The Fort Knox Gold Mystery: Trump, Musk, and the Deep State’s Greatest Secret

Introduction

The discussion surrounding Fort Knox, America's alleged gold reserves, has resurfaced with claims of an impending audit initiated by figures like Elon Musk, Senator Rand Paul, and former President Donald Trump. This article examines the key points presented in Redacted's YouTube latest news, breaking down the implications of a potential financial revelation that could shake the global economic system.

The Greatest Secret in American History?

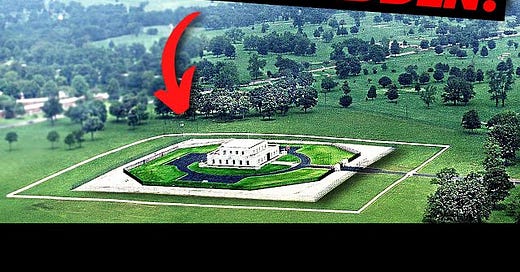

The U.S. government is sitting on a secret larger than the truth behind JFK’s assassination or the mysteries of Area 51. That secret is Fort Knox—the location that supposedly holds America's gold reserves. However, the actual state of these reserves is unknown due to a lack of transparency and government resistance to audits.

The U.S. claims Fort Knox houses 4,580 tons of gold worth $425 billion.

There has been no full, independent audit since 1974, over 50 years ago.

Politicians, including Senator Rand Paul and Congressman Thomas Massie, have been denied access to verify the reserves.

The Deep State is accused of controlling access and information regarding the gold.

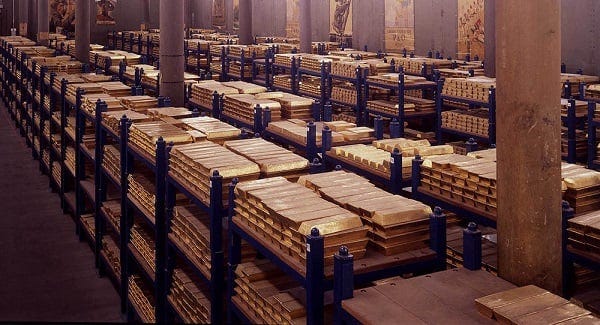

The claim that Fort Knox's gold reserves have not been independently audited raises concerns about financial transparency. If gold reserves are missing, stolen, or replaced with fake bars, it could significantly impact trust in U.S. financial institutions. However, skepticism remains—why would the government risk such a deception, and what proof exists beyond speculation?

Trump and Musk: The Push for Transparency

Elon Musk and Donald Trump are planning a full-scale audit of Fort Knox. This is a move against the Deep State, with Musk’s involvement being likened to his exposure of Twitter’s internal censorship programs.

Key Points:

Musk reportedly posted his intent to audit Fort Knox.

Senator Rand Paul has been advocating for a full accounting of the gold for years.

The media’s reaction is described as panic and damage control, similar to their response to Musk’s Twitter Files.

The Department of Government Efficiency, supposedly led by "Doge," is mentioned as a new initiative by Trump to dismantle government secrecy.

If Musk and Trump truly push for a Fort Knox audit, it could be a landmark moment in financial history. However, some questions remain—does Musk have the authority or expertise to conduct such an audit? Will government agencies cooperate? The claim that the media is panicking may reflect political bias, but mainstream skepticism towards Musk’s credibility in this area is also worth noting.

The Financial Domino Effect: What’s at Stake?

The potential absence of gold in Fort Knox is presented as a global financial catastrophe in the making. The argument suggests that the U.S. economy relies on the perception of strong gold reserves, even though the dollar is no longer backed by gold.

Key Points:

If Fort Knox is empty, trust in the U.S. government and Federal Reserve could collapse.

Foreign governments and investors might dump U.S. Treasury bonds, leading to skyrocketing interest rates.

A shift towards gold-backed currencies by nations like China and Russia could undermine U.S. financial supremacy.

Gold, silver, and Bitcoin prices could surge as investors seek safe-haven assets.

The Federal Reserve could be exposed for manipulating gold prices through paper derivatives.

While these claims are speculative, they highlight the fragility of modern economic trust systems. The U.S. dollar’s strength is largely based on faith in its institutions, not direct backing by gold. If an audit exposes discrepancies, it could lead to a financial crisis. However, it’s unclear whether the government would allow such findings to become public without major political resistance.

Could This Lead to the End of the Federal Reserve?

One of the most radical claims is that an exposed Fort Knox fraud would trigger mass resignations, criminal charges, and calls to abolish the Federal Reserve. This would be accompanied by a push to return to a gold-backed currency, an idea that Trump has reportedly hinted at.

Key Points:

The Federal Reserve’s legitimacy would be questioned if Fort Knox’s gold is missing.

A shift to a gold-backed dollar could bring financial stability but limit government spending.

Trump has alluded to returning to a gold standard, though details remain vague.

The Deep State, global banking elites, and the IMF’s role in financial control could come under scrutiny.

The idea of abolishing the Federal Reserve has been discussed for decades, but it remains unlikely without overwhelming evidence of fraud. A gold-backed currency would limit monetary policy flexibility, potentially harming economic growth. However, if significant fraud is uncovered, public pressure for radical reforms could grow.

Is the World Ready for the Truth?

If Musk and Trump succeed in pushing for an audit, it could reshape the global financial landscape. However, skepticism remains about whether the government would allow such an audit and what the true findings might be.

Regardless of the outcome, the questions raised about financial transparency, the Federal Reserve, and the U.S. dollar’s future are critical discussions in today’s economic climate. The coming months may determine whether these revelations lead to a historic transformation—or remain just another conspiracy theory.