Trump’s Tariff Strategy: How Market Chaos is Unfolding

Insights from Tucker Carlson and Bob Lighthizer

Introduction

In a thought-provoking conversation between Tucker Carlson and Bob Lighthizer, the former U.S. Trade Representative, the complex nature of Donald Trump’s tariff strategy is unpacked. Why did the Trump administration make such aggressive moves against China? Was it merely about economics, or did it reflect a larger geopolitical struggle? As tariffs were imposed on Chinese goods, the effects rippled through the global economy. But were these actions really about correcting trade imbalances, or was there a deeper, more strategic play at work? Lighthizer offers a rare behind-the-scenes look at the thought process driving one of the most controversial trade strategies in recent history, posing the question: Can America afford to keep ignoring the challenges posed by China’s growing power?

This article explores the key points from the interview, analyzing the far-reaching impacts of Trump’s tariffs, and diving into whether these bold moves will ultimately help secure the future of American industry—or backfire in ways we haven’t yet fully grasped.

The Failure of the Current Trade System

Bob Lighthizer starts the conversation by addressing what he perceives as the fundamental failure of the current global trading system. He argues that trade, at its core, should be a mutually beneficial process where countries export to import, thereby allowing them to specialize and improve their standards of living. However, Lighthizer points out that the system has evolved in a way that no longer benefits the U.S. as intended.

Unequal Systems: Lighthizer critiques the imbalance between countries with open capital and trade systems, such as the U.S., and those with industrial policies designed to amass wealth without improving the living standards of their citizens. He uses the example of China, which he argues seeks to amass wealth by obtaining U.S. technology and assets.

