bullish Indicator?

Hemke pointed out a possible inverse head and shoulders pattern forming in silver since October, which could indicate a bullish breakout if the price surpasses $33.

"There's two shoulders… there's a head… and there's kind of a shoulder line at about $33."

Vermeulen agreed that the price action suggests an uptrend, but he remained cautious about the extent of silver’s potential gains.

"It's pausing before it's going to move higher… but the only catch is there's not a whole lot of upside before major resistance."

Analysis and Market Implications

An inverse head and shoulders pattern is typically a bullish reversal signal. If silver decisively breaks above $33, it could trigger a move toward $35.50. However, given the overhead resistance, traders should watch for potential pullbacks.

Gold vs. Silver: Choosing the Right Trade

Vermeulen reiterated that while silver presents significant trading opportunities, he generally prefers gold due to its more stable price action. He advised investors to accumulate gold during market uncertainty and consider adding silver when it experiences a deeper correction.

"I would be accumulating gold versus silver right now… and pick up silver when it has a much bigger percentage correction."

He further explained that gold acts as a safer global asset, while silver’s smaller market size makes it more vulnerable to wild swings.

Analysis and Market Implications

Investors must weigh their risk tolerance when choosing between gold and silver. Those seeking stability may find gold a better option, while those willing to endure volatility for potentially greater gains might prefer silver. Timing is also crucial—buying silver after a correction could offer a more favorable risk-reward ratio.

The Role of Technical Trading: Avoiding Bear Markets

Vermeulen concluded the discussion by emphasizing the importance of technical analysis in avoiding major market downturns. His strategy focuses on ETF trading, maintaining a disciplined approach with 5 to 12 trades per year.

"My whole mission is to help people avoid bear markets… and allow us to take advantage of sideways and falling markets."

He also mentioned his YouTube channel, The Technical Traders, where he provides educational content on Fibonacci analysis and market trends.

Analysis and Market Implications

Technical analysis can provide traders with a structured approach to navigating volatile markets. Vermeulen’s strategy of selective, high-confidence trades minimizes risk while maximizing returns. His emphasis on avoiding bear markets aligns with long-term portfolio preservation strategies.

Final Thoughts: Key Takeaways for Precious Metals Investors

The discussion between Hemke and Vermeulen offered valuable insights into the gold and silver markets, emphasizing both technical patterns and market fundamentals. Here are the key takeaways:

Gold is at a critical Fibonacci level, with $3,050 as the next target.

Silver faces supply tightness but remains volatile, with $35 as a key resistance level.

An inverse head and shoulders pattern in silver suggests further upside, but major resistance could limit gains.

Gold remains a safer play compared to silver in the current environment, though silver could be an attractive buy after a correction.

Technical trading can help investors avoid bear markets, making disciplined trading strategies essential.

As the precious metals markets evolve, investors should closely monitor key resistance levels, supply constraints, and market momentum to make informed decisions.

For more insights, visit The Technical Traders and Sprott Money for expert analysis and educational resources.

The reason silver, as you say, can pop and drop is because of manipulation. If such a small market size were allowed to be freely traded it would outshine gold.

How is it possible otherwise that a commodity with a mining ratio of say less than 8 to 1 currently trade at about 90 to 1. With about 60% of that mined amount being used in industry etc.. Considering that the last 5 years or so usage has exceeded mining supply makes the evaluation even more dubious.

So I say that when the 300 plus paper ETF's holders of silver must get in formation for musical chairs there will be a lot of unhappy campers when the music stops. I hope you are aware of when the song could end.

I wish you well.