Treasury Buyback Operations

How Government Debt Management Affects Market Dynamics and Investment Opportunities

Introduction

In the complex and ever-changing world of finance, making informed investment decisions requires a deep understanding of market dynamics and effective risk management strategies. This article draws on the expertise of financial professionals Paul and Chris, who bring decades of experience and a nuanced understanding of the financial markets. Their insights are designed to help investors navigate current market conditions, manage risks effectively, and safeguard their financial future, particularly in retirement.

Paul and Chris are affiliated with Peak Financial Investing, a firm dedicated to providing tailored financial advice and services. Through their work, they aim to educate and empower investors by highlighting the importance of historical market valuations, the critical role of energy in economic growth, and the necessity of proactive risk management.

In this article, we distill their valuable insights into practical advice for investors. We explore historical market trends, current market risks, and the implications of technological advancements like AI. We also emphasize the importance of personalized risk management strategies, particularly for retirees, who are most vulnerable to market volatility.

Historical Market Valuations and Their Lessons

Paul provides a historical perspective on market valuations, emphasizing the importance of price-to-earnings (P/E) ratios. He explains that:

A P/E ratio of 20 is historically expensive.

A P/E ratio of 15 is considered fairly priced.

A P/E ratio of 10 represents an exceptional buying opportunity.

Reviewing market history from 1926 to the present, Paul notes that major market declines, such as those during the Great Depression and the 1970s, created prime buying opportunities due to significantly lower valuations.

The Role of Energy in Economic Growth

Chris introduces the critical role of energy, particularly oil, in driving economic growth. He cautions that the assumptions of unlimited energy availability, which have underpinned past economic growth, may no longer hold true.

Key Insights:

Energy as a Growth Driver:

Historically, abundant and cheap energy has fueled economic expansion and productivity improvements.

The next 20 years may see significant shifts in energy availability and consumption patterns.

Implications for Investors:

Investors must consider the potential impact of energy constraints on economic growth and market performance.

The transition to alternative energy sources and the role of technology in optimizing energy use will be crucial factors.

The Double-Edged Sword of AI

Paul and Chris discuss the transformative potential of artificial intelligence (AI) and its implications for the economy and job market.

Key Insights:

Efficiency and Displacement:

AI promises significant efficiency gains but also poses a risk of widespread job displacement.

Sectors like legal services and construction are already seeing early impacts of AI and automation.

Economic Growth and Job Market:

While AI can drive economic growth through increased productivity, it also raises concerns about income inequality and job security.

Policymakers and investors need to consider strategies to mitigate the negative impacts of AI on the workforce.

Risk Management: Protecting Your Capital

Effective risk management is essential, especially for retirees who rely on their investments for income. Paul stresses the importance of having a robust risk management strategy to navigate market volatility.

Key Insights:

The Importance of Risk Management:

A significant market decline can dramatically impact retirees who are drawing income from their investments.

Investors need to be aware of their risk tolerance and have strategies in place to protect their capital.

Modern Portfolio Theory:

While Modern Portfolio Theory (MPT) has been a cornerstone of investment strategy, its assumptions may not hold true in current market conditions.

Paul suggests that retirees need to move beyond MPT and adopt a more dynamic approach to risk management.

Tailored Strategies for Retirees:

Retirees should evaluate their portfolios to ensure they can withstand potential market declines.

Diversification, regular portfolio reviews, and adjustments based on market conditions are crucial for long-term financial security.