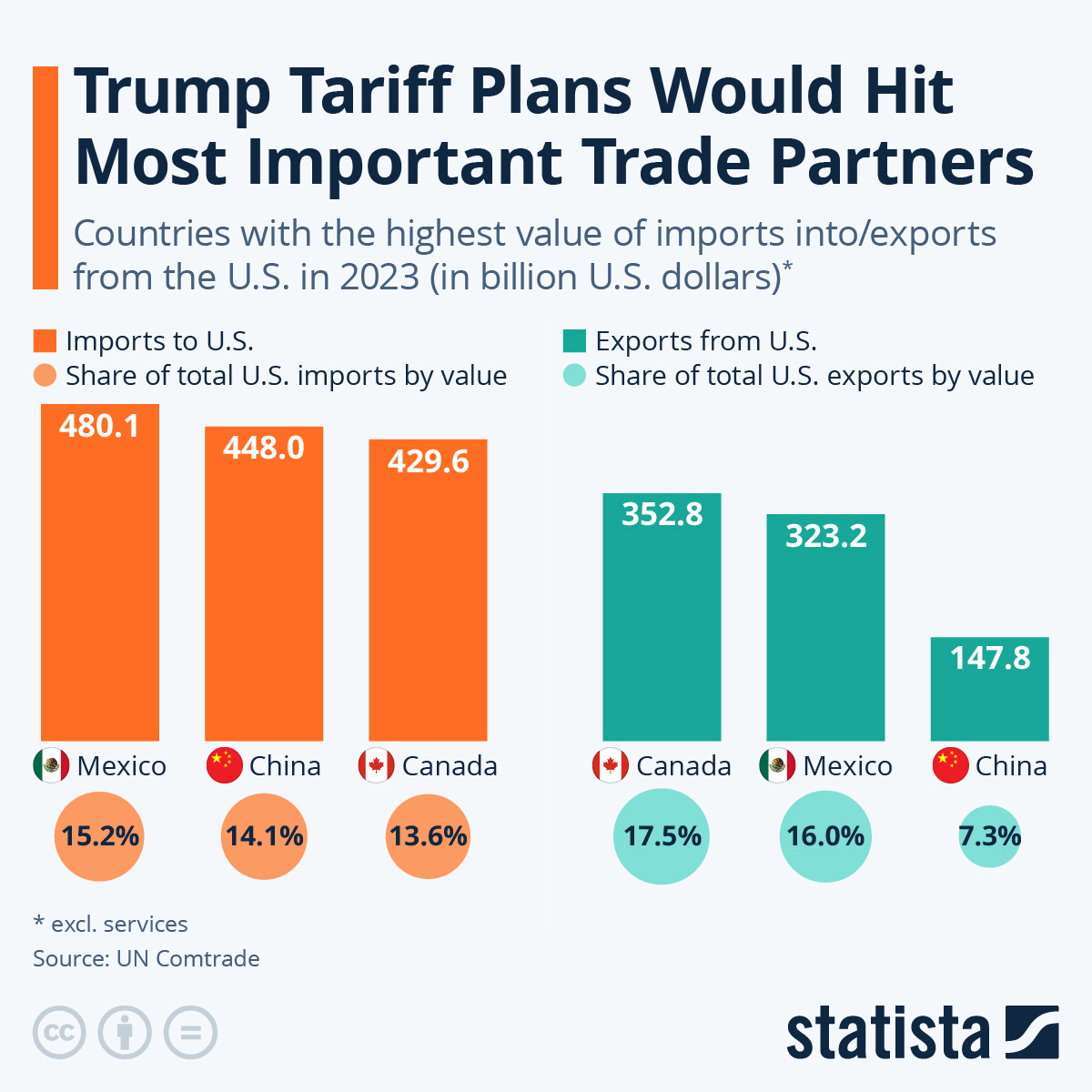

Trade Deficits: The U.S. trade deficits, particularly with China, are at the heart of Lighthizer’s argument. He highlights how the U.S. now runs trade deficits of around $700 to $800 billion annually, which he views as a direct transfer of wealth from the U.S. overseas. This imbalance, he argues, is unsustainable and harmful to the U.S. economy.

Lighthizer emphasizes that the U.S. is operating in an imbalanced global system where unfair practices by certain nations undermine the U.S. economy. He underlines how this imbalance — particularly in the context of China’s practices — leads to the U.S. losing valuable economic ground. Trump’s “America First” approach, which advocates for correcting these imbalances, is at the heart of his policies, including tariffs.

Trump’s Tariff Strategy: A Defensive Move Against China

At the heart of the discussion is the economic strategy implemented by the Trump administration, primarily targeting China. According to Lighthizer, Trump’s tariffs were not an arbitrary or punitive measure but rather a necessary defense against China's unfair trade practices, including intellectual property theft, market manipulation, and economic espionage. Lighthizer says, “We were transferring hundreds of billions of dollars in trade deficit… we are transferring hundreds of billions of dollars in stolen technology.” This clearly underscores the concerns within the administration about the economic imbalance between the U.S. and China, which was seen as unsustainable and harmful to American interests.

The U.S. trade deficit with China is framed as a crucial reason for the tariffs, with the belief that China’s growing economic influence posed a long-term threat to U.S. economic power. Lighthizer further elaborates that while tariffs would cause short-term challenges, particularly higher consumer prices, they were an essential step to force China to negotiate a more balanced economic relationship.

The tariffs reflect a shift toward protectionism, strategically aimed at limiting China's economic manipulation. They were not only a defense against specific unfair practices but also a broader effort to level the economic playing field. This dual-purpose approach signifies a marked shift in U.S. trade policy from passive engagement to active intervention.

BE AWARE! They don’t need to rob you at gunpoint anymore—now, they do it with a smile and a signature. HERE IS HOW!

European governments have devised a plan to use personal savings to fund national deficits and investment projects, effectively turning private wealth into a public resource. This initiative, known as the “European Savings and Investments Union,” seeks to redirect what officials call “unused savings” into private corporations and military infrastructure.

