Understanding the Uranium Market: History, Dynamics, and Future Prospects

Exploring the Role of Nuclear Power, Supply and Demand Dynamics, Price Appreciation, and Performance of Mining Stocks

The Uranium Sector: A Comprehensive Analysis

The uranium sector has been gaining attention recently due to the potential for a sustained upward movement in the spot price of uranium. In this essay, we will provide a comprehensive analysis of the uranium market by discussing the sector's current state and potential for future growth. We will cover the following topics:

The state of the uranium market

The Role of nuclear power in the energy industry

The supply and demand dynamics of the uranium market

The potential for uranium price appreciation

The performance of uranium mining stocks

The State of the Uranium Market

The uranium market is currently in a state of flux. Over the past few years, the price of uranium has been relatively low due to oversupply and weak demand. This situation has been exacerbated by the COVID-19 pandemic, which has led to reduced demand for electricity and disrupted supply chains. The oversupply of uranium can be traced back to the 2000s when a number of new mines were opened and production ramped up. However, demand failed to keep pace with this increased supply, leading to a surplus of uranium on the market. This oversupply has been further exacerbated by the shutdown of several nuclear reactors in Japan following the Fukushima disaster.

Despite these challenges, there are some positive signs for the uranium market. The demand for nuclear power is expected to increase in the coming years, particularly in Asia, where countries such as China and India are building new reactors. In addition, several countries have announced plans to phase out their use of fossil fuels in favor of nuclear power, which could further increase demand for uranium.

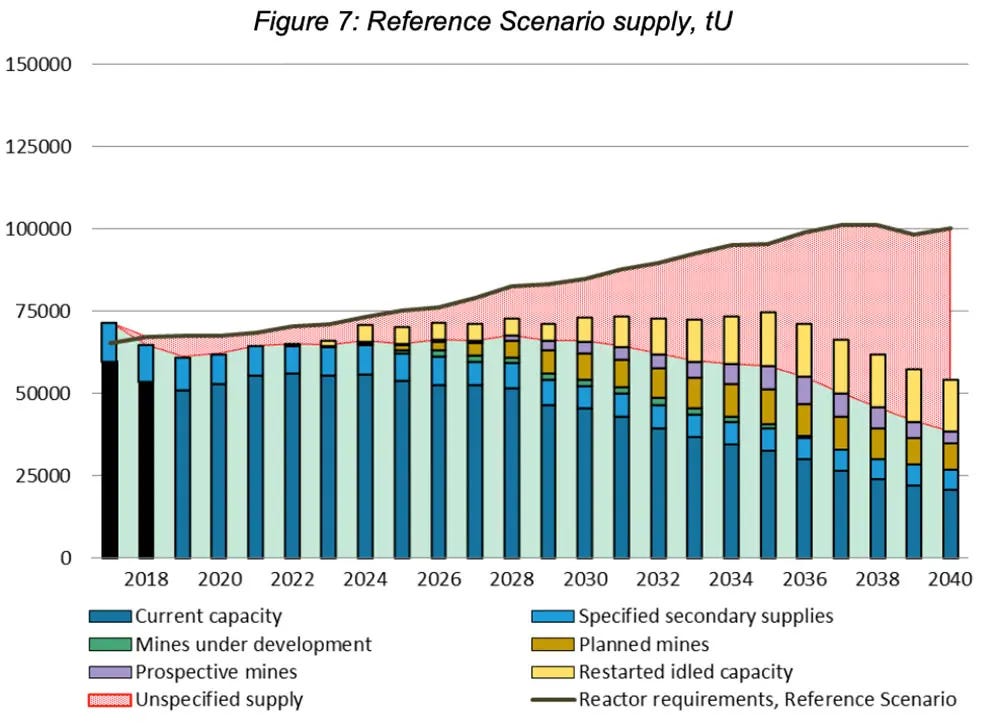

Furthermore, some analysts predict that the market will shift towards a deficit in the coming years. This is due to the fact that the long-term contracts between uranium producers and consumers are set to expire, and there has not been enough investment in new mines to meet the future demand. This could lead to a tightening of supply, which could push up prices and benefit uranium producers.

