The Stability of a Gold and Silver Monetary System

Why a Money System Based on Precious Metals Would Reduce Inflation and Promote Economic Stability

Some argue that true money is only gold and silver, while all paper fiat currencies are simply a currency. As Ayn Rand once said, "Money is only a tool. It will take you wherever you wish, but it will not replace you as the driver." This is because gold and silver have been used as money for thousands of years, while fiat currency is a relatively recent invention that is not backed by anything tangible.

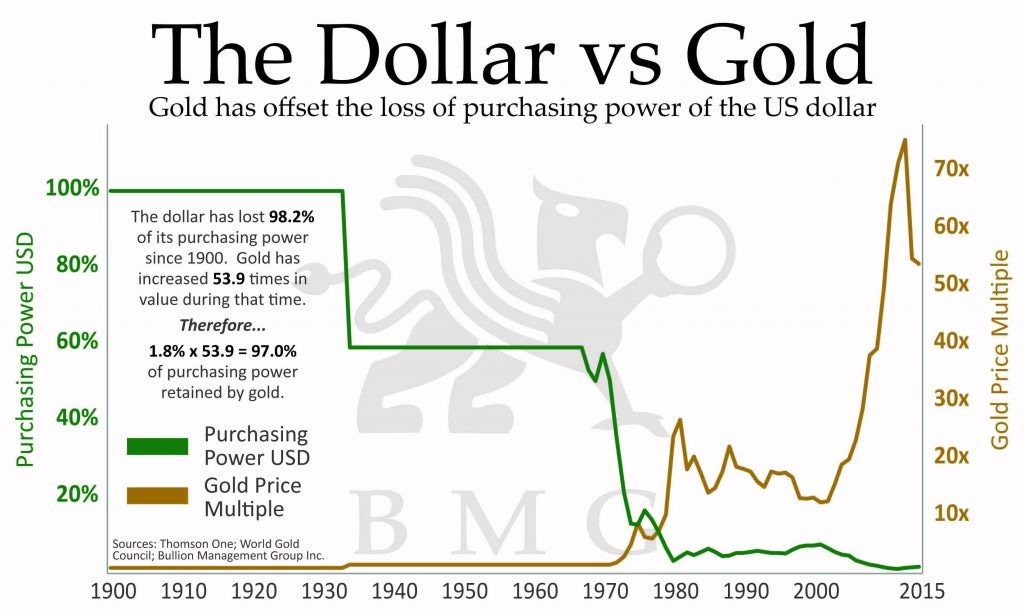

According to this perspective, God's money is precious metals, which have inherent value and are considered a gift from God. The limited supply and inherent value of precious metals make them a reliable store of value that can retain their value over time. On the other hand, fiat currencies are considered dangerous and unstable in the long term, as they can lose their value over time due to inflation and excessive currency printing. As Ronald Reagan once said, "Inflation is as violent as a mugger, as frightening as an armed robber, and as deadly as a hitman."

In a scenario where money is defined as only gold and silver, prices would likely be much more stable than in an economy with fiat currency. This is because the supply of gold and silver is relatively limited, and their value is widely recognized and accepted. As a result, the fluctuations in the value of gold and silver would be relatively small, leading to a more stable price environment.

In addition, inflation would not be as much of a problem in an economy where money is defined as only gold and silver. Inflation is typically caused by an increase in the money supply, which leads to an oversupply of money relative to the supply of goods and services, thus, rising prices. However, because the supply of gold and silver is limited, it is much harder for governments to artificially increase the supply of money and cause inflation.

Furthermore, because gold and silver have intrinsic value, they would retain their purchasing power over time. This means that individuals who hold gold and silver would be less likely to lose the value of their wealth due to inflation or currency devaluation. Overall, an economy where money is defined as only gold and silver would likely have more stable prices and be less vulnerable to inflationary pressures.

However, there are also some potential drawbacks to a gold and silver-based monetary system. For one, it can be challenging to manage the supply of money since it is directly linked to the availability of gold and silver. In addition, the cost of producing and storing physical gold and silver can be expensive, which could increase transaction costs.

Overall, a gold and silver-based monetary system would likely be more stable than a fiat currency system, but it could also be more challenging to manage and could come with some additional costs.

In conclusion, while currency and money are often used interchangeably, they are not the same thing. Money refers to a stable medium of exchange that has a generally accepted value, while currency specifically refers to a form of money issued by a government or central bank. According to some, true money is only gold and silver, which have inherent value and are a reliable store of value over time. As J.P. Morgan once said, "Gold is money, everything else is credit."