The Debate Over Inflation and Tariffs

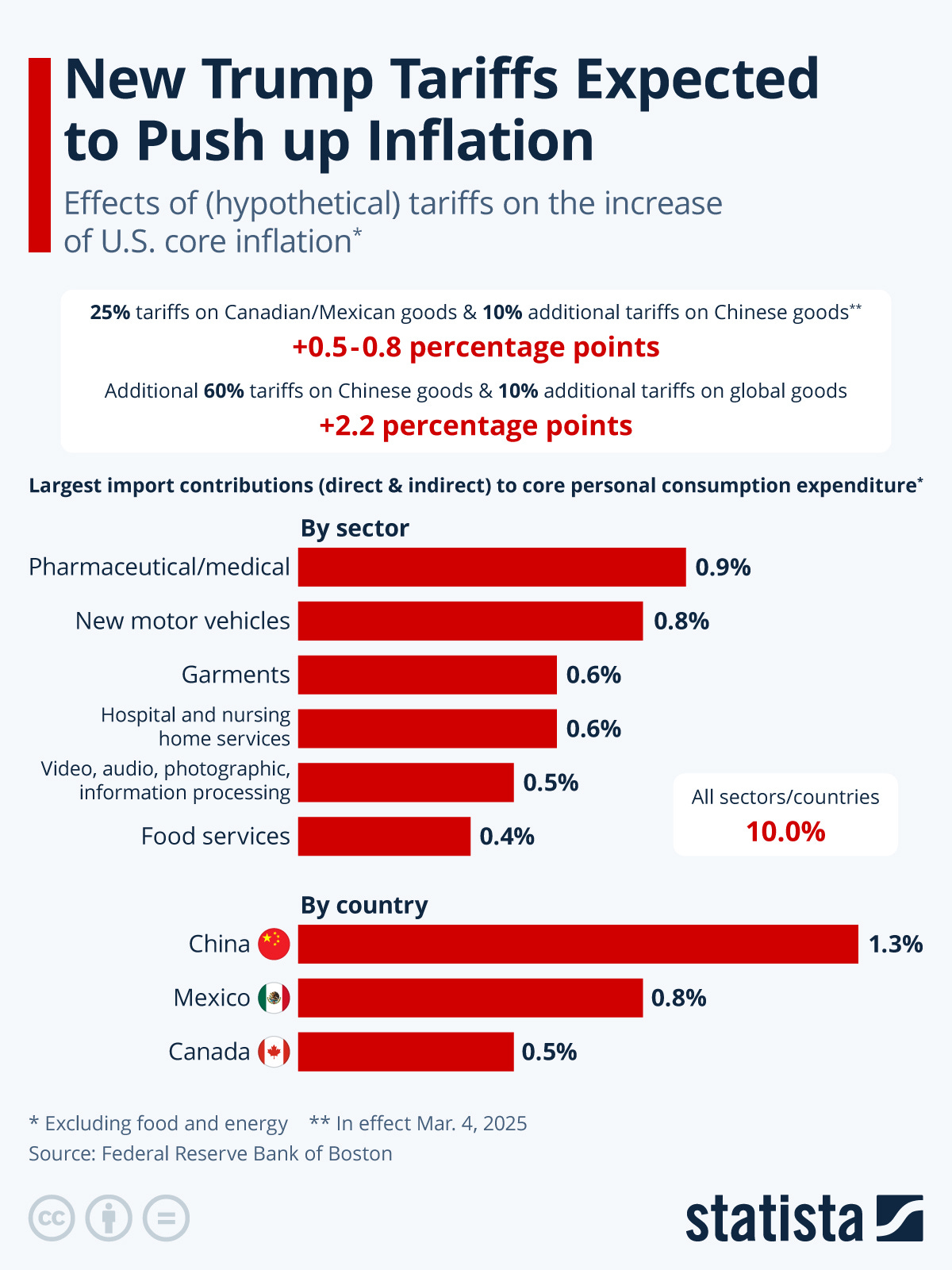

A significant portion of the discussion revolves around the potential economic impact of Trump’s tariff strategy, specifically whether it will lead to inflation. Many economists warn that tariffs, by increasing the cost of imported goods, could drive up prices for consumers. Lighthizer addresses these concerns by offering a counter-argument.

