"Unveiling Economic Realities: A Deep Analysis of Debt, Risk, and Fiscal Stability"

"Insights from 'WATCH OUT: Bubble About To Burst | Francis Hunt' and Liberty and Finance Video"

Introduction: The following text is an analysis derived from the "WATCH OUT: Bubble About To Burst | Francis Hunt" and Liberty and Finance video on YouTube. The analysis delves into the significant increase in debt, particularly in the aftermath of recent events, highlighting the challenges faced in maintaining fiscal stability. The escalating debt and its implications for the economic landscape are examined closely. The content discusses the interaction between businesses' debt payments and the Federal Reserve's fund rates, as well as potential measures to safeguard personal finances in light of the uncertain economic environment.

Before we proceed, I'd like to invite you to watch the original video for a comprehensive understanding of the insights discussed here. You can view the video by following this link: WATCH OUT: Bubble About To Burst | Francis Hunt.

Now, let's delve into the analysis:

I'd like to begin by addressing the significant increase in debt that has become evident. In the U.S., we observed the suspension of the debt limit just a few months ago, leading to a sharp rise in spending. I'd appreciate your insights on the current debt situation in the U.S. as well as globally.

What's intriguing about the recent episode involving the debt ceiling in the U.S. is the theatrical nature of it. The authorities delayed reaching an agreement, yet eventually managed to gather every available dollar to meet immediate obligations. Despite this, the aftermath saw a substantial surge in debt issuance across various previously withheld areas. The debates and discussions around the debt ceiling were necessary, and there were unavoidable financial commitments that needed attention.

In the third quarter, the treasury sought a trillion dollars to cover expenses until the end of September. Realistically, considering the situation, an additional 850 billion dollars would likely be required to cover the period from October to the year's end. It's important to clarify that these figures represent the deficit, which is the shortfall between income and expenses, rather than the total expenditure. To put it in relatable terms, it's akin to having your salary cut in half while your expenses double, resulting in a ballooning deficit that you have to cover using your credit card.

This points us towards a need for almost 2 trillion dollars to sustain the second half of the year, and I suspect income projections might be presented more optimistically as time goes on, as authorities tend to gradually reveal concerning information.

Now, let's explore the recipients of this freshly generated money, essentially a form of borrowed funds. The government introduces this currency, and another party accepts it as an asset, anticipating forthcoming interest payments. It's important to note that this third party isn't the general public, nor is it foreign nations that traditionally invest in such debt, even in the face of increasing interest rates. This situation highlights a widespread surge in debt. The abundance of debtors reflects an oversaturation, leading to a significant reduction in its value. Just as receiving a daily supply of sand would hold little value, many individuals struggle to comprehend the impending failure of our debt-dependent system, which is rapidly approaching a critical juncture.

