Concerns About Inflation Resurgence

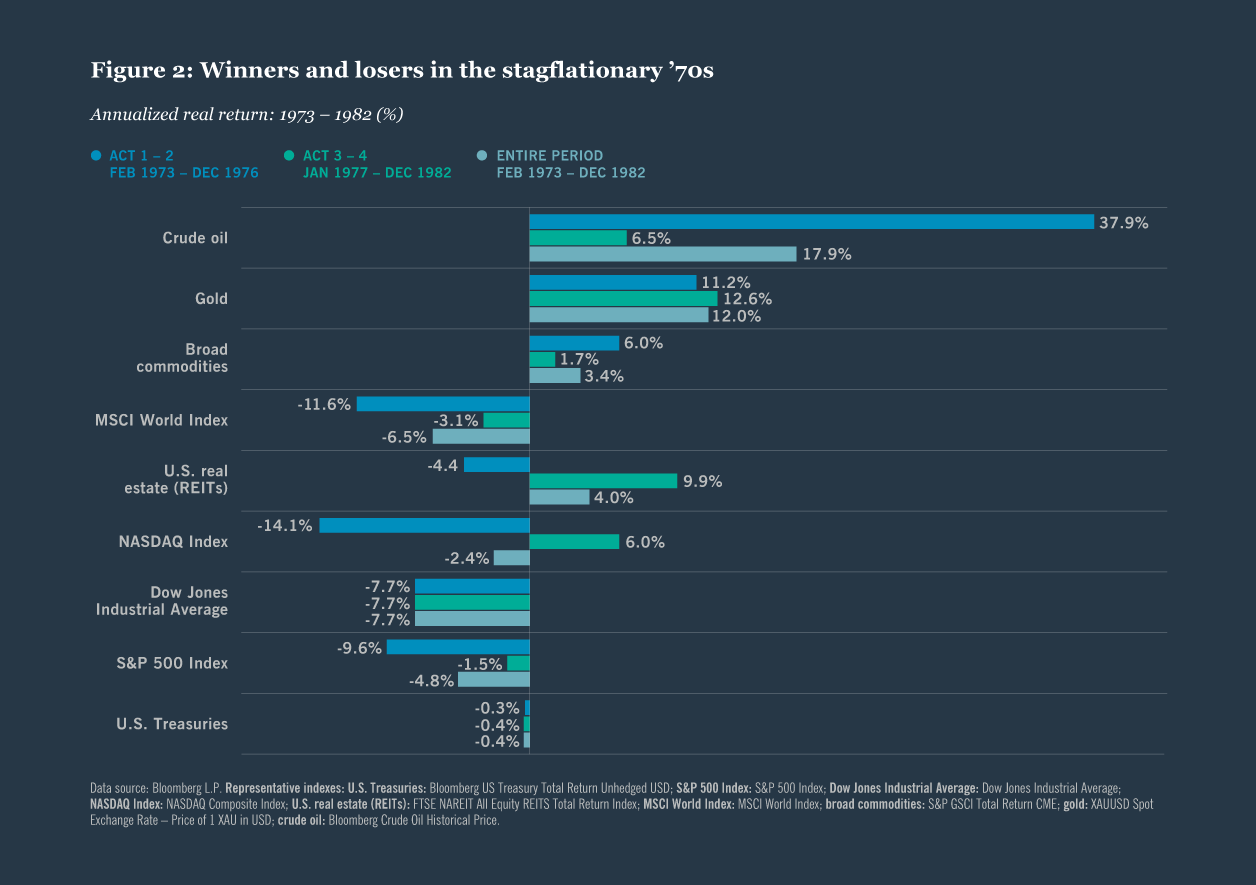

An increasingly salient concern that appears to be receiving insufficient attention is the looming possibility of a resurgence in inflation. Delving deeper into this issue, if we were to find ourselves in a scenario reminiscent of the stagflationary periods observed in the 1970s or 1940s, it's crucial to highlight the historical interplay between the resurgence of inflation and the downward trajectory of equity markets. This correlation unveils a complex relationship that has significant implications for economic dynamics.