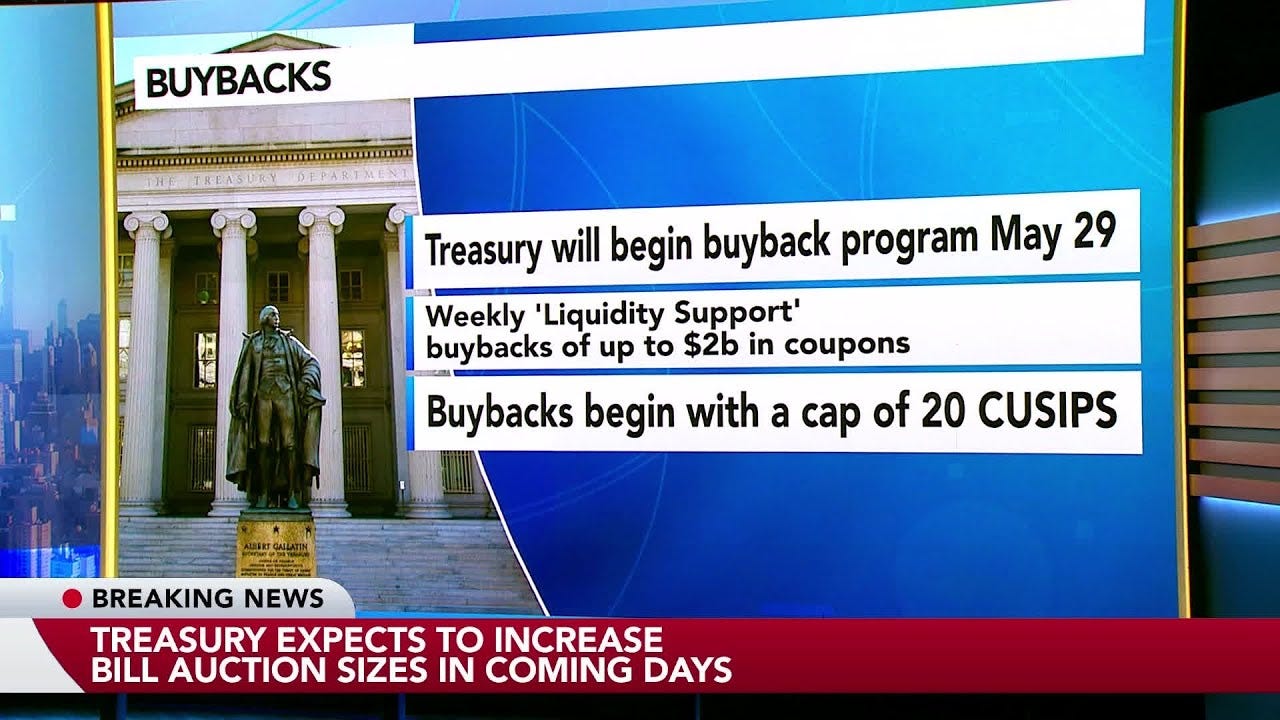

Understanding Treasury Buyback Operations: Implications for Investors

Treasury buyback operations are a critical aspect of fiscal policy management and have significant implications for investors, especially in times of economic uncertainty. In this section, we'll delve into what treasury buybacks are, why they are conducted, and how they can affect the investment landscape.

What are Treasury Buybacks?

Treasury buyback operations involve the government repurchasing its own debt securities, such as bonds, from the market. This is typically done to manage the national debt and improve the efficiency of fiscal policy. By buying back debt, the government can reduce the total debt burden and often, the cost of servicing that debt.

Why Conduct Treasury Buybacks?

Debt Management:

The primary reason for treasury buybacks is to manage the maturity profile of the national debt and avoid the clustering of debt maturities. By smoothing out maturities, the government can avoid large lump-sum repayments in any single period, which might strain fiscal resources.

Interest Cost Reduction:

When interest rates fall, treasury buybacks allow the government to retire older securities that have higher interest rates. Reissuing new securities at lower rates reduces the overall cost of borrowing.

Market Signaling:

Buyback operations can also serve as a tool for signaling government confidence in economic policies and fiscal stability. A well-timed buyback can bolster market confidence and stabilize bond markets, especially during volatile periods.

Effects on Investors

Impact on Bond Prices and Yields:

Treasury buybacks generally lead to an increase in the prices of the bonds being bought back, as the supply in the market decreases. For bond investors, this can mean capital gains on bonds they hold. Conversely, yields on these bonds decrease, impacting investors who rely on interest income.

Market Liquidity and Portfolio Adjustments:

Buybacks can affect the liquidity of certain bonds, which might compel investors to adjust their portfolios. For instance, if long-term bonds are being bought back, investors might shift to shorter maturities or different asset classes.

Long-Term Implications:

For long-term investors, understanding the government's debt management strategy can provide insights into future economic policies and interest rate movements. Strategic adjustments in investment portfolios can be made to align with these insights.

Conclusion

Navigating the financial markets requires a comprehensive understanding of historical trends, current risks, and the implications of technological advancements. Paul and Chris from Peak Financial Investing offer valuable insights to help investors make informed decisions and manage risks effectively.

By understanding the role of P/E ratios in market valuations, the critical importance of energy in economic growth, and the dual nature of AI, investors can better prepare for the future. Additionally, adopting a proactive risk management strategy, particularly for retirees, is essential to protect and grow investments.

Peak Financial Investing is committed to providing personalized financial advice and services to help investors achieve their financial goals. Whether you're planning for retirement or looking to optimize your investment strategy, their expertise can guide you through these challenging times.

For more information and to discuss your investment strategy, visit Peak Financial Investing and schedule a consultation with their experienced team.