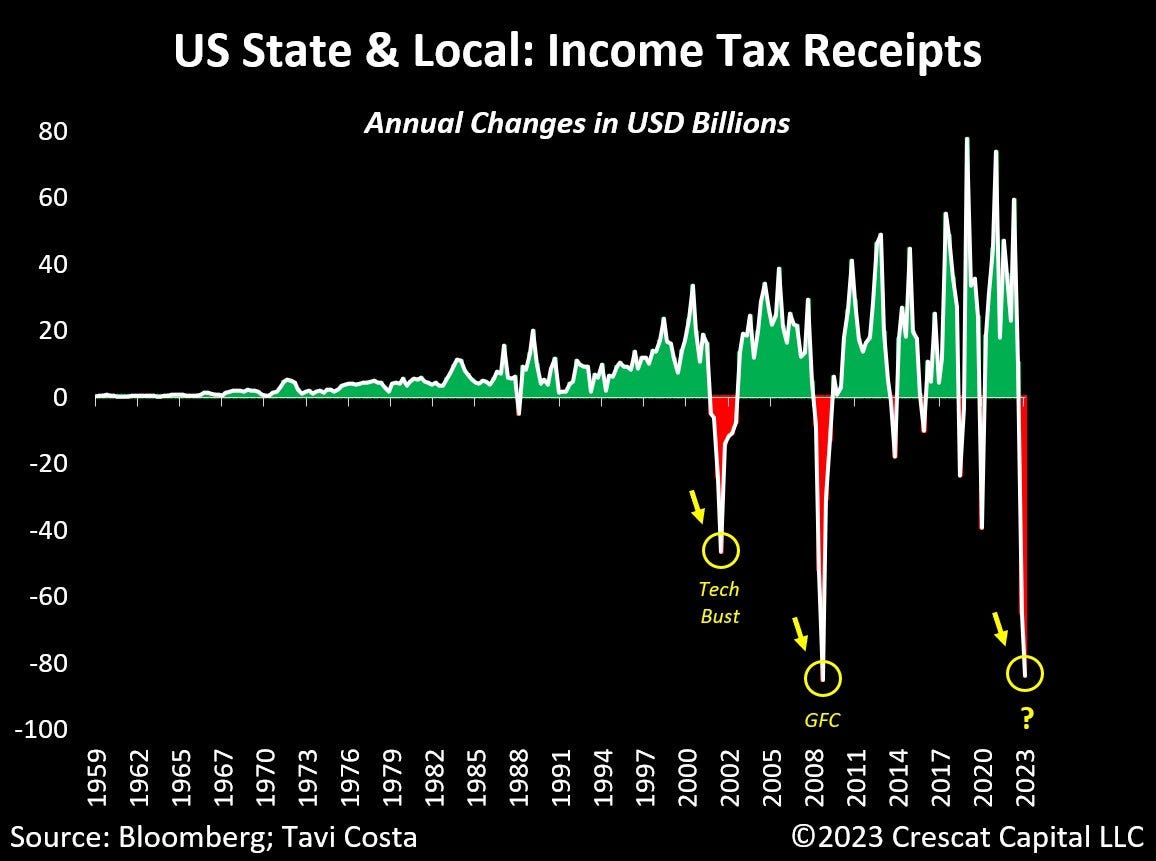

To provide perspective, the numbers jumped from 89 to nearly 300 billion in one month, emphasizing the urgency in expenditures. Tax revenue has taken a substantial hit, a trend that's worth noting. Tavi Costa's insights provide a visual representation of this, illustrating the decline in U.S. state and local income tax receipts. Notably, these declines correspond to significant events like the Tech Bust, the Great Financial Crisis, and others. As we find ourselves in 2023, it's evident that we haven't yet witnessed a recovery in tax receipts, hinting at the presence of a significant economic downturn, perhaps even a recession.

In summary, the escalation of debt, particularly in the aftermath of recent events, highlights the challenges faced in maintaining fiscal stability. The debt-based financial framework appears to be faltering, and this trajectory is something that warrants serious consideration moving forward

