The Future of Gold and Silver: Insights from Brien Lundin

In a recent podcast, Francis Hunt welcomed Brien Lundin, a prominent figure in the precious metals industry, to discuss the current state and future outlook for gold and silver. Lundin, known for his work with Gold Newsletter and the New Orleans Investment Conference, shared his insights on the market dynamics, the role of central banks, and the broader economic environment affecting these precious metals.

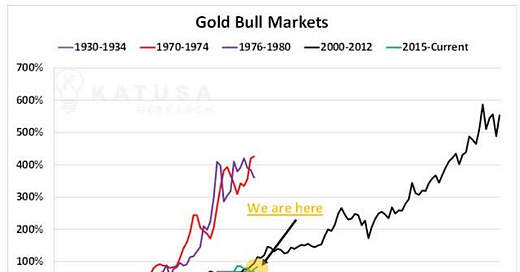

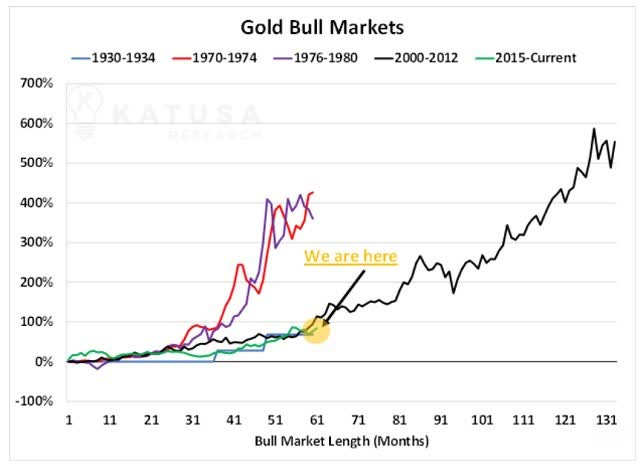

The Fourth Bull Market for Gold

Brien Lundin began by outlining his thesis that we are witnessing the onset of the fourth major bull market in gold as an investment asset since 1971, when gold was decoupled from being money. "We've had three significant bull runs in the past," Lundin explained. "The first in the early '70s, another in the late '70s to the peak in 1980, and the last one from 2000 to 2011. Each of these runs saw gold prices increase significantly."

Lundin believes the current cycle started around December 2015, when gold was approximately $1,040 per ounce. Based on historical trends, he projects that the gold price could reach between $5,000 and $8,000 per ounce by the end of this cycle. "It's a generational opportunity, the kind of thing we haven't seen since around 2000," he said.

Central Bank Buying and Inflation

One of the factors driving this bull market is central bank buying, which has been substantial. Lundin noted, "The drivers so far have been factors that you can't really project well into the future, such as central bank buying and Chinese purchases. Inflation also plays a crucial role, and it's challenging to determine whether lower or higher inflation is bullish for gold in the current environment."

Francis Hunt added to the discussion, highlighting the complexities of inflation's impact on gold. "Who knows these days whether lower inflation is bullish for gold or higher inflation is bullish for gold, because we're in such a topsy-turvy world where everything is based on how it will affect Fed policy," Hunt remarked.

The Fed Pivot and Market Reactions

A significant point of discussion was the anticipated Fed pivot. Both Hunt and Lundin agreed that the Federal Reserve's actions are pivotal for gold's future performance. Lundin predicted, "We have the big factor coming up, that being a Fed pivot, likely involving a couple of rate cuts this fall. The markets, including gold, are starting to price in this upcoming Fed pivot, and gold should do very well in that environment."

Hunt expressed his view on the broader economic implications, "We're in a recession globally, even if official criteria have been adjusted. Typically, this would call for a series of rate cuts, but the absence of significant bids under the debt markets complicates things. This environment could lead to a super spike in interest rates, which could be incredibly bullish for gold."

Eastward Movement of Precious Metals

The conversation also touched on the geopolitical shift in gold and silver markets. Lundin highlighted the significant flow of precious metals from West to East. "Chinese gold imports have been tremendous, and silver imports into India remain a big factor," he noted. "There's a river of gold and silver moving from West to East, usually when the price is declining. But this time, prices are rising, and Eastern investors are following the price higher."

Hunt echoed these sentiments, pointing out the long-term implications of this trend. "We've weaponized the SWIFT system and bifurcated the planet. The metal is moving East, and this shift signifies a decline in the West's dominance. The trust in the fiat system is eroding, and the reliance on the dollar is waning," he said.

The Mining Sector's Challenges and Opportunities

The discussion wouldn't be complete without addressing the performance of mining stocks. Lundin acknowledged the perception that miners haven't kept pace with gold prices. "People believe they haven't kept up with gold, but if you look at the major indices, they have leveraged gold, just not as much as expected," he said. He attributed this to the drivers of the rally being factors that are not well understood or projectable.

Hunt brought up the challenges faced by the mining sector, including inflation, long permitting processes, and the need for significant investments. "Mining companies are in the hated part of the world right now, with permitting taking an average of 17.8 years," he noted. "As we get deeper into the bull market, we might see an amplifier effect where miners start to catch up."

Silver's Performance and Future Prospects

Silver's role in the current bull market was another focal point. Lundin pointed out that silver has actually outperformed gold during this bull market. "Whenever we've had a secular bull market in gold, silver has dramatically outperformed. I expect it to do so again," he said.

Hunt agreed, noting that while silver has been playing catch-up, it seems to be entering a new trading range. "Silver seems to be refusing to drop below $30 for any significant period, and this stability could attract more investors," he observed.

Conclusion

The podcast concluded with a look ahead to upcoming events and how listeners can engage further with Brien Lundin's work. Lundin invited the audience to the New Orleans Investment Conference, highlighting its significance as the world's oldest investment conference, celebrating its 50th anniversary this November. "It's going to be a blockbuster event with lots of great speakers, including Jim Grant," he said.

For more information and resources, Lundin directed listeners to Gold Newsletter's website, where they can access a comprehensive report on investing in gold and silver.

In this insightful conversation, Brien Lundin and Francis Hunt provided a deep dive into the precious metals market, offering valuable perspectives on the factors driving gold and silver prices and the broader economic and geopolitical trends shaping the future.

Support Our Work with a Bitcoin Donation

We also offer the opportunity to support our work and help us continue building the Financial Anarchy community. If you would like to contribute, we gratefully accept donations in Bitcoin. Your support will enable us to create more educational content, engage in meaningful activism, and further our mission of challenging the status quo. To donate, please use the following Bitcoin address:

bc1qmzzj5lfhe5ghv2yh3tfgt3qcuycl3r6n4llrsk

Thank you for joining us on this journey of understanding and change. Together, we can shape a brighter financial future for all.