Introduction: A Crisis Unfolding

Taylor Kenny of ITM Trading warns that a financial crisis similar to 2008 is already underway. However, this time, it's not the banks that are at risk—it’s individual savings, pensions, and retirement funds. Major retailers, including Joann’s, Big Lots, and Forever 21, are declaring bankruptcy at an alarming rate, but the real danger lies beneath the surface.

Behind the wave of business failures is a systematic wealth extraction scheme orchestrated by private equity (PE) firms. These firms are using a specialized debt strategy that not only destroys companies but also jeopardizes the financial security of millions of Americans. As Kenny outlines, this crisis has the potential to be even more devastating than the 2008 collapse.

The Role of Private Equity in the Retail Collapse

Unlike the 2008 crisis, which was driven by toxic mortgage-backed securities, today’s looming disaster is fueled by private equity-backed debt. The scheme works as follows:

Private Equity Firms Target Struggling Companies

PE firms acquire companies that are struggling financially, often retailers with brand recognition and stable revenue streams.They Load the Companies with Debt

Once acquired, these firms saddle the company with excessive debt. However, this isn’t just any debt—it’s a highly volatile form called “back floating rate debt,” which has the ability to retroactively increase interest rates.They Strip the Companies of Assets

PE firms extract as much value as possible by selling off valuable assets, including real estate, intellectual property, and other core components of the business.They Profit While the Companies Collapse

By the time the debt burden becomes unmanageable, the company collapses, leaving employees jobless and communities without essential services. Yet, PE firms have already walked away with massive profits, collected through fees and dividends.

The Red Lobster Example: A Case Study in Financial Engineering

One of the most recent examples of this strategy in action is Red Lobster. The restaurant chain, once a household name, did not fail because of poor management or bad business decisions. Instead, a private equity firm acquired the company and sold the real estate that housed its restaurants.

Despite remaining profitable, Red Lobster was burdened with so much debt that it could no longer sustain operations. Eventually, it was forced to shut down, leaving 35,000 employees without jobs. Meanwhile, the private equity firm walked away with all the profits.

This practice, Kenny explains, is not an isolated incident but a widespread and deliberate strategy used by PE firms to extract wealth at the expense of businesses, employees, and communities.

The Hidden Debt Bomb: CLOs and the Next Financial Collapse

The most alarming aspect of this crisis is where the toxic debt ends up. Similar to how mortgage-backed securities and collateralized debt obligations (CDOs) led to the 2008 crash, private equity firms have repackaged their risky business debt into Collateralized Loan Obligations (CLOs).

CLOs function just like CDOs but with corporate debt instead of mortgages. These financial instruments are then sold to pension funds, retirement accounts, and 401(k) plans—often without the knowledge of the people whose savings are at risk.

Kenny challenges viewers to ask their financial advisors if they know what’s inside their retirement accounts. The reality is that most people, including financial professionals, have little to no insight into the true risk exposure within these investment vehicles.

The Scale of the Crisis: Bigger Than 2008?

To grasp the magnitude of the unfolding crisis, Taylor Kenny draws a direct comparison to the 2008 subprime mortgage collapse. But this time, the stakes are even higher, and the financial burden is being transferred directly to individuals rather than banks.

How Big Was the 2008 Crisis?

