Precious Metals Market: Insights from Andy Schectman

In a recent interview on Liberty and Finance, Andy Schectman, CEO of Miles Franklin Precious Metals, shared in-depth insights on the evolving precious metals market, central bank policies, and investment strategies. The conversation ranged across several critical topics, offering a comprehensive perspective on gold and silver markets and their place in global economic shifts.

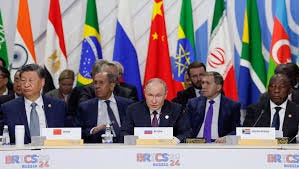

Central Bank Purchases and BRICS Developments

Schectman opened by discussing the aggressive gold-buying patterns of central banks worldwide. “Last year, the central banks bought more gold than at any time in the last 55 years,” he said, attributing this trend to de-dollarization and geopolitical concerns. Central banks, particularly in emerging economies, view gold as a hedge against economic and political uncertainties. Schectman emphasized how these actions signal a long-term shift away from reliance on fiat currencies like the U.S. dollar.

On the topic of the BRICS nations—Brazil, Russia, India, China, and South Africa—Schectman explained their collective move towards a commodity-backed currency. “When you look at what the BRICS nations are doing, it’s very clear that they want to supplant the dollar in global trade,” he noted. He warned of the potential challenges for the U.S. if these countries succeed in reducing their dependence on the dollar, which could lead to significant shifts in global economic power and liquidity.

The Trump Legacy: Economic Boom or Financial Time Bomb?

Schectman’s views emphasize the complex interplay between politics, economic policies, and market behaviors. He acknowledges the unique environment Trump’s presidency created—one marked by tax cuts, deregulation, and a general shift toward populist policies. Schectman explains that the market boomed under Trump’s administration, particularly due to the tax cuts that allowed corporations to repurchase stocks, contributing to the asset bubbles seen in the years that followed. He points out that, despite these measures, the underlying economic problems, particularly the ballooning debt and unsustainable fiscal policies, were never fully addressed.

"Look, the problem is, we have too much debt and that has to be resolved, period," Schectman says, framing the issue of national debt as something that transcends political parties. While Trump pushed for economic growth through aggressive fiscal policies, the long-term impact of such moves has contributed to the current financial instability. Trump’s policies, according to Schectman, created a temporary sense of prosperity, but without addressing the core issues of debt, they set the stage for a potential reckoning in the future.

Schectman further explores how the current political landscape, with Trump’s influence lingering even after his presidency, continues to affect public perception and financial decisions. He warns that while many people feel optimistic due to the market’s recent performance, the insiders—those with a clearer view of the financial system—are signaling caution. "Insiders are telling us a different story," he notes, underscoring the disparity between public euphoria and the more cautious outlook of those deeply embedded in the financial system.

Trump’s continued influence on the Republican Party, as well as his role in shaping the economic narrative, remains central to any analysis of current market conditions. Schectman seems to suggest that while Trump’s presidency may have provided short-term benefits, especially in terms of stock market growth and corporate profits, the long-term consequences of an under-addressed debt crisis are more alarming. The combination of Trump’s populist approach with continued monetary expansion under Biden creates a perfect storm for potential financial instability.

Thus, the analysis of Trump in this interview serves as a critique of his economic legacy, stressing that while he may have achieved immediate successes, they were built on fragile foundations. As Schectman suggests, investors must be aware that the true effects of such policies—especially when combined with the current trajectory of the global economy—are yet to be fully realized. Trump’s policies, therefore, remain a double-edged sword: they brought about prosperity in certain sectors, but they also exacerbated the systemic issues that could cause future economic turmoil.

Fractional Gold Coins and Their Utility

Schectman highlighted the growing interest in fractional gold coins, particularly 1/10th-ounce Gold Eagles. These coins, though priced at a premium relative to their larger counterparts, offer significant advantages in flexibility. “The metric should be: is the savings commensurate with the loss of flexibility?” he asked, advocating for these coins as a practical option for transactions in jurisdictions where gold is recognized as legal tender.

