The Unforeseen Implications of UK's Rising Inflation

Unmasking the Escalating Inflation Crisis: Implications, Challenges, and Calls for Preparedness

Introduction

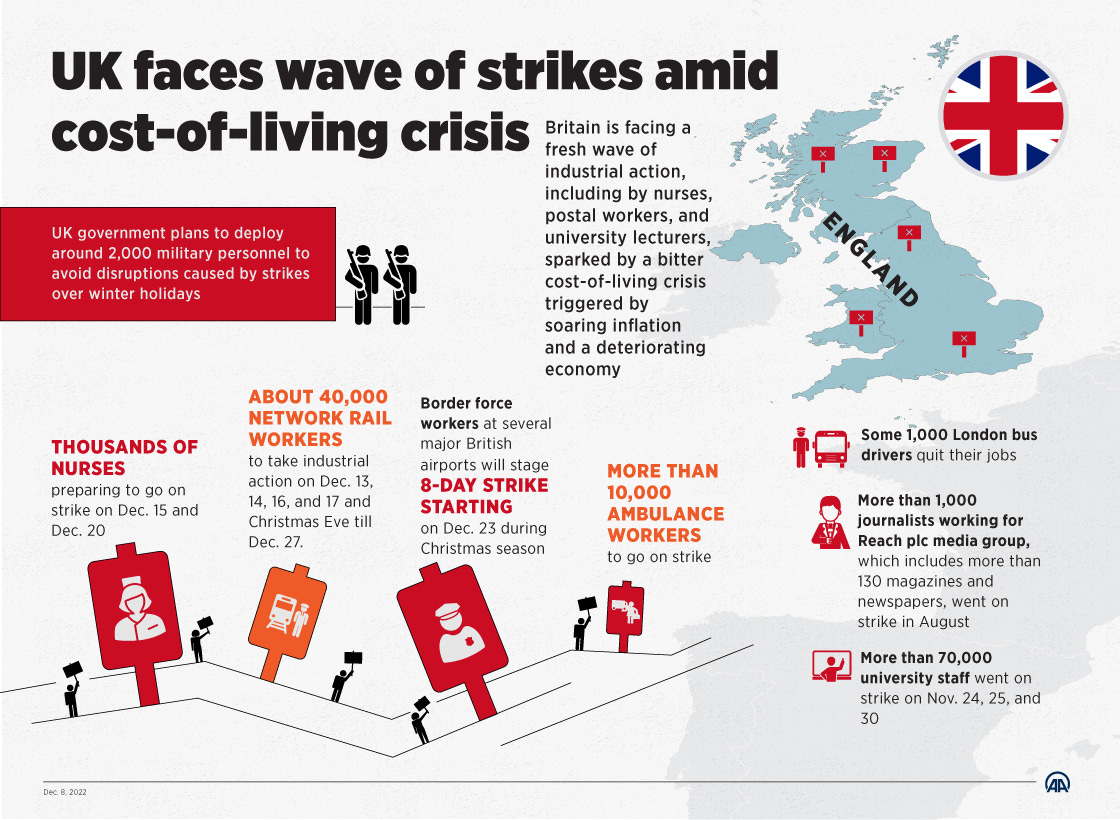

Recent headlines originating from the UK shed light on the intensifying inflation crisis and its potential ramifications not only for the UK but also for the United States. As Europe's economic conditions often foreshadow those of the US, the UK's current predicament demands scrutiny due to its interconnectedness with the American economy. Surprisingly, the surge in inflation has been largely overlooked by economists and policymakers, despite its profound implications for the British economic landscape.

Unexpected Inflation

The shock was caused by the unexpectedly high inflation rate in the UK, reaching a 30-year peak. There is frustration at the continuous occurrence of unforeseen events, emphasizing the unreliability of economic experts who failed to anticipate this development. Despite claims of quantitative tightening and attempts to stabilize the economy, rampant money printing persists, ultimately fueling inflationary pressures. There also are concerns regarding the sustainability of this inflationary trend, questioning whether it has reached its peak or if there is more to come.