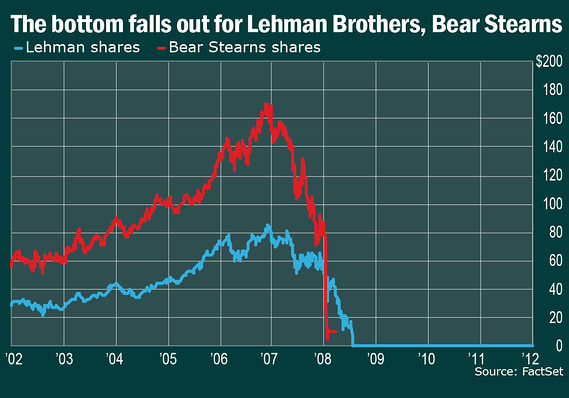

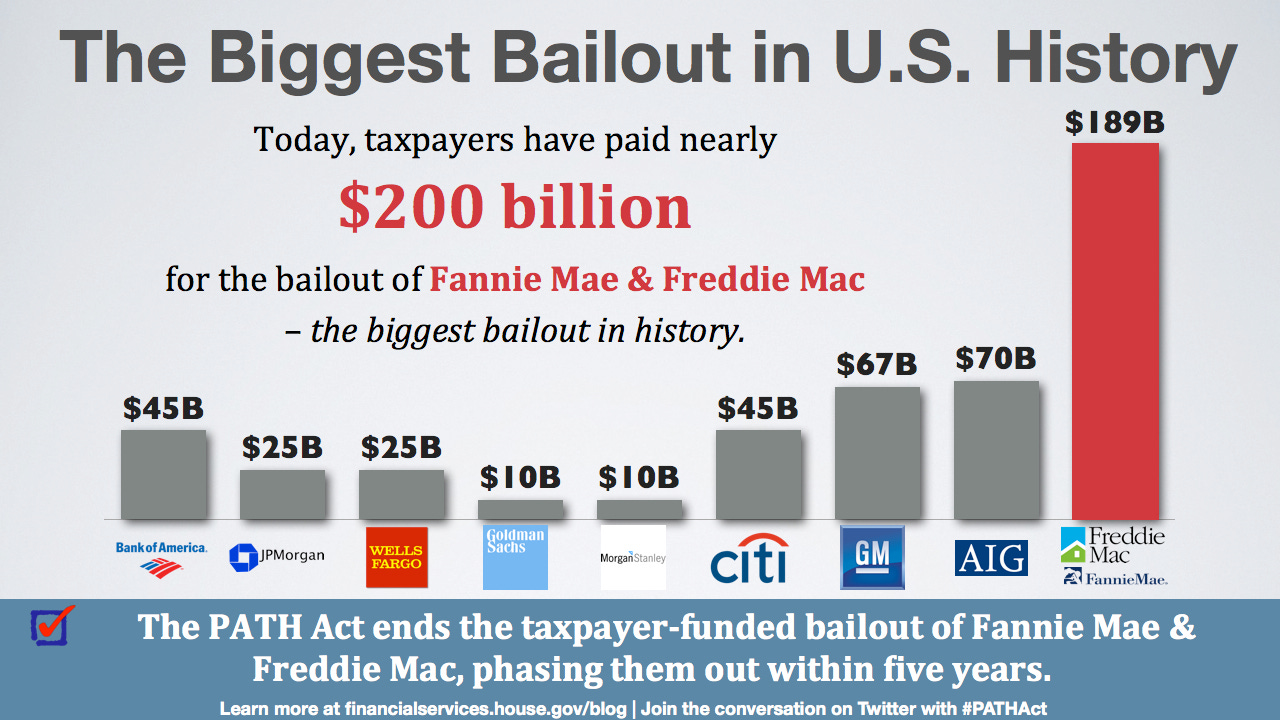

The 2008 financial crisis was triggered by the collapse of the subprime mortgage market, where banks had packaged risky home loans into complex financial products called CDOs (Collateralized Debt Obligations). These were sold to investors under the assumption that they were safe, despite being built on unstable foundations.

At its peak in 2007, the total value of subprime mortgage exposure stood at $1.3 trillion. Adjusted for inflation, that would be roughly $2 trillion today.

When the housing bubble burst and borrowers defaulted, these financial products became worthless overnight, wiping out trillions in wealth, triggering a global financial meltdown, and resulting in millions of lost jobs, foreclosed homes, and collapsed banks.

The Financial System Is Breaking: Why the Smart Money Is Rushing to Gold and Hard Assets!

"I don't trust you as a counterparty. I don't want to take Lehman's paper. I'm Goldman Sachs, I don't want to do business with Lehman because they might go under. Well, that's what's happening in the world right now."