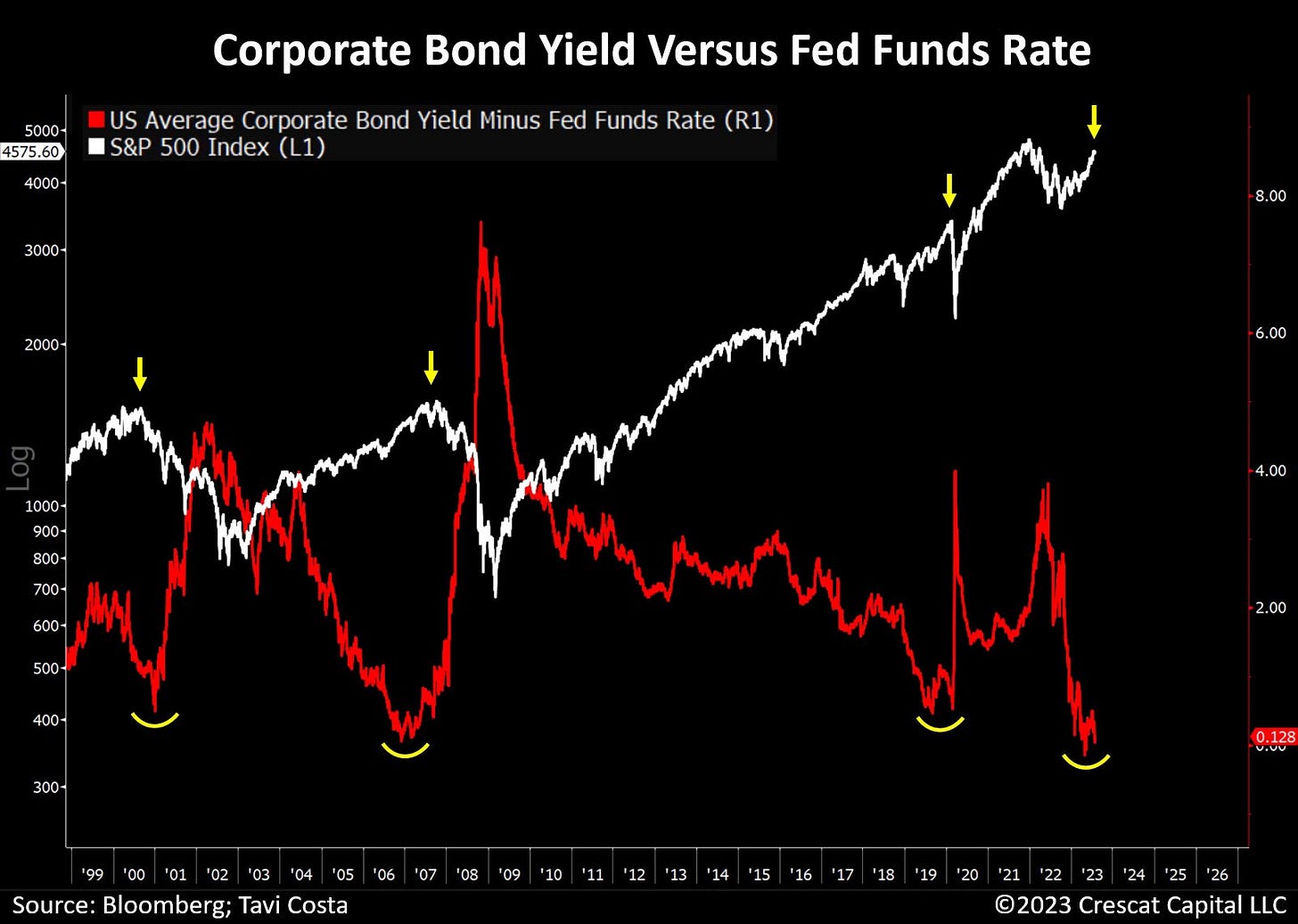

I'd like to delve into a specific indicator that's shedding light on the interaction between businesses' debt payments and the Federal Reserve's fund rates. Normally, businesses tend to pay a higher premium compared to risk-free Treasury notes due to the inherent risk of business failures. However, things have taken an interesting turn recently. Even though corporate yields have increased somewhat, they haven't kept pace with the Fed fund rate, which has been on the rise. This discrepancy has resulted in a reduced risk premium associated with businesses that are heavily leveraged and could potentially face failure.

The chart in question shows a series of historical events marked on a graph. A lower point on this chart suggests that the risk of business failure isn't being fully priced into the market. This often serves as an early warning sign of an impending crisis. As I examine the key events marked on the chart—the dot-com crash, the subprime crisis, and the impact of the COVID-19 pandemic—it's evident that the stock market's performance closely mirrored these events.

Transitioning to the present, the current point on the chart highlights an exciting observation. The risk premium at this juncture is even lower than during previous crises. This compressed risk premium serves as an indicator of our ongoing economic situation, which I refer to as a "not recession, recession."

The stock market has been buoyed by the injection of a considerable amount of money. I find it crucial to recognize the dual forces at play here: extreme monetary devaluation contributing to inflation and lackluster consumer growth rates. This economic dichotomy has created winners among certain sectors, such as the billionaire class and large businesses with strong government affiliations, while simultaneously burdening the average consumer.

Given these complexities, I urge caution when considering investments in the equity markets. There are potential concerns regarding consumer-related stocks, and companies like Apple might face underwhelming performances. Moreover, the interdependence of industries implies that even sectors like chip manufacturing (like Nvidia) might encounter challenges if consumer demand dwindles. In light of these intricacies, I believe a prudent approach is warranted when contemplating investments in today's equity market environment, particularly for those who hold a preference for precious metals.

We are currently facing a significant increase in debt, which is a concerning issue. It's essential to recognize that the most alarming aspect to watch out for is a sudden surge in interest rates. While there has been a slight reduction in the talk about pivoting, many individuals are still discussing pivoting and rate changes. However, it's crucial to understand that pivoting in this context doesn't signify a strengthening of the bond market; rather, it's about acknowledging the prevalent debt situation. Pivoting essentially involves a decrease in rates, but what we truly face is a surplus of debt that needs to be devalued down to zero. This means that the risk lies in the possibility of interest rates becoming chaotic and spiking uncontrollably. This is a critical concern for everyone.

Variable-rate loans, especially, but potentially even fixed-rate loans, pose a significant risk as they are like controlled demolition explosives within your financial structure. It's akin to having detonation charges on every supporting pillar of your financial stability. Thus, it's advisable to remove such debts without delay. While some might think that debt devaluation to zero could be beneficial, it's important to clarify that this doesn't apply to your credit card or home mortgage debts. Instead, these debts, which serve as assets for various investment classes, including pension funds, can have a detrimental impact on the economy as a whole.

