"The Fed's Shocking Moves Could Lead to an Economic Disaster – Peter Schiff Sounds the Alarm!"

The Federal Reserve and Market Dynamics

Peter Schiff emphasizes that the Federal Reserve's recent rate cuts have not aligned with market expectations, leading to adverse reactions in both stock and bond markets. He explains, "The only way they're going to get a meaningful reduction in long-term rates, at least short term, is if the Fed buys those bonds." Schiff anticipates a return to Quantitative Easing (QE), asserting that the Fed lacks alternatives. However, he is skeptical about its long-term efficacy, stating, "It's going to blow up in their faces, but they’re going to do it anyway."

Schiff critiques Jerome Powell's assertion that the economy is in a "really good place," countering that it is between "a rock and a hard place." He also highlights Powell's acknowledgment of "higher than expected inflation" and increased uncertainty. Despite these admissions, Powell suggests it will take years for wages to catch up with rising prices, a scenario Schiff finds implausible, asserting, "Prices are going to start rising a lot higher." The Federal Reserve's divided stance on rate cuts further illustrates economic instability, as one Federal Open Market Committee (FOMC) member dissented.

Interest Rates and Yield Curve Dynamics

The evolving yield curve is another focal point of Schiff's analysis. He outlines the current rates, stating, "The yield on a 12-month Treasury is 4.26%, 2-year is 4.34%, 5-year is 4.39%, a 10-year is 4.51%, and a 30-year is 4.68%." While the curve remains positively sloped from 12 months to 30 years, the six-month rate slightly exceeds the 12 months, creating a minor negative slope. Schiff predicts this trend will normalize over the coming weeks, with the six-month yield falling below the 12-month yield.

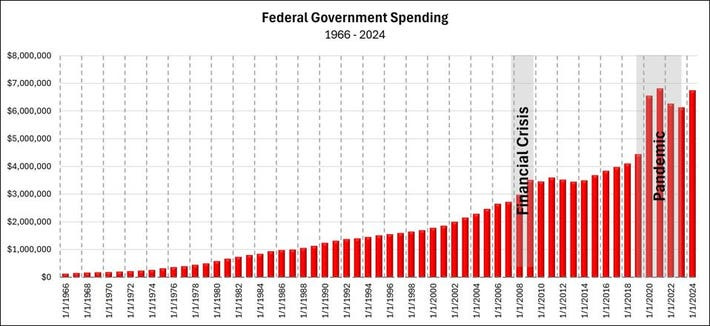

The broader implications of a steepening yield curve concern Schiff, particularly its impact on the bond and real estate markets. He warns, "Longer-duration bonds will move up even more as a result of the loss of confidence in the government’s ability to rein in deficits." Schiff attributes these developments to political inaction and economic misconceptions, stating, "Nothing is getting reduced. We’re going to be in a recession."

Government Spending and Stimulus

Schiff is critical of government spending, especially during economic downturns, likening it to adding weights to a runner’s backpack. "If you really want to stimulate the economy, you’ve got to shrink the government," he argues. He foresees increased spending and higher inflation, driven by the political unwillingness to cut programs during recessions. "Nobody is going to vote to cut anything when the economy is hurting," he remarks.

According to Schiff, stimulus measures' inefficacy lies in their failure to address fundamental economic issues. He dismisses Keynesian approaches, advocating instead for deregulation and reduced government intervention. Schiff concedes that deregulation under Trump is likely because it "doesn’t cost the government any revenue." However, he is skeptical of substantive fiscal reform, predicting, "It’s all going to be about stimulus when the economy turns down."

Gold, Silver, and the Dollar

Shifting to precious metals, Schiff highlights their resilience amid economic uncertainty. Gold, he notes, has performed strongly, particularly in foreign currencies, stating, "Gold is back above $2,600, and the Chinese have been buying up a lot of gold recently." Schiff contrasts this with cryptocurrencies like Bitcoin, emphasizing tangible assets as the preferred hedge.

Silver has also seen fluctuations, falling below $30, but Schiff is optimistic about its recovery. He advises, "You should be calling up the guys over at Schiff Gold... while they’re on sale." Despite the dollar’s recent strength, which has pressured foreign markets and commodities, Schiff maintains that gold and silver remain solid investments for the long term.

US Stock Market and Economic Outlook

Schiff concludes with a grim forecast for the US stock market and economy, predicting an inevitable collapse. He posits, "Either the stock market crashes or the dollar crashes—one of those two things is going to happen." While he expects the stock market to decline first, he believes the Federal Reserve will revert to QE to prevent total economic fallout, sacrificing the dollar in the process.

Acknowledging the political landscape, Schiff expresses concerns about Trump’s ability to navigate post-collapse challenges. "It would be much better to have Trump and his team than Harris and her team in the aftermath of the collapse," he contends. Nonetheless, he remains wary of the prospects for meaningful reform, concluding, "We may not do the right thing with Trump either, but at least we’ve got a shot."Conclusion

Peter Schiff's analysis paints a bleak but consistent picture of economic turbulence, underpinned by misguided policies and systemic flaws in the financial system. He argues that the Federal Reserve's inability to balance inflation control with economic growth has trapped the US economy in a cycle of dependency on low rates and artificial stimulus. "The Fed is not just behind the curve; they're completely off the track," he asserts, warning that any further rate cuts or monetary expansion will only exacerbate the underlying issues.

Schiff’s broader criticism also extends to international dynamics. He highlights that while the US is grappling with inflation and debt, other countries—like China—are strategically positioning themselves by accumulating tangible assets like gold. "They're not buying Bitcoin; they’re buying real gold," he says, emphasizing the strategic foresight of nations preparing for shifts in the global economic balance of power. Schiff warns that as confidence in the US dollar erodes internationally, the country risks losing its privileged position as the world’s reserve currency.

Ultimately, Schiff’s perspective underscores the urgent need for a paradigm shift in economic and fiscal policies. He stresses the importance of reducing government burdens on the economy and fostering sustainable growth through deregulation and prudent spending. However, his outlook remains cautious, concluding that political and institutional inertia make such reforms unlikely in the short term. "The real crisis isn't coming; it’s already here—we're just not willing to face it yet," Schiff laments, urging investors to prepare for a challenging road ahead.

Thank you, dear reader!

Thank you for taking the time to read this comprehensive analysis of Peter Schiff's latest insights. We hope this article has provided you with valuable perspectives on the current economic landscape and the challenges we face. Understanding these issues is crucial for navigating uncertain financial times, and we are committed to bringing you detailed, accurate, and thought-provoking content.

If you found this article helpful, we kindly urge you to share it with your network. Whether it’s through social media, email, or word of mouth, spreading this information can help others stay informed and better prepared. Don’t forget to like and subscribe to our platform so you never miss out on the latest financial news and expert analysis.

Delivering high-quality, relevant financial content requires time, effort, and resources. If you would like to support our mission of providing in-depth economic insights, please consider making a donation. Every contribution, no matter the size, helps us continue to deliver critical information to our readers. Your support means the world to us, and it ensures we can keep shining a light on the issues that matter most.

Thank you again for your support, and stay tuned for more articles, updates, and expert insights. Together, we can stay informed and ready for whatever the markets have in store.