Historical Patterns and Complex Dynamics

During these earlier stagflationary epochs, characterized by the coexistence of stagnant economic growth and elevated inflation, a distinct pattern emerged. Notably, the reacceleration of inflation coincided with a noticeable decline in equity markets. This synchronized movement between inflation and equity performance was not merely coincidental; but a manifestation of intricate economic forces at play.

Factors at Play

The underlying mechanism behind this correlation can be attributed to several intertwined factors. As inflation gains momentum, the purchasing power of consumers is eroded, leading to higher living costs. Consequently, consumer spending habits are altered, and the overall demand for goods and services may experience a contraction. In such an environment, businesses face challenges in maintaining profitability due to higher input costs and potential disruptions in consumer demand.

Challenges for Equity Markets

This dynamic tension between inflation and economic growth creates a challenging landscape for equity markets. The prospects of decreased consumer spending and reduced corporate profitability cast shadows over the optimism of investors, thereby triggering downward pressure on stock prices. Investors often grapple with uncertainty and decreased confidence in the face of rapidly changing economic conditions.

Historical Vulnerabilities

Moreover, the historical echoes of the 1970s and 1940s exemplify the inherent vulnerability of equities to such stagflationary forces. The realization that similar patterns occurred in these notable historical periods reinforces the notion that this phenomenon transcends isolated occurrences. It underscores the systemic nature of the relationship between inflation resurgence and equity market decline.

Contemporary Complexities

As we reflect on these historical precedents and the intricate dynamics they reveal, it becomes apparent that any resurgence in inflation could indeed hold significant repercussions for contemporary equity markets. While each era possesses its unique economic nuances, the underlying principles driving the interplay between inflation and equity performance remain relevant. Consequently, a nuanced understanding of this historical correlation can provide valuable insights into the potential impacts of current and future economic scenarios characterized by inflationary pressures.

The Role of Treasury Yields

The present economic landscape introduces unique complexities that differentiate it from historical stagflationary periods. A pivotal distinction lies in the structural characteristics of the current stagflationary environment, which warrants a more profound exploration to fully grasp its implications.

Inverted Treasury Curve

A central departure from historical norms is the presence of an inverted Treasury curve, a hallmark feature of the current economic scenario. Unlike previous stagflationary cycles where yield curves exhibited a more conventional behavior – with long-term yields decreasing while short-term yields remained relatively stable – the current landscape defies this pattern. Instead, a notable majority of yield spreads are inverted, signifying a situation where short-term yields surpass their longer-term counterparts.

Implications of Yield Curve Inversion

This inversion of the yield curve carries multifaceted implications. Historically, an inverted yield curve has often been interpreted as a harbinger of economic uncertainty and a potential recession. The phenomenon suggests that investors anticipate a future environment characterized by lower interest rates and subdued growth prospects. The current inversion amid stagflationary concerns reflects the intricate dance between economic indicators, investor sentiment, and market expectations.

Volatility in Fixed-Income Markets

In contrast to prior stagflationary periods, where yields generally moved in a more predictable fashion, the present situation introduces a level of volatility and uncertainty in the realm of fixed-income markets. The intricate interplay between short-term and long-term yields mirrors the intricate puzzle of economic forces at work, reflecting broader market sentiment as well as institutional and individual investment strategies.

Impact on Valuations

Additionally, the distinct nature of contemporary valuations further underscores the unique features of the current stagflationary environment. In comparison to the 1970s and 1940s, current market valuations are notably worse. This assessment hints at the potential vulnerabilities and imbalances that could amplify the impact of stagflation on equity markets. The combination of elevated valuations and inflationary pressures poses challenges that may surpass those experienced in previous decades.

Challenging Conventional Wisdom

In essence, the present stagflationary scenario challenges conventional wisdom and historical parallels. The inversion of the Treasury yield curve introduces an element of unpredictability, while the exacerbated valuations underscore the potential fragility of the market. This intricate web of factors suggests that the current dynamics are not a mere replication of historical patterns but rather an evolving narrative shaped by modern economic realities, policy decisions, and market dynamics.

