The Federal Reserve, Stock Markets, and Peter Schiff's Warning

The Financial Saga: The Federal Reserve, Stock Markets, and Peter Schiff's Warning

Welcome to the intricate ballet of financial markets, where the Federal Reserve takes center stage in a drama that could rival Shakespeare's best. Our plot unfolds against the backdrop of the stock market chasing its January 2022 high of 480 points, a target that has everyone in suspense, and the Federal Reserve is the key player in this economic theater.

The central question echoes through the financial corridors: What strategic moves will the Federal Reserve make once the market hits that pivotal high? It's a narrative of economic strategy and monetary policy, where every decision has a ripple effect.

The Enigmatic 10-Year Treasury Yield

Enter the supporting character, the 10-year treasury yield, a nuanced figure that can either be a hero or a villain. When this yield hovers below 4%, it's a boon for tech stocks, injecting vitality into the market. However, cross that 4% threshold, and tech stocks start to stumble, creating a tension that plays out in the daily fluctuations of the market.

Now, let's delve into the epic tale of financial engineering spanning from 2008 to 2023. The Federal Reserve, akin to a maestro conducting a symphony, implemented quantitative easing to stabilize markets post the 2008 financial crisis. Yet, the unintended consequence was a surge in stock prices driven more by share buybacks than substantive business growth.

In the midst of this narrative, inflation emerges as a formidable antagonist. A potential sequel to the 2008 crash, with inflation as its ominous undercurrent, threatening to impact purchasing power and economic stability.

The story takes a twist with the introduction of the yield curve inversion – a subplot that heightens the suspense. Short-term treasuries outshining their long-term counterparts becomes a metaphorical storm cloud, signaling potential economic headwinds.

Will the Federal Reserve opt for more quantitative easing, or are we on the brink of a market correction? It's a story that unfolds in real-time, a financial drama where decisions made in boardrooms impact the economic narrative for the masses.

The audience is left to ponder the intricate interplay of economic forces, eagerly awaiting the next act in this financial epic. The drama continues, and only time will reveal the denouement of this economic narrative.

