The $140 Uranium Squeeze: Why the Reckoning Is No Longer Optional

Utilities have lived on cheap uranium for 30 years. That free lunch is over, and they still won’t pay the bill.

Justin Huhn

Utilities built their careers on abundant, low-cost uranium. That era is ending. Yet many still refuse to sign the contracts that would secure their future. A dangerous standoff is taking shape.

The Wild Ride of 2025 and the Analyst Who Never Looks Away

Through most of 2025, uranium investors felt like passengers strapped into a theme park ride that forgot to stop. The year opened with a surge, collapsed into a fast and punishing correction of roughly 30 to 35 percent, then whiplashed back with a 15 to 20 percent rally in barely ten days. By early December, uranium miners were up nearly 50 percent year to date, even as the spot price of uranium, the figure most retail investors obsess over, was “dead flat for the year.”

It is the kind of contradiction that makes newcomers dizzy. But Justin Huhn is no newcomer. On December 6, 2025, after months of silence, the founder of the Uranium Insider Investing Newsletter returned to his audience with Episode 212 of the Uranium Market Minute. Ninety-nine minutes of steady, unblinking dissection of the physical uranium market. The episode, long-awaited, was already ricocheting around energy and commodity circles.

Huhn plays a role familiar to readers of Michael Lewis. He is the quiet analyst who sits in the corner of the room, watching numbers that no one else bothers to watch. When the world fixates on spot price, he tracks the hidden plumbing of the fuel cycle. When traders celebrate sharp gains in miners, he lowers his eyes to the midterm and long-term pricing curves. And when investors lose faith during corrections, his conviction deepens, anchored in the physical market.

What he sees now, after decades of abundant supply and careless pricing, is a future guided by a single word.

“Inevitability.”

The Career-Long Illusion of Cheap Uranium

If you are a nuclear utility fuel buyer, your professional life has been shaped by one defining privilege. For twenty, even thirty years, uranium has been easy. A commodity that seemed incapable of tightening. Something always appeared at the right moment. Inventories, secondary supply, carry trades, and cheap fixed contracts with generous flexibility provisions. The spot market was a supermarket aisle. Prices stayed tame. Panic was unnecessary.

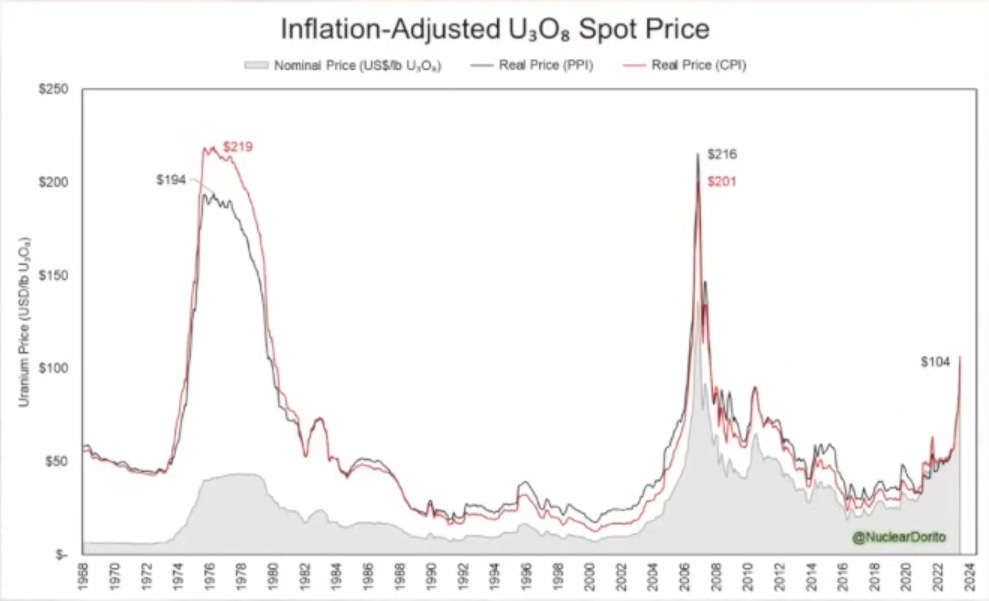

That illusion held through nearly the entire arc of the modern nuclear era. Huhn argues that outside of the mid-2000s spike, “abundant, inexpensive uranium has been the reality for nuclear utility fuel buyers basically for their entire careers.”

Even when the market briefly went wild between 2005 and 2007, utilities comforted themselves with familiar explanations. A few mine floods. A burst of financial speculation. The early Chinese contracting wave. The launch of Uranium Participation Corp. Nothing structural or lasting. Nothing that required a rethinking of risk.

Besides that brief window, and the moment we are now entering, the floor beneath utilities never cracked.

And even during that legendary 2004 to 2007 bull run, the United States was still receiving its long running, twenty million pounds per year of down-blended Russian warheads. A Cold War peace dividend that no one had requested, yet everyone relied upon. Twenty million pounds a year for twenty years until the program ended in 2013.

Since then, nothing similar has existed. Nothing close.

But the muscle memory of abundance persists. Utilities still act as if the supermarket aisle will refill forever.

The problem, Huhn suggests, is that the supermarket is finally running out of food.

The Secondary-Supply Mirage That Vanished