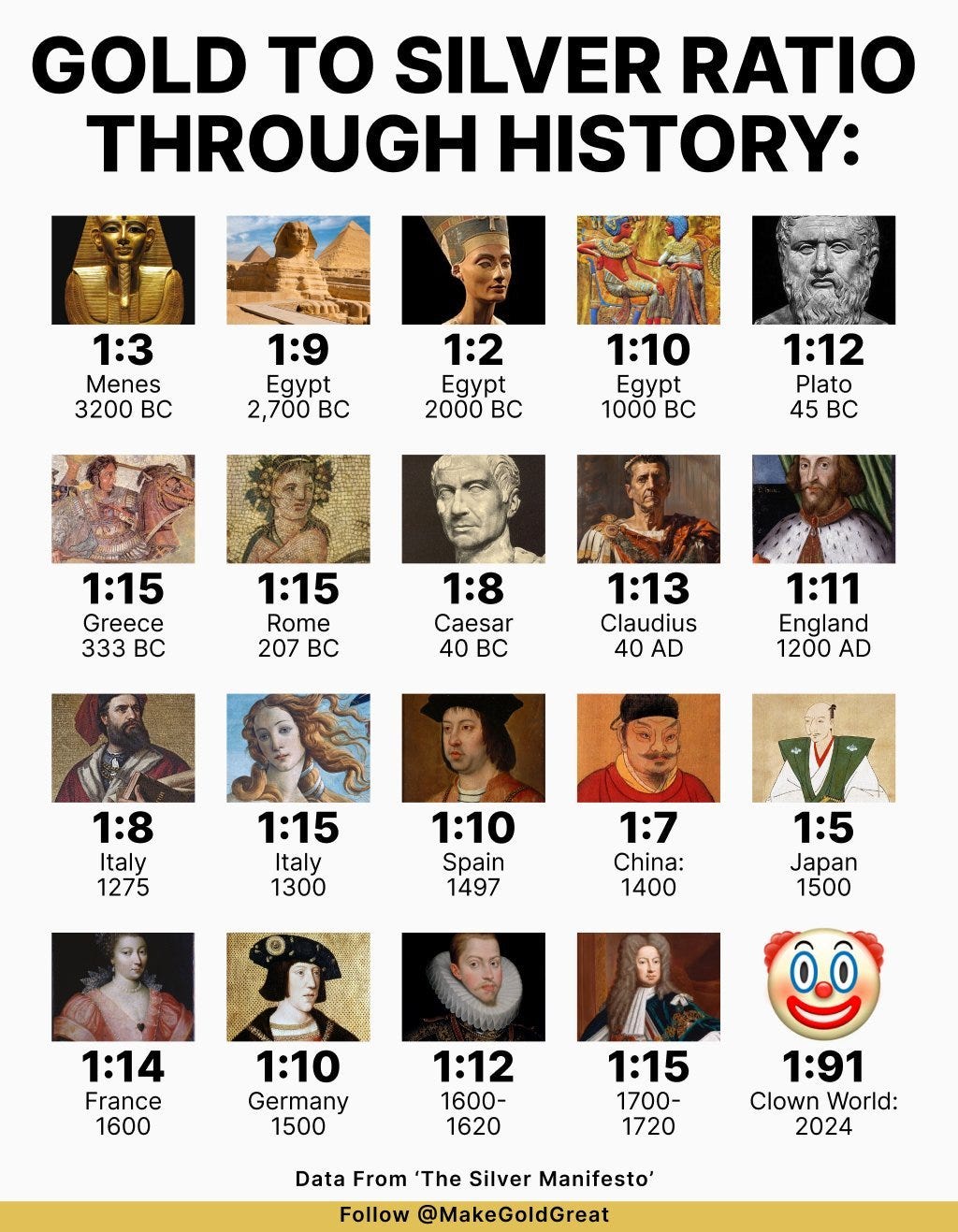

The Historic Gold-to-Silver Ratio: A Look Through the Ages

The gold-to-silver ratio is one of the most important measures of value throughout history, reflecting the relative worth of these two precious metals over time. For thousands of years, societies across the globe have recognized the intrinsic value of gold and silver, using both metals as currency, stores of wealth, and mediums of exchange. The ratio between them has fluctuated depending on economic, political, and technological conditions, but historical records show some striking consistencies and patterns.

