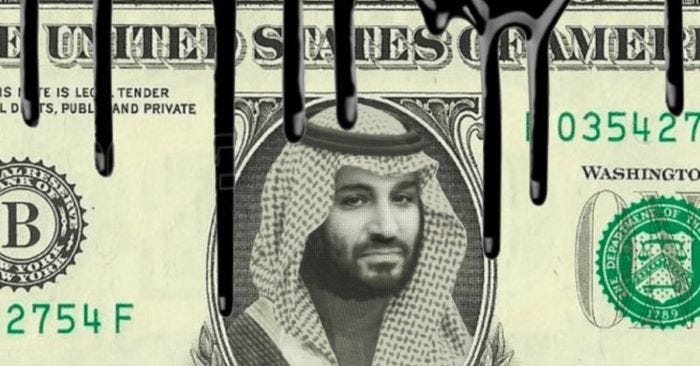

The End of the Petro-Dollar Agreement: A Turning Point in Global Finance

An analysis of Harley Schlanger's video | June 17, 2024

Today marks a significant shift in global finance: the end of the 50-year-old US-Saudi petro-dollar agreement. This development, largely unnoticed by mainstream media, signals a profound change in the international economic landscape. The expiration of this agreement, which stipulated that Saudi Arabia would price its oil exports in US dollars and invest the surplus oil revenues in US Treasuries, marks the end of an era.

This agreement, forged in the aftermath of the 1973 Arab-Israeli War by then-US Secretary of State Henry Kissinger, aimed to maintain the flow of dollars through the US banking system. It followed President Nixon's 1971 decision to detach the dollar from the gold standard, a move intended to stabilize the US economy but which also led to the need for a continuous influx of dollars .

The Petro-Dollar Agreement: A Brief History

For five decades, this arrangement ensured that the US dollar remained the world’s reserve currency. Saudi Arabia’s commitment to sell its oil in dollars and reinvest the revenues in US Treasuries created a cycle that kept the dollar in high demand globally. This system not only bolstered the US economy but also gave the United States significant leverage in global financial markets .

However, the termination of this agreement comes amidst a global shift away from US dominance. The dollar, increasingly weaponized as a tool of Western military and financial policy, has lost favor among many nations. "Think about the sanctions against one country after another," notes Schlanger, "and this will lead to a drop in demand for dollars with profound consequences for the United States" .

The Decline of US Economic Hegemony

Recent events underscore the waning influence of the US and Western leaders, who continue to cling to an outdated unipolar economic model. This model, increasingly challenged by former colonial nations and even countries within the transatlantic alliance, is seen as unsustainable and inequitable.

Schlanger points out that "what’s holding it together is a policy of permanent warfare." The costs of these wars are becoming too high, leading to growing discontent among the population in transatlantic nations .

The late Lyndon LaRouche, an influential economist and political activist, had foreseen these developments. After Nixon’s 1971 decision, LaRouche warned of inevitable inflation and the imposition of shock economic policies globally. He predicted that the United States would dominate international trade and finance, but at the expense of other nations, particularly those in the Global South, who would suffer under harsh International Monetary Fund (IMF) conditionalities and a neocolonial system .

Alternative Proposals for a New Economic Order

Over the years, LaRouche proposed various alternatives to this system. His International Development Bank proposal in 1975 and his productive triangle plan, which aimed to stimulate industrial production in Eastern Europe following the fall of the Soviet Union, were designed to foster equitable global economic development. Most notably, his Four Powers Agreement called for collaboration between Russia, India, China, and the United States to transition from the failed unipolar order to a new era of economic cooperation .

However, Western leaders, entrenched in the belief of their own superiority, dismissed these ideas. "The problem was that the West was stuck in this thinking of the US as the sole superpower," says Schlanger. This mindset led to a series of costly and destructive wars, from Afghanistan to Iraq and Libya, aimed at preserving US dominance .

The Rise of New Economic Alliances

As Russia and China emerge as leading proponents of a new financial and economic system, the US response has been to attempt to weaken these countries and to sow discord among them. Yet, this strategy has failed. Recent events, such as the G7 meeting and the Zelensky summit in Switzerland, reveal a growing divergence in perspectives. The US and NATO’s demands for a Russian surrender and reparations to Ukraine were largely rejected, with the Austrian Chancellor describing the summit as a "Western echo chamber" .

In contrast, Russian President Vladimir Putin has proposed a peace plan based on the terms Ukraine had agreed to in March 2022, which the West has ignored. As the world moves towards a new global trade settlement system, the significance of the end of the petro-dollar system becomes evident. Russia aims to introduce this new settlement system at the upcoming BRICS Summit in October .

Saudi Arabia's Shift and the Rise of Non-Dollar Trade

With the expiration of the US-Saudi petro-dollar agreement, Saudi Arabia is exploring new economic futures, including participating in a trial with China to use digital currencies for trade settlements. An Indian analyst described this move as "a major step towards a commodity-based settlement regime on a non-dollar platform" .

This development echoes LaRouche's proposals from July 2000, where he advocated for a basket of hard commodities to trade without reliance on a single currency. We are already witnessing moves towards using national currencies for trade, such as Saudi Arabia accepting Chinese yuan for oil and the India-Russia agreement on ruble-rupee exchanges .

The Path Forward

It is essential to understand that these changes are not part of a centralized scheme to control individual economies or impose a digital currency that would erode personal financial autonomy. Rather, they represent a shift towards an economic system based on physical goods production and backed by real assets.

For a more in-depth understanding of these developments, I recommend reviewing the recent presentations from the Schiller Institute conference, particularly the panels discussing this transformation. Additionally, LaRouche's article on a basket of hard commodities trade offers valuable insights into this evolving economic landscape .

In conclusion, the end of the petro-dollar system is a harbinger of a more equitable and prosperous global economic order. As nations move away from the US-dominated financial system, they are paving the way for a future that emphasizes real economic growth and stability.

Support Our Work with a Bitcoin Donation

We also offer the opportunity to support our work and help us continue building the Financial Anarchy community. If you would like to contribute, we gratefully accept donations in Bitcoin. Your support will enable us to create more educational content, engage in meaningful activism, and further our mission of challenging the status quo. To donate, please use the following Bitcoin address:

bc1qmzzj5lfhe5ghv2yh3tfgt3qcuycl3r6n4llrsk

Thank you for joining us on this journey of understanding and change. Together, we can shape a brighter financial future for all.