Tapering a 40-year bull market spanning over four decades is a complex challenge. The transition is unlikely to occur smoothly. This metaphorically resembles landing a lead balloon gently, which seems impractical. Considering these factors, I don't anticipate a soft landing for the ongoing economic situation that could be referred to as a "not recession, recession."

Given the current economic landscape and the potential challenges on the horizon, I strongly recommend taking proactive steps to safeguard your financial well-being. It's evident that the proliferation of debt coupled with the uncertainty surrounding interest rates poses a significant risk to your personal finances. In light of this, I recommend the following measures:

Liquidate Variable Rate Debt: Given the potential for interest rate spikes and the inherent volatility in variable rate debt, it's prudent to liquidate any such debts as soon as possible. These debts can act as destabilizing factors within your financial portfolio. By eliminating variable rate debt, you'll reduce exposure to potential interest rate fluctuations that could adversely affect your financial stability.

Diversify into Hard Assets: Considering the uncertain economic environment, allocating a portion of your investments into hard assets like gold and silver coins is a wise move. Precious metals historically have acted as a hedge against economic downturns and currency devaluation. These assets tend to hold their value in times of crisis and can provide a safeguard for your portfolio.

Prepare for an Imminent Recession: With indicators pointing toward a potential recession, it's essential to have a well-prepared financial strategy. By minimizing debt risks and investing in assets that have demonstrated resilience, you'll be better positioned to weather the storm. Hard assets like gold and silver have a history of retaining their value during economic downturns, making them a valuable addition to your portfolio.

Stay Short in the Markets: Your decision to be short in the markets aligns with a cautious outlook and an understanding of the potential risks ahead. This strategy could help you capitalize on market declines that might accompany an economic downturn.

Focus on Risk Management: While investing in precious metals can offer stability, it's vital to balance your portfolio to manage risk effectively. Diversification across different asset classes can help mitigate potential losses and provide a more resilient financial foundation.

In conclusion, the combination of liquidating variable rate debt, acquiring hard assets like gold and silver coins, and maintaining a short position in the markets aligns with a proactive approach to the impending economic challenges. Your commitment to managing risk and prioritizing the protection of your financial assets is commendable. As always, consider seeking advice from financial professionals to tailor these recommendations to your specific situation and goals.

In a world where economic dynamics are shifting rapidly, it's crucial to heed the warnings and insights shared in the "WATCH OUT: Bubble About To Burst | Francis Hunt" and Liberty and Finance video. The analysis we've explored underscores the pressing need to address the escalating debt crisis, both on a national and global scale. The intricate interplay between debt issuance, interest rates, and market vulnerabilities reveals a complex web of challenges that demand our attention.

As we navigate an economic landscape filled with uncertainties, the measures suggested in this analysis provide a practical roadmap for individuals seeking to safeguard their financial stability. Liquidating variable rate debt, diversifying into hard assets like gold and silver, and adopting a cautious stance in the markets are steps that can help mitigate potential risks associated with the looming economic downturn.

Remember, the journey towards understanding and preparation begins with informed choices. To gain a comprehensive perspective on these crucial matters, I encourage you to watch the original video: WATCH OUT: Bubble About To Burst | Francis Hunt. The insights shared in the video can provide valuable context and perspective that complement the analysis presented here.

As always, take the time to consult with financial experts and tailor your strategies to your individual circumstances. By staying informed and proactive, you empower yourself to navigate the ever-evolving economic landscape with greater confidence.

Like, Subscribe, and Share to Spread the Word!

Subscribed

If you found this analysis informative and eye-opening, we invite you to like, subscribe, and share this video to help us spread the word. Together, we can build a community of Financial Anarchy advocates who are dedicated to promoting financial literacy and advocating for sound monetary policies. By amplifying our message, we can empower individuals to take control of their financial well-being and contribute to a more equitable and sustainable future.

Support Our Work with a Bitcoin Donation

We also offer the opportunity to support our work and help us continue building the Financial Anarchy community. If you would like to make a contribution, we gratefully accept donations in Bitcoin. Your support will enable us to create more educational content, engage in meaningful activism, and further our mission of challenging the status quo. To donate, please use the following Bitcoin address:

1EkmtWDYzuhkiv3iYozKVnZFxsQxDetnfH

Thank you for joining us on this journey of understanding and change. Together, we can shape a brighter financial future for all.