The Russian ruble has recently experienced one of its most severe collapses in over two and a half years, marking a significant economic milestone for the nation. On Wednesday, November 27, the ruble’s value plummeted, posting a 10% decline against the U.S. dollar in a single day—a record drop only surpassed by the fallout from Russia’s invasion of Ukraine. This event has raised many questions about the factors contributing to such a drastic fall and its implications for Russia’s already strained economy. Understanding the underlying causes provides valuable insight into the state of the Russian financial system and its vulnerabilities amidst international sanctions.

This article will explore the reasons behind the ruble’s crash, including new sanctions on a key financial institution, Russia's response to stabilize the currency, and the broader implications for the country's economy. It will also analyze how geopolitical tensions and economic policies intersect to create a precarious situation for the ruble and Russia's financial stability.

What Caused the Ruble’s Crash?

The recent crash of the ruble can be attributed primarily to the sanctions imposed by the United States on Gazprombank, a crucial financial institution in Russia. Gazprombank plays a pivotal role in processing payments for Gazprom, Russia’s state-owned energy giant. The bank’s strategic importance lies in its direct ties to the Kremlin and its role in handling payments for natural gas exports, making it a lifeline for foreign currency inflows. Surprisingly, despite the ongoing conflict in Ukraine, Gazprombank had largely avoided full sanctions until now.

The reason for this exemption was straightforward: several European nations, including Austria, Slovakia, and Hungary, rely heavily on Russian natural gas. These landlocked countries face logistical challenges in sourcing alternative energy supplies, particularly liquefied natural gas (LNG), which requires costly infrastructure like regasification facilities. The latest sanctions cut off Gazprombank’s access to international financial markets, thereby choking Russia’s ability to bring in foreign currency—a vital tool for stabilizing the ruble. This sudden loss of foreign reserves triggered panic in the markets, leading to a rapid depreciation of the ruble.

The Impact on the Ruble and Currency Markets

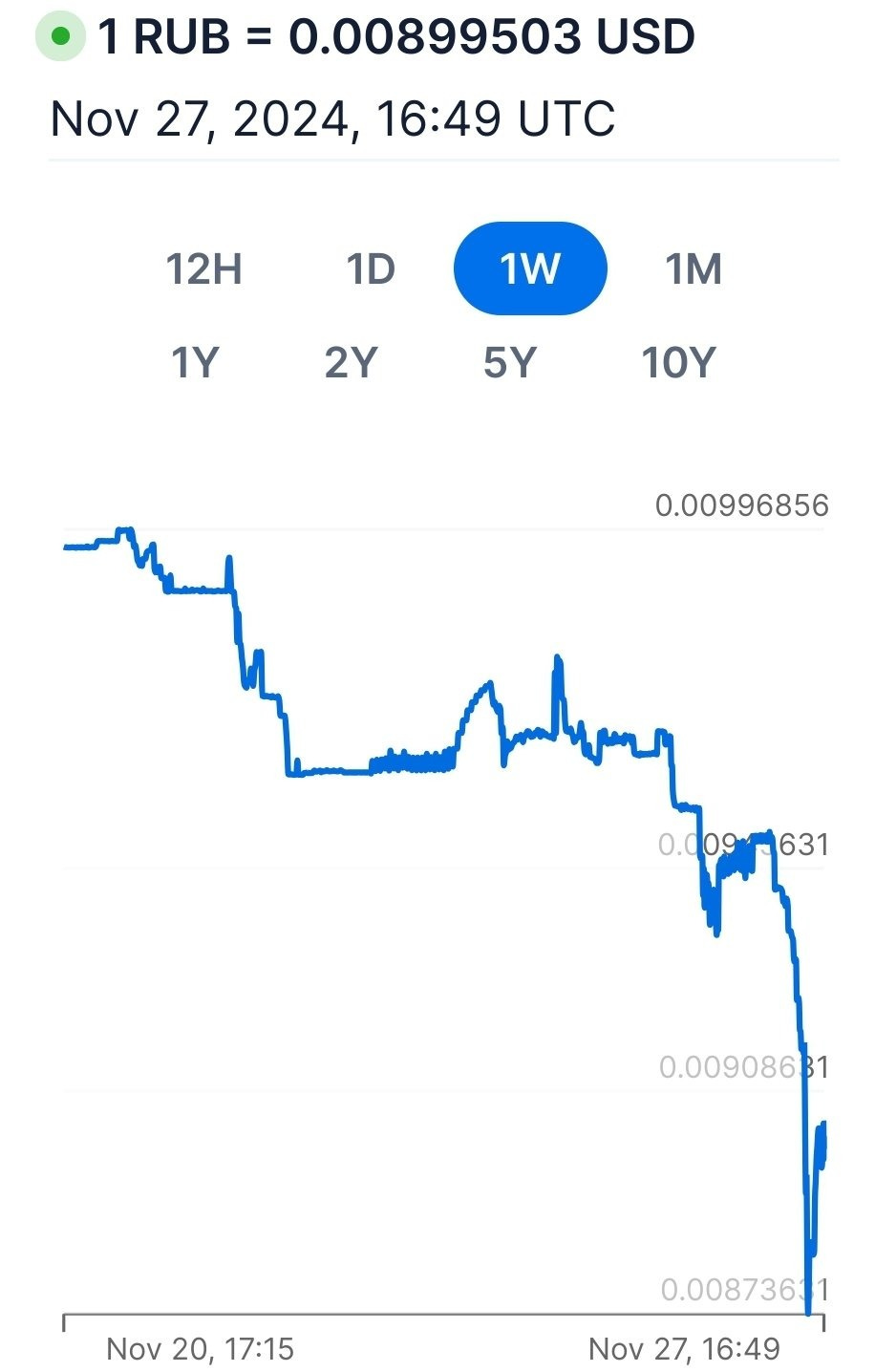

The immediate impact of the sanctions was a sharp devaluation of the ruble. The currency fell from 105 to 115 against the U.S. dollar in a single trading day, representing a 10% decline. Such a drastic drop is almost unheard of for a major currency, signaling a crisis of confidence among investors and traders. Beyond its fall against the dollar, the ruble also depreciated significantly against other currencies, including the Chinese yuan, which is now one of Russia’s most important trade partners. This decline in value against a range of currencies highlights the depth of the financial turmoil.