In ancient civilizations, the gold-to-silver ratio was often fixed by decree. For example, in Egypt, around 3,000 BC, the ratio was set at approximately 1:2. This reflected the relative abundance and difficulty of extracting gold compared to silver in that era. Moving into the Roman Empire, the ratio averaged closer to 1:12, a balance determined by the mining and economic systems of the time. The Romans used both metals extensively in their coinage and trade systems, and this ratio became a benchmark for centuries.

Fast forward to the Middle Ages and into the Renaissance, the ratio tended to hover around 12:1 to 15:1 in Europe and parts of Asia. These numbers were not arbitrary but were often dictated by the natural abundance of the two metals. Silver, being more plentiful than gold, naturally held a lower individual value. However, the stability of this range persisted, underscoring the deep economic interconnection between gold and silver.

As the world entered the 19th century and industrialization expanded, the gold-to-silver ratio became a critical factor in global finance. In the 1870s, during the height of the bimetallic standard, the ratio was around 15:1 across many nations, including the United States and major European powers like France and Britain. However, by the late 19th century, as countries began to favor gold over silver, the ratio started to shift dramatically. This was especially evident after the demonetization of silver in the United States with the Coinage Act of 1873, which was later referred to as “The Crime of 1873.”

These historical ratios are starkly different from the modern figures seen today. Over millennia, the gold-to-silver ratio has averaged 16:1, yet in recent years, it has reached levels as high as 125:1 during economic turmoil, such as the COVID-19 pandemic. This significant deviation from historical norms underscores the degree to which the silver market has been distorted by modern financial instruments and practices, as discussed by Mike Maloney and Allan.

The gold-to-silver ratio has fluctuated over time, but some historical averages include:

Long-term average: Since the 1970s, the average ratio has been around 65:1.

100-year average: The average ratio over 100 years is roughly 40:1.

Historical average: The historical average ratio is roughly 15:1.

Roman Empire: The ratio was fixed at 12.

323 B.C.: The ratio was 12.5.

19th century: The ratio was fixed at 15.

1980: The ratio was 17 at the peak of the precious metals boom.

1991: The ratio peaked at 97.5 to 1.

2020: The ratio peaked at 125 to 1.

Historical Gold-Silver Ratios: Analyzing Market Trends

Mike Maloney and Allan focused their discussion by diving into historical gold-silver ratios, highlighting how these ratios have evolved over time. Allan mentioned, “You can see that it's about 15 in all these different places, 18 in Austria-Hungary and Russia, 23— a bit of an outlier there. But yeah, just in the 1870s, I mean, a pretty modest and consistent ratio of about 15 or 16 to one.” They pointed out an anomaly in Russia's ratio and how this disparity could have created arbitrage opportunities for traders at the time. Maloney elaborated on the implications of this discrepancy, explaining, “Somebody can export one bag of coins of one metal and buy a different metal when you bring it back; you can buy two bags now. And so, you keep repeating the process.”

The conversation progressed to more recent history, with Allan noting, “In 1939, the gold-silver ratio peaked at 98:1 after Roosevelt set gold at $35 an ounce.” Other key historical milestones included the Bretton Woods agreement in 1945, Nixon taking the U.S. off the gold standard in 1971, and the record-breaking ratio of over 125:1 during the COVID-19 pandemic in 2020. Allan highlighted the impact of these events, saying, “The one thing that I would add here... is in 1975, basically allowing gold and silver futures and paper metal, which fundamentally changed market dynamics.”

The Johnson Sandwich and Gresham’s Law

Shifting focus, Maloney brought up the Johnson administration's policies regarding coinage. He explained, “In 1966, Lyndon Johnson created what David Morgan refers to as the Johnson sandwich— when there was copper in the coinage, and they took silver out.” This policy triggered Gresham's Law, where people hoarded valuable silver coins and removed them from circulation. “There wasn’t enough. I’ve got quotes from Johnson saying, ‘We’ve got to have coins for parking meters,’” Maloney recounted. This led to a literal shortage of pocket change in the U.S. economy.

