The Role of Gold and Silver in Mitigating Multifaceted Financial Risks

In today's volatile financial landscape, characterized by bubble stock markets, uncertain interest rates, looming inflation, and geopolitical tensions, investors are seeking refuge from the storm of risks threatening their portfolios. Amidst this uncertainty, gold and silver emerge as traditional safe havens, offering a shield against the myriad of threats lurking in the global economy.

Understanding the Risks

The current environment presents a unique confluence of risks across various sectors:

Equity Markets: The fragility of bubble stock markets, particularly driven by a handful of tech giants, poses a significant threat to the broader market stability.

Banking Sector: The specter of insolvent banks, buoyed temporarily by government interventions, looms large as support programs near their end.

Interest Rates and Inflation: The uncertainty surrounding interest rate movements and the persistent threat of inflation add further complexity to the investment landscape.

Geopolitical Shifts: Geopolitical shifts towards oil-rich nations raise concerns about global stability and economic resilience.

The Appeal of Gold and Silver

In the face of these challenges, gold and silver stand out as time-tested assets capable of preserving wealth and hedging against economic turmoil. Historically, precious metals have served as a premier hedge against inflation and a safe harbor during times of crisis, offering investors a means to safeguard their portfolios. As investors reassess their asset allocations in light of escalating risks, the appeal of gold and silver as alternative stores of value becomes increasingly apparent.

Factors Driving Demand

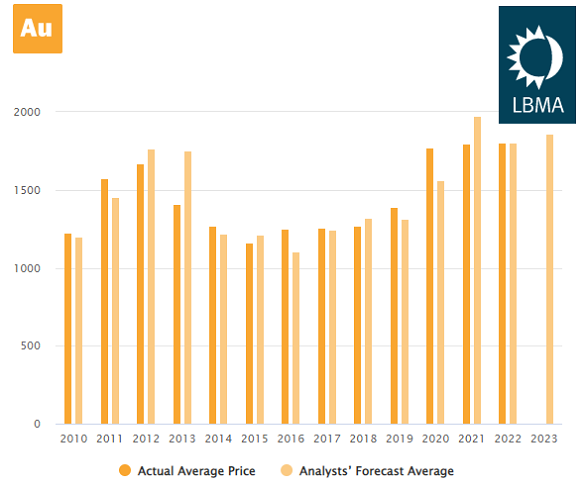

The prevailing economic conditions underscore the importance of considering gold and silver as essential components of an investment strategy. With interest rates potentially poised to decline amidst elevated inflation expectations, the allure of precious metals is likely to intensify. The recent accumulation showed by Central Banks and the insanity of the US debt levels are also a key factor. Despite the recent period of sideways movement in gold and silver prices, primarily driven by subdued inflation expectations, the potential for a resurgence in demand remains significant.

Portfolio Diversification and Risk Mitigation

Moreover, in the event of a banking crisis or stock market downturn, the flight to safety could drive investors towards gold and silver, further bolstering their appeal as portfolio diversifiers. Notably, as traditional fixed-income instruments offer meager returns relative to inflation, the attractiveness of precious metals as an alternative becomes more pronounced.

Blind Spots and Considerations

However, despite their evident strengths, gold and silver investments are not without their blind spots:

Price Volatility: Precious metals can exhibit significant price volatility, posing risks for investors who believe it can generate an overnight 10x.

Regulatory Changes: Changes in regulatory frameworks can impact the liquidity and accessibility of gold and silver markets.

Opportunity Cost: Holding gold and silver may entail opportunity costs, particularly in periods of economic stability.

Conclusion

In conclusion, the role of gold and silver in reducing portfolio risk is undeniable, particularly in today's uncertain economic climate. As investors navigate the complexities of a volatile market environment, the appeal of precious metals as safe-haven assets is poised to grow. However, prudent investment decisions require a comprehensive understanding of the risks and potential benefits associated with gold and silver. By incorporating these timeless assets into a diversified investment strategy, investors can enhance their resilience to the multifaceted risks that define the modern financial landscape.