However, the industry also faces significant challenges, including regulatory hurdles and opposition to nuclear power from environmental groups. The future of nuclear power remains uncertain, and it is difficult to predict how public sentiment, regulatory policies, and technological developments will shape the industry in the years to come.

The Role of Nuclear Power in the Energy Industry

Nuclear power has long been recognized as an important source of energy, providing a significant amount of electricity globally. Nuclear power plants generate electricity by using nuclear fission, a process in which the nucleus of an atom is split, releasing a large amount of energy. This energy is then harnessed to produce electricity.

Nuclear power has a number of advantages over other forms of energy, including its ability to generate large amounts of electricity with relatively low emissions of greenhouse gases. In addition, nuclear power is a reliable source of electricity, with many nuclear power plants operating continuously for years without interruption.

Despite these advantages, nuclear power has faced significant challenges in recent years. The accidents at Chernobyl and Fukushima have highlighted the risks associated with nuclear power, and have led to increased scrutiny and regulation of the industry. In addition, concerns around nuclear waste disposal and the potential for nuclear weapons proliferation have also impacted the industry.

Despite these challenges, nuclear power remains an important source of energy in many countries. In fact, many countries are investing in nuclear power as a way to meet their energy needs while reducing their reliance on fossil fuels. Nuclear power is particularly attractive in countries with limited renewable energy resources, as it provides a reliable and low-emission source of electricity.

However, the role of nuclear power in the energy industry is still a matter of debate. Some argue that the risks associated with nuclear power, including the potential for accidents and the disposal of nuclear waste, make it an unacceptable source of energy. Others argue that nuclear power is a necessary component of a diverse energy mix, particularly in countries that are heavily reliant on fossil fuels.

The future of nuclear power will depend on a number of factors, including advances in technology, public perception, and government policy. Advances in technology, such as the development of new reactor designs and improved safety measures, could help to mitigate some of the risks associated with nuclear power. Public perception will also be important, as concerns around the safety and environmental impact of nuclear power could impact its adoption. Finally, government policy will play a key role in determining the future of nuclear power, as governments can provide financial incentives and regulatory frameworks to encourage the development of nuclear power.

Supply and Demand Dynamics of the Uranium Market

The uranium market is influenced by the basic principles of supply and demand. When demand for uranium exceeds supply, prices rise, and when supply exceeds demand, prices fall. The demand for uranium is largely driven by the need for nuclear fuel to generate electricity in nuclear power plants. The primary consumers of uranium are countries that use nuclear power to generate electricity, with the United States, France, and China being the largest consumers.

On the supply side, the majority of the world's uranium is produced by a handful of countries, including Canada, Kazakhstan, Australia, and Russia. These countries have significant uranium reserves and have invested heavily in developing their uranium mining industries. However, political instability in these countries can lead to disruptions in supply, which can impact prices.

The oversupply of uranium in recent years has been a major factor in the current state of the uranium market. The oversupply can be traced back to the 2000s when a number of new mines were opened and production ramped up. However, demand failed to keep pace with this increased supply, leading to a surplus of uranium on the market. This oversupply has been further exacerbated by the shutdown of several nuclear reactors in Japan following the Fukushima disaster.

Despite the oversupply, there are some positive signs for the uranium market. The demand for nuclear power is expected to increase in the coming years, particularly in Asia, where countries such as China and India are building new reactors. In addition, several countries have announced plans to phase out their use of fossil fuels in favor of nuclear power, which could further increase demand for uranium.

To address the oversupply, some uranium mining companies have taken steps to reduce production and cut costs. This has included suspending or closing mines, reducing exploration and development activities, and cutting jobs. The hope is that by reducing supply, prices will stabilize and eventually rise, leading to increased profits for uranium mining companies.

The Potential for Uranium Price Appreciation

The potential for uranium price appreciation is significant due to the market's shifting supply and demand dynamics. The closure of high-cost uranium mines and the reduction in uranium production due to low prices have led to a decline in uranium supply, while the increase in demand for nuclear power has led to an increase in demand for uranium.