Nuanced Evaluation of Stagflation

Diving deeper into the assessment of the prevailing economic landscape, it becomes apparent that the categorization of the current situation as a stagflationary scenario requires a more nuanced evaluation. While historical correlations between inflation and equity market performance are noteworthy, a closer examination of present factors suggests that a more comprehensive perspective is needed.

Distinctive Elements of the Current Environment

Disagreement with the notion of an ongoing stagflationary scenario stems from a recognition of the distinctive elements shaping the contemporary economic environment. Stagflation, as historically observed, entails the confluence of stagnant economic growth, rising unemployment, and heightened inflation. While elements of inflation have indeed emerged, other components such as overall growth and employment trends exhibit nuances that differ from classic stagflationary periods. Therefore, it's essential to avoid prematurely fitting the current situation into a preconceived historical framework.

Potential Impact on Equity Markets

However, the possibility of increased inflation's impact on equity markets remains a valid consideration. It is reasonable to anticipate that a resurgence in inflation could exert downward pressure on equities, especially if it is accompanied by uncertainty, volatility, and adjustments in investor behavior. The historical precedent of inflation being linked to market decline underpins this concern. Yet, this need not necessarily translate into a replica of past scenarios, given the unique dynamics at play today.

Shift in Investor Preferences

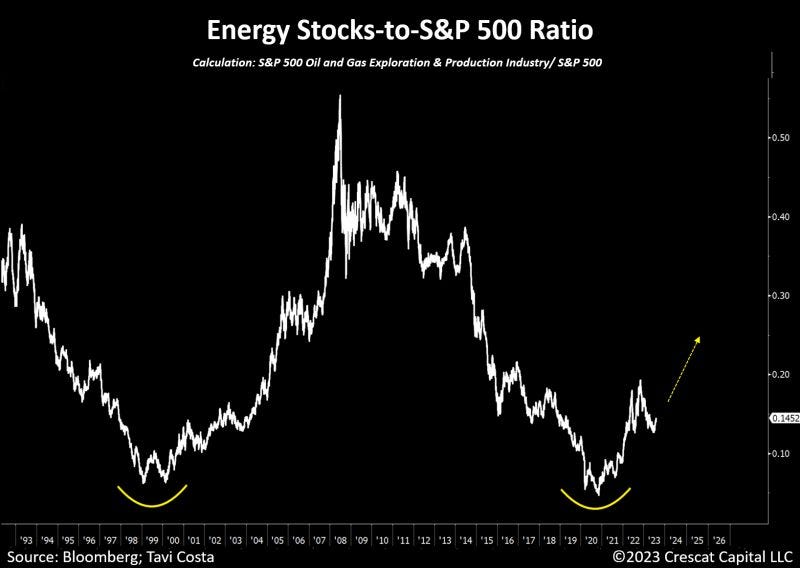

This viewpoint aligns with the insights shared in my recent LinkedIn post, where I delved into the resurgence of energy stocks outperforming the broader market. This observation reflects the intricate interplay between market sectors, investor sentiment, and broader economic trends. The energy sector's recovery after about nine months of underperformance signifies a potential shift in investor preferences, influenced by factors beyond inflation alone.

Factors Behind Energy Sector Resurgence

The outperformance of energy stocks can be attributed to several factors, including the shift from growth to value investing, where investors are drawn to sectors that display potential for robust performance in the face of evolving market conditions. The energy sector's resurgence also reflects the broader cyclicality of certain industries, such as natural resources and energy, which have a historical tendency to thrive during certain phases of economic cycles.

Holistic Interpretation

In essence, while acknowledging the potential impact of inflation on equity markets, it is crucial to avoid overly rigid categorizations. The complexities of the contemporary economic landscape, intertwined with shifting investor behavior and sectoral dynamics, necessitate a more holistic interpretation. By recognizing the multi-dimensional nature of these influences, one can better navigate the current environment, identifying both risks and opportunities that may not be fully captured by historical parallels alone.

