The Rise of Central Bank Gold Purchases: Economic, Geopolitical, and Regulatory Drivers

Exploring the Impact of US Dollar Devaluation, COVID-19, and Basel III on Central Bank Gold Holdings

In the first few months of 2023, central banks have been buying gold at a record-breaking pace. According to the World Gold Council, central banks purchased 116.5 metric tons of gold in the first quarter of 2023. This is the largest increase in quarterly gold buying by central banks in nearly a decade, and it is more than double the amount that was purchased in the same period last year.

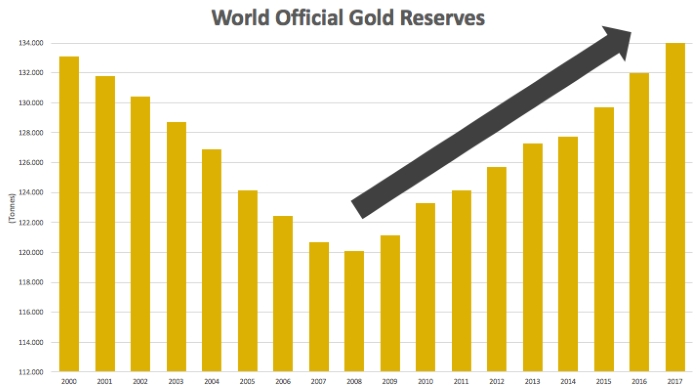

Central banks have been buying gold for several reasons, including diversification of their reserves, reducing their exposure to the US dollar, and hedging against geopolitical risks. In the past, central banks have been net sellers of gold, but this trend has shifted since the financial crisis of 2008. Since then, central banks have been net buyers of gold, and this trend has only intensified in recent years.

Central banks purchased a total of 651.5 metric tons of gold in 2022, which was a 4% increase from the previous year. However, the first quarter of 2023 alone saw a 17% increase in central bank gold purchases compared to the entire year of 2022. This is a significant shift in the trend of central bank gold purchases, and it reflects a growing demand for the yellow metal as a safe-haven asset.

One of the major factors contributing to the increase in central bank gold buying is the Basel III regulations, which came into effect on January 1, 2023. These regulations require banks to hold higher-quality capital, and they also assign a risk-weight to gold that is equivalent to other Tier 1 assets, such as cash and government bonds. This means that gold can now be considered as a highly liquid and secure asset that can be used to meet liquidity requirements.

The Basel III regulations have had a significant impact on gold holdings, particularly for European central banks. These banks hold large amounts of sovereign debt, and the new regulations require them to have more high-quality liquid assets on their balance sheets. Gold fits the bill as a safe and liquid asset that can help banks meet these requirements. As a result, European central banks have been buying gold at a faster pace than their counterparts in other regions.

The history of central bank gold purchases dates back to the 19th century when gold was used as a standard for international trade and settlements. The United States adopted the gold standard in 1879, and other countries followed suit. The gold standard was abandoned during World War I, but it was reinstated in the 1920s. During this period, central banks were active buyers of gold, as they needed it to back their currencies and maintain a fixed exchange rate.