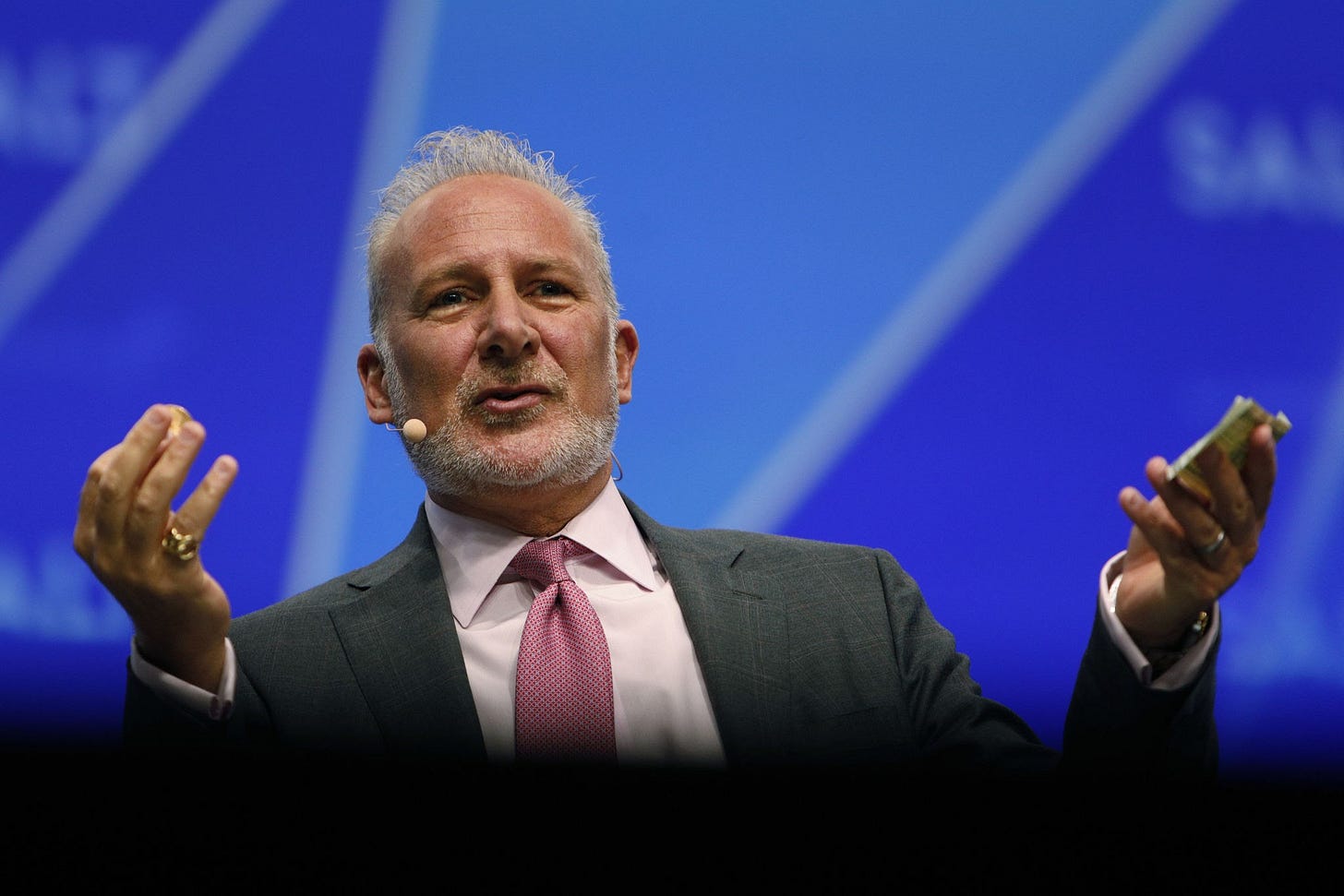

Peter Schiff's Warning: The Banking Sector in Peril

In a recent statement, renowned economist Peter Schiff steps onto the stage, shedding light on the precarious condition of the banking sector. He describes it as "very sick," afflicted with what he considers a terminal disease – a result of government and Federal Reserve policies. Schiff, known for his accurate predictions leading up to the 2008 financial crisis, expresses concern about the current crisis, which he believes has only been temporarily averted.

Schiff emphasizes his earlier warnings about the potential fallout from the widespread celebration of 0% interest rates. While many celebrated the benefits, such as refinancing mortgages at historically low rates, Schiff was one of the few voices cautioning against the long-term consequences for lenders. He pointed out that what may be advantageous for borrowers can spell trouble for lenders locked into low interest rates, facing diminishing returns on their investments.

The economist highlights the imminent threat to the banking system when interest rates inevitably rise. Schiff paints a grim picture, illustrating a scenario where banks, having locked in their portfolios at low rates, would struggle when faced with higher borrowing costs. The warning echoed in March of last year when the financial system experienced a crisis that Schiff believes was only temporarily averted by the Federal Reserve's intervention.

According to Schiff, the Fed's temporary solution involved removing underwater collateral from banks' books and replacing it with cash at 100 cents on the dollar. However, this relief comes with an expiration date, and as March approaches, banks face the daunting task of repaying the Fed. The catch is that they must take back their toxic assets, a move that could potentially bankrupt them.

In essence, Schiff's perspective on the banking sector implies that the crisis has not been eliminated but rather postponed. As we approach the critical deadline in March, the industry awaits to see how these dire predictions will unfold.

Stay informed and vigilant.

Unraveling the Interconnected Threads

As we navigate through these two narratives, the complexity of the financial web becomes apparent. The Federal Reserve, with its role in market dynamics and monetary policy, stands at the crossroads of potential economic shifts. The 10-year treasury yield, a seemingly subtle player, holds the power to influence the fate of tech stocks and, consequently, the broader market.

In the background, Peter Schiff's warnings cast a shadow over the banking sector. His insights, honed by past predictions, paint a somber picture of a banking system grappling with the consequences of government policies and low-interest rates. The imminent threat of rising interest rates becomes a central plot point, adding a layer of suspense to the unfolding financial drama.

The parallels between Schiff's warnings and the intricate dance of the Federal Reserve underscore the interconnectedness of economic factors. The inflationary undercurrent, highlighted by both narratives, becomes a looming storm threatening to disrupt the delicate balance of economic stability.