The current spot price of uranium is well below the levels required to incentivize new mine development and the restart of idled mines. As a result, uranium price is likely to appreciate significantly in the coming years as supply deficits emerge and utilities seek to secure long-term supply contracts.

Despite the challenges facing the uranium market, there are some indications that uranium prices may appreciate in the future. One factor that could lead to higher prices is the expected growth in demand for nuclear power. As countries around the world seek to transition away from fossil fuels and reduce their carbon emissions, nuclear power is being viewed as a key component of the energy mix. This is especially true in countries like China and India, where energy demand is growing rapidly.

In addition, many existing nuclear reactors are reaching the end of their operational lifetimes and will need to be replaced in the coming years. This could lead to a surge in demand for uranium as new reactors are built and existing ones are refurbished.

Another factor that could drive up uranium prices is the potential for supply constraints. While there is currently an oversupply of uranium on the market, this situation could change in the future. As existing mines are depleted and new ones are not brought online to replace them, the supply of uranium could tighten. This could lead to higher prices as buyers compete for a limited supply of the metal.

Finally, the long-term contracts between uranium producers and utilities could also help support higher prices. These contracts provide a level of stability for both producers and consumers, as they allow for predictable prices and supply. If more long-term contracts are signed in the future, it could provide a floor for uranium prices and prevent them from falling too low.

Of course, there are also risks to the uranium market that could prevent prices from appreciating. For example, if the growth in nuclear power is slower than expected or if more countries move away from nuclear power due to safety concerns or other factors, demand for uranium could stagnate. In addition, if new sources of uranium are discovered or if existing mines become more productive, the oversupply situation could persist, putting downward pressure on prices.

The Performance of Uranium Mining Stocks

The performance of uranium mining stocks is closely tied to the state of the uranium market. When uranium prices are high and demand is strong, uranium mining stocks tend to perform well. Conversely, when uranium prices are low and demand is weak, uranium mining stocks tend to struggle.

In recent years, uranium mining stocks have generally underperformed the broader market due to the oversupply and weak demand in the uranium market. However, there are some positive signs for uranium mining stocks in the future. The expected increase in demand for nuclear power, particularly in Asia, could drive up uranium prices and boost the performance of uranium mining stocks.

Investors looking to invest in uranium mining stocks should carefully consider a company's financials, including their balance sheet and cost structure. Companies with low-cost operations and strong balance sheets are better positioned to weather downturns in the uranium market and take advantage of opportunities for growth.

It's also important to consider a company's exposure to long-term uranium contracts, as these can provide stability and predictability in an otherwise volatile market. Companies with a diversified portfolio of long-term contracts with reputable customers are typically viewed more favorably by investors.

In addition, investors should keep an eye on geopolitical risks that could impact the supply of uranium. Countries that produce a significant amount of uranium, such as Canada, Kazakhstan, and Australia, are generally viewed as stable and reliable sources of uranium. However, political instability or conflict in these countries could disrupt the supply of uranium and impact the performance of uranium mining stocks.

Overall, investing in uranium mining stocks can be a high-risk, high-reward proposition. Investors should carefully consider the state of the uranium market, the financials and exposure of individual companies, and geopolitical risks before making any investment decisions.

Like, Subscribe, and Share to Spread the Word!

Subscribed

If you found this analysis informative and eye-opening, we invite you to like, subscribe, and share this video to help us spread the word. Together, we can build a community of Financial Anarchy advocates who are dedicated to promoting financial literacy and advocating for sound monetary policies. By amplifying our message, we can empower individuals to take control of their financial well-being and contribute to a more equitable and sustainable future.

Support Our Work with a Bitcoin Donation

We also offer the opportunity to support our work and help us continue building the Financial Anarchy community. If you would like to make a contribution, we gratefully accept donations in Bitcoin. Your support will enable us to create more educational content, engage in meaningful activism, and further our mission of challenging the status quo. To donate, please use the following Bitcoin address:

1EkmtWDYzuhkiv3iYozKVnZFxsQxDetnfH

Thank you for joining us on this journey of understanding and change. Together, we can shape a brighter financial future for all.