In a recent revelation, the Federal Reserve has openly acknowledged its uncertainty regarding the current economic landscape. With a tone of resignation, they've conceded their inability to curb inflationary pressures, signaling a significant shift in monetary policy. This admission has far-reaching implications for the United States economy, as consumers brace themselves for a prolonged period of escalating prices.

Initially, expectations were rife for multiple interest rate cuts throughout 2024, with Wall Street eagerly anticipating a reduction in borrowing costs. However, the Federal Reserve's latest stance suggests a departure from this trajectory. Instead of aggressive rate cuts, the central bank hints at a more passive approach, allowing inflation to surge unchecked.

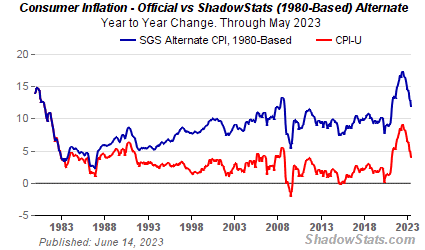

The repercussions of this policy shift are already evident in the latest Consumer Price Index (CPI) numbers, which reveal a stark reality for American consumers. Prices across a spectrum of goods and services have surged by approximately 30%, exerting significant strain on household budgets. This inflationary surge is exacerbating the economic divide, with lower and middle-income households bearing the brunt of the impact while the affluent segments continue to accumulate wealth.

Analyzing the Fed's Stealth Stimulus Strategy

In recent financial discussions, there has been an undercurrent of speculation regarding the Federal Reserve's monetary policy and its impact on the market. Many investors have been keenly awaiting a potential pivot from the Fed in terms of rate cuts in 2024, a scenario that seems widely accepted yet remains uncertain. As it stands, the Fed's ongoing ma…

Amidst these economic uncertainties, the real estate market is experiencing its own upheavals. Despite the historically low-interest rates of the past, the prospect of further reductions seems increasingly remote. As a result, prospective homebuyers and sellers are recalibrating their strategies, shifting focus away from interest rates towards their immediate housing needs. The traditional correlation between interest rates and housing market dynamics appears to be fading, as buyers and sellers prioritize their housing decisions independent of monetary policy shifts.

Furthermore, geopolitical tensions, particularly in regions like the Middle East, loom large over energy markets. The prospect of escalating conflict could lead to unprecedented spikes in oil prices, exacerbating the inflationary pressures already gripping the economy. Should events unfold unfavorably, consumers may face record-breaking gas prices and soaring utility bills, further compounding their financial burdens.

Beyond domestic concerns, global economic dynamics, particularly in China, add another layer of complexity to the situation. China's tumultuous real estate market and its ripple effects on global commodity markets underscore the interconnectedness of the world economy. As Chinese investors pivot towards tangible assets like gold and silver, it signals a broader shift in investment preferences with far-reaching implications for global markets.

In light of these developments, individuals must navigate a landscape characterized by economic uncertainty and volatility. While there may be avenues for mitigating financial risks, such as leveraging assets or exploring alternative investment strategies, the overarching message is one of resilience and adaptability. In an era marked by unprecedented economic challenges, the ability to weather uncertainty and seize opportunities will be paramount for individuals and businesses alike.

Support Our Work with a Bitcoin Donation

We also offer the opportunity to support our work and help us continue building the Financial Anarchy community. If you would like to contribute, we gratefully accept donations in Bitcoin. Your support will enable us to create more educational content, engage in meaningful activism, and further our mission of challenging the status quo. To donate, please use the following Bitcoin address:

bc1qmzzj5lfhe5ghv2yh3tfgt3qcuycl3r6n4llrsk

Thank you for joining us on this journey of understanding and change. Together, we can shape a brighter financial future for all.