The Real Estate Bubble and the Fed's Dangerous Game

Michael Pento's Outlook on Debt, Inflation, and Market Risks

The Federal Reserve's Role in Inflation and Debt Monetization

In this insightful interview with Michael Pento on Liberty and Finance, he emphasizes the critical role central banks, particularly the Federal Reserve, play in exacerbating inflation and government debt. Pento explains that these institutions’ actions are designed not with the public's well-being in mind, but to maintain the solvency of the government.

Monetizing Debt: A Necessary Evil?

According to Pento, the Federal Reserve has been engaging in the practice of monetizing government debt for years. He states, “The government doesn't have any money, so they rely on the Federal Reserve and private banks to create money to finance the debt.” This process is not based on healthy economic growth but is essentially a "vicious cycle," driven by the government's unsustainable spending habits. Pento describes the situation as unsustainable, with the government’s annual deficit now exceeding $2 trillion.

“The Fed’s job is not to protect the public,” Pento adds. “It is to protect the solvency of the government.” The massive creation of money to fund this deficit is, according to Pento, a form of manipulation that distorts the natural course of the economy. The national debt, now exceeding 123% of GDP, highlights the severe imbalance created by these policies.

The Fed’s Actions and the Inflation Crisis

Pento highlights that inflation, particularly in the post-pandemic era, is a direct result of the Fed's policies. The injection of massive amounts of liquidity into the economy, through actions like quantitative easing (QE), has created a bubble in asset prices and consumer prices. He asserts, “Inflation is not a mistake, it’s a feature of these policies. As long as the Fed is going to create money to buy government bonds, you’re going to have inflation.” Pento’s view is that inflation isn’t just an unfortunate consequence of current monetary policies—it’s an inevitable outcome of the Fed’s actions.

The broader implication here is that the Fed’s policies, while designed to create stability in the short term, are actually laying the groundwork for long-term economic instability. Pento warns, “If these policies continue, we are heading straight for a crisis.” He predicts that, without a major policy change, a recession could drive the deficit even higher, potentially reaching $6 trillion annually. This would exacerbate inflation and increase the already unsustainable debt levels.

Debunking the "Fed Put" Myth

A core topic of discussion in the interview is Pento’s strong stance on the "Fed put." This refers to the widely held belief that the Federal Reserve can and will intervene in markets to prevent major declines, essentially guaranteeing a safety net for investors. Pento vehemently argues that this idea is a misconception.

The Fed’s Lagging Response

Pento points to past economic crises to demonstrate that the Fed's actions have consistently been reactive, rather than proactive. He uses the example of the 2008 Financial Crisis, saying, “In 2008, the Fed cut rates from 5.25% to zero, but the S&P 500 still lost 57% of its value.” He also references the Dot-Com Crash of 2000, where, despite the Fed cutting rates from 6.5% to 1% by 2002, the NASDAQ still lost 80% of its value. This historical pattern of delay, according to Pento, shows that the "Fed put" is more of a myth than a reality.

“The Fed always acts based on lagging economic data,” Pento explains. “By the time they act, the damage is already done.” The delay in policy action leads Pento to question the efficacy of the "Fed put" in preventing financial crises or downturns. “There’s no magic that the Fed has. They can’t stop the market from correcting,” Pento warns.

A Dangerous Illusion for Investors

The belief in the "Fed put" has led to complacency in the markets, with investors assuming that the Federal Reserve will always step in to prop up asset prices. Pento asserts, “The markets have been lulled into a false sense of security. The notion that the Fed will always come to the rescue encourages too much risk-taking.” This misplaced trust is dangerous, as it encourages risk-taking and overleveraging. Pento’s position is clear: the Fed’s monetary interventions may offer short-term relief, but they do little to solve the structural problems within the economy. Instead, they exacerbate the eventual bust when the markets finally correct.

The Battle Against the Banking Lobby

The Great Taking: How the Banking Lobby Controls Securities Ownership and Threatens Financial Freedom

The Road Ahead: Anemic Growth and Potential Recession

Looking ahead to 2025 and beyond, Pento paints a grim picture for the U.S. economy, with anemic GDP growth and the possibility of a recession. He notes that while the Federal Reserve’s projections for GDP growth have been revised downward, the actual outlook remains concerning.

Challenges to Economic Growth

Pento highlights several key factors that will contribute to weak economic performance in the coming years. “The combination of rising tariffs, trade wars, and the decline of liquidity will make it very difficult for GDP growth to rebound,” he says. The post-pandemic era saw massive liquidity injections from the Fed, but now that liquidity is drying up, the consequences are becoming clear. “We are witnessing the reduction of liquidity, and that means we’re going to see less borrowing, less spending, and a weaker economy,” Pento warns.