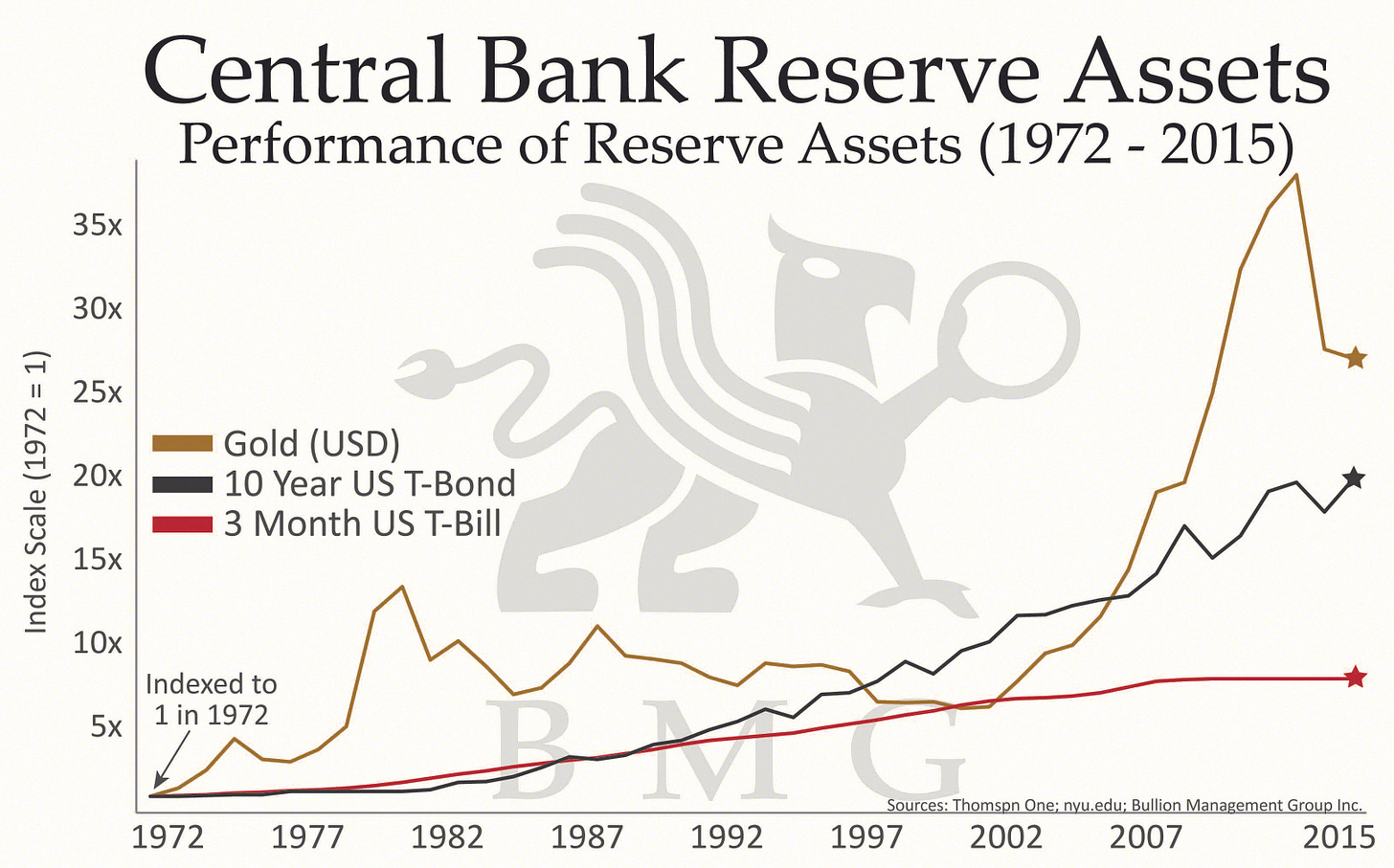

After World War II, the Bretton Woods Agreement established the US dollar as the world's reserve currency, and central banks began accumulating US dollars instead of gold. However, in the 1960s, the US faced a balance-of-payments deficit, and other countries began to demand gold in exchange for their dollars. This led to a drain on the US gold reserves, and in 1971, President Nixon suspended the convertibility of the dollar into gold, effectively ending the gold standard.

In the 1970s and 1980s, central banks were net sellers of gold as they attempted to diversify their foreign exchange reserves and raise funds to support their economies. The United States, for example, sold off over half of its gold reserves between 1978 and 1980. In the 1990s, however, the trend began to reverse, and central banks became net buyers of gold again.

One of the drivers behind the increase in central bank gold purchases in the 1990s was the breakdown of the Soviet Union. Central banks in the former Soviet bloc were eager to diversify their foreign exchange reserves and reduce their dependence on the US dollar. Many of these countries began accumulating gold as a way to achieve this goal. China also began buying gold in the 1990s, although its purchases were relatively small at the time.

