In this insightful podcast discussion with Elijah K. Johnson from Liberty and Finance, Tavi Costa, partner at Crescat Capital, offered a deep dive into the global economic shifts currently underway, with a focus on the US dollar, precious metals, and the evolving landscape for emerging markets. Costa, known for his macroeconomic expertise, shared his perspectives on key issues such as the decline of the US dollar, the pivotal role of gold and silver, and the possibility of radical changes to the global financial system.

The Impact of Scott Bessent’s Potential Treasury Secretary Appointment

One of the most intriguing aspects of the conversation revolved around the potential appointment of Scott Bessent as Treasury Secretary under a Trump administration. Costa shared his belief that Bessent’s appointment might not be the bearish signal that many in the markets assumed.

Costa stated, “I actually think Scott Bessent could be really bullish for gold.” He explained that Bessent, who is known for his pro-gold stance, may play a pivotal role in a broader global monetary realignment. Costa pointed out that Bessent has publicly stated that gold is one of his largest positions, reflecting a belief that gold could become increasingly critical in a world where fiat currencies face significant challenges. He continued, “Gold could come back into the fold as a real backing to currencies, just like in the Bretton Woods system, and this could lead to a huge demand for gold globally.”

Costa’s optimistic view is rooted in the broader trend of central banks and national governments returning to gold as a hedge against the increasing vulnerability of fiat currencies, particularly the US dollar. “If Bessent’s influence leads us toward a system where gold has a greater role, this could be a significant turning point for the precious metals market,” Costa emphasized.