He also mentions that the U.S. economy is increasingly dependent on government intervention, particularly through fiscal deficits and monetary policy, rather than organic economic growth driven by productivity and innovation. “We are not seeing a recovery based on true economic fundamentals,” he states. “The recovery is based on government spending and debt issuance.”

The Declining Liquidity and its Economic Consequences

One of the most alarming insights Pento shares is the decreasing liquidity in the system. He points out that the reserves in the banking system have been running low, and banks are tightening their lending standards. “Banks are beginning to reduce lending, which means less credit in the economy. This will lead to slower economic growth, higher unemployment, and reduced investment,” Pento says.

Additionally, Pento discusses the reverse wealth effect, where declining asset prices—particularly in real estate—are eroding household wealth. “Real estate is starting to decline, and with it, consumer confidence is also beginning to falter,” he notes. This has a ripple effect on the broader economy, leading to a reduction in consumer spending and contributing to the downward economic spiral.

The Risks of Asset Prices and the Wealth Effect

Pento also warns that, with the current economic conditions, asset prices—especially in the real estate and stock markets—are highly vulnerable to sharp declines.

The Vulnerability of Real Estate

Real estate is one of the sectors most susceptible to a downturn, particularly because many investors entered the market during the period of ultra-low interest rates. “In places like Florida and New Jersey, properties are sitting on the market unsold. I’m seeing price reductions almost every day,” Pento says. With the market showing signs of stagnation, Pento believes that real estate could be in for a sharp correction. “We could see a wave of investment properties flooding the market. These properties could turn into liabilities for investors if the market continues to cool off.”

This situation could lead to a "tsunami" of investment properties flooding the market. Many of these properties, once seen as a source of easy profits, could turn into liabilities if the market continues to falter, as renters stop paying, and owners are forced to sell at a loss.

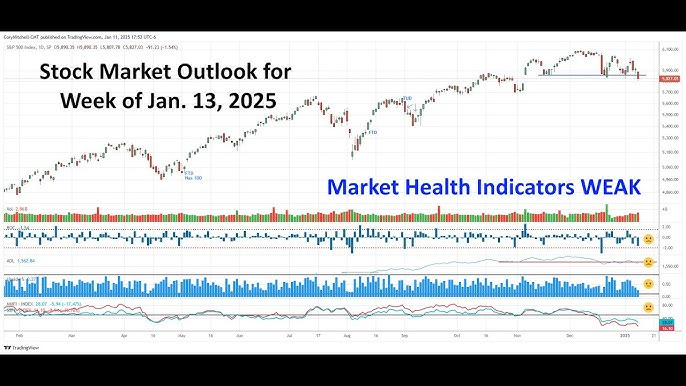

Stock Market Risks and the S&P 500

The stock market, too, is facing significant risks. Despite claims of a strong economy, the S&P 500 and NASDAQ are already down for the year. Pento points out, “The market has already shown signs of weakness in 2025. With weak GDP growth and no major fiscal stimulus, it’s hard to see where the earnings growth is going to come from.”

The fall of asset prices, particularly in high-volatility sectors, could create significant challenges for investors who are unprepared for the economic shifts ahead. Pento stresses, “We are heading into a market where stocks are vastly overvalued, and if there’s no fundamental growth to support them, they’re at risk of sharp corrections.”

Conclusion: A Call for Caution and Preparedness

Pento’s outlook is a cautionary tale for investors, warning that the Federal Reserve’s actions are setting the stage for a broader economic collapse. The combination of high government debt, the decline in liquidity, and the risks to asset prices all point to a challenging economic environment in the coming years. As he concludes, “The risks are mounting, and investors need to be cautious. Prepare for a reality where the government’s economic policies no longer provide a stable foundation for growth.”

By reflecting on the interview’s insights, it’s clear that Pento’s analysis points to an increasingly volatile economic environment, where both government debt and inflation are set to become even more significant threats in the near future. As he advises, “Stay vigilant, be prepared, and understand that the Fed’s actions are only masking the underlying problems in the economy.”Support My Work – Help Secure a Stronger Future

If you enjoy reading Financial Anarchy and find value in the content I produce, I would greatly appreciate your support through a paid subscription or donation. While all my work is available for free, your support helps me maintain and grow this platform while providing for my family.

Your contributions allow me to continue creating high-quality, insightful material on finance, economics, and global events—without relying on outside funding. This means I can remain independent and focused on delivering the content that matters to you.

Becoming a paid supporter, even at a small level, helps improve my financial stability, allowing me to dedicate more time and resources to producing content you love. Every donation makes a difference, and your support truly means the world to me and my family.

Thank you for being part of Financial Anarchy. Together, we can continue to grow this community and keep the content coming!