He also addressed the appeal of fractional gold coins from mints outside the U.S., such as the UK and Australia. While praising their quality and craftsmanship, Schectman reiterated his preference for American-made coins. “I prefer the American-made coins for various reasons I’ve told you about,” he stated, citing advice from industry expert Jim Sinclair. Schectman underscored the importance of choosing coins that align with personal goals and regional market conditions.

Market Diversification and Investment Strategy

Schectman advised viewers to diversify their portfolios across undervalued assets and prepare for potential market volatility. “It doesn’t have to be physical gold and silver from Miles Franklin. It could be oil and gas stock… it could be cryptocurrency,” he said. Highlighting the current federal funds rate of around 5%, he recommended short-term U.S. Treasuries as a conservative option for riding out market uncertainties.

He also expressed caution about the recent market rally, pointing to insider selling as a red flag. “If the insiders are right, at a six-to-one clip, we’re going to see a pullback,” Schectman predicted. He encouraged taking profits from overvalued assets and reallocating to safer or undervalued areas, emphasizing the importance of balancing risk while navigating uncertain times.

The Role of Silver in Wealth Preservation

Schectman expanded on the unique role silver plays in wealth preservation, particularly in volatile economic climates. He noted that silver's dual role as both an industrial and monetary metal positions it as a versatile investment. “Silver is an incredibly undervalued asset with immense potential upside,” he said, pointing out that it often outperforms gold during periods of monetary expansion and inflation.

He also highlighted silver’s affordability compared to gold, making it an accessible option for investors seeking to protect their wealth. “For those who want to dip their toes into precious metals without a large upfront cost, silver is the ideal starting point,” he suggested. He reiterated that silver could serve as both a hedge against inflation and a practical medium of exchange in times of financial instability.

Global Liquidity and the Importance of Flexibility

Another topic Schectman addressed was global liquidity and its implications for asset allocation. He stressed the importance of flexibility, especially in uncertain economic times, citing the liquidity of precious metals as a key advantage. “Anything from the six major mints—U.S., Canada, Austria, Australia, South Africa, and the United Kingdom—is synonymous with immediate liquidity,” he said, underscoring the universal appeal of these assets.

Schectman explained that liquidity should be a priority for investors, as it allows them to adapt quickly to changing market conditions. He advised maintaining a balance between long-term holdings and liquid assets to ensure financial stability. “Markets need to breathe, and we’ve seen quite a rally in the risk-on trade,” he observed, urging investors to be prepared for both opportunities and challenges in the year ahead.

Closing Remarks and Outlook for 2024

Schectman concluded the interview by emphasizing the importance of vigilance and adaptability in navigating the complexities of the global economy. “Keep a close eye on what’s happening around the globe—it’s very fluid,” he said. He encouraged viewers to remain informed about geopolitical and economic trends, as these factors could significantly impact market dynamics in the coming year.

As the conversation wrapped up, Schectman wished the audience a safe and prosperous holiday season. “Markets need time to settle, and we’ve seen incredible growth in the risk-on trade,” he reflected, adding that diversification and strategic planning would be crucial for investors heading into 2024.

Thank you for being so supportive

Wishing you all a Merry Christmas filled with joy, love, and peace. May this festive season bring warmth to your hearts and happiness to your homes. Thank you for your support and readership—here’s to more wonderful moments in the coming year! 🎄✨

We sincerely thank you for taking the time to read this article and for your ongoing interest in the insights we bring from industry leaders like Andy Schectman. At Financial Anarchy, we are committed to delivering in-depth and unbiased perspectives on critical topics affecting your financial security and future. Your engagement is what makes our work meaningful.

If you found this article valuable, we encourage you to subscribe to our channel, follow us on social media, and share this content with others who may benefit from it. Your support not only helps us grow our community but also ensures that more people can access these crucial discussions.

Additionally, if you’d like to contribute to our mission of providing high-quality, independent financial journalism, please consider donating. Every contribution, no matter the size, makes a significant impact and enables us to continue bringing you content that empowers and informs. Together, we can navigate these challenging times and build a stronger, more informed community.

Thank you again for your support, and we look forward to continuing this journey with you.