How the Current Crisis Compares

According to Kenny, the private equity-backed debt market today is nearly double that amount—but with even more layers of financialization on top.

Key Differences Between 2008 and Today

The biggest danger? The 2008 crisis was triggered by banks, which were bailed out to prevent total collapse. This time, individuals—retirees, pension holders, and everyday investors—are the ones carrying the risk.

“When this debt bomb goes off, it’s not banks this time who are on the other end—it is you, me, your grandma, your grandpa, your neighbor, your loved one.”

The Hidden Risk: The Derivatives Market

One of the most alarming aspects of the 2008 financial collapse was the shadowy world of derivatives, which made it difficult to assess the full extent of financial exposure. These derivatives magnified the crisis by layering additional bets on top of already risky investments, creating an unpredictable domino effect.

History Repeats Itself: The Role of Derivatives in Today’s Crisis

Kenny warns that today’s financial system is even more complex and opaque than in 2008.

“No one even knows how big the derivatives market is. Some estimate in total it could be over a quadrillion dollars.”

Why is this important?

Derivatives allow for excessive risk-taking—just as they did before the 2008 crash.

Many of these instruments exist off-balance sheet, making it difficult to track total exposure.

When CLOs (Collateralized Loan Obligations) start failing, their impact could ripple through the entire financial system, just like the CDOs of 2008.

The end result? Just as the collapse of mortgage-backed securities wiped out trillions in home values and retirement savings in 2008, the failure of corporate debt CLOs could devastate pensions and 401(k)s across America.

Unseen Threats: The "Shadow Banking" Factor

Unlike the regulated banking system that played a central role in 2008, today’s crisis is being driven by private equity and shadow banking institutions, which operate with minimal oversight.

What is Shadow Banking?

Shadow banking refers to non-bank financial institutions that engage in bank-like activities without regulation.

Private equity firms, hedge funds, and asset managers have quietly taken over the financial system, often leveraging riskier debt than traditional banks.

These institutions are not subject to capital requirements—meaning they can take on far greater risks without safeguards.

Why This Matters:

In 2008, at least regulators could see the risk accumulating within banks.

Today, private equity firms and shadow banks operate largely outside of regulatory oversight, meaning the true size of the risk is almost impossible to track.

“The exposure is so much bigger than we think—just like in 2008, when no one knew the full extent of CDO exposure until it was too late.”

Why the Crisis Hasn’t Fully Hit—Yet

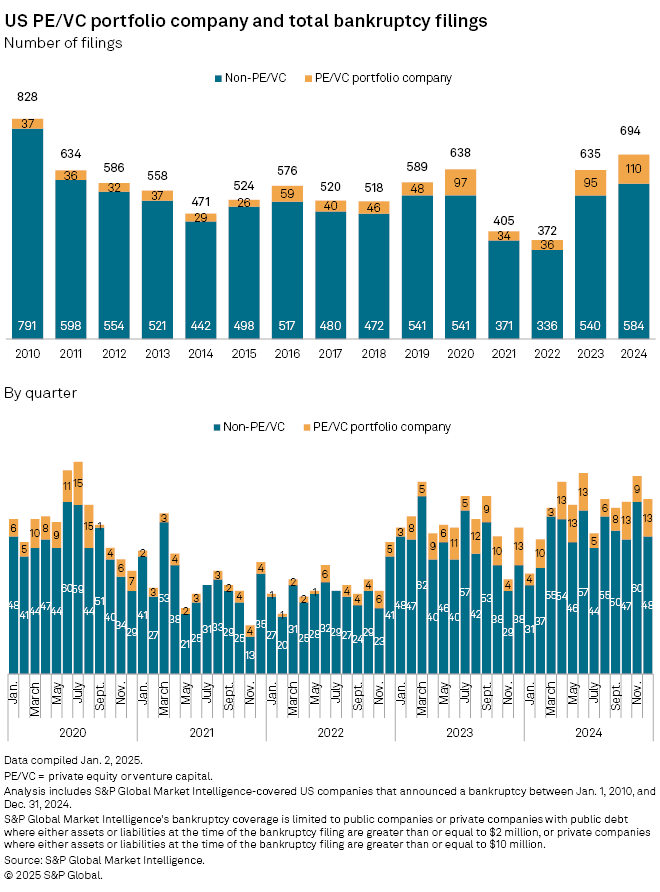

Even though bankruptcies are already at their highest level since 2008, the real financial collapse hasn’t started yet.