In the 2000s, central bank gold purchases increased, with China becoming a major buyer. In 2003, China announced that it had increased its gold reserves by 400 tonnes, a move that surprised the gold market and sparked a rally in gold prices. Other emerging market central banks also began buying gold, as they sought to diversify their reserves and reduce their exposure to the US dollar.

The financial crisis of 2008-2009 also played a role in driving central bank gold purchases. The crisis highlighted the vulnerabilities of the global financial system, and many central banks began to question the stability of the US dollar and other fiat currencies. Gold, with its long history as a store of value and safe haven asset, became an attractive alternative.

In recent years, central bank gold purchases have continued to increase, reaching record levels in 2018 and 2019. According to the World Gold Council, central banks purchased 651.5 tonnes of gold in 2018, the highest level of net purchases since 1967. In 2019, central banks bought 650.3 tonnes of gold, with Russia, China, and Turkey being the largest buyers.

In 2020, central banks around the world bought a total of 650.3 tonnes of gold, up from 570.2 tonnes in 2019. This represents the largest annual increase in gold purchases by central banks since the end of the gold standard in 1971. The increase in gold purchases was driven in part by the economic uncertainty created by the pandemic, which led many central banks to seek out safe-haven assets like gold.

One notable example of a central bank increasing its gold purchases in response to the pandemic is the Bank of Russia. In 2020, the Bank of Russia bought a total of 264.3 tonnes of gold, more than any other central bank in the world. This was a significant increase from the 158.1 tonnes of gold that the bank purchased in 2019.

Another central bank that increased its gold purchases in response to the pandemic is the People’s Bank of China. In 2020, the People’s Bank of China bought a total of 67.4 tonnes of gold, up from 41.8 tonnes in 2019. The bank cited the need to diversify its reserves as the main reason for the increase in gold purchases.

Other central banks that increased their gold purchases in 2020 include the Reserve Bank of India, the National Bank of Kazakhstan, and the Central Bank of Turkey. All of these central banks cited the need to diversify their reserves and mitigate risk as the main reasons for increasing their gold purchases.

While the COVID-19 pandemic has played a significant role in driving up gold purchases by central banks, it is not the only factor at play. Central banks have been increasing their gold purchases for several years now, in response to a number of economic and geopolitical factors.

One of the main factors driving central bank gold purchases in recent years has been the decline in the US dollar. As the world’s reserve currency, the US dollar has traditionally been the primary asset held by central banks around the world. However, in recent years, the US dollar has lost value relative to other major currencies, such as the euro and the yen. This has led many central banks to seek out alternative assets, such as gold, as a way to diversify their reserves and mitigate risk.

Another factor driving central bank gold purchases is the rise of geopolitical tensions around the world. As political and economic uncertainty increases, many central banks are turning to gold as a way to hedge against potential disruptions in the global financial system.

In the near future, it is probable that central banks will maintain a consistent pace of gold acquisitions. The depreciation of the US dollar and the financial ambiguity caused by the COVID-19 pandemic will persist as driving forces behind the demand for gold as a safe haven asset. Additionally, the implementation of the Basel III regulation will likely incentivize central banks to acquire more gold, as it has made the asset more appealing for central bank reserves.

Like, Subscribe, and Share to Spread the Word!

Subscribed

If you found this analysis informative and eye-opening, we invite you to like, subscribe, and share this video to help us spread the word. Together, we can build a community of Financial Anarchy advocates who are dedicated to promoting financial literacy and advocating for sound monetary policies. By amplifying our message, we can empower individuals to take control of their financial well-being and contribute to a more equitable and sustainable future.

Support Our Work with a Bitcoin Donation

We also offer the opportunity to support our work and help us continue building the Financial Anarchy community. If you would like to make a contribution, we gratefully accept donations in Bitcoin. Your support will enable us to create more educational content, engage in meaningful activism, and further our mission of challenging the status quo. To donate, please use the following Bitcoin address:

1EkmtWDYzuhkiv3iYozKVnZFxsQxDetnfH

Thank you for joining us on this journey of understanding and change. Together, we can shape a brighter financial future for all.