The Cliffhanger: March Approaches

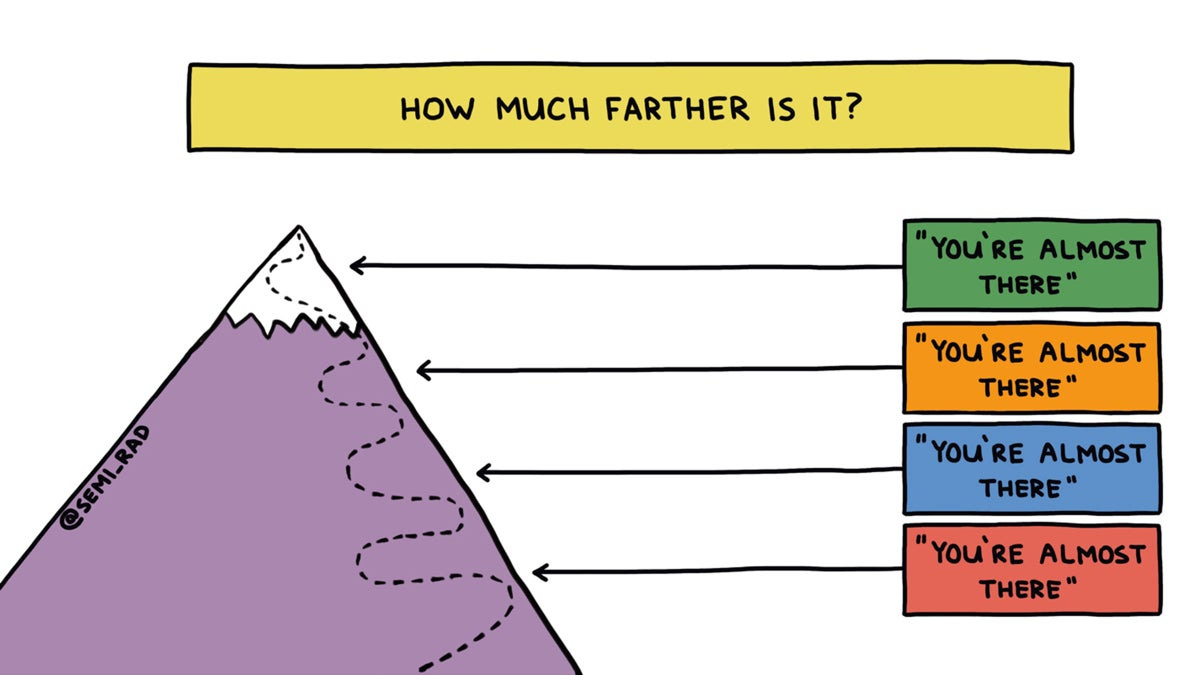

As the financial narrative unfolds, we find ourselves at a critical juncture. The Federal Reserve holds the script for the next act, and the market's pursuit of the January 2022 high intensifies. Peter Schiff's warnings cast a shadow over the banking sector, hinting at a crisis that may have only been delayed.

The looming March deadline becomes the focal point of suspense, with banks facing the challenge of repaying the Fed while grappling with potentially bankrupting toxic assets. The interconnected threads of inflation, interest rates, and government policies weave a narrative that keeps the industry and the audience on edge.

Conclusion: Awaiting the Denouement

We are left with more questions than answers. Will the Federal Reserve resort to more quantitative easing, or are we on the brink of a market correction? Will Peter Schiff's warnings about the banking sector's precarious condition come to fruition as March approaches?

In this intricate play of economic forces, only time will reveal the denouement of this financial narrative. The audience, both industry insiders and everyday individuals, must stay informed and vigilant, ready to adapt to the twists and turns that lie ahead in the unfolding financial epic. The stage is set, and the next act awaits its moment in the spotlight.

Support Our Work with a Bitcoin Donation

We also offer the opportunity to support our work and help us continue building the Financial Anarchy community. If you would like to contribute, we gratefully accept donations in Bitcoin. Your support will enable us to create more educational content, engage in meaningful activism, and further our mission of challenging the status quo. To donate, please use the following Bitcoin address:

Thank you for joining us on this journey of understanding and change. Together, we can shape a brighter financial future for all.