Why?

Many companies are still barely keeping up with their debt—but rising interest rates are pushing them to the edge.

CLOs (Collateralized Loan Obligations) haven’t fully unraveled yet, but when they do, they could trigger a widespread collapse.

Government interventions like stimulus measures and low interest rates have delayed the inevitable, but they can’t prevent it forever.

The Warning Signs:

Private equity-backed bankruptcies were up 15% year-over-year—the most on record.

Major banks have quietly started cutting exposure to corporate debt markets.

Retailers, hospitals, and nursing homes are failing at an accelerating pace.

The Big Question: Will There Be a Bailout?

In 2008, banks were bailed out—will individuals be next?

“It’s easy to say that this time there would be a bailout, right? But do you really think that our system can handle it?”

Unlike the bank bailouts of 2008, a direct bailout of pension funds and retirement accounts would mean injecting trillions into the economy, likely leading to:

Massive inflation

Currency devaluation

A complete financial reset

“If another bailout occurs, do you really think our system can handle it? Your dollar has already lost so much purchasing power. Another massive papering over of the system would lead to rapid inflation and a potential currency reset.”

The Real-World Consequences: Communities Left in Crisis

Private equity’s influence extends far beyond retail. These firms have acquired significant stakes in hospitals, nursing homes, residential mortgages, and critical industries, meaning that the collapse of these debt-ridden companies won’t just result in job losses—it will affect essential services that millions of Americans rely on.

The fallout from these bankruptcies is already visible:

2024 has seen the highest number of bankruptcies since 2008.

Private equity-backed bankruptcies have surged by 15% year-over-year—the highest on record.

Tens of millions of people work for PE-owned companies that are now at risk.

Despite this, there has been little to no regulatory oversight to stop private equity firms from continuing these exploitative practices.

Will There Be a Bailout?

One of the most troubling aspects of this crisis is that when the debt bomb finally explodes, there will be no banks to bail out—only individuals who have lost their life savings.

Kenny raises a critical question: If millions of retirees lose their pensions and 401(k)s, will the government step in with a bailout? And if so, can the financial system even handle it?

The U.S. dollar has already suffered significant devaluation due to inflation and government spending. Another major bailout could trigger even worse inflation or a currency reset, dramatically altering the financial landscape.

What Can You Do to Protect Yourself?

Given the systemic risks posed by private equity, Kenny offers several recommendations for individuals looking to protect their wealth:

Educate Yourself – Awareness is the first step to financial protection. Understanding how PE firms operate and where their risks lie can help you make informed decisions about your investments.

Monitor Your Retirement Accounts – Review your pension, 401(k), or IRA to identify exposure to CLOs or other high-risk investments. Speak to financial professionals, but be aware that even they may not fully understand the risks involved.

Diversify Outside the System – Kenny emphasizes the importance of holding physical assets like gold and silver, which do not carry counterparty risk. Unlike stocks or bonds, these assets retain value regardless of financial crises.

Stay Alert to Policy Changes – There are rumors that Donald Trump may seek to curb private equity’s influence if re-elected. However, relying on political solutions is uncertain, and individuals should take proactive steps to secure their wealth.

Conclusion: A Crisis in the Making

The collapse of major retailers is just the beginning of a much larger financial crisis. Private equity firms have designed a system that extracts wealth from businesses, leaving them burdened with unsustainable debt while transferring risk onto everyday Americans.

If history is any guide, the consequences of this reckless financial engineering will not be fully understood until it is too late. But for those paying attention, there are steps that can be taken now to mitigate the damage.

As Taylor Kenny warns, the next financial crisis won’t be about saving the banks—it will be about saving yourself.