The depreciation of the ruble is not just a symbolic loss; it has tangible economic consequences. A weaker ruble makes imports significantly more expensive, exacerbating inflation. For example, a product that cost 85 rubles three months ago now costs 110 rubles, reflecting a 30% price increase. This surge far outstrips the official inflation rate of 8.5%, highlighting a disconnect between government statistics and economic reality. As import costs rise, Russian consumers and businesses face increasing financial pressure, deepening the economic strain.

Russia’s Response to the Crisis

In response to the ruble’s collapse, the Bank of Russia took decisive action by announcing a halt to foreign currency purchases on the domestic market. This suspension, effective from November 28, 2024, will last until the end of the year. The central bank’s objective is to curb volatility and stabilize the ruble’s value by essentially freezing the market. This strategy effectively eliminates any significant fluctuations in the ruble’s exchange rate, as the central bank is the primary player in Russia’s currency market.

However, this is not the first time Russia has employed such a tactic. In August 2023, when the ruble fell below 100 against the U.S. dollar, the central bank intervened similarly after pressure from President Putin. At that time, the ruble’s depreciation prompted concerns about the currency’s stability, leading to temporary market closure. While these measures have succeeded in halting further declines in the short term, they do not address the underlying economic weaknesses, raising concerns about the long-term sustainability of such interventions.

The Role of the National Wealth Fund

Under Russian regulations, the Finance Ministry is required to cover shortfalls in foreign currency through the National Wealth Fund (NWF). This fund acts as a financial buffer, allowing the government to support the ruble and stabilize the economy during times of crisis. However, with the sanctions on Gazprombank cutting off a significant source of foreign currency, the Kremlin’s ability to replenish the NWF is severely constrained. The risk now is that continued reliance on the NWF could deplete it within a short period, leaving Russia without a financial safety net.

This depletion of reserves could have dire consequences for Russia’s economic stability. The NWF is not just a tool for currency stabilization; it also funds critical government programs and social services. A rapid drawdown of the fund would force the government to make difficult choices about resource allocation, potentially leading to cuts in public spending. The loss of confidence in Russia’s financial system could also deter foreign investment, compounding the country’s economic woes.

Broader Economic Implications

The ruble’s collapse is symptomatic of deeper issues within the Russian economy. A falling currency drives up the cost of imports, which, in turn, fuels inflation. Over the past few months, the ruble has depreciated significantly, and the resulting price increases have placed additional strain on Russian households and businesses. The Bank of Russia’s decision to raise interest rates in an attempt to curb inflation only adds to the economic burden, creating a vicious cycle of rising costs and slowing growth.

This economic contraction has far-reaching implications. As inflation erodes purchasing power, consumer demand weakens, leading to a slowdown in economic activity. For businesses, higher borrowing costs and reduced consumer spending create a challenging environment. The combined effect of these factors is a shrinking economy, which could push Russia into a prolonged recession. The government’s attempts to manage the crisis through market interventions and reserve drawdowns may provide temporary relief but are unlikely to resolve the underlying structural problems.

Geopolitical Factors and Pipeline Politics

Geopolitical tensions have further complicated the situation. Ukraine’s decision not to renew its gas transit agreement with Russia has effectively closed key pipelines, cutting off a significant revenue stream for Gazprom. In response, Gazprom threatened to halt gas supplies to Austria, framing the decision as a strategic countermeasure. This standoff underscores the complex interplay between geopolitics and energy policy, with both sides seeking to assert control over critical infrastructure.

The sanctions on Gazprombank and the closure of gas pipelines highlight the broader geopolitical stakes. The U.S. and its allies see these measures as a way to weaken Russia’s financial position, while Russia views them as an attack on its economic sovereignty. The fallout from these actions will likely continue to shape the geopolitical landscape, with implications for global energy markets and international relations.

Closing the Market: A Temporary Fix?

By halting foreign currency purchases, the Bank of Russia has effectively closed the market for the ruble. This move is intended to prevent further depreciation and stabilize the currency in the short term. However, it does not address the fundamental economic challenges facing Russia. The lack of real-time data will make it difficult to assess the true state of the economy, but the underlying problems remain unresolved.

Closing the market may buy the government some time, but it also signals a lack of confidence in the ruble’s resilience. The decision to shut down trading underscores the severity of the crisis and raises questions about the long-term viability of Russia’s economic policies. Without structural reforms and a resolution to the geopolitical conflicts driving the crisis, the ruble’s stability remains precarious.

Conclusion

The recent crash of the ruble is a stark reminder of the mounting pressures on Russia’s economy. Sanctions on Gazprombank have cut off a vital source of foreign currency, triggering a significant devaluation of the ruble. While the Bank of Russia’s decision to close the market may temporarily stabilize the currency, it masks deeper economic problems that remain unresolved.

As the Russian government grapples with these challenges, the coming months will be critical in determining the ruble’s fate and the broader trajectory of the economy. The situation highlights the complex interplay between economic policy, geopolitical tensions, and financial stability, with significant implications for Russia and the global economy.