The Decline of the US Dollar and its Impact on Global Markets

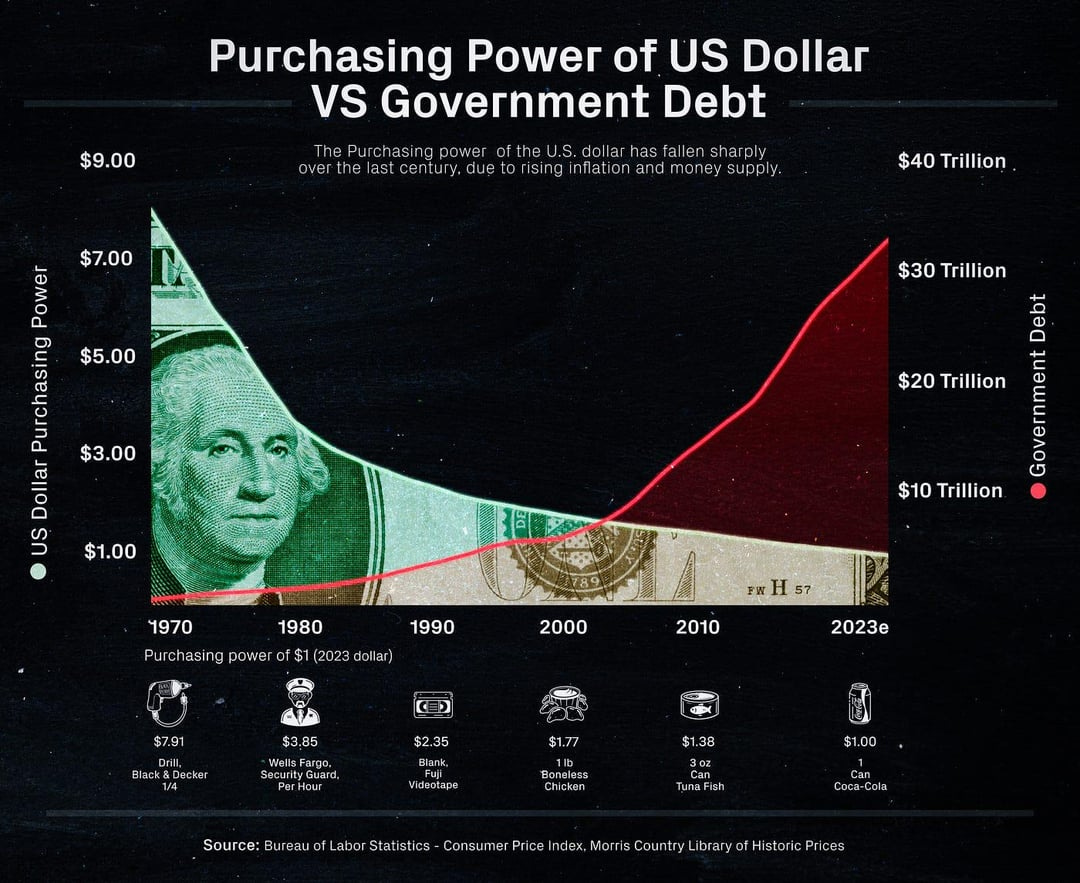

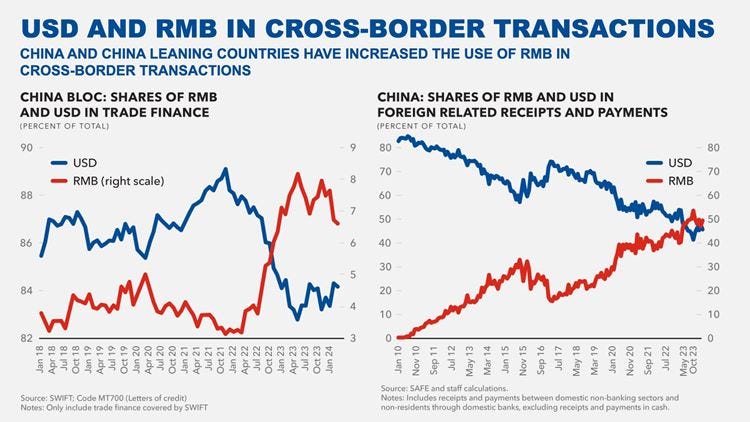

Costa also shared his bearish outlook on the US dollar, suggesting that its days as the dominant global reserve currency may be numbered. “I think the US dollar has probably peaked,” Costa noted, pointing to its recent rally driven by rising 10-year yields and inflation expectations. He explained that the dollar’s current strength is largely a result of speculative behavior rather than underlying economic fundamentals.

Costa raised concerns about the unsustainable fiscal policies of the US, especially the nation’s massive debt load, and the potential for a sharp devaluation of the dollar in the near future. “If policymakers continue on the current path, the US may face a scenario where the dollar is forced to devalue significantly, and we may experience a period of hyperinflation,” Costa warned. This could create an environment where the US is forced to rely on gold and precious metals to stabilize the economy, making them more critical than ever.

He also touched on the broader implications of a weakening dollar on global capital flows, suggesting that as the dollar loses strength, foreign markets—especially those in emerging economies—could see a resurgence in investment. Costa forecasted that “foreign markets are likely to outperform the US for the first time in over 20 years,” as investors shift their focus from an overvalued US stock market to undervalued assets in regions like Latin America and Asia.

The Case for Precious Metals: Gold and Silver

The conversation then shifted to the precious metals market, where Costa expressed his strong belief in the future of both gold and silver. Gold, having already surpassed its 2011 highs, is widely seen as a store of value during periods of inflation and economic turmoil. But it is silver that Costa views as the most exciting opportunity.

Costa explained, “Silver is extremely undervalued compared to gold. It’s still 30% below its 2011 highs, while gold is already 40% above.” He sees this significant disparity as unsustainable and believes that silver is poised for a major rally in the coming years. Costa highlighted silver’s dual role as both a monetary asset and a critical industrial metal, particularly in the production of solar panels and other green technologies. “Silver is going to be one of the most sought-after metals in the future, especially as we move towards more renewable energy sources,” Costa remarked, pointing to the growing demand for silver in solar panel production.

The rising demand for silver in green technologies, along with its historical role as a monetary hedge, has led Costa to believe that this could be the decade of silver. “Silver could become one of the best-performing assets of the next decade, with both industrial and monetary demand driving its price up,” Costa stated.

Costa also noted that a stagflationary environment, akin to the 1970s, could create ideal conditions for both gold and silver to thrive. In such a scenario, where inflation is high but economic growth is slow, precious metals are often seen as safe havens. “If we see stagflation, gold will likely trade higher, and silver should benefit right alongside it,” Costa predicted.

A Pivotal Moment for the Global Economy

Reflecting on the broader economic landscape, Costa described the current period as a pivotal moment in the history of macroeconomics. “We are witnessing a global shift in the financial system, and it’s hard to know exactly where things are headed, but there is no doubt this is a momentous time,” Costa said. He pointed to the potential for radical changes in how the global financial system is structured, particularly in relation to the US dollar and its role in global trade.

Costa emphasized that we are likely on the brink of significant changes that will reshape the global economy. “This could be a moment where things change in ways that we haven’t seen in decades,” Costa stated. These changes, in his view, will create opportunities in emerging markets, precious metals, and industrial sectors that were once overlooked.

He concluded with a message of cautious optimism, stating that “the world is changing, and those who are prepared for these changes will be positioned to benefit. We are entering a new era where precious metals, particularly gold and silver, could play an increasingly critical role.”

The Path Forward

As the discussion came to a close, Costa reiterated his belief that the global economy is entering a period of significant transformation. “It’s an exciting time, but also a challenging one. There are major risks ahead, but there are also incredible opportunities for those who can see the bigger picture,” he said.

For investors, Costa’s message is clear: “Prepare for volatility, and pay attention to the long-term trends. The shift towards precious metals and emerging markets could be the defining theme of the next decade.”

In summary, Costa’s insights provide a sobering yet optimistic outlook on the future of the US dollar, precious metals, and the global economy. The coming years could witness significant changes in how currencies, markets, and economies operate, with gold and silver emerging as critical assets in a rapidly changing world. As Costa put it, “This is one of the most exciting times in my career because I can see how pivotal this moment could be for the history of macroeconomics.”