Resource-Intensive Sectors and Cycles

Delving into the resurgence of energy stocks and its connection to historical trends reveals a fascinating interplay between market dynamics, economic cycles, and resource-intensive sectors. The revival of energy stocks is not an isolated phenomenon; rather, it finds its roots in a larger historical pattern shaped by multifaceted factors.

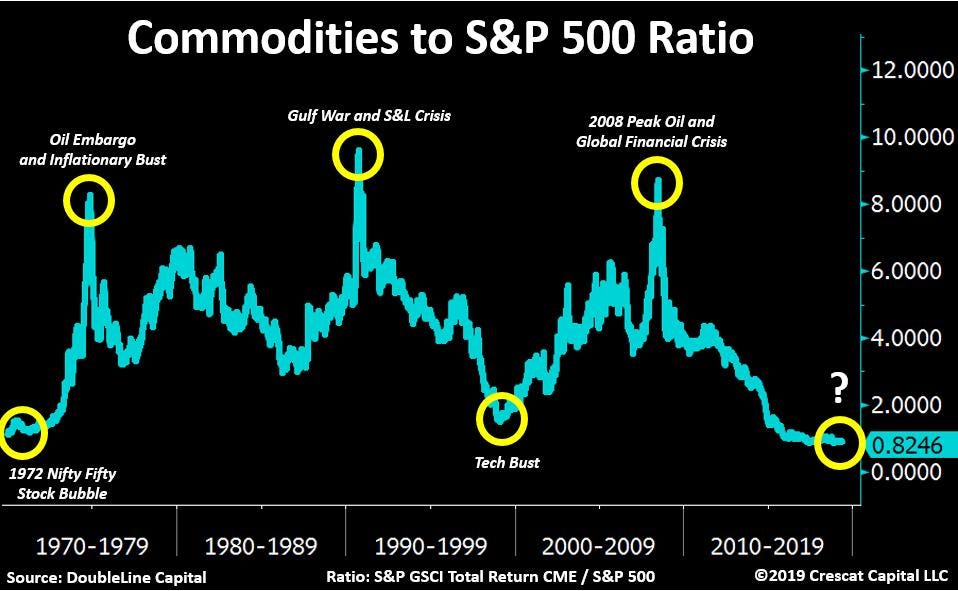

Cyclic Nature of Resource-Intensive Industries

At the heart of this trend lies a profound understanding of the cyclical nature of resource-intensive industries, such as mining and energy. Historical observations reveal a recurring pattern where periods of capacity cutbacks among natural resource producers are followed by phases of renewed prosperity in commodities. This cyclical behavior stems from the inherent nature of these industries, which are characterized by prolonged production cycles and the intricate interplay between supply and demand dynamics.

Transformative Phases in Industry Cycles

Capacity cutbacks and hesitance among natural resource producers to invest in new projects are significant indicators of industry sentiment. These actions often arise during periods of economic uncertainty, oversupply, or technological shifts that disrupt traditional business models. As producers scale back production and delay investments, the available supply of resources becomes constrained over time.

Role of Supply-Demand Imbalance

This, in turn, sets the stage for a transformative phase in the industry cycle. The reduced supply gradually aligns with resurging demand as economic conditions stabilize or technology advancements create new opportunities for resource utilization. The resulting supply-demand imbalance serves as a catalyst for price appreciation, benefiting industries that were previously grappling with oversupply.

Resurgence of Energy Stocks

The energy sector's resurgence in the present context aligns seamlessly with this historical pattern. The hesitance among energy producers to invest and expand capacity during periods of economic uncertainty or evolving energy landscapes contributes to a supply deficit over time. This trend lays the groundwork for a phase where demand for energy resources gains momentum due to global economic recovery or shifts in energy consumption patterns.

Long-Term Cycles and Investment Realities

Long-term cycles inherent in resource-intensive sectors, such as mining and energy, further magnify the significance of this trend. Increased supply, whether from new discoveries or capacity expansions, necessitates substantial time and capital investment. Exploration, development, and extraction processes are often complex, requiring meticulous planning, regulatory approvals, and substantial financial commitments. This extended timeline underscores the enduring nature of industry cycles, where changes in supply take time to materialize.