Inflation Concerns: Lighthizer acknowledges that tariffs could cause certain goods to become more expensive, but he insists that these price increases will be limited and temporary. He differentiates between inflation—an economy-wide increase in prices—and isolated price hikes on specific goods.

Historical Precedent: Lighthizer references past economic policies that involved similar tariff increases, where concerns about inflation were proven wrong. He cites the example of the U.S. under Trump’s previous tariffs, where inflation remained low despite significant tariffs being applied.

Monetary Policy and Inflation: Lighthizer explains that inflation is primarily a monetary phenomenon, driven by factors like the money supply and interest rates. Tariffs, he argues, will not necessarily lead to broad inflation if U.S. production increases and consumption remains stable.

Lighthizer pushes back against the traditional view that tariffs lead to inflation. He argues that, when combined with increased domestic production, the higher cost of imports can be absorbed without causing widespread inflation. By distinguishing between isolated price hikes and general inflation, Lighthizer reassures that the economic risks of tariffs are manageable.

The Historical Context of U.S. Trade Policies

Lighthizer draws on his extensive experience to provide historical context, referencing the U.S.'s economic battles in the 1980s, particularly with Japan. During this period, Japan’s market manipulation was viewed as an economic threat, similar to China’s current practices. Lighthizer argues that the current situation with China required even more aggressive tactics due to China’s sheer size and influence.

Lighthizer links the U.S.-China trade conflict to past trade disputes, such as the one with Japan. However, the size and global impact of China’s economy present unique challenges. The need for more aggressive measures today highlights the difference in scale and global reach between Japan’s influence then and China’s influence now.

The Impact of Tariffs on U.S. Industry and Consumers

Lighthizer acknowledges that the tariffs implemented under Trump’s administration had significant consequences for various sectors, notably the steel and aluminum industries. However, this protectionist approach also resulted in higher prices for U.S. consumers, particularly in the form of tariffs on Chinese imports. The challenge, as Lighthizer points out, was balancing the protection of American industries with the negative consequences for consumers.

He adds, “You can’t say do nothing in the face of a crisis,” indicating that while there were some negative effects, the strategy was a necessary one to protect the U.S. economy in the long run.

While tariffs did provide much-needed protection for key industries, such as steel, they also created trade-offs, particularly in consumer costs. This tension between protecting domestic industries and maintaining consumer welfare was a central challenge for the administration, highlighting the complexities involved in implementing protectionist policies.

China’s Growing Military and Economic Power

Beyond the economic impacts, the discussion delves into the broader geopolitical consequences of China’s actions. Lighthizer points out that China has been aggressively expanding its military capabilities, particularly in the South China Sea, and engaging in espionage on a scale not seen in modern times. “China has the biggest army in the world, and they’re growing it… They have the biggest Navy in the world,” Lighthizer notes, emphasizing the dual economic and military threat posed by China.

Additionally, the conversation touches on China’s global expansion, from building military bases to funding conflicts around the world, such as in the Middle East and Europe. Lighthizer explains that China’s activities aren’t limited to economic espionage and military buildup but extend to influencing global politics through economic and diplomatic means.

Lighthizer’s remarks underscore the existential threat that China’s rise presents to the U.S. on both economic and geopolitical fronts. The trade war, from this perspective, is not just about addressing trade imbalances but also about countering China’s broader ambitions. The tariffs were as much about limiting China’s global influence as they were about correcting economic disparities.