Stagflation: A Growing Concern

Stagflation, which refers to a combination of stagnant economic growth and high inflation, finds its roots in the 1990s recession experienced by the UK. By comparing the current situation to the past economic downturn, one can recognize the severe repercussions encountered during that period. The emergence of unexpectedly elevated inflation rates, particularly in essential consumer sectors like services, suggests the possibility of a similar predicament unfolding. Moreover, the looming specter of heightened interest rates intensifies concerns as it may hinder individuals' capacity to obtain loans, thus adding strain to the overall economy.

The Inflationary Impact

The significant implications of rising inflation, particularly in essential sectors such as food, energy, and housing. Core prices, excluding these necessities, have also witnessed a considerable acceleration. The irony is that items essential for survival experience alarming inflation while other discretionary items remain relatively stable. This disparity underscores the growing challenges faced by individuals as the cost of living continues to rise, further exacerbating the economic turmoil.

Uncertainty and Unpreparedness

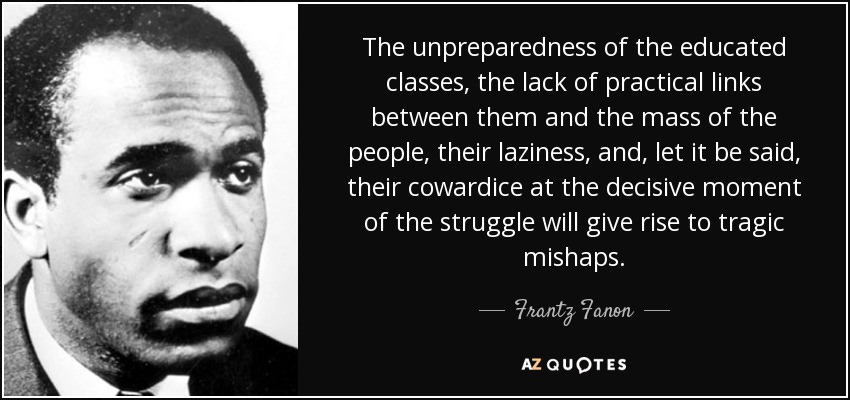

The lack of preparedness among both the general population and policymakers in dealing with the escalating crisis. There is frustration at the prevailing ignorance and complacency surrounding the situation. The failure of economists to accurately predict and address the problem is viewed as a significant flaw in the system. All individuals should take a proactive approach, breaking away from the majority who remain oblivious to the impending consequences.

Implications for Monetary Policy

The potential response of central banks to the rising inflation rates. The likelihood of interest rate hikes is discussed, with traders already speculating on the Bank of England's (BoE) actions. An increase in interest rates suggests that the BoE may surpass the initially projected rate hike of 4.5% to 4.75%. However, the uncertainty and unpredictability of central bank decisions are also acknowledged, with past pauses in rate hikes being proven incorrect due to subsequent inflationary pressures.

Conclusion

The unwelcome surprise of rising inflation in the UK, defying the expectations of economists and policymakers. It underscores the potential ramifications of such a development, including the adverse effects of stagflation and the challenges faced by individuals due to increased living costs. The transcript also highlights the need for better preparation, critical thinking, and proactive measures to effectively navigate these uncertain economic times. Ultimately, it serves as a wake-up call, urging readers to be mindful of the economic indicators and their potential consequences.

Like, Subscribe, and Share to Spread the Word!

Subscribed

If you found this analysis informative and eye-opening, we invite you to like, subscribe, and share this video to help us spread the word. Together, we can build a community of Financial Anarchy advocates who are dedicated to promoting financial literacy and advocating for sound monetary policies. By amplifying our message, we can empower individuals to take control of their financial well-being and contribute to a more equitable and sustainable future.

Support Our Work with a Bitcoin Donation

We also offer the opportunity to support our work and help us continue building the Financial Anarchy community. If you would like to make a contribution, we gratefully accept donations in Bitcoin. Your support will enable us to create more educational content, engage in meaningful activism, and further our mission of challenging the status quo. To donate, please use the following Bitcoin address:

1EkmtWDYzuhkiv3iYozKVnZFxsQxDetnfH

Thank you for joining us on this journey of understanding and change. Together, we can shape a brighter financial future for all.