Shift in Investor Preferences

Understanding these historical trends enables investors and industry observers to anticipate the ebb and flow of resource-intensive sectors. The resurgence of energy stocks is thus not solely a response to short-term market dynamics but an outcome of broader cyclical patterns deeply rooted in the characteristics of these industries. By recognizing the link between capacity cutbacks, industry sentiment, and long-term supply-demand dynamics, stakeholders can better position themselves to navigate the intricacies of resource markets and potentially capitalize on the opportunities presented by these cyclical trends.

Value-Oriented Shift and Energy Sector

The ongoing shift in investor preferences from growth-oriented stocks to value-oriented ones introduces a compelling layer to the resurgence of energy stocks and its broader implications for market dynamics. This shift reflects a market sentiment that recognizes the significance of tangible assets, dividends, and industries that exhibit resilience amid evolving economic conditions.

Energy's Role in Transformation

Energy's role in this transformation is pivotal. Historically, value-oriented sectors like energy have displayed characteristics that resonate with investors seeking stability and tangible returns. The intrinsic link between energy companies and the production of essential resources positions them favorably in value-focused investment strategies. This linkage is especially relevant in the context of evolving global energy demands, which underscore the vital role that energy resources continue to play in driving economic growth.

Continued Outperformance

In light of this shift, the anticipation of continued outperformance within the energy sector gains credence. The energy sector's positive performance over a recent nine-month period can be understood as a phase within a broader market trend. This trend transcends short-term market fluctuations and aligns with the recognition that value-oriented industries, including energy, are poised to thrive as investor preferences evolve.

Market Cycles and Energy Sector

This perspective aligns with the concept of market cycles, where sectors experience varying degrees of prominence as economic and investment paradigms shift. As the energy sector demonstrates resilience and potential for sustained growth within a value-driven framework, its positive trajectory becomes less of an isolated occurrence and more of a reflection of broader market dynamics.

Visual Representation of Growth Potential

Moreover, the accompanying chart serves as a visual representation of the immense growth potential that this trend holds. The upward trajectory depicted in the chart reinforces the notion that the current positive performance of the energy sector is merely the initial phase of a more significant journey. The chart underscores the depth of value that energy stocks can offer within a larger investment context.

Expectations of Continued Performance

Considering these factors, it's reasonable to anticipate that the energy sector's positive performance is likely to persist. As value-oriented strategies gain prominence, the sector's alignment with these strategies strengthens its position. While market cycles are nuanced and subject to various factors, the historical context, evolving market sentiment, and the intrinsic role of energy resources all point towards the potential for the energy sector to thrive as a core component of a diversified investment portfolio.

Conclusion:

In sum, the ongoing shift from growth to value, coupled with the enduring relevance of energy resources, fuels the expectation of continued outperformance within the energy sector. The recent period of growth is part of a broader trend, and the accompanying chart accentuates the significant growth potential that lies ahead, underscoring that we are still in the early stages of this transformative journey.

Like, Subscribe, and Share to Spread the Word!

Subscribed

If you found this analysis informative and eye-opening, we invite you to like, subscribe, and share this video to help us spread the word. Together, we can build a community of Financial Anarchy advocates who are dedicated to promoting financial literacy and advocating for sound monetary policies. By amplifying our message, we can empower individuals to take control of their financial well-being and contribute to a more equitable and sustainable future.

Support Our Work with a Bitcoin Donation

We also offer the opportunity to support our work and help us continue building the Financial Anarchy community. If you would like to make a contribution, we gratefully accept donations in Bitcoin. Your support will enable us to create more educational content, engage in meaningful activism, and further our mission of challenging the status quo. To donate, please use the following Bitcoin address:

1EkmtWDYzuhkiv3iYozKVnZFxsQxDetnfH

Thank you for joining us on this journey of understanding and change. Together, we can shape a brighter financial future for all.