Global Reactions to Trump’s Trade Policies

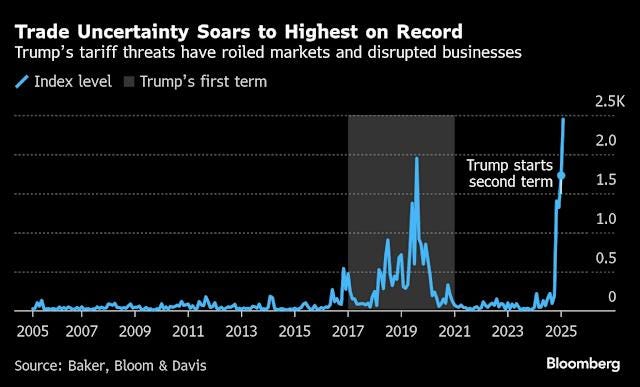

The imposition of tariffs sparked a wave of retaliation from other countries, particularly China, which targeted key U.S. exports such as agricultural products. Lighthizer acknowledges these retaliatory measures, explaining that they were part of China’s broader strategy to undermine U.S. policies. The tariffs caused disruptions in the global trading system, with other countries expressing concerns over the protectionist nature of Trump’s policies.

The global reactions to Trump’s tariffs emphasize the risks of unilateral trade policies. While the tariffs were intended to strengthen the U.S.’s position, they also led to economic and diplomatic tensions that affected international relations. The complexity of global trade, with interconnected supply chains and multilateral trade agreements, meant that any changes made by the U.S. had far-reaching consequences.

China’s Role in Global Technology and Economic Warfare

A significant portion of the conversation is devoted to China’s role in global economic warfare, particularly in terms of technology theft and manipulation. Lighthizer draws attention to the fact that China has been actively involved in stealing intellectual property, with U.S. companies bearing the brunt of this economic espionage. “They are funding the war in the Middle East… they’re selling all the fentanyl that… comes into the United States,” Lighthizer highlights, emphasizing the multifaceted nature of China’s economic tactics.

The conversation also touches on the broader ideological battle, with China positioning itself as a champion of authoritarianism and Marxism. According to Lighthizer, China’s long-term goal is to become the world’s preeminent power, and this ambition directly challenges U.S. hegemony in global economic and political systems.

This broader ideological and economic struggle is what makes the U.S.-China trade war different from previous trade disputes. It is not just about economics—it is about a clash of political and economic ideologies, with China seeking to reshape global governance in ways that challenge the democratic capitalist order led by the U.S.

The U.S. Approach Moving Forward: Strategic Decoupling

Looking ahead, Lighthizer argues for what he calls “strategic decoupling” from China. This concept does not mean an end to all economic ties but calls for more careful management of trade relationships to protect U.S. interests. “We need balanced trade in areas that benefit America… we need independent technology going forward,” he proposes, advocating for the U.S. to reduce its dependence on China for critical technologies and goods.

Strategic decoupling represents a new phase in U.S.-China relations, where the focus shifts from engagement and cooperation to a more cautious, defensive posture. By fostering self-reliance in key industries like technology and manufacturing, the U.S. could protect itself from China’s growing economic and technological influence.

The Legacy of Trump’s Tariff Strategy

As we step back and look at the long-term impact of Trump's tariff strategy, one might wonder: Was this bold approach a necessary defense for U.S. interests, or was it an economic gamble that could have unintended consequences? While the tariffs were presented as a countermeasure to China's unfair trade practices, their broader implications stretch beyond mere economics. Could the aggressive posture against China alter the global balance of power in ways that we can only begin to understand? With China’s growing influence and the U.S. rethinking its strategies, what is the future of global trade, and where does America fit into it?

The legacy of Trump's tariffs is still unfolding. As Lighthizer advocates for “strategic decoupling” and calls for a more cautious approach, one has to ask: Can the U.S. achieve self-reliance in the face of global economic interdependence? What will the next phase of the U.S.-China economic rivalry look like, and how will the world respond? These questions remain as pressing as ever, inviting further scrutiny and reflection on how international trade policies shape the global order.