Maloney also referenced the spike in silver prices in January 1980, recalling, “Silver soared from about four bucks to 50 bucks. The gold-silver ratio spiked below 14.” He added that this scenario might repeat, advising, “When this happens again, it’ll be an alarm to either start considering selling your precious metals or converting your silver to gold to maximize returns.” Maloney emphasized how the current “out-of-whack” ratio prevents him from buying gold, asserting that the market is bound to revert to historical norms.

Paper vs. Physical Metal and Market Manipulation

Highlighting a critical issue, Allan showcased data from the U.S. Debt Clock, noting the staggering discrepancy between paper and physical metal. “The paper silver-to-physical silver ratio is 411:1, and the paper gold-to-physical gold ratio is 133:1,” he pointed out. He warned that these ratios represent a ticking time bomb for the market, stating, “For every physical ounce of metal, there are 100 or 400 paper ounces of the corresponding metal. It’s musical chairs, and when the music stops, 310 people are going to be out of luck.”

Maloney did not mince words, describing the situation as fraudulent: “It’s not even a claim on the actual metal— it’s a fraud.” Both he and Allan agreed that this artificial suppression of prices would ultimately lead to a crisis and a dramatic price correction. “The price is going to have to adjust once people realize that paper metal is not the same as actual metal,” Allan explained.

The Parabolic Base and Future Market Predictions

Turning to technical analysis, Allan showcased four-year charts of gold and silver, illustrating a rare parabolic base pattern forming in both metals. He described the setup as “very, very bullish,” emphasizing its rarity and signaling potential upward momentum. Maloney echoed this sentiment, predicting, “You will see silver in the triple digits. It really needs to be there to get that supply back up.”

Industrial demand for silver, especially in battery technology and solar applications, further supports this forecast. Maloney added, “All you need is a crisis and monetary demand, and gold and silver start acting like money once again. Then you’re going to see some real fireworks— some fireworks in gold and sort of a nuclear bomb in silver.”

Gold’s Bull Market: Parallels to the 1970s

The interview concluded with a comparison of today’s gold market to the bull market of the 1970s. Using charts that aligned historical lows and highs, Maloney and Allan noted how current trends mirror the past. Allan explained, “If this repeats what it did in the 1970s, we’re talking about $9,000 or $10,000 an ounce gold.” He noted that this translates to a fourfold increase in gold prices and, based on the gold-silver ratio, a potential 16x increase in silver prices.

Maloney underscored the role of currency creation in suppressing precious metal prices. “The quantity of currency that was created from 2008 until today, but especially during COVID, should have sent gold and silver prices vertical,” he argued. He predicted that this stored energy would eventually result in explosive price movements, concluding, “We’re talking about some real fireworks.”

This comprehensive discussion between Maloney and Allan highlights the immense potential in the undervaluation of silver, pointing to historical trends, market manipulation, and technical analysis as evidence of an impending price surge. For investors, the opportunity is clear: the time to act may be now.

Thank You and Join the Movement

Thank you for taking the time to explore the profound insights shared by Mike Maloney and Allan on the undervaluation of silver and the potential opportunities within the gold and silver markets. These discussions shed light on critical historical trends, current market manipulation, and the immense potential for price corrections in the near future. Your engagement in understanding these dynamics is a step towards making informed decisions in today’s volatile economic environment.

If you found this article valuable, please consider supporting our efforts to bring such crucial information to a wider audience. Don’t forget to like, subscribe, and share this article with others who may benefit from these insights. Every share helps spread awareness about the immense opportunities in precious metals and fosters informed conversations around these topics.

Additionally, if you’d like to contribute directly to supporting this work, we warmly invite you to donate. Your generosity ensures that we can continue to produce high-quality, data-driven content to empower readers like you. Thank you for being part of this journey—together, we can navigate the financial landscape with clarity and confidence!